The price of Bitcoin has taken a hit amidst rising market greed, leading many investors to question the reasons behind this sudden downturn. With the global crypto market capitalization falling by 5.44% to $3.43 trillion in the past 24 hours, the market has witnessed some of the largest liquidations in recent history. So, what’s causing this correction, and what’s next for Bitcoin? Here’s an in-depth analysis by The Bit Journal.

High Greed Equals High Risk

If you’ve been in the crypto market for a while, you’ve likely experienced similar cycles. When market sentiment becomes excessively greedy and investors grow accustomed to bullish trends, corrections often follow. This pattern reflects a tug-of-war between the market and its participants.

Experienced traders frequently caution that periods of heightened greed are ripe for pullbacks, as the market uses these moments to liquidate overleveraged positions. The current Bitcoin price action exemplifies this phenomenon, leaving many traders caught off guard.

Bitcoin’s Price Action: A Technical Overview

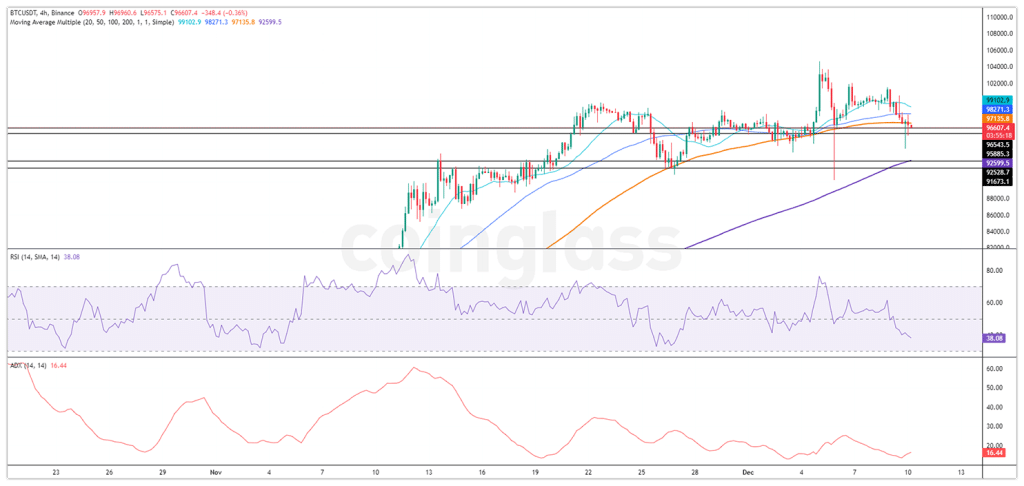

After a rejection from its all-time high, BTC retraced by 13.6% before showing signs of recovery. Initially, Bitcoin managed to hold above its 20-day moving average. However, on December 9, it fell below this level, triggering panic among traders. The downward momentum continued, breaching the 50-day and 100-day moving averages, sending shockwaves through the market.

Currently, Bitcoin is trading at $96,607, reflecting a 2.9% decline in the past 24 hours. Meanwhile, trading volume has surged by 118%, indicating a shift toward short positions. While it’s difficult to predict how much further Bitcoin could fall, the $92,600 support level remains a key threshold, reinforced by the 200-day moving average.

Liquidations and the Role of Whales

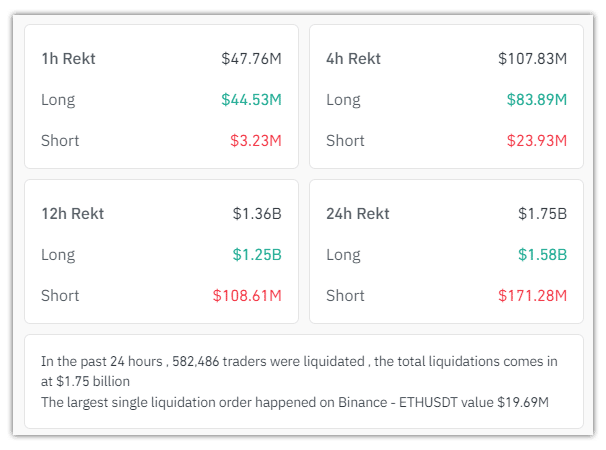

According to data from Coinglass, the past 24 hours have seen $1.75 billion worth of liquidations, with most stemming from long positions. Over 500,000 traders have faced losses, underscoring the market’s volatility.

Interestingly, whale activity suggests a cautious market sentiment. Despite the greedy outlook, many long-position traders appear fearful. Significant buy orders exist between the $92,000 and $94,000 range, suggesting a potential floor for Bitcoin’s decline. However, this dynamic also leaves room for further downside movement before stabilization.

What Lies Ahead?

Corrections in bull markets often bring uncertainty and heightened risk. While the Greed and Fear Index signals extreme greed, technical indicators point to further downside potential. Historically, markets tend to move against emotional extremes, which could mean a sudden Bitcoin rebound if short positions continue to pile up.

For those considering investments, exercising caution is essential. Remember, heightened greed is one of the primary drivers behind Bitcoin’s current dip. Staying informed and managing risk is crucial in such volatile times.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!