The ALGO price has recently gained significant attention with a remarkable 66% surge in transaction volume. Over the past week, it has been the fastest-growing blockchain by volume. Meanwhile, ALGO’s volatility has dropped to 65.57%, the lowest in 30 days. This combination of rising activity and declining volatility is catching the eyes of market participants.

Algorand (ALGO) impressive growth comes as the network shows signs of increased usage. The surge in transaction volume suggests that more users are adopting the Algorand network. At the same time, lower volatility may indicate quiet accumulation, with investors cautiously entering the market.

Key Resistance Levels for Algorand

As ALGO pushes higher, it is testing the upper boundary of a descending channel. This pattern has been in place since late 2024. The price is now approaching key resistance at $0.2541. If it breaks through this level, additional upside targets of $0.3006 and $0.3491 are possible.

On the other hand, the lower support levels are found at $0.1814 and $0.1511. A breakout above resistance could flip the market structure to bullish, suggesting a potential price surge. The Relative Strength Index (RSI) is currently at 50.06, indicating a neutral stance.

This neutral position suggests there is room for upward movement if the market gains momentum. As of now, ALGO price is hovering at $0.1921, down by 6.57% over the past day.

Whale Accumulation: A Bullish Signal for ALGO Price

Whale activity on the Algorand network is showing signs of accumulation. Over the past 30 days, whale wallets have increased their ALGO holdings by 5.12%. This is a clear sign that larger investors are positioning themselves for potential growth. Meanwhile, retail investors and mid-tier wallets have reduced their exposure to ALGO.

This accumulation by whales aligns with historical breakout behavior. Large holders typically accumulate assets during periods of market compression. When the price finally breaks out, these early investors stand to benefit the most.

Transaction Activity and Its Impact on Algorand

The increase in transaction volume is one of the key factors driving ALGO’s recent price movement. Over the past week, transaction activity surged by 66%. This shows growing interest in the Algorand network. The increase in usage is a positive signal for the future of ALGO.

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

|---|---|---|---|---|

| June | $0.204 | $0.217 | $0.229 | 80% |

| July | $0.216 | $0.224 | $0.232 | 82.4% |

| August | $0.217 | $0.221 | $0.225 | 76.9% |

| September | $0.215 | $0.220 | $0.224 | 76.1% |

| October | $0.212 | $0.225 | $0.237 | 86.3% |

| November | $0.216 | $0.226 | $0.236 | 85.5% |

| December | $0.205 | $0.219 | $0.233 | 83.2% |

However, while transaction activity is growing, the decline in volatility suggests that investors are waiting for a clear breakout signal. This indicates that there may be caution in the market, as traders wait for confirmation before making larger moves.

Address Activity: Mixed Signals for ALGO

Despite the surge in transaction volume, the address activity data tells a more mixed story. According to IntoTheBlock data, zero-balance addresses have surged by 23.29%. However, new and active addresses have dropped by 23.90% and 9.12%, respectively. This reflects a decline in engagement from both new and existing users.

While transaction volume is growing, the lack of new and active addresses suggests that retail participation is cautious. This could cap short-term upside unless ALGO price can break out and attract fresh investor interest.

Neutral Market Sentiment and Balanced Netflows

The spot netflow data for ALGO price shows equilibrium, with inflows and outflows both recorded at around $1.89 million. This indicates that traders are currently in a neutral stance, unwilling to commit heavily in either direction. Such neutrality is typical during periods of technical retests, where market participants await confirmation of a clear trend.

