The decentralized finance (DeFi) market just got rocked by some serious whale action, leaving traders scrambling to make sense of the chaos. Two massive crypto investors—one raking in massive profits, the other taking a brutal loss—have moved over $24 million in DeFi tokens to Binance. According to the media reports, this latest development highlights the volatility and unpredictability of the DeFi sector, proving once again that fortunes can be made—or lost—at the click of a button.

Whale “0x257” cashed out nearly $8 million, securing major gains on AAVE, LINK, and UNI, while BlockTower Capital, a prominent institutional investor, dumped a whopping $16.78 million worth of tokens, walking away with a $2.94 million net loss, on Binance.

So, what’s really going on? Is this the start of a larger selloff? Or are these moves just part of the game in DeFi’s unpredictable world? Let’s dive deep into the numbers, analyze market reactions, and see whether DeFi investors should be worried or excited about what’s next.

The $24 Million DeFi Shuffle: Winners & Losers

Whale 0x257: The Big Profit Taker

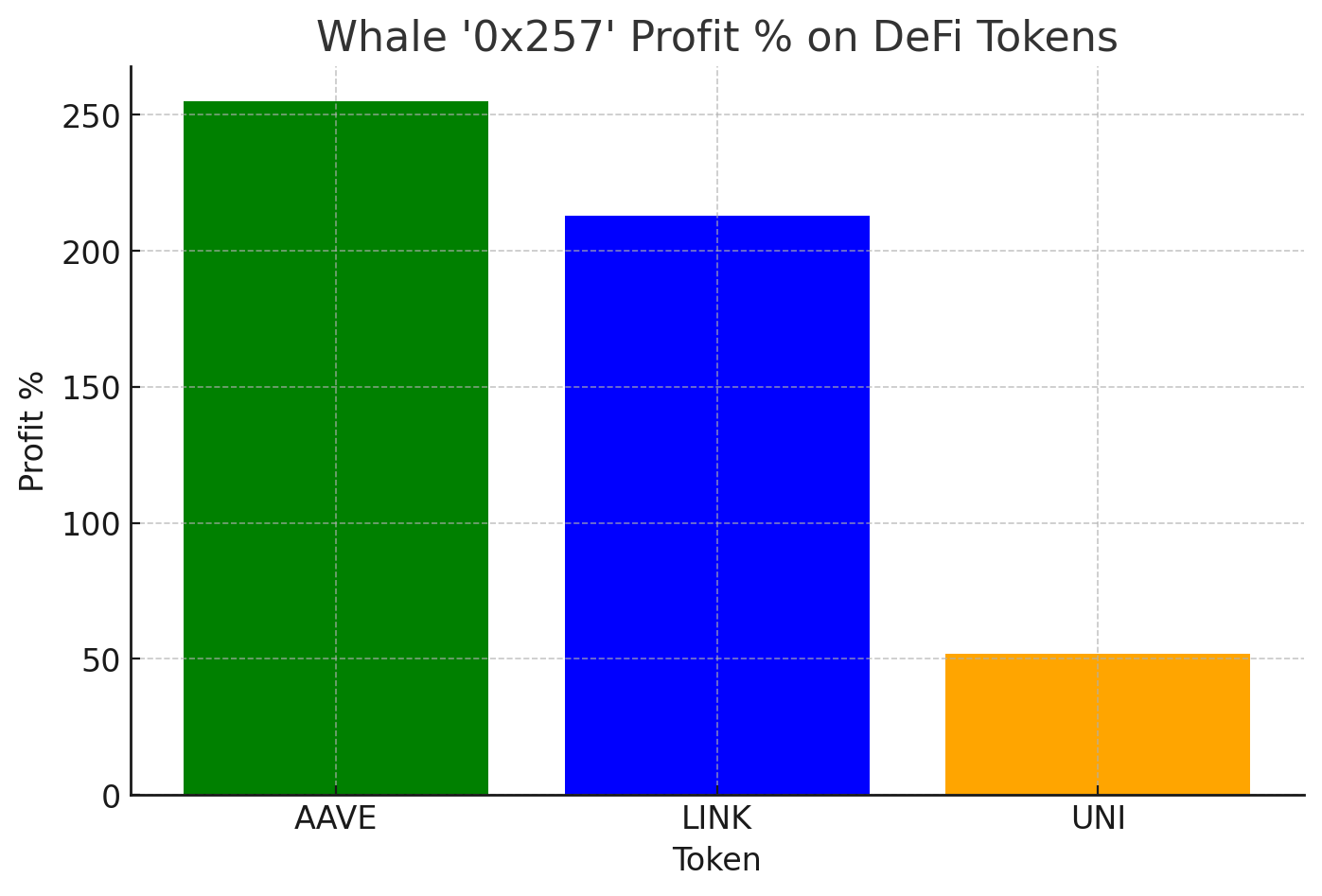

Whale “0x257” has made a power move in the DeFi space, executing a well-timed selloff that resulted in massive profits. This investor, known for holding AAVE, LINK, and UNI for more than two years, strategically offloaded nearly $7.96 million worth of DeFi tokens to Binance, making a 255% return on AAVE, 213% on LINK, and 52% on UNI. That’s no small feat—it’s the kind of success most traders only dream of.

The breakdown of their Binance deposits is as follows:

| Token | Amount Deposited | Value | Profit % |

| AAVE | 13,816 | $3.54M | +255% |

| LINK | 161,463 | $3.13M | +213% |

| UNI | 85,529 | $758K | +52% |

Their gains are impressive, particularly on AAVE and LINK, where they more than tripled their investment. This move suggests “0x257” either anticipated a near-term market dip or simply decided it was time to lock in those profits before things got shakier.

BlockTower Capital: A Painful $2.94M Loss

BlockTower Capital, on the other hand, wasn’t so lucky. The firm unloaded $16.78 million worth of DeFi tokens onto Binance, resulting in a staggering $2.94 million loss. Here’s the damage report:

| Token | Amount Deposited | Value | Gain/Loss % |

| UNI | 532,754 | $5.33M | +12% |

