Japanese investment heavyweight Metaplanet generated significant buzz with their largest Bitcoin purchase to date. On the 23rd of December, the Tokyo-situated investment vehicle procured 619.7 BTC for just under $60 million USD as Bitcoin exchanged hands at approximately $96,000 per coin. This colossal acquisition signifies a strategic shift toward positioning cryptocurrency as a cornerstone holding within Metaplanet’s portfolio.

The acquisition bolsters the company’s reputation as a pioneering Bitcoin supporter and exemplifies its unwavering belief in the digital currency’s potential long-term appreciation. With this latest transaction, Metaplanet’s accumulated Bitcoin reserves now total 1,762 BTC, valued at around $168 million USD. The firm’s resolute commitment to Bitcoin draws comparisons to United States-headquartered MicroStrategy, warranting it the nickname “Asia’s MicroStrategy.”

A Strategic Move in a Volatile Market

Metaplanet’s daring move arrives during increased uncertainty in the cryptocurrency markets. By capitalizing on Bitcoin dipping below $100,000, the firm exhibited astute timing and an eye for worth. This latest procurement dwarfs its previous record buy of 159.7 BTC on October 28th, accentuating its dedication to amplifying Bitcoin holdings.

“Bitcoin is the future of finance, and we aim to be at the forefront of this revolution,” a Metaplanet representative asserted in a recent statement. “Our strategy reflects a long-term vision to maximize shareholder value by fully integrating Bitcoin into our core operations.”

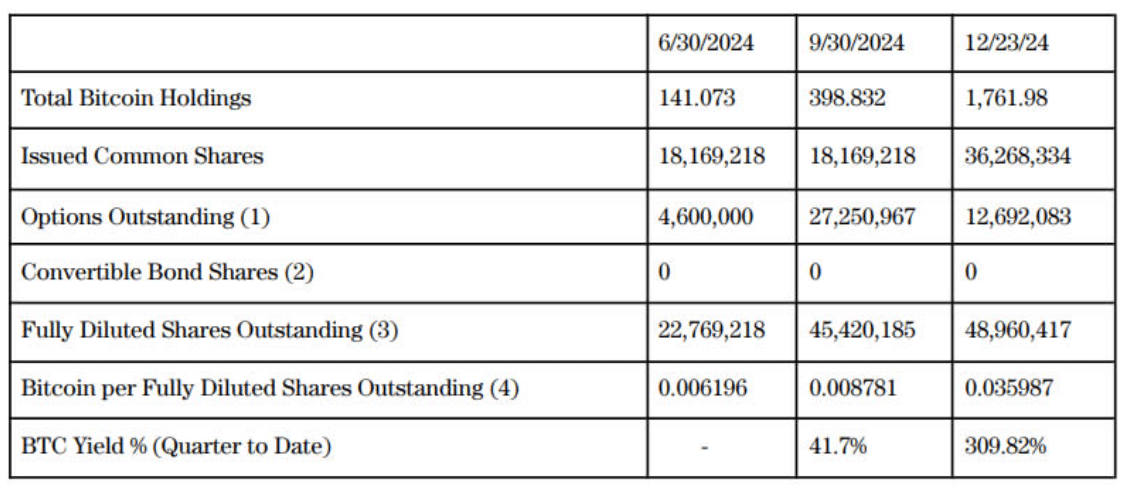

The firm also publicized phenomenal output from its Bitcoin investments. Between October 1st and December 23rd, its BTC yield skyrocketed an astonishing 310%, vastly surpassing the 41.7% yield recorded in the prior quarter.

A Blueprint for Bitcoin Accumulation

Metaplanet’s strategic manoeuvres are an integral facet of a more comprehensive agenda to establish Bitcoin aggregation and administration as a formal operational division. As elucidated in documentation furnished to investors, the enterprise has delineated designs to leverage loans, stock, convertible bonds, and other monetary instruments to bolster its Bitcoin treasury in a substantial manner.

“We at Metaplanet aren’t simply procuring Bitcoin; we’re cultivating an entire ecosystem revolving around it,” the firm asserted. “Our overarching objective is to craft a sustainable framework conducive to generating consistent value for all stakeholders involved.”

In the month of November, the company announced plans to raise sixty-two million dollars (nine billion five hundred million yen) through a stock acquisition program allocated to subsidizing further Bitcoin purchases. This proactive modus operandi echoes the enterprise’s commitment to diversifying its fiscal strategies while deepening its foothold within the cryptocurrency space in a meaningful way.

Stock Price Surges Amid Bitcoin Adoption

Metaplanet’s bold decision to harness the potential of Bitcoin has captured widespread notice among shareholders. The stock price on the Tokyo Stock Exchange jumped a remarkable 5% following their latest declaration to accumulate more. In spite of a transient dip earlier in the week, shares still tower over levels from the advent of the year, reaching an unprecedented apex of 4,080 yen ($26) on December 17.

Specialists attribute the company’s performance profile to their pioneering philosophy of cryptocurrency acceptance. “Metaplanet is reinventing the rulebook for investment agencies in Asia,” elucidated a Tokyo-based financial expert. “Their calculated concentration on Bitcoin is resonating with investors who envision the probability for significantly profitable returns in the foreseeable future.”

Looking Ahead: Beyond Bitcoin Purchases

Metaplanet has pursued a daring strategy with Bitcoin, representing a pivotal shift for the enterprise. Years of shortfalls now appear poised to culminate in the firm’s initial operating earnings since the close of 2017. This recovery is primarily credited to stakes in the premier digital currency and complementary business paradigms forged in Bitcoin’s image.

“Cryptocurrency is more than a simple holding for our organization; it drives novel opportunities,” the leadership stressed. By weaving Bitcoin throughout its procedures, Metaplanet designs to unfurl emerging income pathways and bolster its enduring fiscal soundness. Moreover, the company hopes to inspire others through adventurous innovation that pushes boundaries and elevates the industry in a progressive direction.

Conclusion: A Bold Vision for the Future

While Metaplanet’s record-setting Bitcoin buy made waves, the purchase demonstrated a conviction that cryptocurrency will revolutionize financial systems. Through savvy planning, creative monetary manoeuvres, and a prognosis of long-lasting change, Metaplanet is pioneering an investment path poised to mould the Asian market and far beyond. As Bitcoin gains still more worldwide acclaim, Metaplanet’s boundary-pushing methods may well light the road ahead for other corporations wanting to welcome developing technologies.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

1. Why did Metaplanet buy 619.7 Bitcoin?

Metaplanet perceives Bitcoin as a long-haul resource with transformative monetary potential. The procurement coordinates with its technique to incorporate Bitcoin into its tasks and maximize shareholder worth.

2. How does this purchase impact Metaplanet’s Bitcoin holdings?

This obtaining brings Metaplanet’s all-out Bitcoin holdings to 1,762 BTC, esteemed at around $168 million, cementing its situation as a significant corporate Bitcoin holder. The procurement substantiates the organization’s vision of Bitcoin as a centrepiece of its portfolio and longer-term procedures.

3. What is Metaplanet’s future plan with Bitcoin?

In the future, the company intends to formalize the systematic accumulation of Bitcoin as a business division, leveraging instruments like loans and equity to expand their reserves in a calculated manner while constructing a sustainable framework conducive to continuous growth.