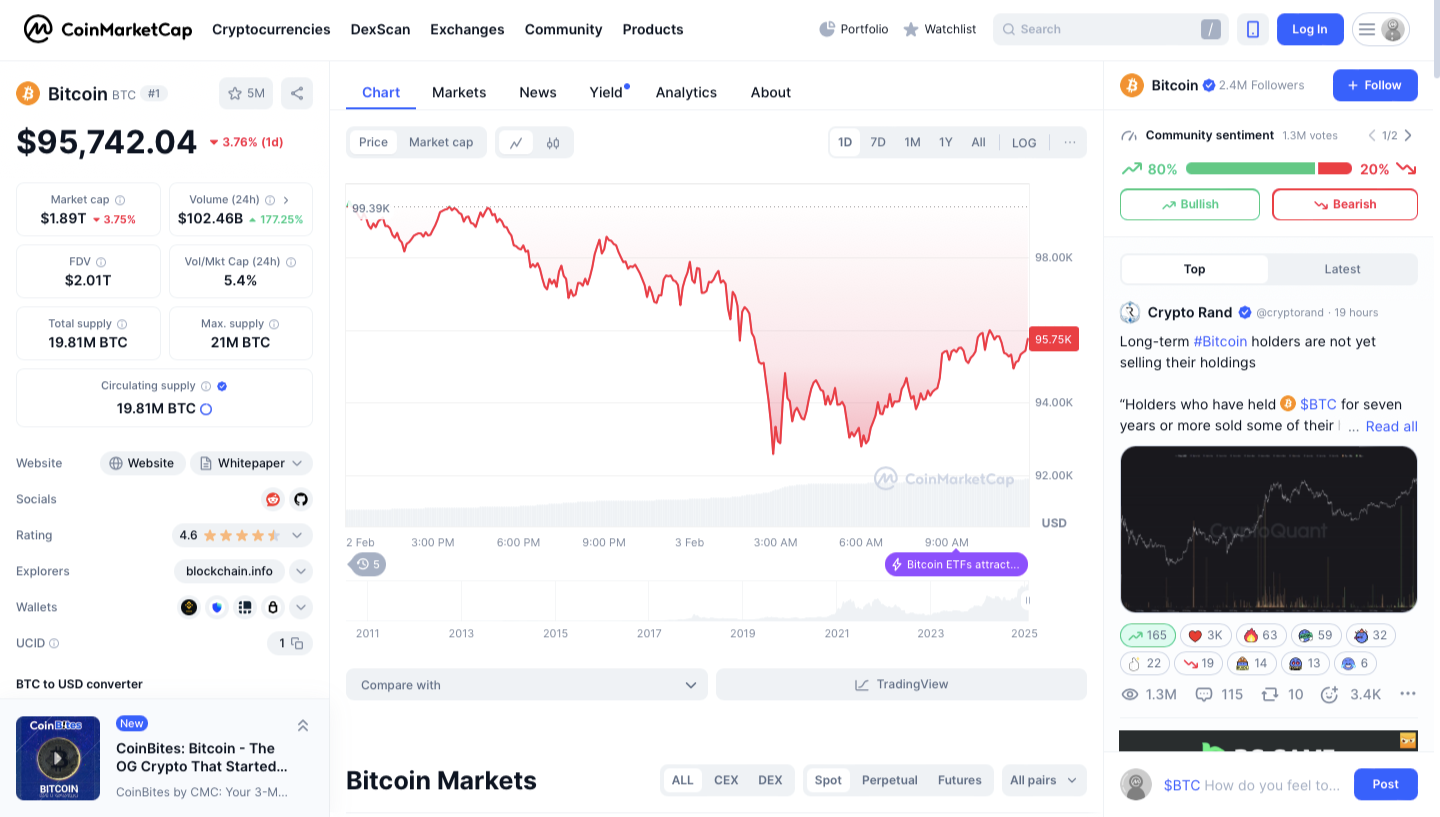

The markets are completely melting down, losing over $400B in less than 24 hours. Bitcoin, Ethereum, XRP, Dogecoin, and more are all down 20%+ today, and investors everywhere are freaking out. No one saw this coming, and traders are trying to figure out what triggered the sell-off of this magnitude. At the heart of this mess are geopolitical tensions, macroeconomic shifts, and internal weaknesses in the crypto market itself.

Trump’s Tariff War Sparks Market-Wide Panic

According to news reports, the latest crypto crash started over the weekend and is largely due to a new trade war that President Trump has started. He invoked the 1977 International Emergency Economic Powers Act (IEEPA) and slapped 25% tariffs on Mexico and Canada and 10% on China.

This has caused inflation and economic instability fears and the traditional markets are reacting sharply. ‘US stock indexes fell after the tariff announcements, and so did the crypto market. Crypto assets like BTC are supposed to be hedges against inflation. However, during times of extreme market turmoi,l they often act like risk-on assets and sell off with equities.

