Algorand (ALGO) is a proof-of-stake blockchain with high throughput and low fees. Analysts see ALGO stabilizing near $0.19–$0.21 in 2025; and rising thereafter. One crypto analysis forecasts an average ALGO price of about $0.21 in 2025,; growing to $0.28 by end-2026 and $0.35 in 2027. Other Algorand price predictions are similarly moderate, while some are more bullish.

Algorand’s blockchain is focused on scalability and security. Its pure Proof-of-Stake consensus allows anyone to run a validating node with just one ALGO staked. The network has seen usage in DeFi and tokenization. ALGO’s tokenomics are inflationary: a fixed max supply of 10 billion ALGO by 2030, with staking rewards around 5–6% APY.

This inflation helps secure the network but can pressure price if demand doesn’t keep up. The Algorand Foundation and a strong technical team founded by Silvio Micali are working to grow the ecosystem but broad retail attention has lagged behind tech promise.

Factors Influencing Price

Real-world use of Algorand (DeFi protocols, NFTs, CBDC initiatives) can drive demand. Recent release of AlgoKit 3.0 in Q1 2025 has boosted developer activity which should help with token adoption.

Strong partnerships like integrating Wormhole’s cross-chain token standard, to enable native token transfers and Paycode to use Algorand for offline digital payments in underserved regions , expand ALGO’s use cases and should support price.

However, growth is hindered by competition from other Layer-1 chains (Ethereum, Solana, Avalanche, etc.) that offer similar or higher scalability.

Algorand will mint all 10B tokens by 2030. The current inflation from staking rewards and initial distributions; is around 5–6% per year which is relatively low. Large token releases in the past temporarily dropped ALGO’s price but the inflation is tapering.

ALGO, like most alts, follows broader crypto cycles. A Bitcoin rally often lifts alts. Bitcoin has been testing new highs which analysts noted could spark a market wide bull run. If crypto markets continue to rise, ALGO could see more investor interest and higher prices.

Recent Developments

Algorand’s ecosystem has seen several developments in 2025 that will impact long term value. In July 2025, Algorand integrated Wormhole’s Native Token Transfer (NTT) standard which enables native cross chain token interoperability.

This allows assets and liquidity to move between Algorand and 40+ other blockchains. This interoperability will expand Algorand’s use cases and demand for ALGO as a bridge token.

Also in mid 2025, Algorand partnered with Paycode to enable offline digital payments for millions in underserved regions. By moving Paycode’s infrastructure onto Algorand, ALGO will be exposed to new use cases in humanitarian aid and financial inclusion. Adoption of ALGO for such high utility applications will improve perception and usage and potentially a higher price floor over time.

Algorand Foundation joined the Blockchain Association in June 2025 to advocate for pro-innovation crypto policy. This doesn’t impact price directly but shows Algorand’s focus on real world blockchain adoption (payments, identity etc) and working with regulatory bodies.

All these sets the stage for ALGO’s medium term trajectory. Technological upgrades (interoperability, updates) and adoption will push price up, inflation and competition will push price down.

Technical Analysis

After peaking around $0.60 in late 2024, ALGO dropped 70% into mid 2025. Several indicators are hinting at a base forming: moving averages are aligned with support ($0.15), and momentum oscillators are neutral to slightly positive.

Volatility has picked up and the MACD is crossing above the signal line. Early signs of buying interest. But key resistance is around $0.25 and $0.30 (recent highs). A break of those levels with volume would be needed to sustain any rally.

Key support levels are the April 2025 low around $0.15. If the market drops; ALGO may retest that zone; failure there could mean a new long term downtrend. Holding above $0.15-$0.17 would keep the outlook constructive.

Long term bullish confirmation will require ALGO to break resistance and make higher lows.

