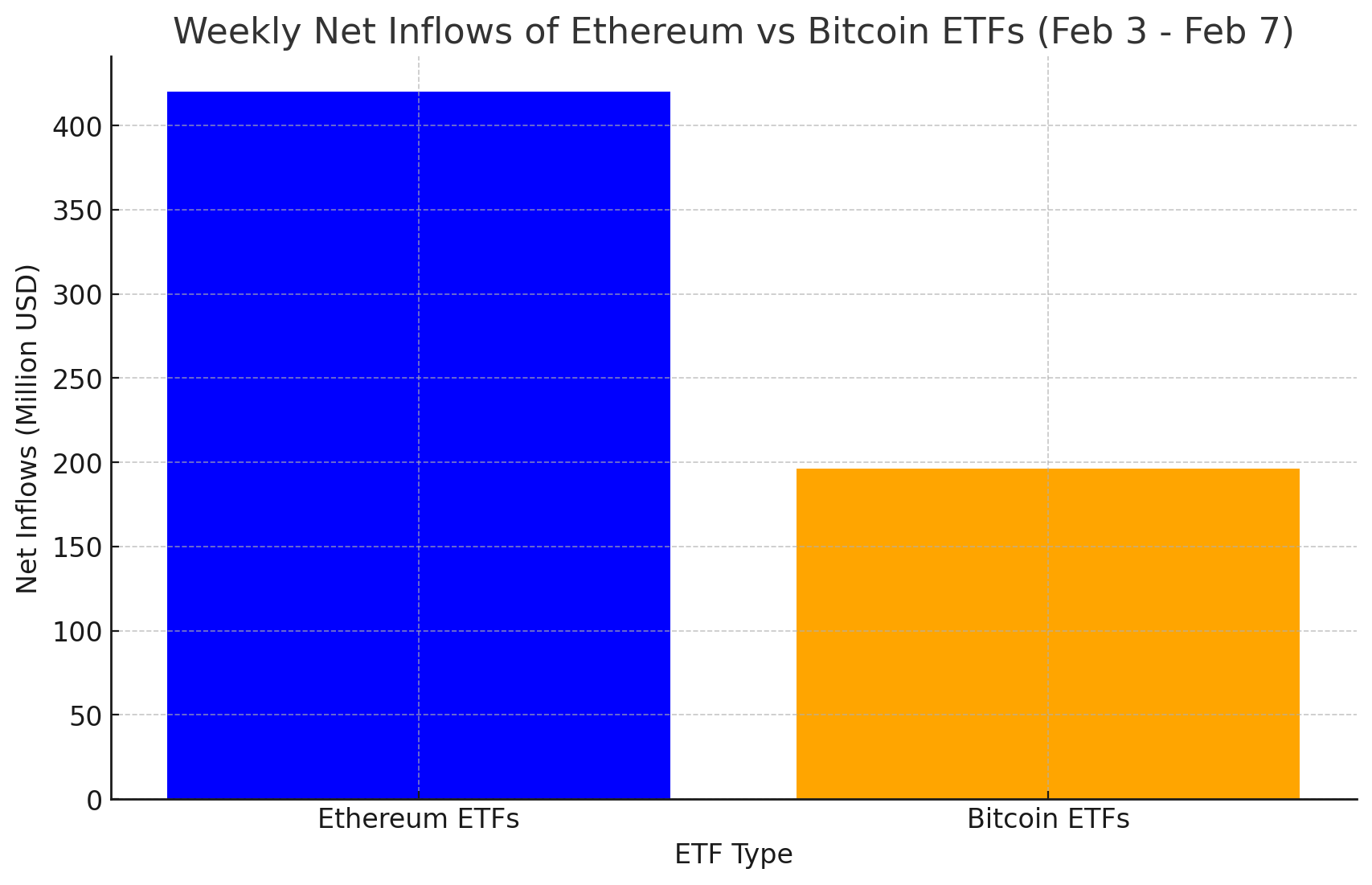

Cryptocurrency investment is evolving at lightning speed, and if you’ve been keeping an eye on the market, you might’ve noticed something unusual happening in the ETF space. For the past week, Ethereum ETFs have significantly outperformed Bitcoin ETFs in terms of net inflows. And we’re not talking about a slight edge—Ether ETFs raked in more than double the inflows of Bitcoin ETFs.

According to media reports, between February 3 and February 7, Ethereum-focused ETFs saw a net inflow of $420.06 million, while Bitcoin ETFs only brought in $203.54 million during the same period. That’s a dramatic shift in market sentiment, especially given Bitcoin’s long-standing dominance as the premier cryptocurrency investment.

So, what’s going on? Why are investors suddenly pouring money into Ethereum-based funds while Bitcoin ETFs are lagging behind? And most importantly, what does this mean for the broader crypto investment landscape?

Whether you’re a seasoned investor or just dipping your toes into the world of crypto ETFs, this development is worth unpacking. In this deep dive, we’ll break down why Ether ETFs are seeing a surge in investor confidence, which funds are leading the charge, and what this trend signals for the future of cryptocurrency investment.

