Ethereum investors are eagerly awaiting a rally, with market sentiment suggesting a potential upward movement for the ETH token. Despite ongoing debates on social media about Ethereum’s stagnation, the market is showing signs of optimism. Traders are increasingly turning to Ethereum-based derivatives, and rising network activity is bolstering this bullish outlook.

Activity Surges in Ethereum Derivatives Market

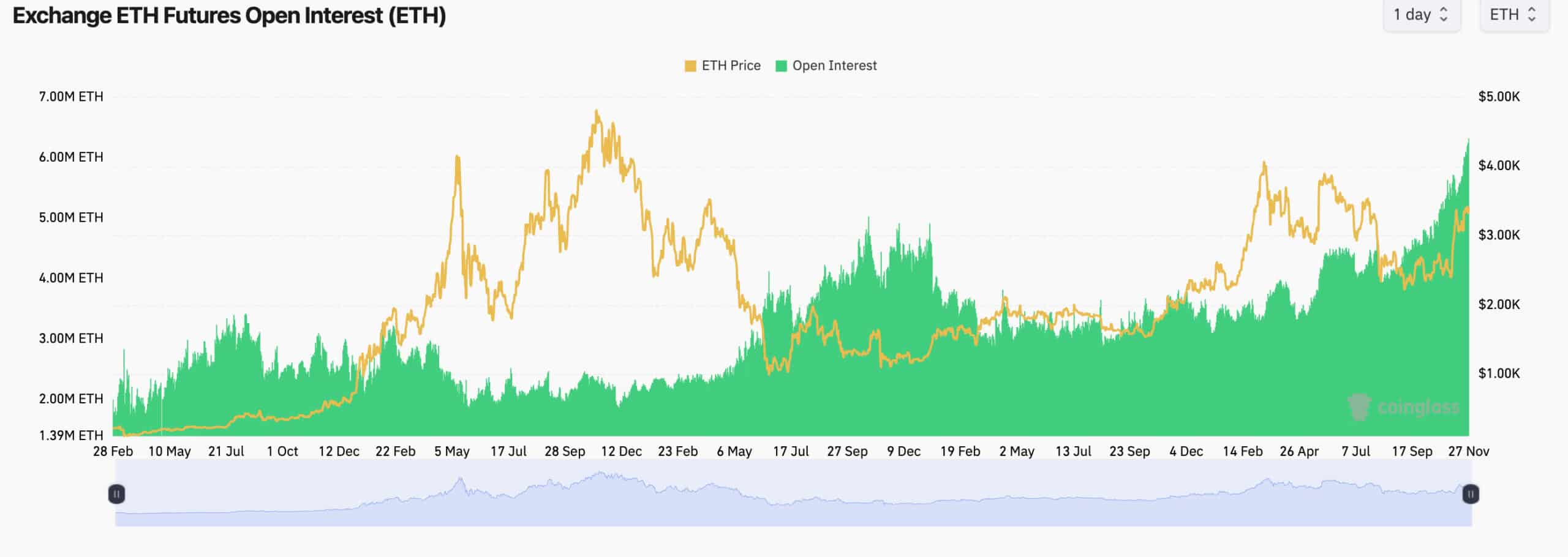

Data from CoinGlass highlights a notable increase in activity within Ethereum’s derivatives market. Open interest in perpetual and standard futures contracts has reached 6.32 million ETH, surpassing $27 billion in value. This represents a 17% increase since the beginning of the month, a trend often associated with a bullish market sentiment. Ethereum’s price has already risen 35% this month, climbing to $3,400.

Additionally, the premium gap between quarterly ETH futures and spot prices has widened. Offshore exchanges now report an annualized basis premium of 16%, while CME’s front-month premium stands at 14%. These elevated premiums indicate growing interest in spot ETH ETFs, which could attract further capital to the market.

Total Value Locked in Ethereum Applications

The total value locked (TVL) in Ethereum-based applications has surged to $65 billion, a level not seen since May 2022. However, much of this TVL is concentrated in three key platforms. Lido holds over $32 billion in staked ETH, while Aave manages $26 billion in various assets, and EigenLayer secures $14 billion in locked value.

Additionally, new wallet creation, transaction volumes, and on-chain activity on Ethereum have shown an uptick compared to last month, though they have yet to reach the highs of March. This increased activity is contributing positively to ETH’s price dynamics.

DeFi and Stablecoin Dynamics

In the DeFi sector, Ethereum has reclaimed its position ahead of Tron in terms of USDT supply, with $60.3 billion compared to Tron’s $57.94 billion. This marks the first time since June 2022 that Ethereum has overtaken Tron in this metric, underscoring its renewed dominance in the DeFi ecosystem.

While Solana continues to gain traction in DeFi due to its broad user base, Ethereum’s institutional adoption and extensive application ecosystem keep it ahead in the long term. The potential easing of regulatory burdens under the newly elected U.S. president has also fueled optimism, with expectations of a bull market for ETH and major DeFi tokens.

Optimism for Ethereum’s Future

According to The Bit Journal, these developments suggest a promising future for Ethereum. With institutional interest rising and network activity increasing, ETH is positioned for potential growth. Investors are encouraged to monitor these key metrics closely as Ethereum gears up for its next big rally.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Folgen Sie uns auf Twitter und LinkedIn und treten Sie unserem Telegram-Kanal bei, um sofort über aktuelle Nachrichten informiert zu werden!