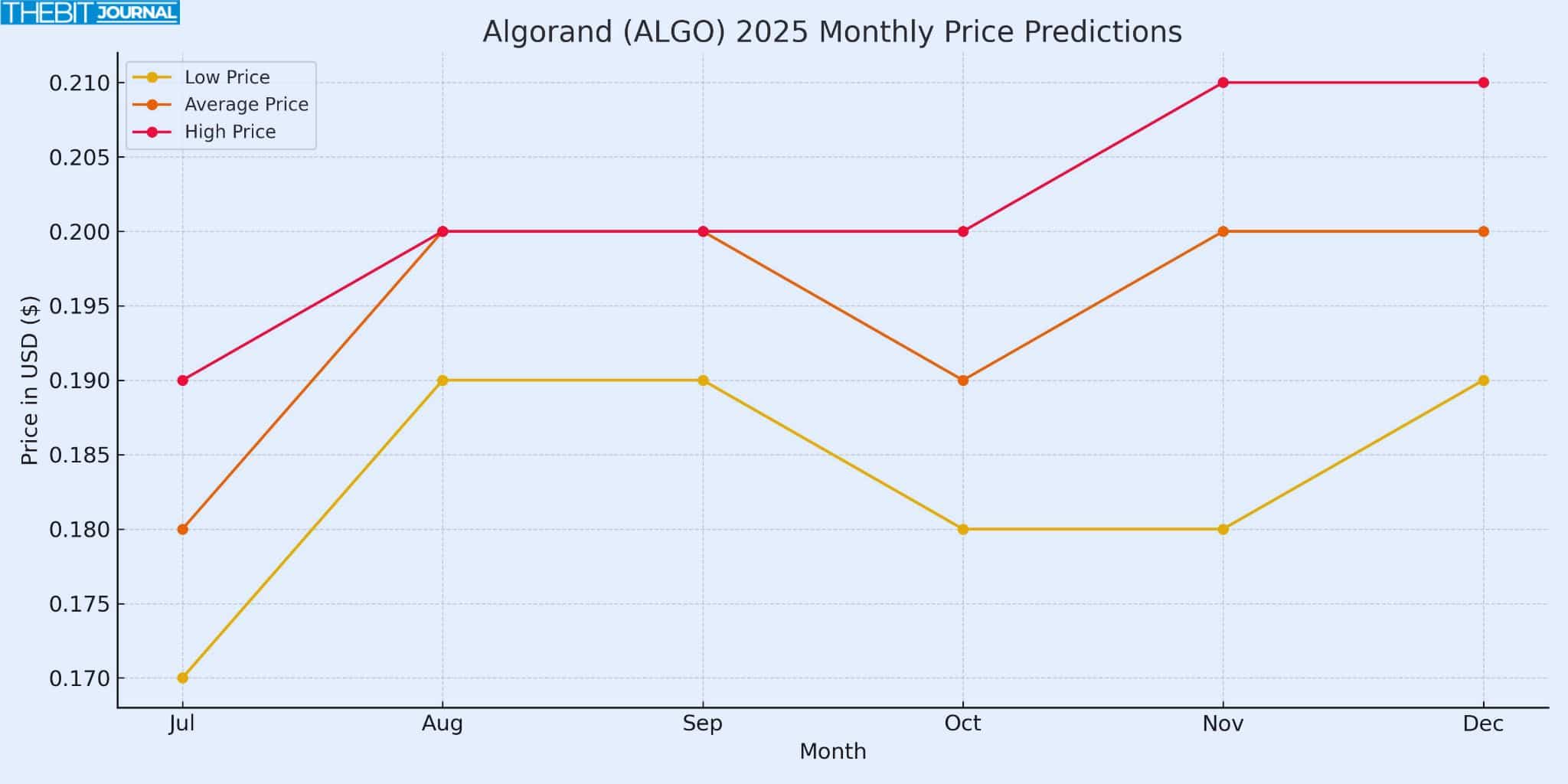

2025 Algorand Price Prediction

The 2025 predictions are for a relatively flat range between $0.17 and $0.21. Analysts expect ALGO to trade in a tight range as it consolidates from previous downturns. Despite bearish charts in the first half of the year, positive macro signals like Bitcoin breaking above $100,000 and growing developer interest with AlgoKit 3.0, have added a stabilizing effect.

But ALGO still can’t break out of this range due to low TVL and trading volume compared to Solana and Avalanche. Without stronger DeFi adoption or liquidity inflows, ALGO may stay in this channel all year.

Algorand Price Prediction Table (2025)

| Month (2025) | Low Price ($) | Avg. Price ($) | High Price ($) |

| July 2025 | 0.17 | 0.18 | 0.19 |

| August 2025 | 0.19 | 0.20 | 0.20 |

| September 2025 | 0.19 | 0.20 | 0.20 |

| October 2025 | 0.18 | 0.19 | 0.20 |

| November 2025 | 0.18 | 0.20 | 0.21 |

| December 2025 | 0.19 | 0.20 | 0.21 |

2026–2027 Price Analysis

Long term ALGO is expected to grow gradually but sustainably. By 2026 the low volatility of 2025 could turn into modest gains as the market gets more optimistic and use cases expand. Forecasts have the average price at $0.24 in 2026 which is an uplift from new real world integrations (e.g. Paycode for offline payments), deeper cross chain utility via Wormhole and decreasing inflationary impact as the emission curve slows down.