Ethereum ETFs Take the Lead: Breaking Down the Numbers

The past week has been an eye-opener for cryptocurrency investors. The latest ETF inflow data shows a significant shift in investor sentiment, with Ethereum-based ETFs far outperforming their Bitcoin counterparts. This isn’t just a minor fluctuation—it’s a clear and decisive shift in preference. Let’s break down the numbers, analyze what’s happening, and explore why investors are betting big on Ethereum ETFs right now.

Ethereum ETFs Are Crushing It: The Numbers Speak for Themselves

When we zoom in on the figures from February 3 to February 7, the difference between Ethereum and Bitcoin ETF inflows is staggering. Ethereum ETFs didn’t just win the week—they absolutely dominated.

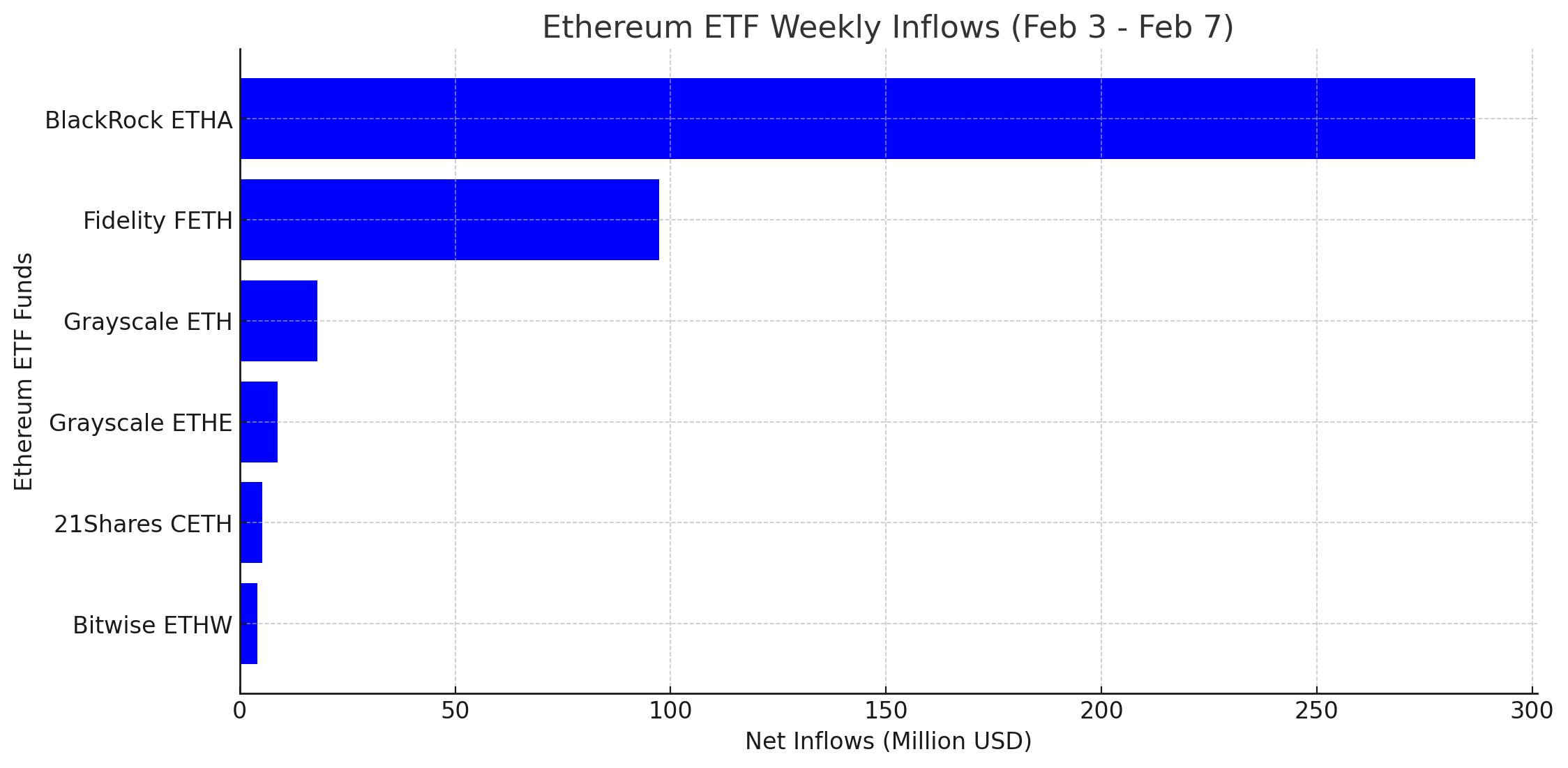

Top Ethereum ETFs and Their Weekly Inflows (Feb. 3 – Feb. 7)

| ETF Name | Net Inflows (Million USD) | Total Net Assets (Billion USD) |

|---|---|---|

| BlackRock ETHA | $286.81 | $3.56 |

| Fidelity FETH | $97.28 | $1.19 |

| Grayscale ETH | $17.96 | — |

| Grayscale ETHE | $8.69 | — |

| 21Shares CETH | $5.19 | — |

| Bitwise ETHW | $4.14 | — |

Total inflows: $420.06 million

This is massive—Ethereum ETFs saw an influx of nearly half a billion dollars in just a few days. Now, let’s compare that to Bitcoin’s performance.

