As per the source, Binance, one of the world’s leading crypto exchanges, has suspended an employee following allegations of insider trading. This incident has sparked discussions about the integrity of trading practices within the crypto sphere and the measures companies must implement to uphold trust and transparency.

The Allegations Unveiled

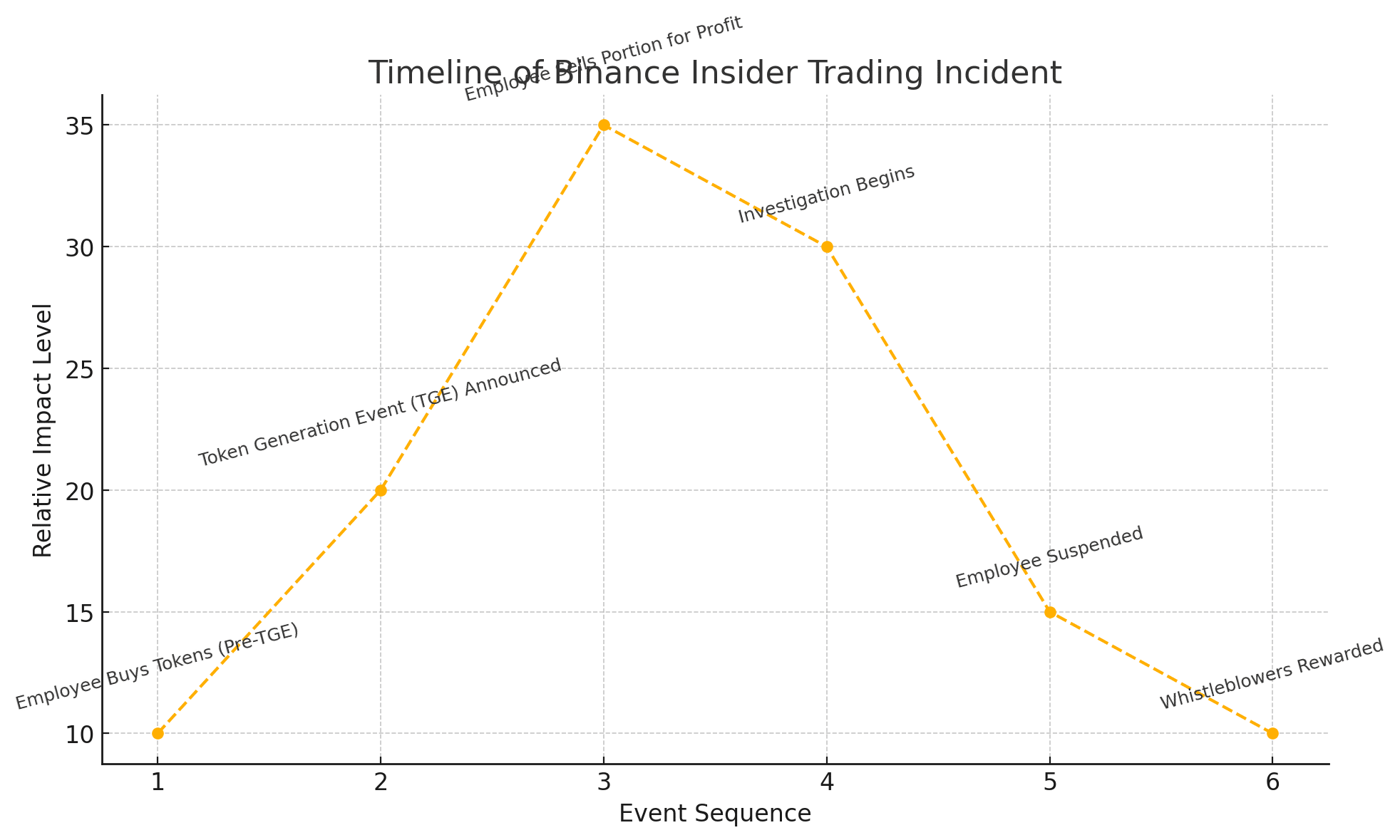

On March 23, 2025, Binance’s Internal Audit team received a complaint alleging that a staff member had engaged in front-running trades using insider information to gain improper profits. The employee in question had recently transitioned from a business development role at BNB Chain to the Binance Wallet team. Leveraging confidential information from their previous position, the employee anticipated a Token Generation Event (TGE) that was expected to garner significant community interest.

