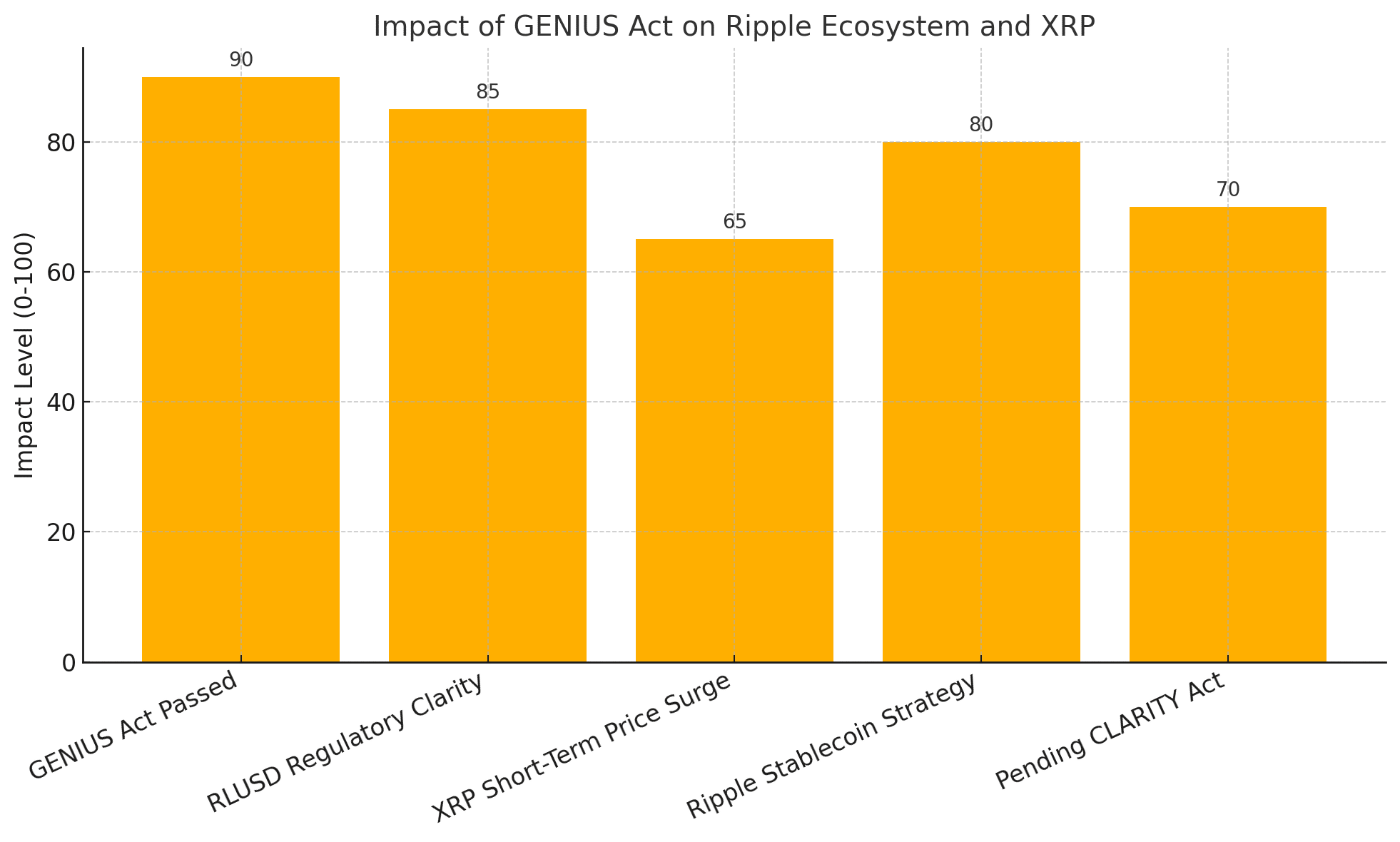

The passage of the GENIUS Act, a legislative milestone intended to federally regulate stablecoins, has marked a dramatic change in the US crypto ecosystem. President Trump signed the Guiding and Establishing National Innovation for U.S. Stablecoins Act, providing much-needed certainty for stablecoin issuers.

Ripple stands to benefit the most from this decision, as its RLUSD stablecoin is now poised to serve as a regulatory-compliant bridge between conventional banking and blockchain-powered settlements.

This development has rekindled concerns in the XRP investors concerning long-term growth, particularly now that Ripple has integrated RLUSD directly into the XRP Ledger (XRPL). While XRP investors are optimistic about price rises, experts warn that actual value will be determined by how Ripple uses this legislative opportunity in its stablecoin and cross-border payment plan.