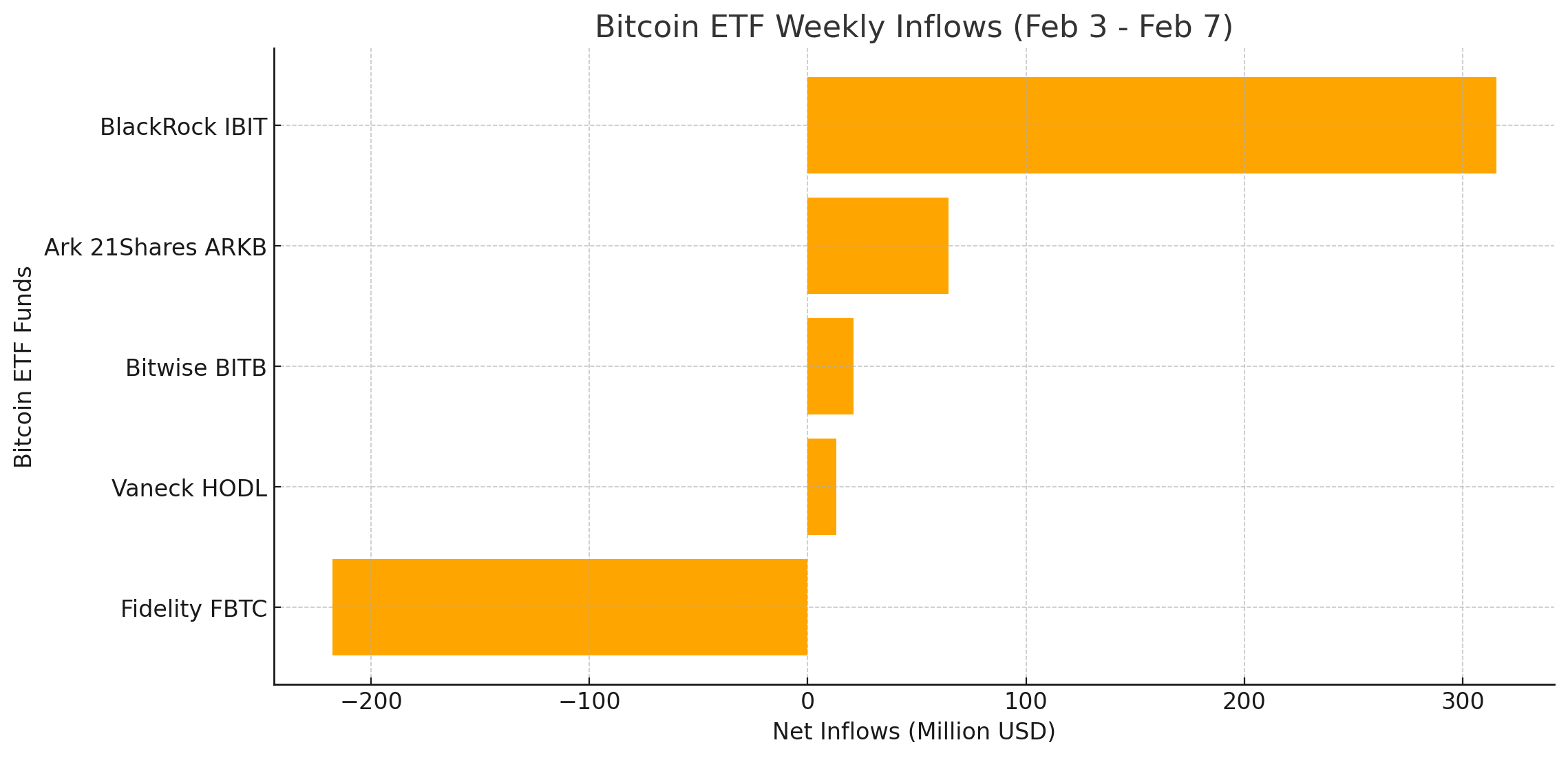

Top Bitcoin ETFs and Their Weekly Inflows (Feb. 3 – Feb. 7)

| ETF Name | Net Inflows (Million USD) | Total Net Assets (Billion USD) |

|---|---|---|

| BlackRock IBIT | $315.26 | — |

| Ark 21Shares ARKB | $64.41 | — |

| Bitwise BITB | $21.05 | — |

| Vaneck HODL | $13.13 | — |

| Fidelity FBTC | -217.78 (outflow) | — |

Total inflows: $203.54 million

Key Takeaways from the Data

- Ethereum ETFs brought in more than double the inflows of Bitcoin ETFs.

- BlackRock’s ETHA alone pulled in $286.81 million, which is nearly as much as all Bitcoin ETFs combined.