| LINK | 197,451 | $4.29M | -9% |

| MKR | 3,862 | $3.77M | -31% |

| ENA | 5.153M | $3.39M | -29% |

Let’s break it down. Whale “0x257” deposited 13,816 AAVE tokens, valued at $3.54 million, into Binance, securing the biggest win with a staggering +255% profit. Then came 161,463 LINK tokens, worth $3.13 million, netting an equally jaw-dropping 213% gain. Finally, they moved 85,529 UNI tokens, bringing in $758,000, and still managed a solid 52% return. In total, this whale walked away with a multimillion-dollar payday, reinforcing the idea that patience—and smart timing—can lead to massive returns in the crypto game.

But why sell now? Given the market’s recent volatility, “0x257” may have seen the writing on the wall and decided it was the perfect time to take profits. With Trump’s tariffs shaking global markets, crypto has become highly reactive to macroeconomic shifts, and DeFi tokens have been hit especially hard. By cashing out when the market was still relatively stable, this whale avoided potential losses from a deeper market correction.

Another possibility? “0x257” may be looking to reinvest. Crypto whales don’t typically exit the market altogether—they move funds to seize better opportunities. Whether it’s rotating into Bitcoin, Ethereum, or another undervalued DeFi project, this whale could be setting up for the next big play. Given the fast-paced nature of crypto, traders who make proactive decisions tend to come out on top.

One key takeaway from “0x257″’s move? Timing is everything in the crypto market. Holding assets long-term can be profitable, but knowing when to exit is just as important. This whale didn’t just wait for prices to pump—they executed a strategic exit, locking in profits before potential volatility wiped them out.

Now, the big question: Will more whales follow suit? If other major investors take the same route and start offloading their DeFi holdings, the market could see increased selling pressure, possibly leading to further price dips. But if new buyers jump in to scoop up DeFi tokens at lower prices, we could see a strong rebound.

Regardless of what happens next, “0x257” just proved that smart investing, patience, and market awareness can turn a long-term hold into a multi-million-dollar win. Their successful trade serves as a lesson for investors—when opportunity knocks, don’t hesitate to cash in.

