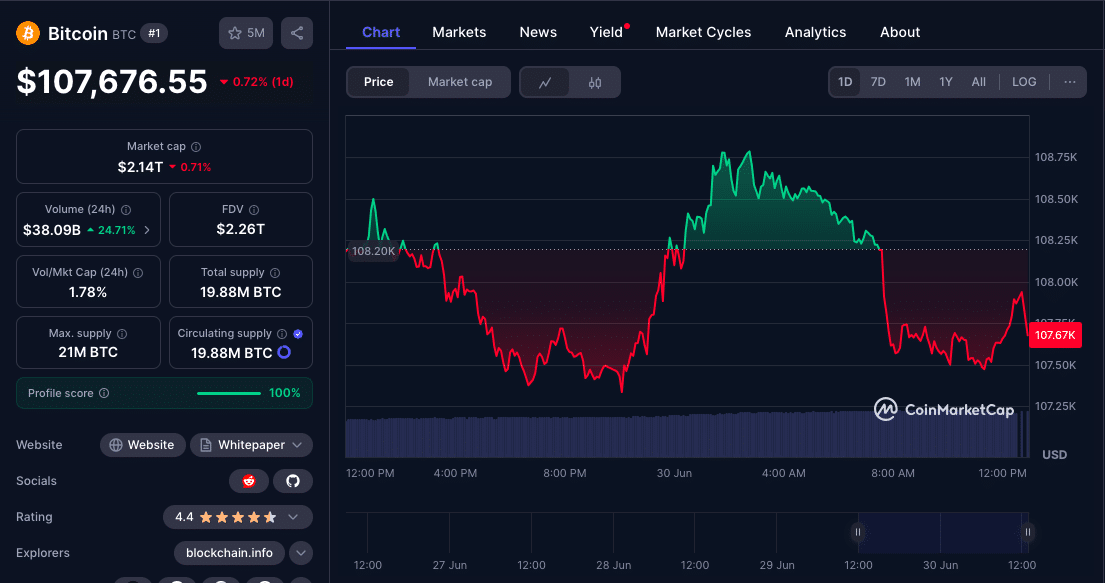

Bitcoin holds $100K for its sixth consecutive week despite heightened volatility and active reshuffling of large-scale holdings. While ETF inflows remain robust, the digital asset has struggled to push beyond its psychological ceiling, a pause many believe stems from a silent tug-of-war between seasoned holders exiting the market and a new wave of long-term institutional entrants.

This standstill, however, may not reflect stagnation but rather a foundational reshaping of Bitcoin’s investor base. With Wall Street entities absorbing coins offloaded by early adopters and corporate treasuries entering the accumulation phase, market analysts suggest a new price engine is quietly forming As a result, the question remains. Will Bitcoin Hold 100k?