Prior to the public announcement, the employee allegedly used multiple linked wallet addresses to purchase a substantial volume of the project’s tokens. Following the announcement, they reportedly sold a portion of these holdings, securing significant profits while retaining additional tokens with notable unrealized gains.

Binance’s Response and Disciplinary Measures

In reaction to these findings, Binance acted swiftly by suspending the employee pending further disciplinary action. The company emphasized that such behavior constitutes a clear breach of its policies, particularly concerning the misuse of non-public information for personal gain. Binance has committed to cooperating with relevant authorities to pursue appropriate legal measures against the individual involved. Furthermore, Binance announced a total reward of $100,000, to be equally distributed among four whistleblowers who reported the misconduct through official channels.

Upholding Integrity: Binance’s Insider Trading Policies

Binance maintains a stringent policy against insider trading to ensure a fair and transparent trading environment. Established in 2018, the Staff Dealing Policy includes blackout periods and strict trading restrictions for employees and their immediate family members. Any staff found misusing non-public information face severe consequences, including termination and potential legal action. Binance also encourages external partners to adhere to non-disclosure agreements, warning that breaches could lead to immediate service termination or associated token delisting.

Broader Implications for the Crypto Industry

This incident underscores the cryptocurrency industry’s ongoing challenges regarding regulatory compliance and ethical trading practices. Insider trading not only undermines market integrity but also erodes investor trust. The swift action taken by Binance reflects the industry’s increasing commitment to self-regulation and the importance of internal controls to detect and prevent such misconduct.

Conclusion

The suspension of a Binance employee over insider trading allegations serves as a critical reminder of the necessity for stringent ethical standards within the cryptocurrency industry. As the sector continues to evolve, maintaining transparency and trust remains paramount. Binance’s proactive measures highlight the importance of internal vigilance and the role of the community in upholding the integrity of the crypto trading environment.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

Frequently Asked Questions (FAQs)

What is insider trading?

Insider trading involves buying or selling a security by someone who has access to material, non-public information about that security. It is considered illegal and unethical as it gives an unfair advantage to the insider over other investors.

What is front-running in trading?

Front-running is the act of entering into a trade based on advance, non-public knowledge of a large pending transaction that will influence the price of the asset. Traders engage in front-running to capitalize on the anticipated price movement.

How does Binance handle insider trading allegations?

Binance has a strict policy against insider trading, including a Staff Dealing Policy with blackout periods and trading restrictions for employees and their families. Violations can result in suspension, termination, and legal action. Binance also collaborates with authorities to address such misconduct.

What are Token Generation Events (TGEs)?

Token Generation Events refer to the creation and distribution of new cryptocurrency tokens, often associated with fundraising activities for new blockchain projects. They are similar to Initial Coin Offerings (ICOs) and are used to raise capital and distribute tokens to investors.

How can the crypto community report unethical behavior?

Binance encourages individuals to report unethical behavior via their official audit email: [email protected]. Valid reports that lead to successful action may be eligible for financial rewards, as demonstrated in this recent case.

Glossary of Key Terms

Insider Trading: The illegal practice of trading on the stock exchange to one’s own advantage through having access to confidential information.

Front-Running: The unethical practice of a broker trading an equity based on advanced knowledge of a large pending transaction that will affect its price.

Token Generation Event (TGE): An event in which a new cryptocurrency token is created and distributed to investors, often as a means of fundraising for blockchain projects.

Binance Wallet Team: A division within Binance responsible for managing the development and maintenance of Binance’s cryptocurrency wallet services.

Whistleblower: An individual who exposes information or activity within a private or public organization that is deemed illegal, unethical, or not correct.