XRP is struggling amidst uncertainties stemming from the SEC’s appeal and the Bitwise XRP-focused ETF application. While Bitwise’s filing sparked optimism among investors, the SEC’s appeal quickly overshadowed these hopes, leading to a sharp decline in XRP prices.

SEC Appeal and ETF Application for XRP

Recently, Bitwise submitted an application for an ETF focused on XRP to the U.S. Securities and Exchange Commission (SEC), causing excitement among investors. However, this was short-lived as the SEC filed an appeal, negatively impacting the market. The SEC is challenging a court decision from two months ago related to Ripple Labs’ programmatic sales, reigniting concerns for XRP holders.

Ripple’s Legal Battle Continues to Weigh on XRP

Despite Ripple’s positive outcome earlier this year in its ongoing legal battle with the SEC, the appeal process continues to exert downward pressure on XRP prices. The possibility of XRP being classified as a security still looms over the market, a development that would be detrimental to its price.

Sharp Decline in XRP Price

Due to these uncertainties, XRP experienced an 11% drop, falling to $0.537 within the last 24 hours. Over the past week, the coin has lost 16% of its value. According to CoinGecko, XRP was the third worst-performing cryptocurrency among the top 100. In comparison, Bitcoin and Ethereum saw losses of only 0.5% and 3.7%, respectively. This steep decline has caused concern among investors, with the prolonged SEC appeal making a short-term recovery unlikely.

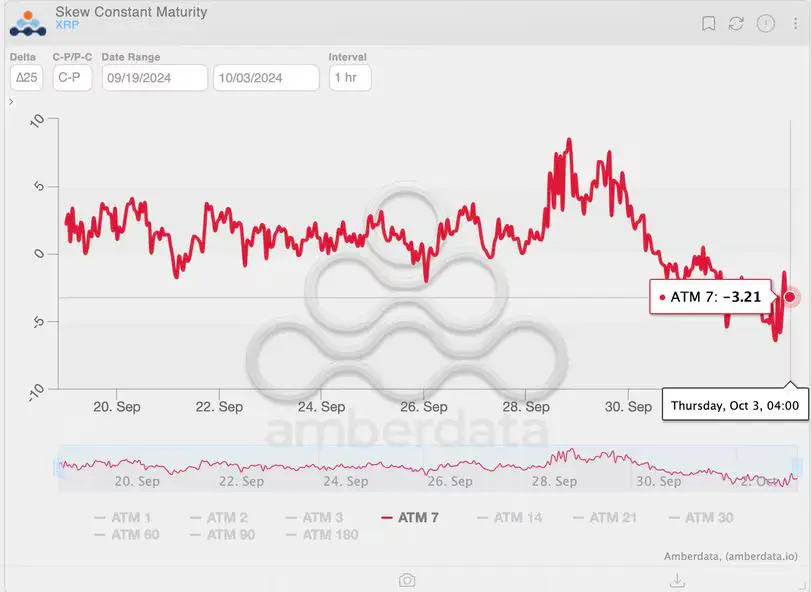

Bearish Sentiment in the Options Market

In the options market, XRP is facing additional selling pressure. Its seven-day call-put ratio is at -3.2%, indicating that investors are seeking more protection against price drops. While Bitcoin and Ethereum remain in neutral or slightly positive territory, XRP continues to exhibit bearish trends.

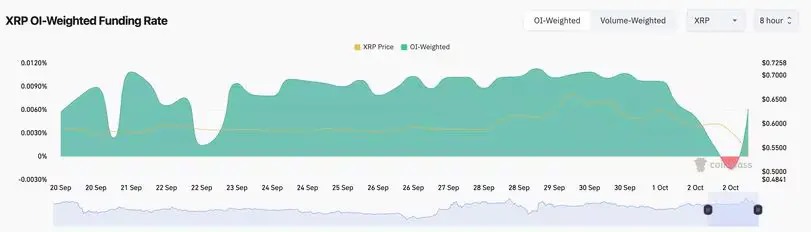

Futures Market Shows Glimmers of Hope

Futures Market Shows Glimmers of Hope

On the flip side, in the perpetual futures market, XRP’s funding rates briefly turned negative but quickly bounced back to positive. Positive funding rates indicate that long positions are paying short positions, signaling some optimism for a recovery in the short term.

While there are signs of potential rebound in the futures market, the overall sentiment toward XRP remains bearish. Investors should stay cautious and closely monitor further developments, adjusting their strategies accordingly. Stay informed with The Bit Journal for updates on XRP and the broader crypto market.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!

Futures Market Shows Glimmers of Hope

Futures Market Shows Glimmers of Hope