The mechanisms that secure and validate transactions are paramount in the crypto market. Two primary consensus mechanisms have emerged: Proof of Work (PoW) and Proof of Stake (PoS). While PoW has been instrumental since the inception of Bitcoin, PoS offers a more energy-efficient and scalable alternative. This article delves deep into the Proof of Stake mechanism, its workings, advantages, and comparisons with Proof of Work, and addresses common questions surrounding it.

What is Proof of Stake?

Proof of Stake is a consensus algorithm used in blockchain networks to achieve distributed consensus. Unlike Proof of Work, which relies on miners solving complex mathematical puzzles, PoS selects validators based on the number of coins they hold and are willing to “stake” as collateral. This approach not only reduces energy consumption but also aligns validators’ interests with the network’s health and security.

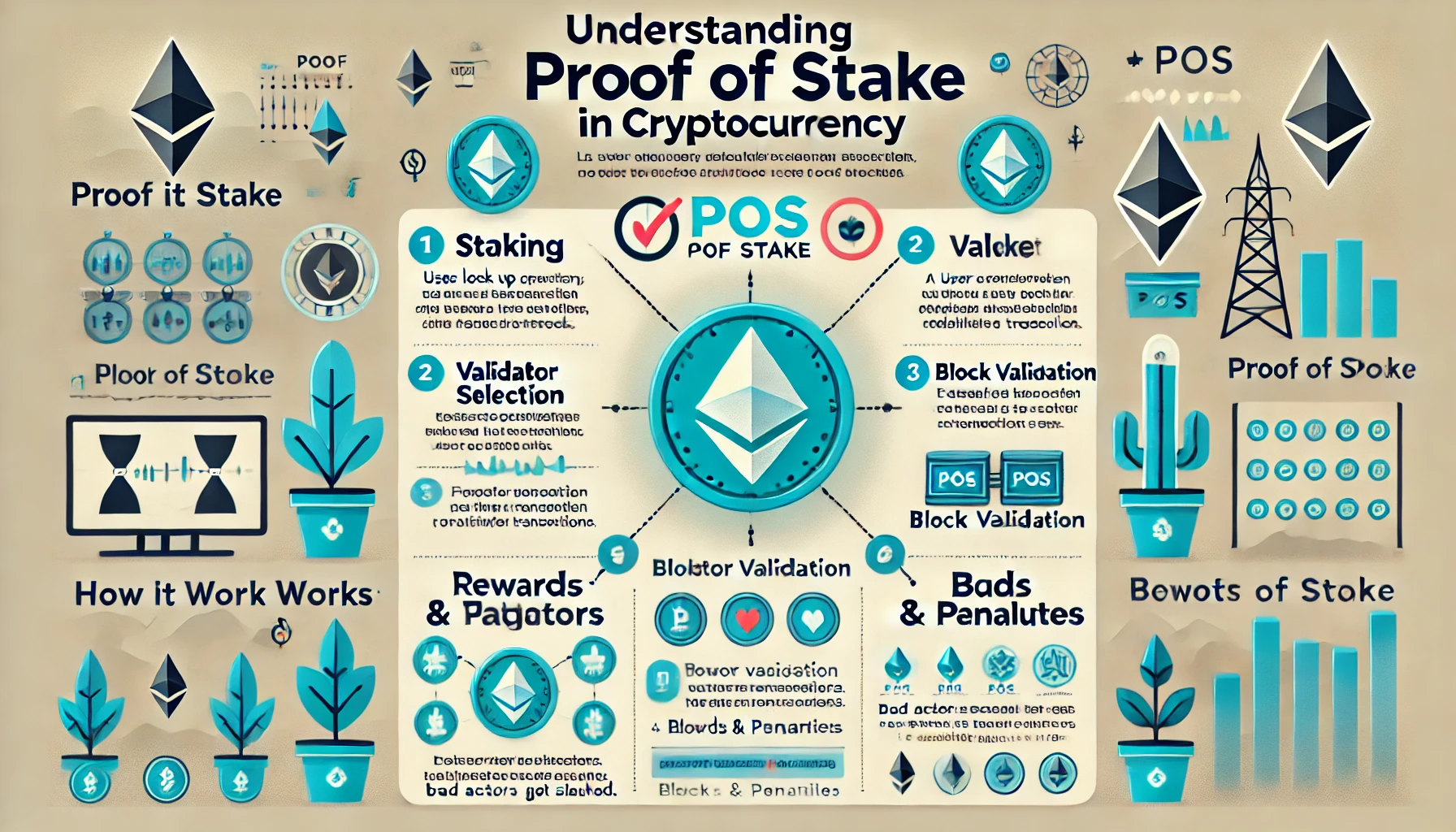

How Does Proof of Stake Work?

Staking: Participants (validators) lock a portion of their cryptocurrency holdings as a stake in the network.

Validator Selection: The network randomly selects a validator to propose the next block, with the probability of selection often proportional to the amount staked.

Block Validation: The chosen validator verifies the legitimacy of transactions within the block.

Consensus: Other validators attest to the validity of the proposed block. Once a certain number of attestations are received, the block is added to the blockchain.

