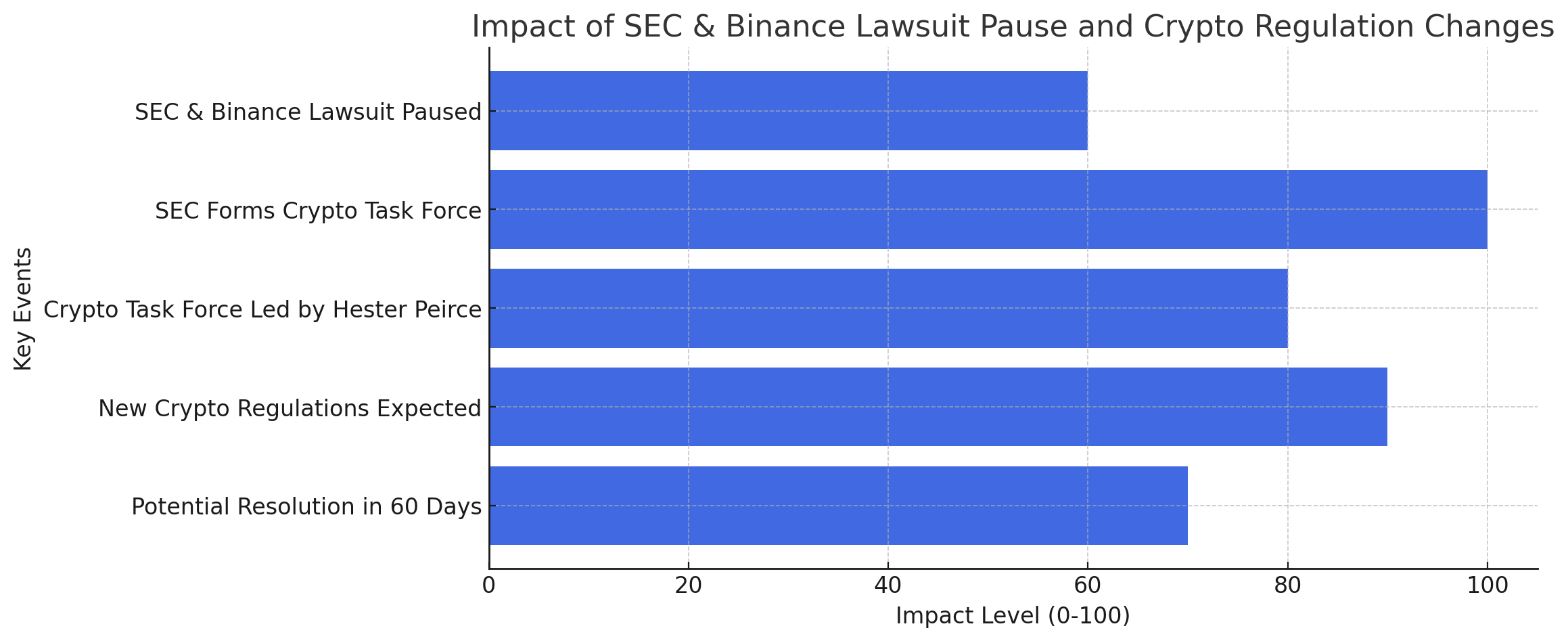

According to the report, the U.S. Securities and Exchange Commission (SEC) and Binance have jointly requested a 60-day pause in their ongoing legal battle. This move comes as the SEC’s newly established Crypto Task Force, led by Commissioner Hester Peirce, embarks on crafting a comprehensive regulatory framework for digital assets.

A Strategic Pause Amid Regulatory Evolution

On February 10, 2025, the SEC and Binance filed a joint motion with the U.S. District Court for the District of Columbia, seeking a temporary halt to their litigation. The motion emphasizes that the efforts of the Crypto Task Force “may impact and facilitate the potential resolution of this case.”

This pause is not merely a procedural tactic but reflects a broader shift in the SEC’s approach to cryptocurrency regulation. Historically, the SEC has been criticized for its “regulation-by-enforcement” strategy, which many argue stifled innovation and created an environment of uncertainty. The formation of the Crypto Task Force signals a move towards establishing clear guidelines that balance investor protection with industry growth.

The Genesis of the Crypto Task Force

Acting SEC Chairman Mark Uyeda announced the creation of the Crypto Task Force on January 21, 2025. Commissioner Hester Peirce, affectionately known in the crypto community as “Crypto Mom” for her progressive views, was appointed to lead this initiative. The task force aims to:

- Draw clear regulatory lines.

- Distinguish securities from non-securities.

- Craft tailored disclosure frameworks.

- Provide realistic paths to registration for both crypto assets and market intermediaries.

Peirce has been a vocal critic of the SEC’s previous reliance on enforcement actions without providing adequate guidance. She advocates for a regulatory environment that fosters innovation while ensuring investor protection. “The SEC can do better,” Peirce stated, emphasizing the need for clarity and practical solutions.

Implications for the Crypto Industry

The joint motion to pause the lawsuit is seen by many as an olive branch extended by the SEC towards the crypto industry. It suggests a willingness to collaborate and develop a regulatory framework that accommodates the unique aspects of digital assets. This move has been lauded by industry stakeholders who have long called for clearer guidelines.

A spokesperson for Binance expressed optimism, stating,

“The SEC’s case has always been without merit, and we are eager to put this behind us and to continue our focus on keeping Binance the most secure, licensed, and trusted exchange in the world.”

SEC and Binance: A New Era of Collaboration?

The 60-day pause provides a window for the Crypto Task Force to make significant strides in formulating policies that could redefine the regulatory landscape for cryptocurrencies in the U.S. The outcome of this initiative holds the potential to set a precedent for how digital assets are treated, balancing the need for oversight with the imperative of fostering innovation.

As the task force embarks on this mission, the crypto community remains hopeful that this marks the beginning of a more collaborative and transparent relationship between regulators and industry participants.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What led to the SEC and Binance requesting a 60-day pause in their lawsuit?

The pause was requested to allow the SEC’s newly formed Crypto Task Force to develop a comprehensive regulatory framework for digital assets, which could influence the resolution of the case.

Who is leading the SEC’s Crypto Task Force?

Commissioner Hester Peirce, known for her supportive stance on cryptocurrency innovation, is heading the task force.

What are the main objectives of the Crypto Task Force?

The task force aims to establish clear regulatory guidelines, distinguish between securities and non-securities, and create practical paths for crypto assets and intermediaries to register with the SEC.

How has the crypto industry responded to this development?

The industry has largely welcomed the move, viewing it as a positive step towards clearer regulations and a more collaborative approach between regulators and crypto companies.

Glossary

Securities and Exchange Commission (SEC): A U.S. federal agency responsible for enforcing laws against market manipulation.

Binance: One of the world’s largest cryptocurrency exchanges.

Crypto Task Force: A newly established SEC initiative aimed at creating a clear regulatory framework for digital assets.

Hester Peirce: An SEC Commissioner known for her advocacy of clear and supportive crypto regulations.