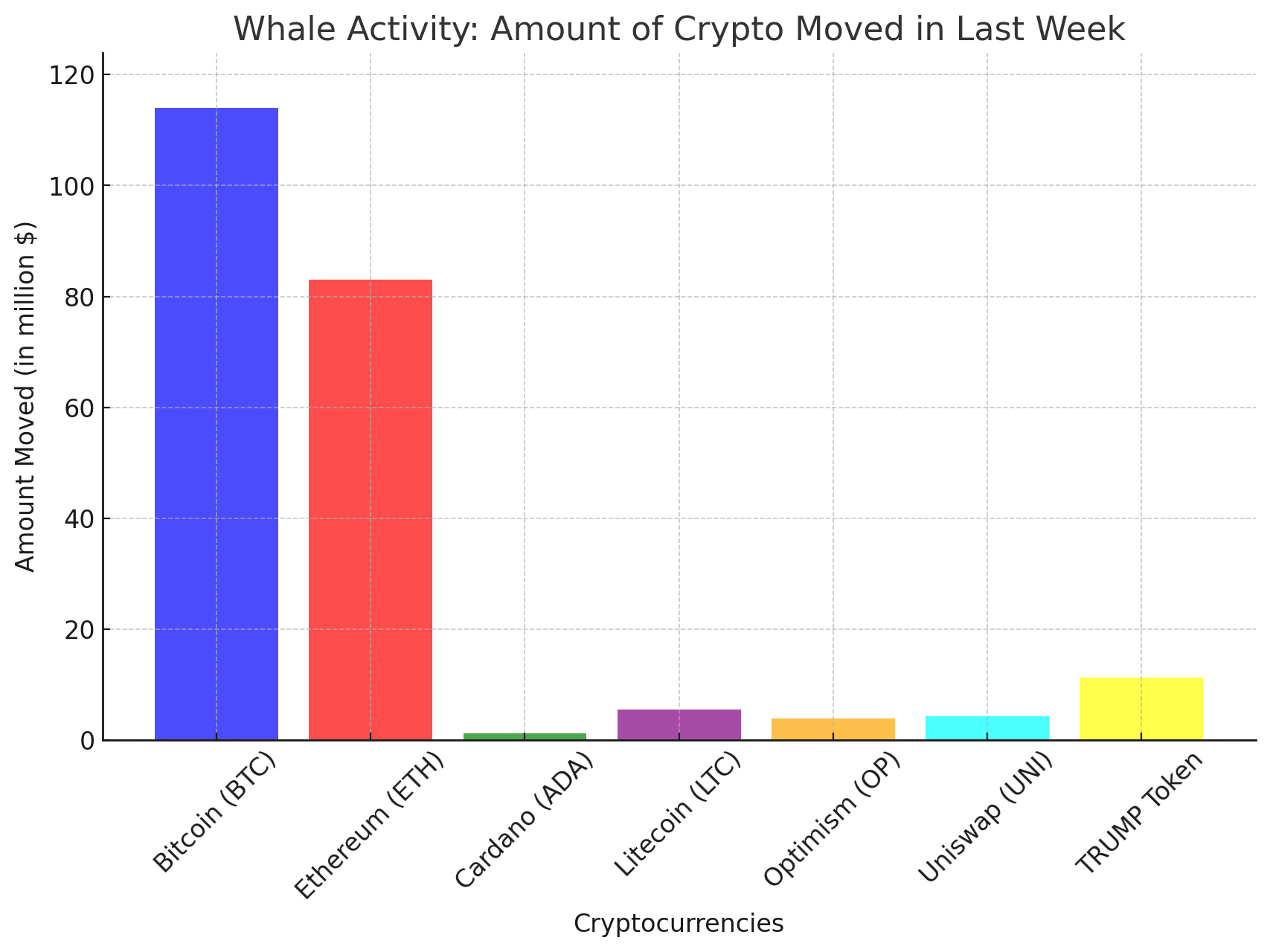

According to recent data over the past week, spanning from February 26 to March 3, 2025, several notable whale movements have been observed across various cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), Litecoin (LTC), Optimism (OP), Uniswap (UNI), and the politically linked TRUMP token. This article delves into these significant transactions, exploring their potential implications on the broader crypto market.

Bitcoin (BTC): Whale Movements and Market Impact

Bitcoin’s whale activity surged this week, with massive transfers and strategic acquisitions influencing market sentiment. A dormant whale moved $114 million worth of BTC to Binance after years of inactivity, raising speculation about market liquidity shifts. Meanwhile, a separate $83 million Bitcoin purchase signaled renewed investor confidence. These high-stake transactions have sparked volatility, leaving traders watching for potential price swings in the coming days.