DeFi Market Overview: A Week of Wild Swings

It’s not just these whales making waves—the entire DeFi market has been on a rollercoaster ride. Over the past seven days, some of the biggest DeFi tokens have taken a serious hit, with prices tumbling across the board. However, there’s a silver lining: in the last 24 hours, we’ve seen signs of a potential recovery, hinting that the worst might be over.

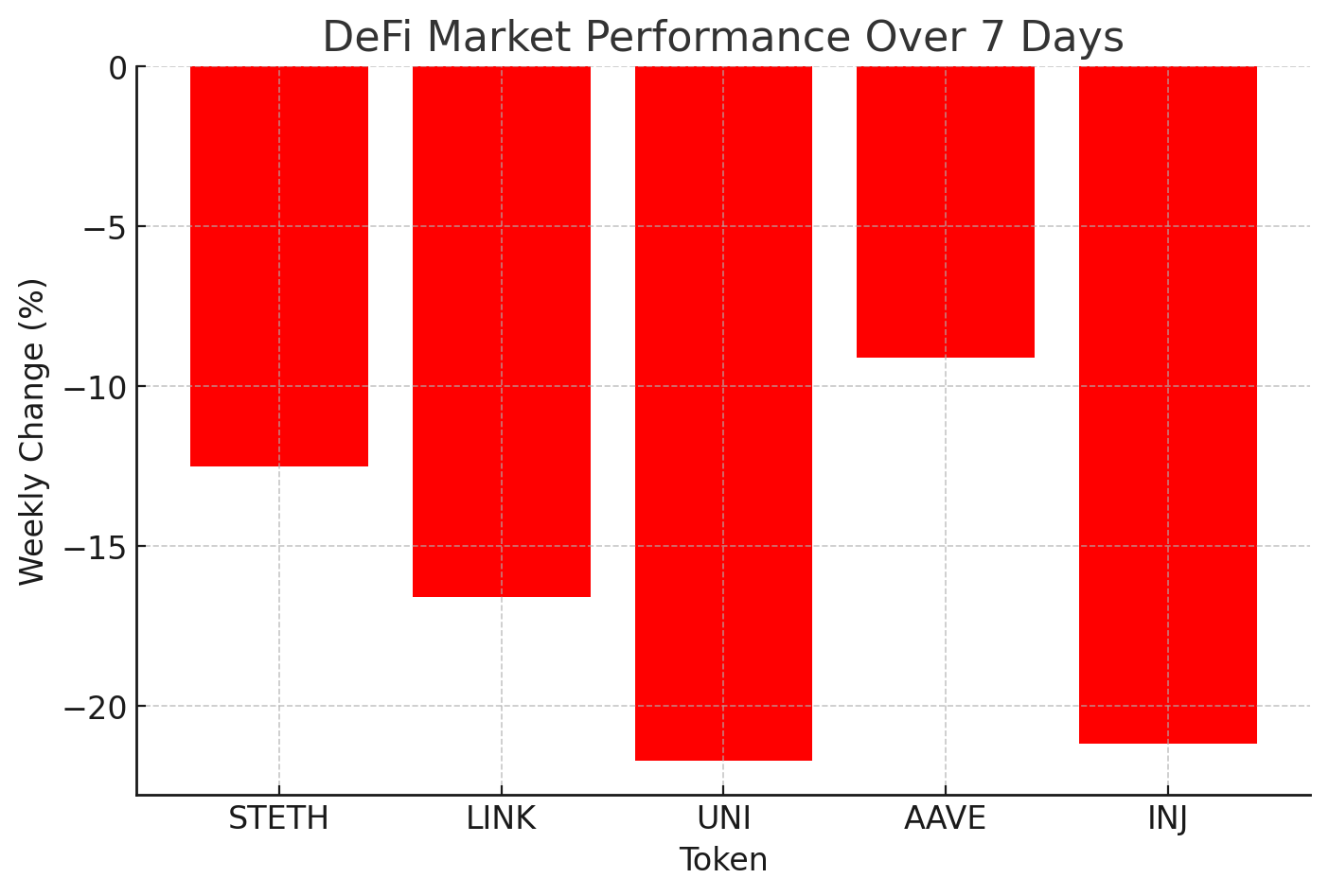

Let’s talk numbers. The past week has been rough for DeFi investors, with nearly all major tokens experiencing double-digit losses. Here’s how some of the top projects performed:

