From meme to metrics: DOGE’s institutional endorsement, Dogecoin (DOGE) may have begun as a tongue-in-cheek crypto experiment, but it’s increasingly shedding its meme coin label.

A new report from 21Shares, one of the world’s largest crypto exchange-traded product (ETP) providers, positions DOGE as a legitimate component of diversified investment portfolios, citing its asymmetric return potential and historically low correlation with traditional assets.

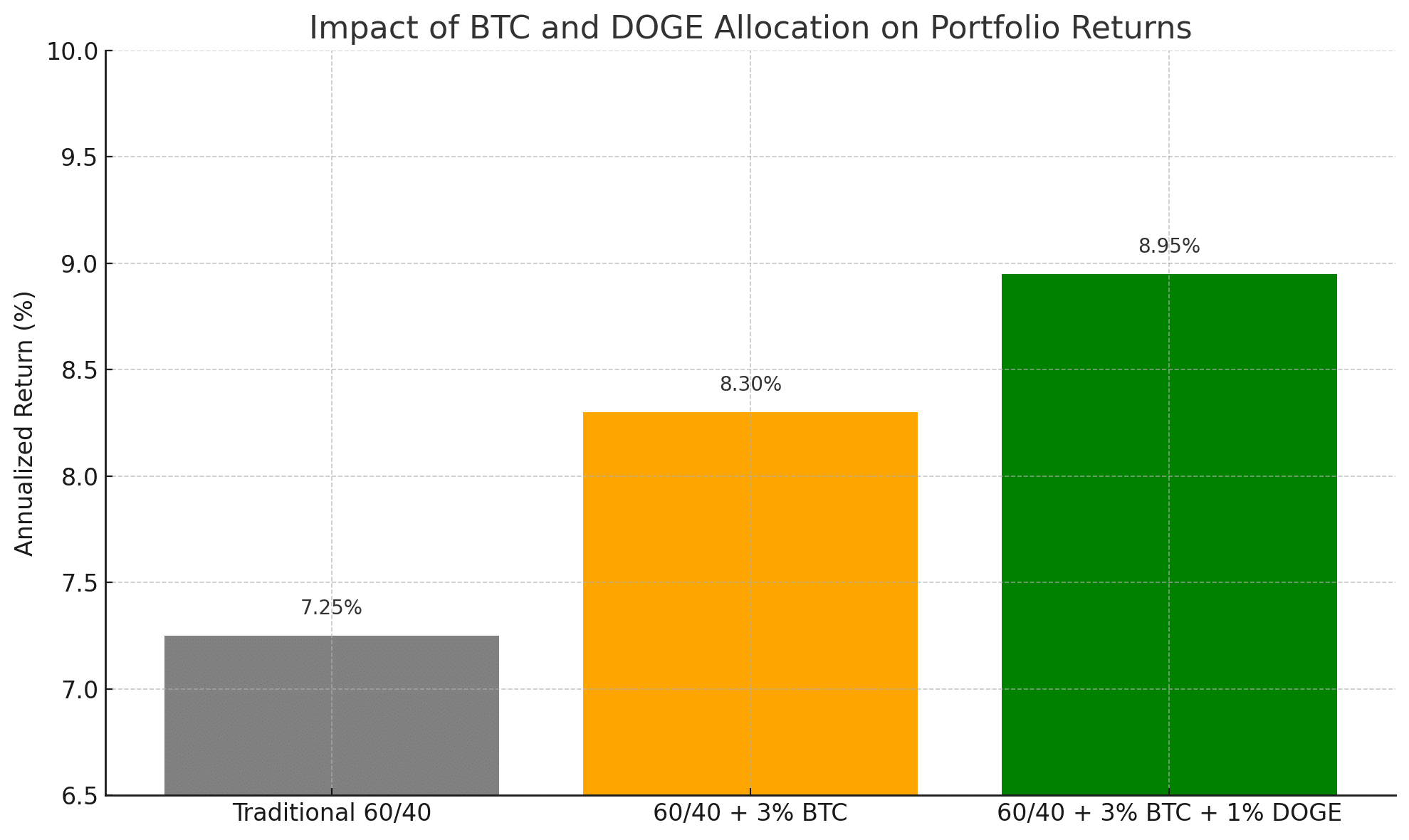

According to the analysis, even a modest 1% allocation to Dogecoin—alongside a 3% Bitcoin holding, in a classic 60/40 stock-bond portfolio can significantly boost overall returns while maintaining acceptable risk.

