As market volatility reaches new heights, the shift in investor sentiment is clear: Gold over Bitcoin is becoming the preferred safe-haven choice. With rising geopolitical tensions, including President Trump’s trade wars, and growing economic uncertainty, investors are seeking assets that will maintain their value during times of crisis. Bitcoin, once regarded as “digital gold,” is no longer the go-to asset for protection, as gold is gaining traction over Bitcoin among investors.

Why Gold Is Outperforming Bitcoin

In a recent report by J.P. Morgan, analysts noted that gold is the preferred choice over Bitcoin for investors seeking stability. Bitcoin, which once followed gold’s safe-haven trends, has struggled to maintain its position as a reliable store of value. Analysts pointed out that while gold ETFs have seen strong inflows, Bitcoin has been absent from these safe-haven flows, reflecting its inability to serve as a reliable hedge during times of crisis. As gold hits new record highs, the value of gold over Bitcoin is becoming increasingly apparent in the market.

Gold Shines While Bitcoin Struggles

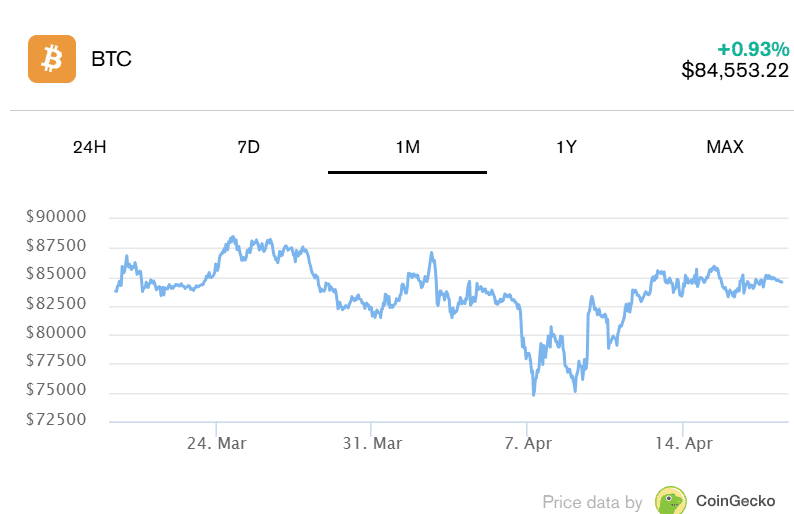

Gold has shown a robust performance, while Bitcoin’s value has been lacklustre in comparison. In recent weeks, gold prices have surged, reaching new highs above $3,660, while Bitcoin has dropped by over 20% from its record high of nearly $ 69,000. The volatility of Bitcoin is evident, and many investors are now opting for gold over Bitcoin to preserve their wealth. Historically, gold has been a stable store of value, especially when fiat currencies or equities face uncertainty. This is why investors are leaning toward gold over Bitcoin in these turbulent times.

Gold Over Bitcoin: The Safe-Haven Asset of Choice

Gold has always been viewed as a reliable safe-haven asset. In times of geopolitical instability and economic uncertainty, investors often turn to gold as a means of protecting their wealth. Gold over Bitcoin is the preferred option because gold has a long track record of stability.

Bitcoin, however, has failed to replicate this behaviour. While Bitcoin experienced a surge in December 2024, it has yet to establish the same level of trust that gold has garnered over centuries. As market conditions worsen, the preference for gold over Bitcoin becomes increasingly apparent.

Bitcoin’s Safe-Haven Narrative Under Pressure

Bitcoin’s early narrative as a safe-haven asset is being questioned, especially as its correlation with U.S. equities grows. While Bitcoin was once viewed as an alternative to gold, it has increasingly become correlated with the volatile tech stock market.

This shift has left gold as the clear choice for investors seeking stability over Bitcoin. Bitcoin’s inability to attract safe-haven flows during uncertain times has left it in the shadow of gold, which continues to benefit from its reputation as a long-term store of value.

Increased Investment in Gold ETFs Over Bitcoin

Gold-backed ETFs have experienced significant growth, with investors increasingly seeking exposure to gold as a stable investment option. In contrast, Bitcoin ETFs have failed to maintain their momentum.

The rise of gold over Bitcoin in the market is reflected in the performance of these ETFs. Gold ETFs have seen $21.1 billion in net inflows in the first quarter of 2025, while Bitcoin ETFs have struggled to attract the same level of investment. This shift highlights the growing preference for gold over Bitcoin as a means to safeguard wealth.