- Fidelity’s FETH also saw significant investment, adding nearly $100 million in inflows.

- Fidelity’s Bitcoin ETF (FBTC) saw massive outflows, losing $217.78 million.

What Does This Mean?

Ethereum isn’t just playing second fiddle to Bitcoin anymore—it’s becoming a dominant force in crypto ETFs. The numbers are clear: investors are moving money into Ethereum at an unprecedented rate, showing a strong shift in sentiment toward Ethereum-based investment products.

Why Are Investors Betting on Ether ETFs?

Ethereum has been around for nearly a decade, but right now, it seems to be gaining serious momentum among institutional investors. While Bitcoin remains the undisputed king in terms of total assets under management, Ethereum is proving itself as a more versatile, dynamic investment.

For years, Bitcoin has dominated the cryptocurrency space, largely because of its reputation as “digital gold.” Its primary use case revolves around being a store of value, a hedge against inflation, and a decentralized alternative to traditional financial assets like gold or fiat currency. Bitcoin’s fixed supply of 21 million coins makes it inherently scarce, and over time, it has gained institutional adoption as a reliable long-term investment.

But while Bitcoin remains the king of store-of-value assets, Ethereum is proving to be so much more than just digital gold. Unlike Bitcoin, which primarily serves as a way to hold value, Ethereum is a fully functional ecosystem powering the next generation of the internet—Web3.

Ethereum’s real-world applications extend far beyond just financial speculation. It’s the backbone of decentralized finance (DeFi), smart contracts, NFTs (non-fungible tokens), and decentralized applications (dApps). Its utility stretches across multiple industries, from finance and gaming to supply chain management and digital identity verification. This versatility gives Ethereum a fundamentally different value proposition than Bitcoin—one that investors are starting to recognize as a massive opportunity for growth.

The biggest differentiator between Bitcoin and Ethereum is Ethereum’s ability to execute smart contracts. Smart contracts are self-executing agreements written in code that run automatically when certain conditions are met. This innovation eliminates the need for intermediaries, making transactions more efficient, transparent, and secure. Because of this capability, Ethereum is the foundation for a growing number of DeFi protocols, where users can lend, borrow, trade, and earn interest on their crypto holdings without relying on banks or centralized financial institutions.

DeFi has exploded in popularity in the last few years, and Ethereum remains the dominant blockchain in this sector. Platforms like Uniswap, Aave, and MakerDAO allow users to trade assets, take out loans, and earn yield—all without the need for a traditional bank. This is a game-changer for the financial industry, and Ethereum is at the heart of it.

Beyond finance, Ethereum is also the foundation of the NFT revolution. NFTs have transformed how we think about digital ownership, enabling artists, musicians, and content creators to monetize their work in new ways. Platforms like OpenSea, Rarible, and Foundation all run on Ethereum’s blockchain, making it the go-to network for digital art and collectibles.

Ethereum’s Layer 2 scaling solutions, such as Arbitrum, Optimism, and Polygon, have made the network more efficient and cost-effective, further solidifying its dominance. These solutions lower transaction costs and increase speed, making Ethereum even more attractive to developers and businesses.

For investors, Ethereum isn’t just a cryptocurrency—it’s a bet on the future of decentralized technology. Those who believe that blockchain will disrupt traditional finance, gaming, and digital ownership naturally see Ethereum as a stronger long-term investment than Bitcoin. It’s not just a currency—it’s the infrastructure for the next wave of internet innovation.

