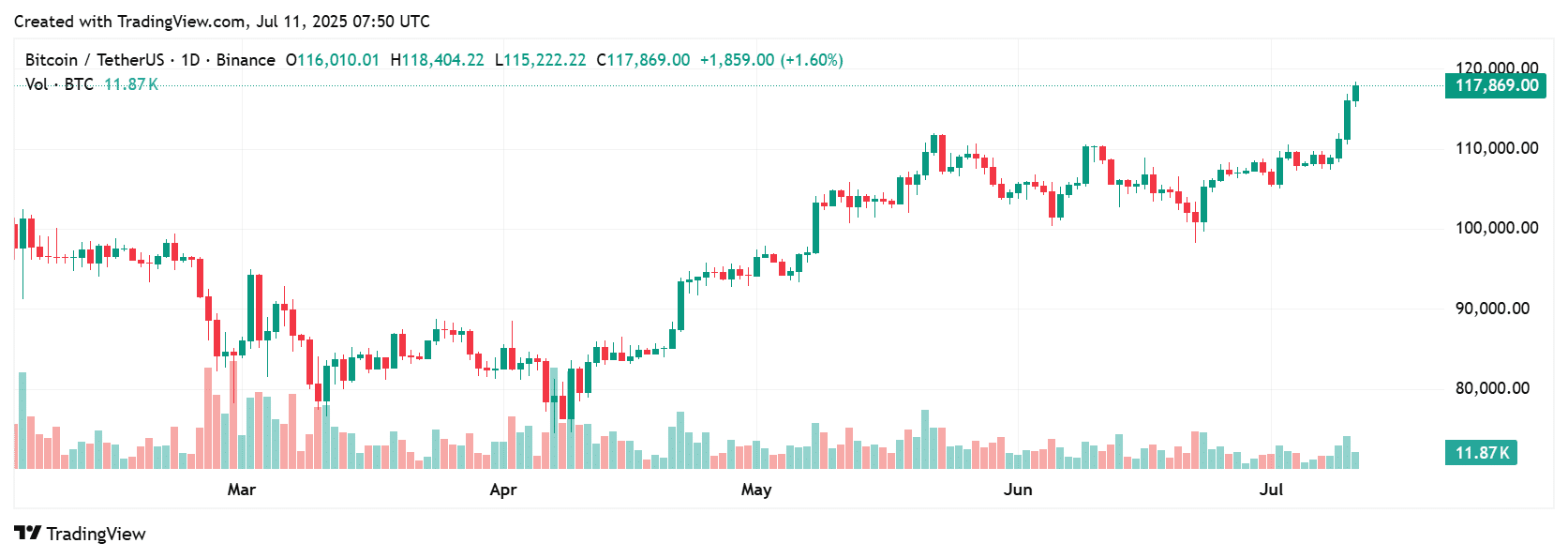

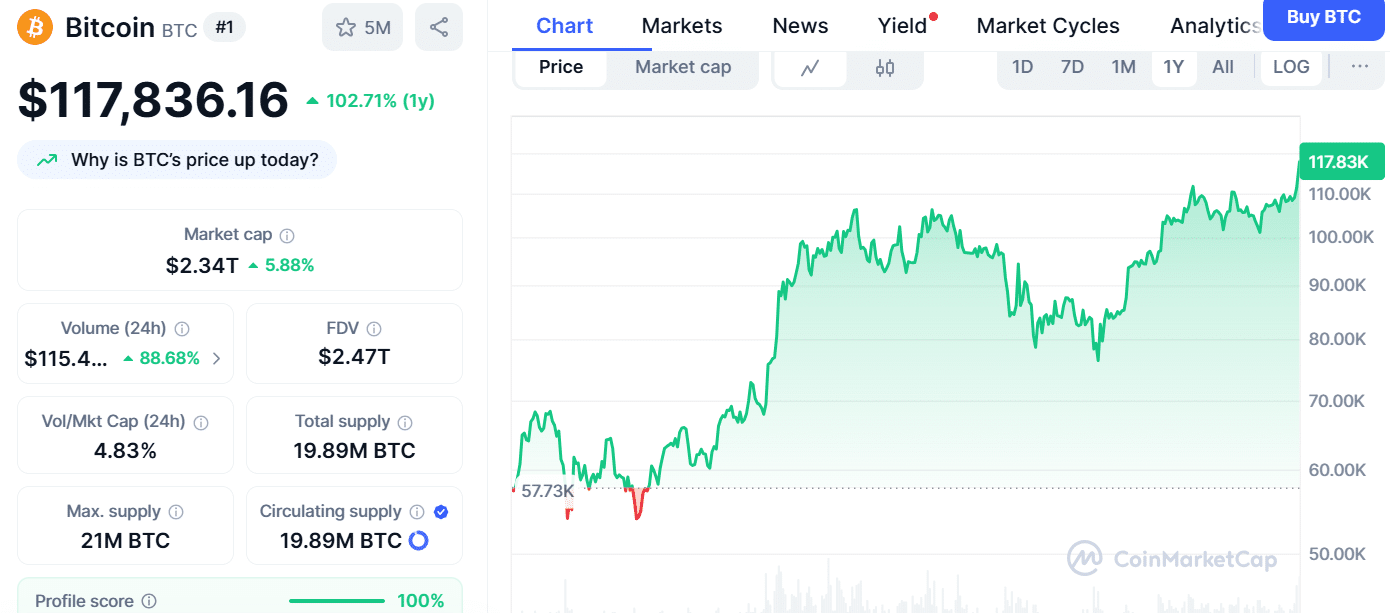

It’s official: Bitcoin has reached new territory again. This second week of July, the world’s biggest cryptocurrency smashed previous milestones by surpassing $117,000. The swift and furious surge sent shockwaves across crypto markets, not only among holders, but also in the derivatives area, where billions of dollars in short bets were wiped out.