Profit-Taking at the Peak: Bitcoin Veterans Cash Out

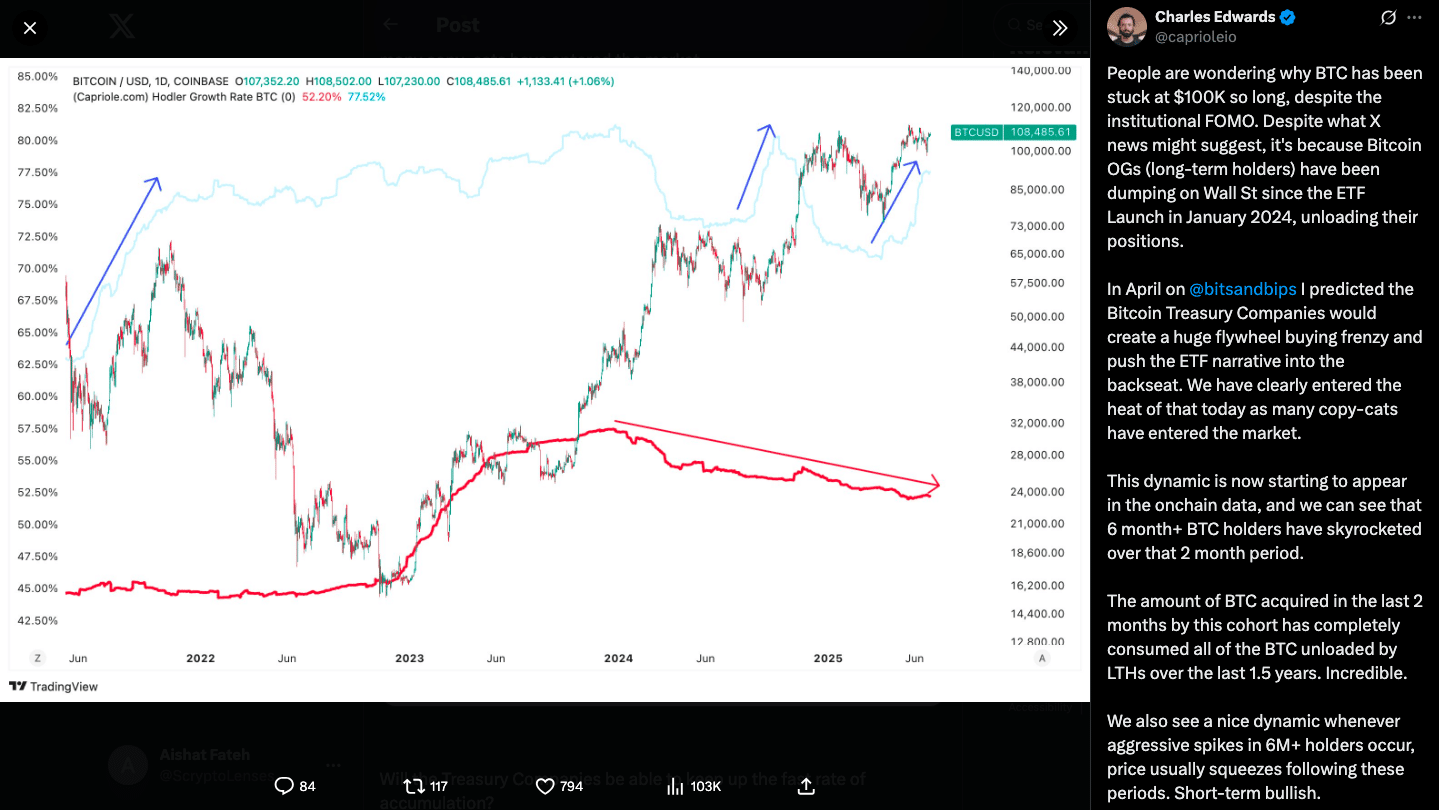

Charles Edwards, founder of Capriole Investments, recently explained that Bitcoin’s recent stall around $100,000 is largely the result of legacy holders taking profits following the launch of spot Bitcoin ETFs earlier this year. In a June 29 post on X, Edwards wrote,

“People are wondering why Bitcoin has been stuck at $100K for so long. It’s because Bitcoin OGs have been dumping on Wall Street since the ETF launch.”

On-chain analytics from Glassnode and CryptoQuant confirm this trend. Dormant coin movement has spiked over the last 90 days, suggesting that long-held BTC is being sold or transferred.

While this has capped short-term upside, analysts argue that the long-term effect could be bullish. Transferring supply from early speculators to conviction-driven institutional buyers often strengthens market structure and reduces price volatility.

Corporate Treasuries Quietly Rewire Bitcoin’s Demand Curve

As Bitcoin holds above $100K despite heavy profit-taking, the quiet arrival of a new investor class is beginning to tip the balance. Corporate treasury participation is on the rise. Edwards highlighted this, describing it as a “flywheel effect” where steady institutional buying creates price floors that attract even more capital. This rotation isn’t just theoretical; it’s visible in both data and disclosures.

According to Arkham Intelligence, several mid-sized U.S. public firms have added Bitcoin to their treasuries in Q2 2025, following MicroStrategy’s aggressive path. Meanwhile, El Salvador, Bhutan, and Argentina have confirmed continued BTC reserve accumulation through sovereign wealth channels.

Data from IntoTheBlock shows that Bitcoin addresses holding between 1,000 and 10,000 BTC, often linked to corporate and high-net-worth wallets, have grown by 11% in the last 60 days. Many of these addresses exhibit low outflow rates, supporting the notion of treasury-grade holding patterns.