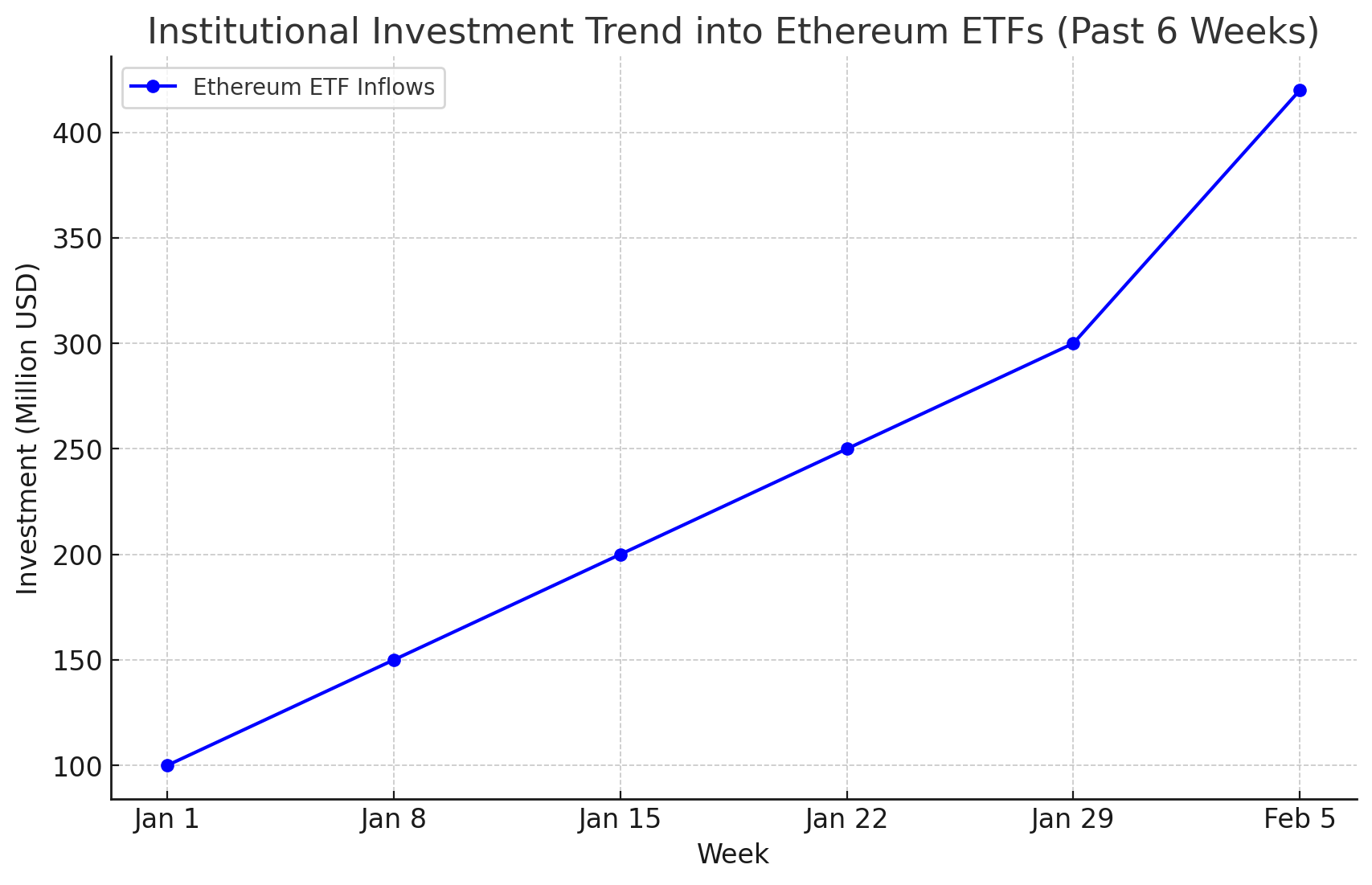

2. Institutional Adoption is Booming

Ethereum has been gaining serious traction among institutional investors, and the numbers don’t lie. Over the past year, some of the biggest financial powerhouses in the world, including BlackRock and Fidelity, have significantly increased their exposure to Ethereum. These firms are not just dabbling in crypto as a speculative asset—they’re pouring millions into Ether ETFs, signaling that they see Ethereum as a legitimate, long-term investment. This isn’t just hype. When institutions like BlackRock, which manages trillions in assets, start putting their money into Ethereum-based products, it sends a clear message: Ethereum is here to stay, and its future looks promising.

A major turning point for institutional Ethereum adoption came in May 2024, when the U.S. Securities and Exchange Commission (SEC) approved spot Ether ETFs. This decision was a game-changer for the industry. Up until that point, institutional investors had limited ways to gain exposure to Ethereum without directly buying and holding the asset. While some hedge funds and forward-thinking firms had already started integrating Ethereum into their portfolios, the lack of a regulated investment vehicle kept many traditional investors on the sidelines.

The approval of spot Ether ETFs changed everything. Now, institutional investors no longer need to worry about custody, security risks, or navigating crypto exchanges to gain exposure to Ethereum. Instead, they can simply buy into an ETF—just like they would with traditional assets like gold, tech stocks, or real estate investment trusts. This has made Ethereum much more accessible to pension funds, endowments, and other major institutional players, many of whom had been waiting for a more familiar, regulated way to invest in crypto.

Since the ETF approvals, money has been flowing into Ethereum at an unprecedented rate. Just in the first week of February 2025, Ethereum ETFs saw $420.06 million in net inflows, more than double what Bitcoin ETFs attracted in the same period. Leading the pack was BlackRock’s iShares Ethereum Trust (ETHA), which brought in $286.81 million in inflows, followed by Fidelity’s Ethereum Fund (FETH), which added another $97.28 million. The sheer scale of these investments underscores how much confidence institutions now have in Ethereum’s future.

What makes this surge in institutional investment even more interesting is that it’s happening alongside major Ethereum network upgrades that are making the blockchain faster, cheaper, and more scalable. Institutions aren’t just investing in Ethereum because they think it will go up in value—they see it as the underlying infrastructure of the future financial system. With the continued rise of Decentralized Finance (DeFi), tokenized assets, and blockchain-based financial services, Ethereum is positioned to be the backbone of the next era of digital finance.

For years, Bitcoin dominated institutional investment in crypto. But now, Ethereum is rapidly closing the gap. The influx of institutional money is legitimizing Ethereum as an asset class, making it clear that it is not just a speculative digital currency but a foundational technology with massive growth potential. If this trend continues, Ethereum could become the go-to choice for institutions looking to invest in blockchain technology, further accelerating its adoption and cementing its place in global finance.