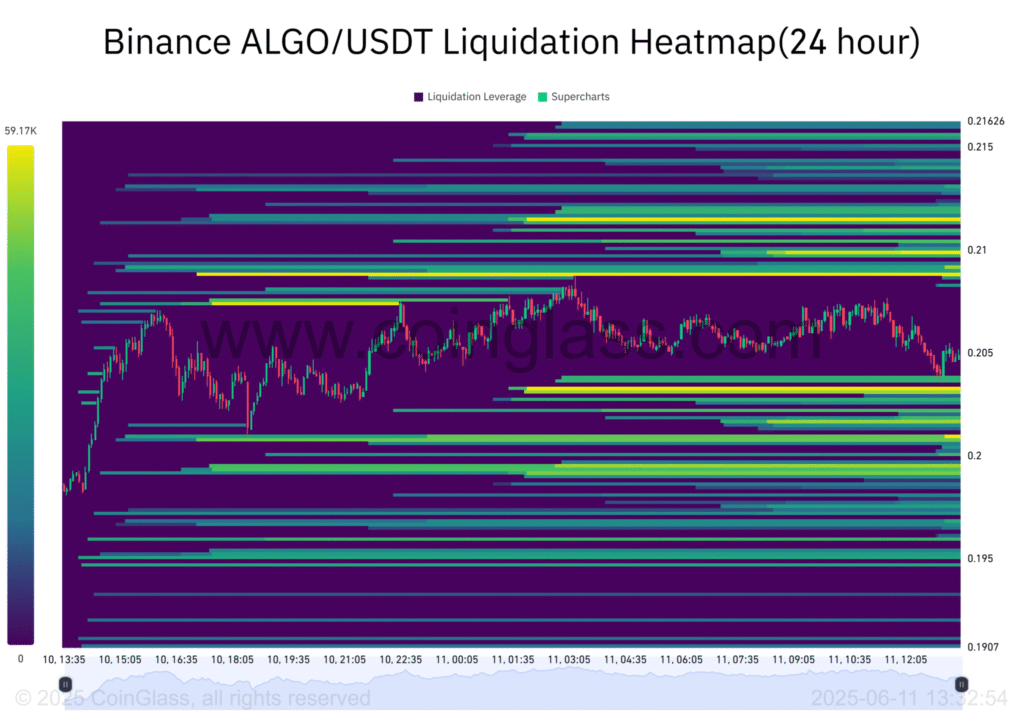

This balance of inflows and outflows could shift quickly if the ALGO price breaks resistance. A move above $0.2541 could trigger a wave of buying, while failure to break resistance might result in selling pressure.

ALGO Price: Critical Resistance Zone

According to Binance’s 24-hour liquidation heatmap, the $0.21 level is a critical resistance zone. Dense clusters around this price point suggest that a move above it could trigger short liquidations. This could add upward momentum to ALGO’s price. On the other hand, failure to break through could lead to selling pressure, especially from overleveraged positions.

Conclusion

The current situation with ALGO price shows both potential and caution. The recent surge in transaction activity and whale accumulation suggests that the market may be gearing up for a breakout. However, the decline in volatility and the mixed signals in address activity indicate that investors are still waiting for a clear signal before making significant moves.

All eyes are on the $0.21–$0.2541 resistance zone. A confirmed breakout could signal the start of a new bullish phase for ALGO. On the other hand, a failure to break through could lead to short-term selling pressure and continued consolidation.

Frequently Asked Questions (FAQ)

1. Why has ALGO’s transaction volume surged by 66%?

The surge in transaction volume reflects increasing adoption of the Algorand network and growing user activity.

2. What does the neutral RSI of 50.06 mean for ALGO?

The neutral RSI suggests that the ALGO price has room for upward movement, depending on market conditions.

3. How does whale accumulation affect ALGO price?

Whale accumulation is typically a bullish signal, indicating that large investors are positioning for future price gains.

4. What is the significance of the $0.2541 resistance level?

Breaking the $0.2541 resistance could signal a bullish shift in the market, opening the door for higher prices.

Appendix Glossary of Key Terms

ALGO Price: The market value of the Algorand (ALGO) cryptocurrency.

RSI (Relative Strength Index): A momentum oscillator that measures the speed and change of price movements.

Whale Activity: Large holders or investors who control significant amounts of a cryptocurrency.

Volatility: The degree of variation in the price of an asset over time.

Descending Channel: A chart pattern characterized by lower highs and lower lows, indicating a bearish trend.

Support Level: A price level where an asset tends to find buying interest, preventing further decline.

Resistance Level: A price point at which selling pressure often outweighs buying interest, preventing further price increases.

Reference

AMB Crypto – ambcrypto.com