Bitcoin’s price volatility has made it less attractive as a safe-haven asset, especially during times of global instability. Gold, on the other hand, has maintained its status as a stable store of value, offering protection from market fluctuations.

As international tensions rise, investors are increasingly opting for gold over Bitcoin to mitigate risk. While Bitcoin may offer high rewards, its volatility makes it unsuitable for those looking to preserve capital during uncertain times.

Gold Over Bitcoin: A Long-Term Investment Choice

Gold has proven to be a long-term investment that holds its value over time. Unlike Bitcoin, which has shown significant price swings, gold’s steady growth has made it a safe-haven asset for centuries.

The current market conditions have reinforced the importance of gold over Bitcoin as a stable investment option. For long-term investors, gold is often considered a more secure and stable asset than Bitcoin, making it the preferred choice during uncertain economic times.

Geopolitical Tensions Push Gold to the Forefront

Geopolitical tensions, particularly related to trade wars and the potential for a global recession, have driven many investors to seek out safe-haven assets. Gold’s ability to maintain its value in such times has made it the asset of choice.

As the market becomes more volatile, gold over Bitcoin is gaining increasing popularity. Bitcoin, despite its early promise, has failed to provide the same level of stability that gold consistently delivers in times of geopolitical uncertainty.

The Role of Gold Futures in the Shift from Bitcoin

Gold futures have also seen increased buying from investors looking to capitalize on gold’s growth potential. As Bitcoin’s volatility increases, investors are opting for the security of gold over Bitcoin. Gold futures offer investors a means to gain exposure to the precious metal without the need to hold physical gold. This trend further underscores the preference for gold over Bitcoin, particularly as demand for safe-haven assets increases.

Conclusion

In conclusion, gold has become the preferred choice over Bitcoin for investors seeking stability amid global uncertainty. While Bitcoin was once viewed as a potential hedge against economic instability, its volatility and correlation with equities have made it less reliable as a safe-haven asset. In contrast, gold continues to attract investment due to its long history as a store of value.

As geopolitical tensions rise and market volatility increases, gold over Bitcoin is proving to be the safer and more reliable investment option for those looking to protect their wealth.

Gold’s performance during times of crisis, combined with its consistent ability to preserve value, ensures its place as the go-to safe-haven asset in uncertain times. As Bitcoin continues to experience significant price fluctuations, investors are increasingly turning to gold as their preferred asset. Gold over Bitcoin is clearly emerging as the smarter investment choice in today’s market.

Frequently Asked Questions

1- Why is gold over Bitcoin the top choice for investors now?

Gold is often regarded as a stable store of value, particularly during periods of market volatility, unlike Bitcoin, which has exhibited significant price fluctuations.

2- How does gold perform over Bitcoin during economic crises?

Gold maintains its value and performs well during economic instability, while Bitcoin struggles with high volatility, making it less reliable.

3- What makes gold over Bitcoin more stable long-term?

Gold has a proven history of preserving value for centuries, whereas Bitcoin’s relatively short existence and price fluctuations make it less stable in the long run.

4- Why are investors ditching Bitcoin for gold in uncertain times?

Investors prefer gold over Bitcoin due to its track record of stability and value preservation, especially when geopolitical tensions and economic uncertainty rise.

Appendix: Glossary of Key Terms

Safe-Haven Asset: An investment considered to be stable or to retain value during times of economic uncertainty or market volatility.

Gold ETFs: Exchange-traded funds that track the price of gold, allowing investors to gain exposure to the precious metal without physically owning it.

Bitcoin ETF: A type of exchange-traded fund that tracks the price of Bitcoin, offering investors a way to invest in Bitcoin without holding the digital currency directly.

Volatility: A statistical measure of the variation in the price of an asset over time, indicating how much and how quickly an asset’s price fluctuates.

Geopolitical Tension: Political or economic instability that arises from conflicts between countries or regions, often influencing global markets and investor behavior.

Digital Gold: A term used to describe Bitcoin’s early narrative as an alternative to traditional gold, believed to serve as a store of value in the digital age.

Market Liquidity: The ability to quickly buy or sell an asset without causing a significant impact on its price, ensuring that assets can be exchanged easily.

Sources

Decrypt – decrypt.co

THE BLOCK – theblock.co

CoinTelegraph – cointelegraph.com