3. Ethereum’s Upgrades Are Making It More Efficient

For years, Ethereum has faced a major challenge that many critics were quick to point out—high gas fees and slow transaction speeds. While Ethereum’s decentralized ecosystem and smart contract capabilities made it the dominant player in the blockchain space, these inefficiencies held it back from reaching its full potential. Many users and developers were forced to explore alternatives, including other blockchains like Solana, Avalanche, and Binance Smart Chain, which offered lower fees and faster transaction speeds. However, Ethereum’s developers have been working tirelessly to address these issues, and now, thanks to significant upgrades, the network is becoming more efficient than ever.

One of the biggest advancements in Ethereum’s evolution has been EIP-4844, also known as proto-danksharding. This upgrade is designed to radically reduce transaction costs and improve scalability, making Ethereum a more viable option for both users and developers. In the past, ETH’s gas fees could skyrocket during times of high network activity, making it too expensive for smaller transactions and everyday use. DeFi users, NFT traders, and even developers faced serious hurdles because of these high costs. Proto-danksharding, however, introduces a new way to handle transaction data by optimizing how Ethereum processes and stores information. This results in lower gas fees and faster transaction speeds, making Ethereum far more accessible to mainstream users.

Another major upgrade that has contributed to Ethereum’s efficiency is the move from Proof of Work (PoW) to Proof of Stake (PoS), which was implemented during The Merge in September 2022. This shift drastically reduced Ethereum’s energy consumption by more than 99%, making it one of the most environmentally friendly blockchain networks in the world. Not only did this transition improve Ethereum’s sustainability, but it also laid the groundwork for future scalability upgrades like sharding. These improvements have boosted investor confidence in Ethereum’s long-term viability, proving that the network is constantly evolving to meet the demands of a growing user base.

ETH’s scaling solutions don’t stop there. Layer 2 networks like Arbitrum, Optimism, and zkSync are also playing a critical role in improving Ethereum’s transaction efficiency. These networks work on top of Ethereum’s main blockchain, processing transactions faster and at a fraction of the cost, while still maintaining Ethereum’s security and decentralization. As more users and developers migrate to Layer 2 solutions, Ethereum’s overall network congestion decreases, leading to even better efficiency and usability.

With these improvements, investors are betting big on Ethereum’s continued adoption. A more scalable, cost-efficient Ethereum means more projects will be built on its network, more users will engage with its ecosystem, and more businesses will adopt blockchain-based solutions. This growing confidence is reflected in Ethereum ETF inflows, institutional adoption, and developer activity, all of which are at record highs. As ETH continues to refine its infrastructure, it’s becoming clear that it’s not just a cryptocurrency—it’s the foundation of the future digital economy.