7-Day DeFi Performance

| Token | Weekly Change (%) |

| STETH | -12.5% |

| LINK | -16.6% |

| UNI | -21.7% |

| AAVE | -9.1% |

| INJ | -21.18% |

That’s downright brutal. UNI and INJ took the hardest hits, shedding more than 21% of their value in just a week. LINK, which is often considered a safer bet in the DeFi space, also got slammed, dropping by nearly 17%. Even AAVE, which had been relatively stable compared to its peers, wasn’t spared, sliding down 9.1%.

What’s causing this bloodbath? The macro uncertainty triggered by Trump’s tariffs is definitely a big factor. The entire crypto market, especially DeFi, has reacted negatively to fears of an economic slowdown and stricter regulations. Investors have been pulling back, leading to widespread sell-offs across the sector.

But here’s the thing—DeFi isn’t dead. In fact, the past 24 hours have shown signs of a potential turnaround, with some tokens gaining momentum. Could this be the start of a recovery, or just a temporary relief rally? The next few days will be crucial in determining whether DeFi bounces back or continues its downward slide.

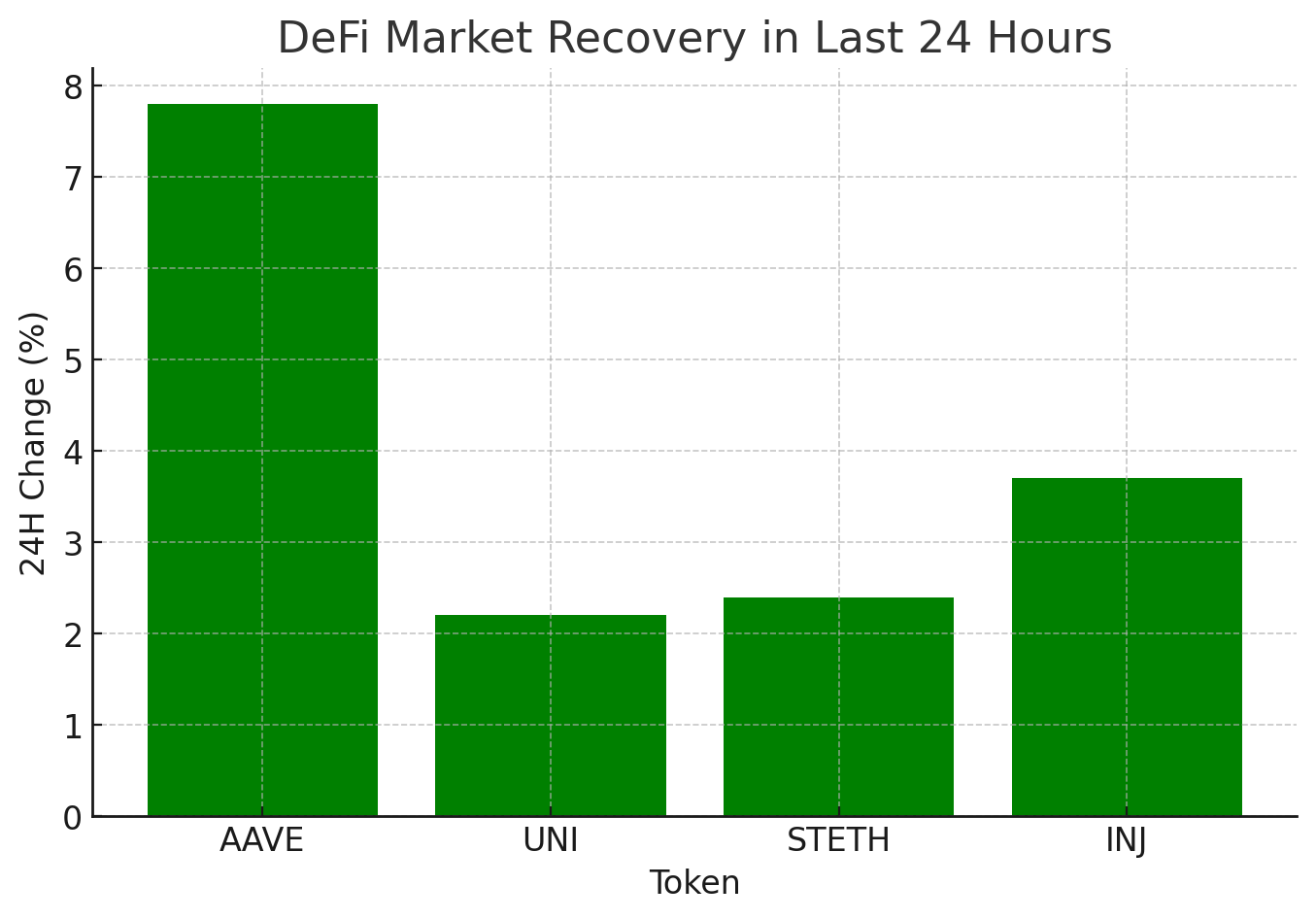

24-Hour Bounce Back

In a surprising turn of events, some of the top DeFi tokens have staged a sharp comeback in the last 24 hours, suggesting that traders may see this recent downturn as a buying opportunity. After a brutal week of double-digit losses, select DeFi assets are showing early signs of recovery, hinting at a potential trend reversal in the broader market.

Here’s a look at the DeFi tokens that are bouncing back:

| Token | 24H Change (%) |

| AAVE | +7.8% |

| UNI | +2.2% |

| STETH | +2.4% |

| INJ | +3.7% |

These positive price movements suggest that while DeFi remains under pressure, there is a resurgence in buying activity, especially from traders looking to capitalize on lower prices. AAVE, which was down nearly 10% last week, has surged by 7.8% in just a day, making it one of the best-performing DeFi assets in this short recovery phase. UNI and STETH have also posted modest gains, while INJ, which suffered a 21% weekly drop, has clawed back 3.7% in the last 24 hours.