Dormant Whale Awakens with a $114 Million Transfer

On March 3, 2025, a dormant Bitcoin whale, inactive for three years, reportedly transferred 1,250 BTC (approximately $114.96 million) to the Binance exchange. This sudden movement has raised questions about the whale’s intentions, with speculations ranging from profit realization to strategic portfolio rebalancing. Such substantial transfers can influence market liquidity and trader sentiment, potentially leading to increased volatility.

$83 Million Bitcoin Acquisition Signals Market Confidence

In a separate event on March 3, 2025, a significant Bitcoin acquisition worth $83 million was executed by a whale. This transaction indicates potential market confidence or anticipation of future price movements. Large-scale purchases like this often impact market liquidity and can lead to price fluctuations, attracting trader interest.

Ethereum (ETH): Price Decline Amid Whale Activity

Ethereum, the second-largest cryptocurrency by market capitalization, experienced a price decline, falling to $2,000—a 16-month low. Several factors contributed to this downturn, including macroeconomic pressures, massive liquidations, and notable whale activity. The substantial movements by large holders have intensified selling pressure, leading to increased volatility and raising concerns among investors about Ethereum’s short-term trajectory.

Cardano (ADA): Surge in Whale Demand and Price Appreciation

Cardano has witnessed a remarkable surge in whale demand, leading to significant price appreciation. The cryptocurrency’s value soared to $1.19, with large investors accumulating substantial amounts of ADA tokens. This increased demand is attributed to positive market sentiment and Cardano’s inclusion in strategic crypto reserves, positioning it as a promising asset for future growth.

Altcoins: Whale Accumulation in Litecoin (LTC), Optimism (OP), and Uniswap (UNI)

Whales have also shown interest in several altcoins, notably Litecoin, Optimism, and Uniswap. Despite recent price declines, these cryptocurrencies have seen increased accumulation by large holders, suggesting a bullish outlook. Upcoming developments and the current undervalued status of these assets present potential buying opportunities for investors seeking to capitalize on future gains.

TRUMP Token: Significant Investment Following Previous Losses

On March 3, 2025, a whale reportedly invested $11.28 million in the TRUMP token, purchasing 777,684 tokens at $14.50 each. This move follows previous trading losses, indicating a renewed confidence in the token’s potential. The investment led to a 3.5% price increase within the first hour, reflecting the substantial impact of whale activities on the token’s market performance.

Conclusion

The past week has underscored the significant influence of whale activities on the cryptocurrency market. From substantial Bitcoin transfers and acquisitions to notable movements in Ethereum, Cardano, and various altcoins, these large-scale transactions have played a crucial role in shaping market dynamics. As cryptocurrencies continue to evolve, monitoring whale activities remains essential for investors aiming to navigate the complexities of the digital asset landscape.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. Why did a Bitcoin whale move $114 million worth of BTC to Binance?

A dormant whale, inactive for three years, transferred 1,250 BTC (~$114 million) to Binance on March 3, 2025. While the exact reason remains unknown, such large transfers often indicate profit-taking, portfolio rebalancing, or strategic market positioning. The move raised concerns about potential sell pressure and price volatility in the coming days.

2. How did whales impact Bitcoin’s price this week?

Whale activity had a mixed impact on Bitcoin’s price. The $114 million transfer to Binance raised fears of increased selling pressure, while another whale’s $83 million BTC acquisition suggested bullish sentiment. These competing forces contributed to heightened market fluctuations, with traders closely monitoring whale wallet movements.

3. Are whale movements a reliable indicator of Bitcoin’s future price?

Whale transactions strongly influence Bitcoin’s short-term price action but should be analyzed alongside broader market conditions, macroeconomic factors, and technical indicators. Large buy-ins can signal bullish momentum, while exchange deposits may indicate upcoming sell-offs. However, not all whale transfers directly affect price trends.

4. What should traders do in response to whale activity?

Traders should monitor on-chain data, track whale wallet movements, and analyze order book trends to anticipate potential price swings. Avoid emotional trading based on single whale transactions and consider stop-loss strategies to manage risk. Keeping an eye on fundamental market drivers remains crucial for making informed decisions.

Glossary

Whale: A term used to describe individuals or entities that hold large amounts of cryptocurrency, capable of influencing market prices.

Altcoin: Any cryptocurrency other than Bitcoin.

Dormant Wallet: A cryptocurrency wallet that has not been active or involved in transactions for an extended period.

Market Liquidity: The extent to which an asset can be bought or sold quickly without affecting its price.

Portfolio Rebalancing: The process of realigning the weightings of a portfolio’s assets to maintain a desired risk level or investment strategy.