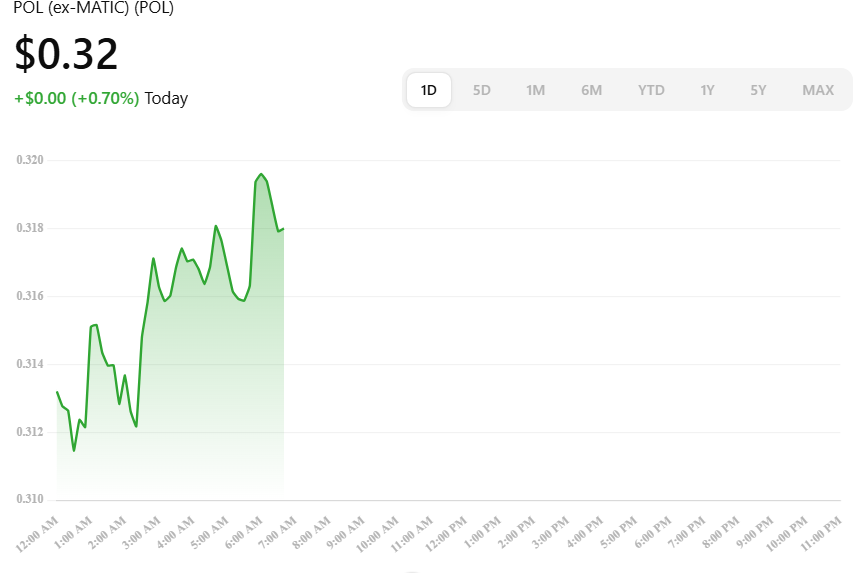

Polygon’s POL token has certainly garnered considerable notice from financial backers and expert examiners alike in recent days. As of the fifth day of February in the year 2025, POL is exchanging hands at approximately $0.317, communicating a delicate climb of 0.00391% from its earlier concluded cost. This narrow motion belies the critical dialog encompassing a pivotal value benchmark that could potentially determine the token’s ensuing course.