By 2027, ALGO’s average price is expected to be around $0.32. This is due to compounding ecosystem growth, possibly higher DeFi adoption and broader altcoin rallies as BTC continues to get adopted by institutions. But unless Algorand’s TVL and user base scales big time, growth could be within the forecasted range of $0.35-$0.37.

Algorand Price Prediction Table (2026–2027)

| Year | Low Price ($) | Avg. Price ($) | High Price ($) |

| 2026 | 0.22 | 0.24 | 0.27 |

| 2027 | 0.31 | 0.32 | 0.37 |

Expert Forecasts

Most Algorand price predictions expect moderate growth by 2027. Analysts’ forecast has ALGO “hovering around $0.21 throughout 2025” then rising to $0.28 by end 2026. By 2027 they have $0.35 (average). These are assuming steady market and adoption trends. Coinpedia’s analysis is more bullish: under strong adoption they see ALGO possibly hitting $0.50-$0.90 by end 2025, but also a bear scenario (down to $0.20).

WalletInvestor’s long term technical model has ALGO at $0.31 by 2030 (low growth). Changelly’s price engine (AI based forecast) has a 2026 Algorand price prediction low of $0.22 and high of $0.27 and by 2027; an average of $0.32. These are at the lower end of the other projections.

Conclusion

Long term Algorand price prediction is cautiously optimistic. Current forecasts show modest gains for 2025–2027, with prices around $0.20s in 2025 and potentially into the $0.30s by 2027. Positive drivers include expanding real world use via partnerships and DeFi growth, and improving tech. Those should help increase demand for ALGO.

On the other hand, ALGO has inflationary issuance and strong competition. Most analysts agree ALGO won’t see explosive growth without major market shifts. Instead, the consensus is for a slow but steady uptrend, perhaps $0.30–$0.40 in 2027 under favorable conditions.

Investors should watch key developments as those will be the key to any breakout. As always crypto investing is risky; price forecasts are just a guide not a guarantee.

Summary

Algorand’s price will hold near current levels into late 2025 (around $0.19–$0.22); before rising. Analyst models predict 2026 average of around $0.28 and $0.35 by end-2027. Growth drivers are expanding use cases; key partnerships (e.g. cross-chain Wormhole integration, Paycode digital payments) and macro crypto trends. Overall; forecasts are for modest long term gains for ALGO with peaks around $0.30–$0.40 in 2027.

FAQs

Will Algorand’s price reach $1 in 2025?

Most forecasts don’t see ALGO reaching $1 by 2025. Even in a bull case ALGO isn’t seen to peak above $1. Leading predictions are $0.20–$0.30. A $1 price would require a big market move or some unexpected news.

What moves Algorand’s price?

Key drivers are network adoption, supply factors, broader crypto market trends and technical momentum. Big partnerships and upgrades are bullish factors; Inflationary supply and competition from other chains are bearish factors.

How high is Algorand’s staking yield?

Algorand’s staking rewards is around 5–6% APY right now. This is the network’s inflation rate. These rewards incentivize holding ALGO but new supply at this rate must be absorbed by demand to avoid selling pressure.

Is Algorand a Proof-of-Stake or Proof-of-Work blockchain?

Algorand is Proof-of-Stake (PoS). It’s a Pure PoS where any token holder can participate in block validation with minimal requirements. No mining or Proof-of-Work.

Glossary

Algorand (ALGO): a layer 1 blockchain and its native cryptocurrency (ticker ALGO). It uses pure Proof-of-Stake to achieve fast low cost transactions.

Proof-of-Stake (PoS): a consensus mechanism where validators stake tokens to secure the network and earn rewards.

Staking APY: Annual Percentage Yield earned by staking ALGO.

Total Value Locked (TVL): the sum of crypto assets locked in a blockchain’s DeFi apps.

Relative Strength Index (RSI): a technical indicator (0–100) showing whether an asset is overbought or oversold.

Interoperability: the ability to move tokens across different blockchains.

Sources

Cryptopolitan

CryptoNews

Changelly

Coinpedia

WalletInvestor