The study, which simulated multiple rebalancing strategies, found that annualized returns rose from 7.25% to as high as 8.95%, while the Sharpe ratio, a measure of risk-adjusted return, also improved.

“This isn’t about hype anymore,” the report stated. “It’s about math.”

The Portfolio Effect: Low Correlation, High Asymmetry

One of Dogecoin’s greatest strengths, according to 21Shares and data from Messari, lies in its low correlation with both equities and mainstream cryptocurrencies like Ethereum and Solana.

DOGE behaves differently in market cycles and often rallies based on unique retail-driven narratives. This distinct price behavior makes it a valuable diversifier when carefully allocated and rebalanced periodically.

Furthermore, 21Shares found that the drawdown risks introduced by DOGE were minimal, especially in portfolios that included regular monthly or weekly rebalancing. Even in stress-test scenarios, Dogecoin portfolios did not significantly underperform during market downturns.

Glassnode data supports this outlook, showing that DOGE’s volatility has declined over the past year, while on-chain activity has remained steady, signaling that its core user base may be maturing.

DOGE Price Projections: Bearish, Neutral, and Bullish Paths

The 21Shares report offers three distinct forward-looking price models for Dogecoin based on its performance in past market cycles:

Bearish Case: DOGE compounds at 10% annually from its $0.73 2021 peak, reaching ~$0.38 by late 2025. This would mark the first cycle where it fails to set a new all-time high.

Neutral Case: A performance near historical averages could push DOGE to $0.65–$0.70, essentially retesting its previous highs.

Bullish Case: If market sentiment turns euphoric or DOGE is integrated into more fintech platforms, price targets could exceed $1.00, driven by retail inflows and Elon Musk-fueled narratives.

Currently trading near $0.15, DOGE would more than double in value in the bearish scenario and 6x or more in the bullish case.

Is Dogecoin Becoming a Real Asset Class?

Until now, Dogecoin has largely been viewed as a meme-fueled rollercoaster—volatile, unpredictable, and unserious. However, the growing inclusion of DOGE in institutional-level analysis, like this 21Shares report, represents a significant shift.

Other analysts echo this view. Crypto researcher Noelle Acheson told CoinDesk,

“You can’t ignore Dogecoin anymore if you’re modeling portfolio scenarios for Gen Z investors or crypto-native strategies. Its data speaks louder than its doge.”

Moreover, platforms like Robinhood and Coinbase have maintained consistent DOGE trading volume, and blockchain explorers show a resilient base of over 4.5 million wallet addresses holding the token long-term. This combination of community loyalty, low correlation, and upside optionality is what turns DOGE from a joke into a potential alpha generator.

Conclusion: 21Shares, the Joke Is Over — Dogecoin Is Portfolio Material

What started as satire is now being dissected in Swiss investment offices and Wall Street quant models. 21Shares’ endorsement isn’t just a compliment—it’s a signal that Dogecoin, with its quirky origins and explosive past, has grown into a statistically viable asset in modern portfolio theory.

With historical upside, manageable downside risk, and a future tied to both fintech innovation and digital culture, Dogecoin may finally be moving from meme to mainstream.

The numbers, it seems, are no laughing matter.

FAQs

Why is Dogecoin being considered for investment portfolios?

According to recent institutional research, Dogecoin’s historical performance, low correlation with traditional assets, and asymmetric risk/reward make it a strong portfolio diversifier.

What did 21Shares recommend?

21Shares suggested that a small allocation—around 1%—to Dogecoin in a traditional portfolio can improve risk-adjusted returns without significantly increasing volatility.

What are the price projections for DOGE?

The bearish model targets ~$0.38 by late 2025, the neutral case returns it to its all-time high, and the bullish case projects a move beyond $1.00.

Is Dogecoin still a meme coin?

While it retains its cultural identity, DOGE is increasingly being viewed as a legitimate crypto asset with measurable financial utility.

Glossary of Terms

Sharpe Ratio – A measure of risk-adjusted return that compares the return of an asset to its risk.

Correlation – A statistical measure of how assets move in relation to one another. Low correlation improves diversification.

Rebalancing – The process of adjusting a portfolio to maintain target asset allocations, crucial for risk control and performance.

Asymmetric Return Profile – An investment with limited downside and substantial upside potential, common in options and speculative assets.