The Crucial $0.50 Benchmark

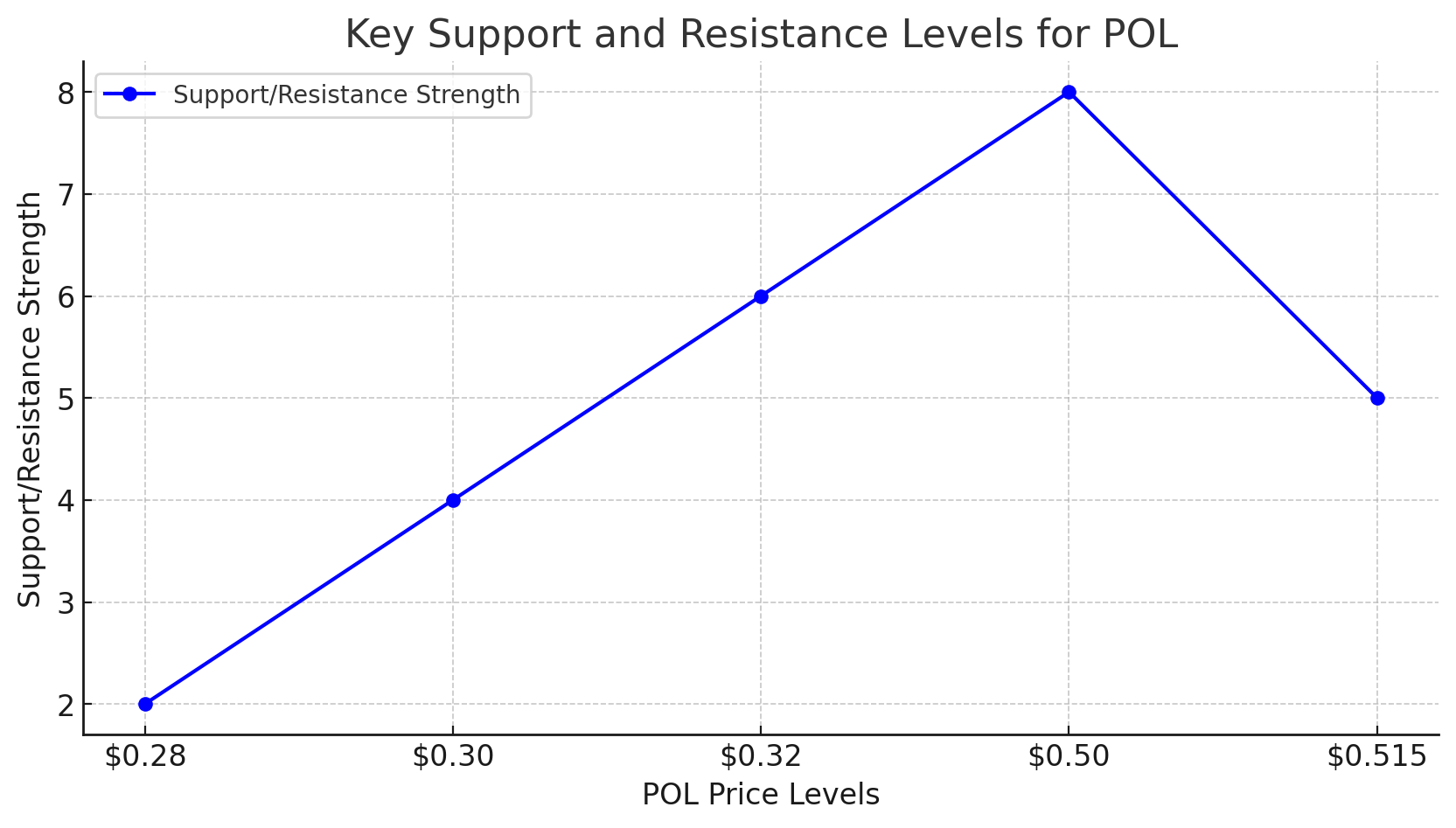

On-chain metrics pointed to a make-or-break moment looming for POL at the $0.50 border. Findings demonstrated comprehensive stockpiling between $0.364 and $0.509, with nearly 9.97 billion POL tokens accumulated within this range. This clustering implies that the $0.50 mark operates as a noteworthy support or resistance level. Successfully retaining and sustaining this threshold could bolster market faith, potentially guiding to cost stabilization or an ascending pattern. In reverse, failing to establish this area as backing might amplify the hazards of further declines, as owners who paid at higher prices may choose to sell, intensifying the downward push.

Technical Indicators: A Mixed Bag

A closer examination into POL’s latest moves unveils a multifaceted picture. After a fleeting liquidity purge, the token rocketed precipitously to $0.515 only to plummet again in late January 2025. Currently, POL hovers tenuously above a pivotal support level, circling $0.32. Maintaining altitude above this line may signal inner toughness and potentially spark an ascension.

However, the fluctuating Moving Average Convergence Divergence remains in the red, betraying bearish momentum still reigns. What’s more, the full number of addresses clinging to a balance has reduced somewhat, intimating diminished active participation. Should the tally of busy addresses stabilize or burgeon, it could be revived investor interest and back a value recovery. On the contrary, a further depletion in busy addresses may suggest the continuation of the bearish trend.

Market Sentiment and Future Outlook

The broader sentiments regarding POL encompass both wary optimism and confident anticipation. Some analysts insist the reclamation of the crucial $0.50 benchmark is imperative to sustain an enduring recovery. “Reestablishing dominion over this pivotal price zone is critically important for instigating a rebound in the market,” underlines renowned crypto analyst Ali Martinez. At the same time, bearish inclinations and investor sell-offs have prompted expectations of possible declines. As covered by The Currency Analytics,

“Polygon (POL) is presently confronting robust bearish cost activity, with specialists anticipating a likely 44% value drop against the proceeding market downturn.”

Community and Developmental Factors

Beyond mere monetary fluctuations, Polygon’s community growth and developmental strides significantly impact its unfolding future. The transition from MATIC to POL in 2024 signified more than a superficial rebranding effort; it aimed to enhance the token’s practicalities and governance capacities. This maneuver was viewed as fundamental for Polygon’s evolution into a ZK chain and for its integration with the Aggregated Layer (AggLayer).

Conclusion

As POL navigates the complex terrain of the cryptocurrency markets, its capability to reclaim and maintain the $0.50 benchmark will be closely scrutinized by investors and analysts alike. While technical indicators and prevailing sentiment offer important insights, the token’s future will also depend on broader market dynamics and Polygon’s ongoing innovations. Investors are advised to stay informed and account for both technical and fundamental factors when making decisions related to their POL holdings.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

Why does the $0.50 price point carry significance for POL?

Accumulated around the $0.50 mark is nearly 9.97 billion POL tokens, forming a zone of key support and resistance. Reclaiming this level could signal bullish momentum going forward; failing to do so risks precipitating further sell-offs.

What may occur if POL slides below $0.32?

Breaking below the $0.32 support threshold risks triggering a downtrend, potentially testing lower support floors at $0.30 or possibly even $0.28, amplifying selling pressure in the process.

Which technical markers are currently impacting POL’s price dynamics?

The MACD (Moving Average Convergence Divergence) resides in negative territory, betokening bearish momentum. Additionally, diminishing active addresses hints at waning investor participation.

How do Polygon’s advancements impact POL’s valuation?

Polygon’s transition from MATIC to POL, coupled with its integration into the Aggregated Layer (AggLayer) are intended to bolster scalability and functionality over the long haul, which could cultivate enduring investor belief.

Glossary of Key Terms

Liquidity Sweep – A price movement that clears out stop-losses before reversing direction.

Resistance Level – A price point where selling pressure is strong enough to prevent further upward movement.

Support Level – A price point where buying interest is strong enough to prevent further downward movement.

MACD (Moving Average Convergence Divergence) – A technical indicator used to determine momentum and trend strength.

Accumulation Zone – A price range where a large number of tokens have been purchased and held, often influencing future price movements.

Sell-Off – A period of declining prices due to increased selling pressure.

Active Addresses – The number of unique wallet addresses transacting with a token, often a measure of investor interest.

Bearish Momentum – A trend where the price of an asset is declining or expected to decline.