Rewards and Penalties: Validators earn rewards for validating blocks. However, malicious behavior or validating fraudulent transactions can lead to penalties, including the loss of their staked assets—a process known as “slashing.”

Advantages of Proof of Stake

Energy Efficiency: PoS significantly reduces energy consumption compared to PoW. For instance, Ethereum’s transition to PoS in 2022 led to a 99.95% reduction in its energy usage.

Security: Attacking a PoS network would require an entity to control a majority of the staked currency, which is economically prohibitive and deters malicious activities.

Decentralization: Lower barriers to entry allow more participants to become validators, promoting a more decentralized network.

Proof of Stake vs. Proof of Work

While both PoS and PoW aim to secure the network and validate transactions, they differ fundamentally in their approaches:

| Aspect | Proof of Work (PoW) | Proof of Stake (PoS) |

|---|---|---|

| Energy Consumption | High energy usage due to intensive computational requirements. For example, Bitcoin’s annual energy consumption is comparable to that of entire countries like Poland. | Significantly lower energy consumption. Ethereum’s shift to PoS reduced its energy usage by over 99.9%. |

| Validator Selection | Miners compete to solve cryptographic puzzles; the first to solve adds the next block. | Validators are chosen based on the amount of cryptocurrency they stake, reducing the need for competition. |

| Hardware Requirements | Requires specialized and powerful hardware (e.g., ASICs) to remain competitive. | Can be operated using standard computer hardware, making it more accessible. |

| Security | Security is maintained through computational power; a 51% attack would require controlling the majority of the network’s mining hashrate. | Security is maintained through economic stake; an attacker would need to control the majority of the staked currency, which is economically unfeasible. |

Environmental Impact

The environmental concerns associated with PoW have been a driving force behind the adoption of PoS. PoW networks, like Bitcoin, consume vast amounts of energy, leading to significant carbon footprints. In contrast, PoS networks drastically reduce energy consumption. Ethereum’s transition to PoS, known as “The Merge,” decreased its energy consumption by approximately 99.95%, highlighting the environmental benefits of PoS.

Common Criticisms and Misconceptions

Centralization Concerns: Critics argue that PoS may lead to centralization, as those with more funds can stake more and, therefore, have more influence. However, mechanisms like capping the maximum stake and incentivizing smaller validators aim to mitigate this risk.

Security Issues: Some believe PoS is less secure than PoW. However, PoS networks implement penalties, such as slashing, to deter malicious behavior, and the economic cost of attacking a PoS network is prohibitively high.

Conclusion

Proof of Stake (PoS) has emerged as a game-changing consensus mechanism, offering a more energy-efficient, scalable, and environmentally friendly alternative to Proof of Work (PoW). By allowing participants to validate transactions based on their staked assets rather than computational power, PoS enhances security while reducing the costs and energy consumption associated with traditional mining. Whether you are an investor, developer, or blockchain enthusiast, understanding PoS is crucial as the industry moves toward a more sustainable digital future.

Frequently Asked Questions (FAQs)

1. What is staking in Proof of Stake?

Staking involves locking up a certain amount of cryptocurrency to participate in the network’s validation process. Validators are selected to propose and validate new blocks based on the amount they have staked.

2. How are validators chosen in a PoS system?

Validators are typically chosen randomly, with the probability of selection proportional to the amount of cryptocurrency they have staked. This ensures that those with a higher stake have a higher chance of being selected but doesn’t guarantee selection.

3. What happens if a validator behaves maliciously?

If a validator attempts to validate fraudulent transactions or behaves dishonestly, they can be penalized through a process called “slashing,” where a portion of their staked assets is forfeited.

4. Can anyone become a validator in a PoS network?

Yes, anyone who meets the minimum staking requirement can become a validator. The specific amount required varies by network.

5. How does PoS impact transaction speeds and fees?

Due to its efficient validation process, PoS can improve transaction speeds and reduce fees. However, actual performance depends on the specific blockchain implementation.

Glossary of Key Terms

Blockchain: A decentralized digital ledger that records transactions across a network of computers.

Consensus Mechanism: A protocol used by blockchain networks to achieve agreement on the state of the ledger among distributed participants.

Proof of Stake (PoS): A consensus mechanism where validators are chosen based on the amount of cryptocurrency they stake, rather than computational power.

Proof of Work (PoW): A consensus mechanism that requires miners to solve complex mathematical puzzles to validate transactions and create new blocks.

Staking: The process of locking up cryptocurrency to participate in a PoS network and earn rewards as a validator.

Validator: A participant in a PoS network who validates transactions and adds new blocks to the blockchain.

Slashing: A penalty mechanism in PoS where a validator loses a portion of their staked assets due to malicious behavior or protocol violations.

The Merge: Ethereum’s transition from PoW to PoS in September 2022 significantly reduced its energy consumption.

51% Attack: A security vulnerability in blockchain networks where a single entity gains control of more than 50% of the network’s mining power or staked assets, allowing them to manipulate transactions.

Gas Fees: Transaction fees paid by users to compensate validators or miners for processing transactions on a blockchain.

Decentralization: The principle of distributing power and decision-making across a network rather than relying on a central authority.

Sources