Bitcoin ETFs: Still a Powerhouse, But Facing Some Hurdles

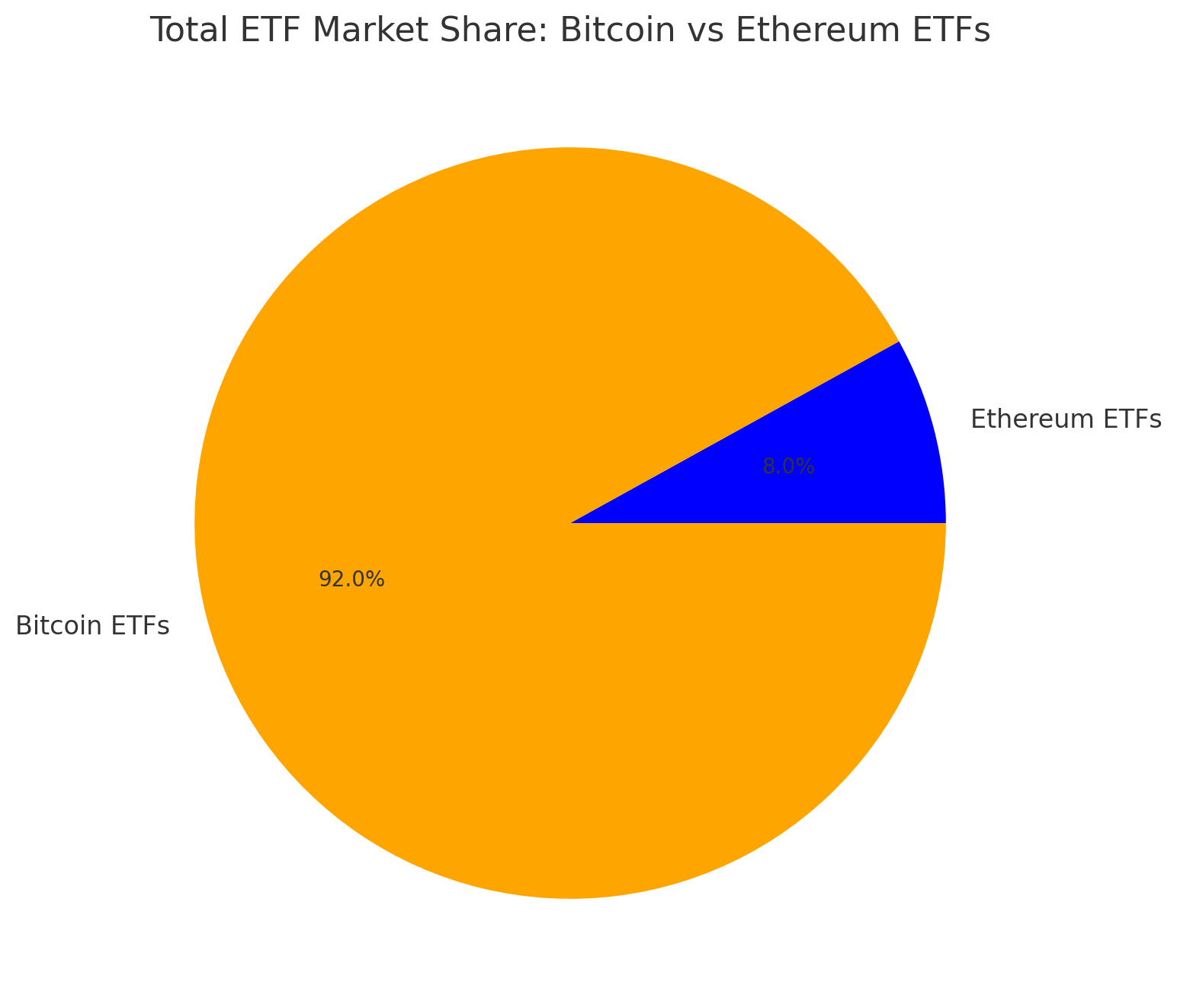

While Ether ETFs are getting all the hype, let’s not pretend Bitcoin is out of the game. In fact, Bitcoin still holds the lion’s share of ETF assets.

As of February 7:

- Total net assets for Bitcoin ETFs: $113.09 billion

- Total net assets for Ether ETFs: $9.88 billion

So while Ether ETFs are growing faster, Bitcoin still dominates in terms of total investor money.

The Problem? Some Investors Are Cashing Out

Bitcoin ETFs saw some serious outflows last week—most notably from Fidelity’s FBTC, which lost $217.78 million.

Why?

- Bitcoin has been trading sideways for the past few weeks.

- Ethereum is showing more network growth.

- Some investors are taking profits.

Bitcoin isn’t going anywhere, but it’s clear that investors are exploring other opportunities, and right now, Ethereum is looking more attractive.

Conclusion: Ethereum’s Moment is Here—But Will It Last?

Right now, ETH is having its moment. The numbers show that investors are increasingly bullish on Ethereum-based ETFs, and for good reason.

- Ethereum isn’t just a cryptocurrency—it’s a platform powering the next wave of digital innovation.

- Institutional investors are getting on board, signaling long-term confidence.

- Ethereum’s network is improving, making it more efficient and scalable.

But does this mean Bitcoin is out of the game? Not at all. Bitcoin still has the largest market share, and when its price starts moving again, we could see a major rebound in Bitcoin ETF inflows.

For now, though, one thing is clear: Ethereum is making a serious case for itself as the top crypto investment of 2025.

So, if you’re watching the crypto ETF space, keep your eyes on Ethereum—because investors sure are.

Frequently Asked Questions (FAQs)

1. Why are Ethereum ETFs seeing more inflows than Bitcoin ETFs?

Ethereum ETFs have recently experienced significantly higher inflows compared to Bitcoin ETFs due to growing institutional interest and Ethereum’s expanding real-world utility. Unlike Bitcoin, which primarily serves as a store of value, Ethereum powers DeFi (Decentralized Finance), smart contracts, NFTs, and Layer 2 scaling solutions. As investors recognize Ethereum’s potential as a technological and financial infrastructure, more capital is flowing into Ethereum-based investment products.

2. What are the key differences between Ethereum ETFs and Bitcoin ETFs?

Bitcoin ETFs track Bitcoin’s price and are generally seen as an investment in digital gold—a hedge against inflation and a long-term store of value. In contrast, Ethereum ETFs track Ethereum’s price movements, but Ethereum also functions as a programmable blockchain that enables smart contracts, DeFi applications, and decentralized exchanges. This technological advantage is attracting investors looking for growth potential beyond just a store of value.

3. How much money flowed into Ethereum ETFs compared to Bitcoin ETFs in the past week?

Between February 3 and February 7, 2025, Ethereum ETFs saw a net inflow of $420.06 million, more than double the $203.54 million that flowed into Bitcoin ETFs. The largest Ethereum ETF inflow came from BlackRock’s ETHA, which pulled in $286.81 million, while Fidelity’s FETH added another $97.28 million. Meanwhile, Bitcoin ETFs saw mixed results, with Fidelity’s FBTC losing $217.78 million in outflows.