As traders celebrated BTC’s breakthrough, nearly $1.58 billion in open interest evaporated, and $963 million in short liquidations highlighted a stark contrast. Wenny Cai, COO of SynFutures, expressed it simply:

“The current rally is exhilarating, but it isn’t completely organic. What we’re witnessing is mostly a short-coverage pinch.

In other words, the price explosion might be driven more by traders canceling poor bets than by new investment inflows.

A Look Back: How Bitcoin Got Here

To comprehend the present mess, we must first go back in time. Following months of consolidation and investor skepticism, Bitcoin’s latest burst over $113K surprised many. Analysts were drawn to the character of the price movement. Instead of a prolonged build-up fueled by rising spot activity, the move was abrupt, triggered by cascading liquidations in the futures market.

This trend resembles previous surges in which leverage-fueled wagers failed, forcing traders to swiftly unwind holdings. This time, however, the scale was different.

“Over a billion dollars in shorts vaporized in 24 hours?” “That’s one of the biggest in months,” said Arthur Hayes, BitMEX co-founder and derivatives specialist. “It’s not just a pump, it’s a market cleansing event.”

The Calm Before a Storm, or Start of a New Cycle?

Despite the volatility, others believe this is a necessary step toward a more stable bull market. Bitcoin’s price has risen from $70K to $118K over the last quarter in a very steady manner. According to CoinDesk, this represents a transition away from “Wild West” pricing behavior and toward more Wall Street-like dynamics, less chaotic and more organized.

This development has been aided by increased institutional usage. ETFs, corporate treasury allocations, and accommodative regulatory rhetoric from US politicians have all led to a more mature environment.

“Bitcoin is no longer a speculative toy. Bloomberg ETF analyst James Seyffart said that it is being considered as digital gold, and the markets reflect this.

Derivatives Data: A Window Into Market Psychology

The cryptocurrency futures market operates as a crystal ball, providing insights into trading behavior. The most recent statistics portray the tale of a market taken by surprise. A domino effect resulted from a mix of overleveraged positions and underestimated resistance zones.

According to Deribit and Glassnode, a considerable portion of call options, worth more than $868 million, are currently available at strike prices over $140,000, with the majority expiring in September. This suggests that traders continue to anticipate Bitcoin to rise in value.

| Price Level | Market Sentiment |

|---|---|

| $107,000 | Critical support zone |

| $117,000 | Breakout confirmation |

| $140,000 | Institutional target |

| $146,400 | Long-term bullish cap |

Whether Bitcoin sustains its gains depends largely on whether the market can avoid another wave of forced liquidations, or if new spot buyers step in to solidify support.

Policy, Politics, and Predictions

While technical factors come into play, macro mood is also important. This recent surge comes with a rush of good headlines: U.S. Senate hearings showing regulatory support, Donald Trump’s revived pro-Bitcoin position, and large corporations transferring funds into Bitcoin.

Meanwhile, Deribit call option flows, ETF performance, and stablecoin demand all indicate that Bitcoin’s bull case is far from over.

“Traders are betting big on a $140K summer,” said CoinGlass analyst Emily Rood. “The option data does not lie. “The smart money is looking up, not down.”

Final Take: Don’t Mistake Momentum for Certainty

Bitcoin’s surge over $117K is historic, but there are some cautionary indicators. Derivatives statistics indicate that the market’s undercurrent is tumultuous. While the future is bright for long-term investors, short-term traders should exercise caution.

However, the mood has altered. This is no longer merely a speculative rally. It’s a maturation process supported by institutions, regulatory impetus, and mainstream belief. Bitcoin now demands respect rather than attention.

FAQs

What caused the massive liquidations in Bitcoin derivatives?

A sudden surge in price triggered a short squeeze, liquidating over $1.5B in leveraged positions.

Is this rally sustainable?

It depends. If supported by spot buying and institutional flows, the rally could continue. Otherwise, it may retrace.

How high could Bitcoin go in 2025?

Analysts point to targets between $140K and $146K based on technical charts and options data.

Is this a good time to invest?

Long-term investors may find value, but short-term traders should manage risk carefully due to high volatility.

Glossary of Key Terms

Derivatives – Financial contracts whose value is based on an underlying asset, like Bitcoin.

Liquidation – Forced closure of a position due to insufficient collateral.

Short Squeeze – When short sellers are forced to buy back at higher prices, pushing the asset up.

Call Option – A financial bet that an asset will exceed a certain price by a set date.

Open Interest – The total number of active derivative contracts in the market.