So, what’s driving this sudden shift? Whale accumulation could be playing a major role. After all, when large investors begin accumulating assets at depressed prices, it often sparks a chain reaction, bringing in more traders looking to ride the momentum. Additionally, short sellers covering their positions may have contributed to this mini-rebound.

While it’s still too early to declare a full-scale recovery, this uptick suggests that some investors are regaining confidence in DeFi projects despite the broader crypto market’s volatility. If this buying pressure continues, we could see DeFi tokens regain more ground in the coming days.

What’s Next for DeFi? Bearish Breakdown or Bullish Bounce?

The recent whale selloff in the DeFi market has raised a major question: Is this just an isolated event, or does it signal a bigger trend? While whale 0x257 locked in massive profits, another large investor, BlockTower Capital, suffered heavy losses after dumping a significant amount of DeFi tokens on Binance. This contrasting behavior among top players has left many investors wondering: Is DeFi heading for a deeper correction, or is this just a temporary shakeout?

The Bearish Case: A Deeper Correction in DeFi?

If BlockTower Capital’s $16.78 million selloff is any indication, some big investors may be losing confidence in DeFi. Large-scale liquidations often trigger a domino effect, forcing other investors to cut their losses before the market moves further downward. If we see more institutional-sized dumps, it could signal that the bearish trend in DeFi isn’t over yet.

Here’s why a deeper correction could be in play:

- More Whale Selloffs – When one big player exits, others often follow suit to avoid getting stuck in a potential long-term downtrend. If additional whales start liquidating their holdings, it could accelerate DeFi’s losses in the short term.

- Weak Market Sentiment – Over the past week, major DeFi tokens have been battered, with some dropping over 20%. This kind of downturn shakes investor confidence, making it harder for DeFi projects to regain traction.

