Since reaching its all-time high of $108,000 on January 20, Bitcoin has experienced a sharp correction, dropping 30% to $76,700 as of March 11. The sell-off has sparked panic among investors, but analysts suggest that this downturn aligns with historical bull cycle corrections.

Key Levels to Watch

Crypto analyst Rekt Capital has examined Bitcoin’s past bull market pullbacks, highlighting that corrections in 2017 averaged 35%, while 2021 saw retracements of around 37%. If Bitcoin follows a similar pattern in this cycle, the price could drop to approximately $70,000 before stabilizing.

Experts emphasize that such corrections are a natural part of bull markets and urge investors to remain patient rather than succumb to panic selling.

Patience Is Key

Arthur Hayes, co-founder of BitMEX, had already predicted in late February that Bitcoin could dip to $70,000. In a follow-up statement on March 10, he reaffirmed his view, citing large funds selling off their ETF holdings.

Hayes reassured investors, stating that a 36% correction is normal for a bull market and that monetary policy shifts by central banks will ultimately help the market recover.

Macroeconomic Uncertainty and Bitcoin’s Outlook

Recession fears have triggered large-scale sell-offs not only in crypto but also in the stock market. Major indices like the S&P 500, Nasdaq, and Dow Jones have suffered significant declines, with tech companies collectively losing $750 billion in market value in a single day.

Meanwhile, JPMorgan has raised its recession probability for 2025, downgrading its U.S. economic growth forecasts. As economic uncertainty persists, risk-averse investors are pulling out of volatile assets like Bitcoin.

Market Recovery: A 2025 Outlook

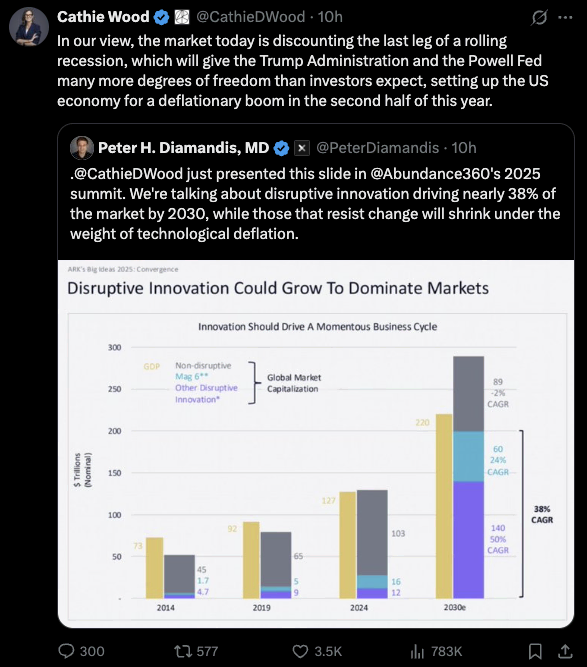

Cathie Wood, CEO of Ark Invest, believes that the economic downturn is nearing its final stage, which could lead to increased flexibility from the U.S. government. Wood suggests that central banks may resort to further monetary expansion, potentially setting the stage for a recovery in Bitcoin and broader financial markets by the second half of 2025.

As investors await more clarity, The Bit Journal will continue to provide insights on Bitcoin’s price action and the evolving macroeconomic landscape.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!