On-Chain Data Signals Reinforced Accumulation

While some sell-offs were inevitable following Bitcoin’s explosive Q1 gains, the network’s underlying health remains solid. Metrics such as long-term holder supply, accumulation addresses, and UTXO age bands all suggest that the distribution phase is nearing completion.

According to CryptoQuant, addresses that have held Bitcoin for more than six months now command over 70% of circulating supply. This figure rose 4.2% since April, indicating that recent inflows are being absorbed by holders with long-term conviction. Moreover, the Net Unrealized Profit/Loss (NUPL) metric sits at 0.58, comfortably within the “belief” zone but not yet at euphoria, suggesting room for further upside without overheating.

Historically, similar periods of accumulation by six-month-plus holders have preceded substantial rallies. In late 2020, a similar setup occurred just before Bitcoin surged from $20,000 to $65,000 in under five months.

Capriole’s Edwards commented on this structural foundation, adding:

“The real story isn’t the stall at $100K, it’s the transfer of Bitcoin into hands that won’t sell for years. That’s where the bull market really begins.”

Forecast Models: What Experts See for BTC in the Months Ahead

Price models and forecast platforms remain optimistic despite the recent slowdown. While short-term upside may be capped, long-term projections continue to reflect confidence in Bitcoin’s structural trajectory.

According to CoinCodex, Bitcoin could reach $128,000 by December 2025 under its bullish scenario, driven by sustained ETF inflows and macro hedge demand. WalletInvestor maintains a 12-month price target of $115,000, citing reduced miner selling and increased corporate inflows. Changelly’s analyst desk forecasts BTC will end 2025 between $120,000 and $135,000, assuming geopolitical tensions persist and traditional fiat hedges lose appeal.

AI-driven forecast engine 3Beasts suggests a base-case scenario of $111,000 by Q4 2025, with a high-end target of $142,000 if long-term holders continue their current pace of accumulation.

Most models agree on one thing: Bitcoin’s fundamentals remain intact. If the rotation from speculative to institutional hands persists, the current stall may simply be a breather before the next leg higher.

Conclusion: Will Bitcoin Hold 100k?

Bitcoin holding $100K is not because of waning interest, but due to an underlying reshuffle of its investor base. Long-time holders are cashing out after years of gains, while new institutional buyers, including corporate treasuries and ETF funds, gradually take their place. This ongoing transition signals deepening maturity, not exhaustion.

The flywheel effect triggered by disciplined accumulation could set the stage for Bitcoin’s next rally. As on-chain metrics firm up and whale wallets grow, the groundwork is being laid for a potential breakout above $100K.

Summary:

Bitcoin holds $100K amid a crucial investor shift. Long-term holders, or “OGs,” have been selling into ETF-driven liquidity, creating short-term resistance. Yet, a new class of institutional buyers, especially corporate treasuries, is stepping in, fueling steady accumulation. On-chain data shows rising holdings by six-month-plus wallets, suggesting increasing long-term conviction. Charles Edwards of Capriole Investments sees this as a bullish “flywheel” forming.

FAQs

Why is Bitcoin holding at $100K without moving higher?

The price plateau reflects a rotation of holdings, from long-time holders selling at profits to institutions gradually accumulating via ETFs and treasuries.

Are ETFs still receiving inflows?

Yes, spot Bitcoin ETFs continue to attract steady inflows, despite the price stall, indicating sustained institutional interest.

Who is buying Bitcoin right now?

Corporate treasuries, sovereign entities, and ETF managers are absorbing supply sold by earlier holders.

What could trigger the next breakout?

A continuation of institutional accumulation and a breakout of Bitcoin’s bullish pennant pattern above $105K could ignite the next rally.

Glossary

OGs (Original Gangsters): Early adopters of Bitcoin who have held the asset since its lower price eras.

ETF (Exchange-Traded Fund): A publicly traded investment vehicle that allows investors to gain exposure to an asset like Bitcoin.

Corporate Treasury Allocation: The process by which companies purchase and hold assets like Bitcoin as part of their cash management strategy.

Accumulation Address: A wallet that steadily increases its holdings without significant outflows, indicating long-term holding intent.

NUPL (Net Unrealized Profit/Loss): A metric used to assess investor sentiment and market phases based on unrealized gains or losses.

References