The cryptocurrency market sees cycles known as altcoin seasons, where investors flock to smaller coins in hopes of major gains. However, as the market matures, some experts believe these seasons may yield diminishing returns. Two renowned analysts, Willy Woo and il Capo of Crypto, have recently shared insights that every investor should closely consider for their portfolio strategy.

Is Altcoin Season Losing Steam?

On October 26, Willy Woo suggested that altcoin seasons might not pack the same punch they once did. According to Woo, the altcoin booms that began during the 2017 ICO craze may no longer deliver the massive returns once anticipated. Even as Bitcoin rallies, Woo predicts that mid- and small-cap altcoins could follow suit, but with lower volatility and potentially reduced returns. Woo emphasized that altcoin investments remain a popular choice for risk-tolerant investors, signaling that while altcoin season might cool, the appetite for these assets will likely persist.

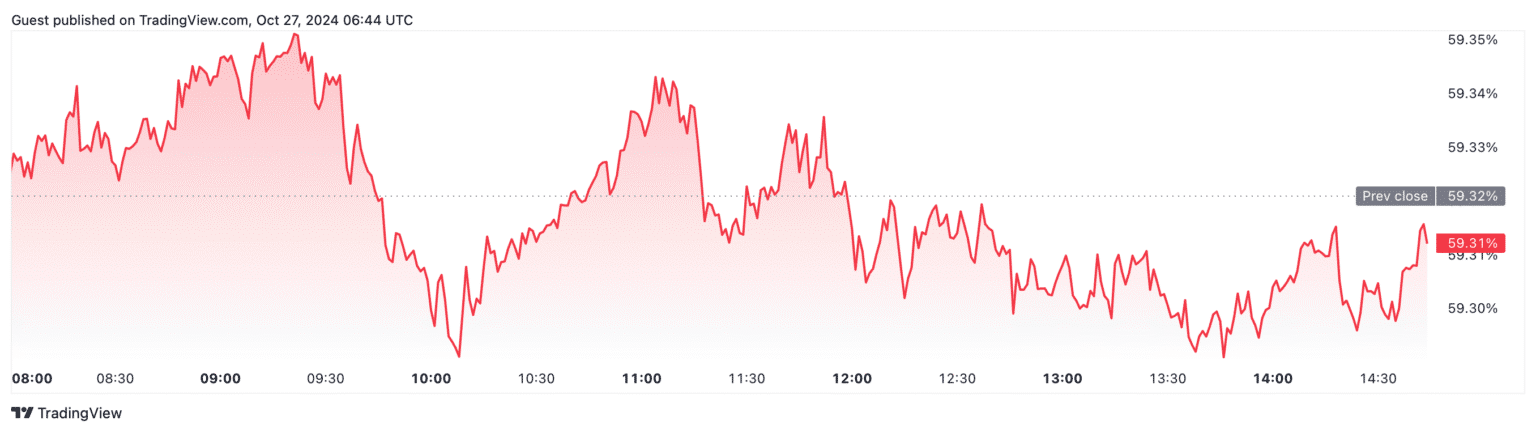

Bitcoin’s market dominance, often a reliable indicator for altcoin momentum, currently sits around 59.31%, based on TradingView data. Analysts anticipate that a rise to 60% might trigger a capital shift from Bitcoin into altcoins. However, Woo foresees this season focusing largely on meme coins, which, while popular, he describes as more of a “casino-like bubble” than viable investments.

Il Capo Warns of a “Black Swan” Scenario

Meanwhile, il Capo of Crypto, known for his bearish stances, pointed to the upcoming U.S. elections as a potential risk for the cryptocurrency market. According to il Capo, a sudden, unpredictable “black swan” event tied to the elections could result in major price drops for altcoins. In his view, altcoin projects might face up to a 35% dip, while even large-cap coins could fall 25% to 35%, and smaller market-cap assets could see losses ranging from 40% to 60%.

Despite this grim forecast, il Capo remains optimistic for long-term investors. He suggests that a severe market drop might be the final shakeout needed for a robust altcoin season. He advised investors to prepare, rather than panic, and consider significant declines as potential entry points into the market. Notably, after previous bearish predictions, il Capo recently disclosed holding a variety of altcoins, a shift from his past stance on the market’s future.

As The Bit Journal continues to follow these trends, investors should weigh the insights of these top analysts and assess their risk tolerance carefully.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!