- Regulatory Uncertainty – The SEC’s new Crypto Task Force is currently reviewing regulations on DeFi, and some investors may be reducing their exposure until there’s more clarity. If new regulations restrict DeFi lending, staking, or liquidity farming, it could hit the sector hard.

- Bitcoin and Macro Pressures – Bitcoin recently dropped below $97K, and when the king of crypto struggles, altcoins—including DeFi tokens—usually bleed even more. If macro factors, such as Trump’s tariffs or interest rate concerns, keep markets uncertain, DeFi could remain under pressure for an extended period.

If this bearish case plays out, DeFi could be on the brink of a larger downtrend, where prices fall further, and retail investors start panic-selling, amplifying the correction.

The Bullish Case: A Classic Market Overreaction?

On the flip side, whale 0x257 might just be cashing in on profits without abandoning the DeFi sector entirely. Given that this investor held AAVE, LINK, and UNI for over two years, it’s possible they simply took advantage of the recent market swings rather than signaling a lack of confidence in DeFi’s future.

Here’s why DeFi could bounce back stronger:

- 24-Hour Price Rebound – After a rough seven-day losing streak, multiple top DeFi tokens have already started to recover. AAVE, UNI, and STETH have gained between 2% and 7.8% in the past 24 hours, suggesting that traders are buying the dip rather than panicking.

- Market Cycles and Accumulation – Every bull run starts with smart money accumulation. If whales like 0x257 are taking profits while holding onto core positions, it could indicate long-term confidence in DeFi rather than a full exit.

- DeFi Fundamentals Remain Strong – Despite price volatility, DeFi continues to grow, with more protocols launching new features and institutions showing renewed interest.

- Potential Short Squeeze – If too many traders short DeFi tokens, we could see a strong reversal as shorts get liquidated, forcing a rapid price spike.

Final Thoughts: Is This a Buying Opportunity?

Right now, both bullish and bearish factors are at play. If more whales dump their holdings, we could see further downside for DeFi. However, if the current price rebound continues, DeFi could stabilize and regain momentum as traders re-enter the market at discounted levels.

The coming days will be crucial in determining whether this is just another dip before a rally or the beginning of a longer DeFi downtrend. Investors should watch whale activity, Bitcoin’s performance, and regulatory developments closely to get a clearer picture of where the market is headed next.

At this point, DeFi investors have two choices—panic or play smart.

- If you believe in DeFi’s long-term potential, then these dips could be an opportunity to accumulate tokens at a discount.

- If you’re cautious, watching whale activity and waiting for confirmation of a trend reversal might be the best approach.

For now, DeFi remains as unpredictable as ever, and one thing’s for sure: The next few days will be crucial in determining where this market heads next.

Frequently Asked Questions (FAQs)

1. Why did whale “0x257” sell AAVE, LINK, and UNI?

Whale “0x257” likely sold these tokens to lock in profits, as they had been holding since mid-2022 and saw massive returns—255% on AAVE, 213% on LINK, and 52% on UNI.

2. Why did BlockTower Capital take a $2.94 million loss?

BlockTower Capital dumped $16.78 million in DeFi tokens, possibly due to strategic portfolio adjustments or loss-cutting amid DeFi market uncertainty.

3. Is the DeFi market crashing?

Not exactly. While major DeFi tokens have seen double-digit losses over the past week, some have started recovering in the past 24 hours.

4. Should I buy DeFi tokens now?

That depends on your risk appetite. If you believe in DeFi’s long-term potential, this could be a buy-the-dip opportunity. However, waiting for market confirmation is always a safer play.

5. What DeFi tokens are rebounding?

In the last 24 hours, AAVE (+7.8%), UNI (+2.2%), STETH (+2.4%), and INJ (+3.7%) have shown signs of recovery.

6. How do whale movements impact crypto prices?

When large investors buy or sell millions in tokens, they can significantly impact market sentiment, leading to price swings in either direction.

7. What’s the long-term outlook for DeFi?

Despite short-term volatility, DeFi’s long-term potential remains strong, especially as institutions continue exploring decentralized finance applications.

References:

Coin Pedia – coinpedia.org

Binance – binance.com