GENIUS Act: A New Legal Framework for Stablecoins

The GENIUS Act creates a clear and legally recognized framework for the development and operation of stablecoins in the United States. It requires full currency or US Treasury backing, public disclosure of reserve assets, and a three-year phased enforcement period. Ripple is already preparing its RLUSD stablecoin to meet these standards, enhancing its reputation with regulators and institutional investors alike.

Ripple CEO Brad Garlinghouse responded to the news by saying,

“This is exactly the kind of legislation the industry has been waiting for, clear, enforceable, and designed to foster innovation within boundaries.”

According to Garlinghouse, the GENIUS Act confirms RLUSD’s position as a “regulated liquidity instrument” and paves the way for new applications in DeFi, cross-border payments, and on-chain financing.

For XRP investors, the legislation is a double-edged sword. While RLUSD will boost the Ripple ecosystem, economists caution that XRP may not benefit immediately from price hikes due to its limited burn mechanism and enormous circulating supply.

XRP Price Sees Momentum but Faces Long-Term Test

Following the GENIUS Act’s approval, XRP temporarily rose above $3.64 before encountering resistance. The increase was mostly driven by mood, with traders seeing the Act as a larger validation of Ripple’s plan. Analysts, on the other hand, advise against becoming too optimistic.

According to crypto expert Josh Olszewicz, the GENIUS Act is positive for the stablecoin industry in the United States, but it has no direct impact on XRP’s tokenomics. Unless RLUSD acceptance leads to high-frequency transactions on XRPL, XRP may not see sustained price growth.”

Nonetheless, the synergy between RLUSD and XRP remains Ripple’s long-term investment. As RLUSD becomes a trustworthy, stable asset for global payments, XRP may grow into a frictionless bridge currency if future legislation, such as the CLARITY Act, clarifies XRP’s security status.

Ripple’s RLUSD Push: A Strategic Treasury Play

In addition to price action, Ripple is using RLUSD to realign its strategy. According to reports, Ripple intends to register RLUSD under a national trust-bank charter, with custodian partnerships underway with BNY Mellon. The business is also looking for a Federal Reserve master account, which would put RLUSD on par with conventional financial infrastructure.

This puts Ripple in a unique position to compete with incumbents such as Circle’s USDC and PayPal USD. Ripple’s advantage stems from its pre-existing blockchain, the XRPL, and an integrated user base that already transacts in XRP for XRP investors. By including RLUSD as a native asset into the XRPL, Ripple can provide consistent, controlled liquidity while avoiding centralization problems.

Such regulatory compliance might also let Ripple to serve government and corporate customers under the newly specified standards of the GENIUS Act, something no other crypto-native stablecoin issuer has yet accomplished.

The CLARITY Act and XRP Investors

While the GENIUS Act legalizes Ripple’s stablecoin concept, XRP continues to function in the gray zone. The CLARITY Act, another measure presently being debated in Congress, attempts to establish the legal status of digital assets such as XRP. Until this is fixed, XRP’s usage as a fully compliant utility token is speculative.

For the time being, the GENIUS Act serves as an important stepping stone, anchoring RLUSD inside a legislative framework while indirectly increasing the usefulness of the XRP investors. However, complete investor trust will only return after the token is definitively classified.

Conclusion

The GENIUS Act is a watershed point in Ripple’s growth and offers a cautiously hopeful outlook for XRP investors. The regulation strengthens Ripple’s position in regulated markets by formalizing the function of stablecoins such as RLUSD. However, XRP’s future remains dependent on practical usefulness and imminent legislative action. For the time being, the focus is on Ripple’s capacity to leverage on regulatory certainty and drive large-scale RLUSD adoption.

FAQs

What is the GENIUS Act?

The GENIUS Act is U.S. legislation that provides a regulatory framework for issuing and managing stablecoins like RLUSD.

Does the GENIUS Act directly impact XRP?

Not directly. The Act benefits RLUSD, but XRP’s price is only affected if stablecoin usage increases demand for XRP on-chain.

What is RLUSD?

RLUSD is Ripple’s stablecoin, designed to comply with U.S. laws and act as a liquidity bridge within the XRPL ecosystem.

Is XRP now legally classified as a non-security?

No. XRP’s legal status is still unclear. The CLARITY Act may provide formal classification in the future.

Glossary

GENIUS Act – Guiding and Establishing National Innovation for U.S. Stablecoins Act; regulates U.S. stablecoins.

RLUSD – Ripple’s U.S.-backed stablecoin aimed at institutional use.

XRP Ledger (XRPL) – Decentralized blockchain developed by Ripple to support global payments.

CLARITY Act – Proposed legislation to define the legal status of cryptocurrencies like XRP.

Burn Mechanism – A process that reduces token supply by permanently removing coins through transaction fees.

Sources