4. Why are institutional investors showing more interest in Ethereum ETFs?

Institutional investors are favoring Ethereum ETFs due to recent regulatory approvals and Ethereum’s improved scalability and efficiency. The approval of spot Ethereum ETFs in May 2024 made it easier for institutions to invest in Ethereum without dealing with self-custody or crypto exchanges. Additionally, Ethereum’s transition to Proof of Stake (PoS) and upgrades like EIP-4844 (proto-danksharding) have made the network cheaper, faster, and more energy-efficient, increasing confidence in its long-term adoption.

5. Will Bitcoin ETFs regain momentum, or is Ethereum becoming the new leader?

While Ethereum ETFs are currently experiencing higher inflows, Bitcoin remains the dominant cryptocurrency ETF in terms of total assets under management (AUM). As of February 7, Bitcoin ETFs held $113.09 billion in assets, while Ethereum ETFs had $9.88 billion. However, if Ethereum’s momentum continues and more institutional investors allocate funds toward it, we could see Ethereum narrow the gap over time. Bitcoin is unlikely to lose its status as the primary store of value, but Ethereum is positioning itself as the future of decentralized applications and finance.

6. How do Ethereum’s network upgrades impact its investment appeal?

Ethereum has undergone major upgrades that enhance its efficiency, scalability, and cost-effectiveness. The move from Proof of Work (PoW) to Proof of Stake (PoS) in 2022 reduced its energy consumption by over 99%, making it more sustainable. Additionally, upgrades like EIP-4844 and Layer 2 scaling solutions (Arbitrum, Optimism, Polygon, and zkSync) have made transactions cheaper and faster, making Ethereum a more attractive investment for institutional and retail investors alike.

7. Is investing in Ethereum ETFs riskier than investing in Bitcoin ETFs?

Ethereum ETFs carry a different risk profile than Bitcoin ETFs. Since Bitcoin is seen primarily as a store of value with a fixed supply, its price movements are often less volatile than Ethereum’s, which is tied to network development, DeFi adoption, and NFT activity. However, Ethereum’s expanding use cases and continuous upgrades also present more opportunities for higher growth potential. Investors should consider their risk tolerance, time horizon, and belief in blockchain adoption before choosing between Ethereum and Bitcoin ETFs.

Glossary of Key Terms

1. Exchange-Traded Fund (ETF)

An ETF is a type of investment fund that trades on stock exchanges like a stock. Cryptocurrency ETFs track the price of digital assets like Bitcoin and Ethereum, allowing investors to gain exposure without having to directly buy or store the underlying cryptocurrencies.

2. Spot ETF

A spot ETF holds the actual asset it tracks, rather than futures contracts or derivatives. In the case of a spot Ethereum ETF, the fund holds actual Ethereum (ETH) tokens, giving investors direct exposure to Ethereum’s price movements.

3. Net Inflows

Net inflows refer to the total amount of money invested into an ETF over a specific period, minus any withdrawals. If an ETF experiences high net inflows, it means more investors are buying into the fund, signaling increased confidence in the asset.

4. Institutional Investors

Institutional investors are large entities, such as hedge funds, pension funds, and asset management firms, that invest significant amounts of money in various financial markets. The involvement of major institutional players like BlackRock and Fidelity in Ethereum ETFs suggests increasing mainstream acceptance of cryptocurrency investments.

5. Smart Contracts

Smart contracts are self-executing agreements written in code that automatically execute when predetermined conditions are met. These contracts are a fundamental part of Ethereum’s ecosystem, enabling Decentralized Finance (DeFi), NFTs, and dApps without needing intermediaries.

6. Decentralized Finance (DeFi)

DeFi refers to a financial ecosystem built on blockchain technology that removes the need for traditional banks and intermediaries. Users can lend, borrow, trade, and earn interest on cryptocurrencies through smart contract-powered platforms like Uniswap, Aave, and MakerDAO, all of which run on Ethereum.

7. Layer 2 Scaling Solutions

Layer 2 solutions are technologies built on top of a blockchain to improve scalability and reduce transaction costs. Ethereum’s most popular Layer 2 solutions include Arbitrum, Optimism, and Polygon, which allow for faster and cheaper transactions while maintaining Ethereum’s security and decentralization.

8. Proof of Stake (PoS)

Proof of Stake is a blockchain consensus mechanism where validators stake ETH to secure the network and confirm transactions. Ethereum transitioned from Proof of Work (PoW) to PoS in September 2022 during “The Merge,” reducing energy consumption by over 99% and making Ethereum more sustainable.

9. Gas Fees

Gas fees are the transaction costs required to process transactions on the Ethereum network. These fees fluctuate based on network demand and can sometimes be high. However, upgrades like EIP-4844 (proto-danksharding) and Layer 2 solutions are helping lower gas fees, making Ethereum transactions more affordable.

10. Crypto Market Capitalization (Market Cap)

Market capitalization in crypto refers to the total value of a cryptocurrency or an ETF based on its price and circulating supply. Bitcoin currently holds the largest market cap, but Ethereum is closing the gap as more institutional investors enter the space through ETFs.

References:

Bitcoin News – Bitcoin.news

Ethereum – Ethereum.org

Bitcoin – Bitcoin.org