“Trade wars create uncertainty and uncertainty breeds fear,” said Alex Krüger, a financial strategist, recently on X. “Crypto, despite its long term potential isn’t immune to macroeconomic shocks.”

Bitcoin’s Network Activity Hits Record Lows

While external factors are strong’, internal weaknesses in the crypto ecosystem are causing the sell-off. According to data from the on-chain analytics platform CryptoQuant, BTC’s network activity is at record lows. The Bitcoin mempool – a representation of unconfirmed transactions waiting to be processed in the blockchain; is almost ’empty. That’s very unusual for the largest cryptocurrency.

Transaction fees are at 1 sat/vB, indicating no demand for block space. This is a sign of weak investor participation, not a good sign when markets get crazy. The Bitcoin network last saw this kind of activity in March 2024 during another market turmoil.

Over $2.18 Billion Liquidated: A Wave of Forced Selling

Another factor contributing to this market crash is the liquidation wave. Over $2.18 billion in crypto positions were allegedly liquidated in 24 hours and belonged to over 715,000 traders worldwide. Longs lost $1.85 billion of crypto positions, shorts lost $334 million.

Officials say, the largest single liquidation was on Binance, one trader lost $25.64 million in a single trade. Large liquidations create an avalanche and forced selling feeds back into more price declines, more liquidations.

“Leverage is a double edged sword,” said crypto analyst Michaël van de Poppe. “When markets turn south, over-leveraged positions get wiped out, accelerating the downturn.”

The Strengthening U.S. Dollar Adds Fuel to the Fire

Adding to the trade ‘war and internal crypto market weakness, the U.S. dollar is getting stronger. The US Dollar Index, which is measured against a basket of other major currencies, is at ‘108.50. The 10-year US Treasury bond yield is reportedly above 4.54%, simultaneously.

Bitcoin often inversely correlates with the U.S. dollar and Treasury yields. A strong dollar makes Bitcoin less attractive as an alternative asset as investors move to government bonds and cash. This has been a macro dynamic that has crushed Bitcoin’s price during dollar-strength periods.

Expert Insight: Navigating Crypto’s Volatile Landscape

If anything, from an expert standpoint, this really shows how brittle speculative markets are to macroeconomic shocks. As we analyze these trends, it goes to show that as much as cryptocurrencies promise decentralization and financial freedom, they are still closely tied to traditional markets.

“Crypto isn’t operating in a vacuum,” says Jeff Park, Head of Alpha Strategies at Bitwise. “Global monetary policy, geopolitical tensions, and investor psychology all play a role in shaping price movements.”

Park also noted that while this is painful, it’s an opportunity for long-term investors.

“Market corrections are painful but necessary. They shake out weak hands, reduce speculative froth and lay the groundwork for the next growth phase,” he said.

Bitcoin is currently just above the $93,000 support level. A break below $90,000 could open up more downside, with analysts warning of a drop to $85,000 if the bears hold.

Crypto Fear & Greed Index is at 38, from neutral to fear – definitely a bearish market. The index shows the market sentiment and usually extreme fear has preceded big bounces in the past.

Bitcoin had to break above $95,000 with volume to show confidence is back. Otherwise, it’s still on thin ice.

Conclusion

The current crypto crash shows us again this asset class’s brutal truth. Caused by a combination of external factors like Trump’s trade war, internal market dynamics like decreasing network activity and macroeconomic pressures from a strong dollar, the $400 billion wipeout proves how intertwined traditional finance and digital assets are.

While it looks bleak right now, history shows crypto is resilient. For more advanced investors, these downturns are an opportunity to re-evaluate their strategy, pick long-term value, and prepare for the next bull run.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. Why did the crypto market crash?

Several reasons, including Trump’s tariff announcements, decreasing Bitcoin network activity, crypto liquidation and a strong dollar.

2. How much did the crypto market lose?

It reportedly lost $400 billion in 24 hours with major cryptos like Bitcoin, Ethereum, XRP and Dogecoin losing up to 20% each.

3. How did the Trump tariffs impact this crash?

Trump’s tariffs meant inflation and economic uncertainty, which naturally flowed into traditional markets and crypto markets and caused panic selling.

4. Is this the end of the crypto bull run?

Not necessarily, market corrections are normal in crypto. Long term everything looks good, this will go back above key support levels.

5. What to do when a crypto crashes?

Don’t panic about a sell-off; reassess your strategy and then look at long-term fundamentals. Also, keep up to date via credible sources and don’t over-leverage.

References

- Newsweek. “Why Are Cryptocurrencies Crashing? Trump Tariffs Spook Markets.”

- CryptoQuant. “On-Chain Data Shows Decline in Bitcoin Activity.”

- CoinMarketCap. “24-Hour Liquidation Data for Major Cryptocurrencies.”

- Times of India. “Robert Kiyosaki Predicts Market Crash in 2025.”

- Bitwise Investments. “Jeff Park’s Market Analysis on Crypto Volatility.”