Checkmate said that the current Bitcoin price action looks similar to the 2016-2017 period. On The Podcast, Check estimated that the BTC price may reach $150,000 before a major pullback. He described the $ 120,000-$ 150,000 range as the topping cloud, the level that can be touched but is not sustainable. Anything above that, Check said, will be short-lived as a swift downward correction is expected.

Check explained that most of today’s investors would be profitable if Bitcoin reached $120,000, with those who have been holding for a longer period making even more profits. ”Above that is speculative fever,” Check said, noting that he did not expect any price increase above $150,000 to be sustainable. He predicted that Bitcoin will probably fall back to these levels once the FOMO subsides.

Bitcoin’s 2016-2017 Parallels

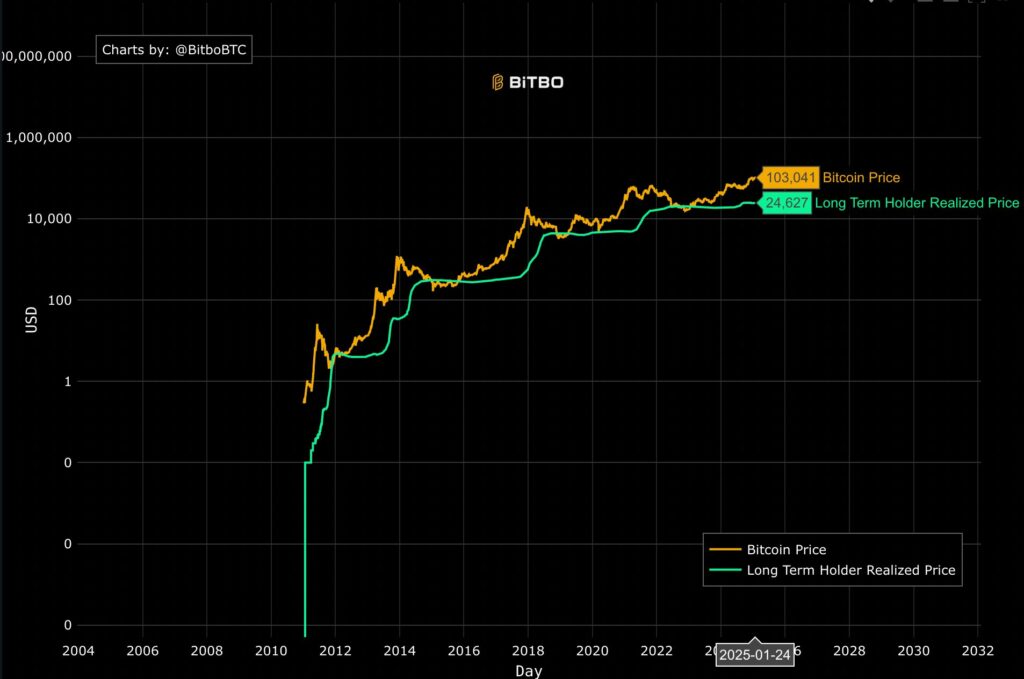

The possibilities for making big money is obvious, especially for those who have been holding their BTC for a long time. According to data from Bitbo, short-term holders are buying BTC at an average price of $90,349 per BTC, while long-term holders are doing this at an average of just $24,627.

If Bitcoin reaches $150k, short-term holders will accrue a 66% profit. However, the long-term investors would be making a profit of 509%, an incredible appreciation when considering the volatile nature of Bitcoin.

Check also pointed out the comparison between the current market cycle and the previous one that occurred in 2016-2017. Bitcoin trading was rather insensitive during the first half of the year 2017, ranging between $800 and $1,600. Only in December, BTC skyrocketed to as high as $19,783. Check argues that the current situation is quite the same; Bitcoin experiences frequent fluctuations with occasional spikes and drops.

The analyst is expecting that BTC may remain within this range for another six months to May 2025. He pointed out that, as in the previous cycle, there may be a number of spikes followed by lulls. He said that it could be the case for a while longer, with BTC inching up and up until it is ready for its next big leap.

At the time of writing, BTC can be bought at $104,920. This continued growth has led to questions within the crypto space about what is next for the cryptocurrency. There are those who believe it will just keep on going up and there are some who think that Bitcoin will correct itself soon.

Bitcoin’s Next All-Time High

In a post on X on January 23, another trader using the pseudonym BitQuant offered a different view. Bitquant stated that even in the event of a BTC price drop, those who think the cryptocurrency has peaked and started declining will be left holding the bag. He said that short-term fluctuations do not change the fact that BT has a very positive long-term outlook.

Crypto trader Braver concurred with the assertion that by the first quarter of 2025 there will be a crypto bull run. Braver added that this would not be the biggest bull market of the year. However, he thinks that the true macro cycle top will start in the fourth quarter of 2025. This will be the highest point for Bitcoin in the current cycle, according to Braver.

Another analyst, Mags mentioned that the recent high of Bitcoin at $109,000 on January 20 might not be the ceiling. If this pattern continues, Mags said that a new all-time high could occur within the 230 to 330-day period from that peak. It is possible to notice that the next major price spike is likely to happen between July and October 2025 according to this timeline.

Bitcoin’s 2025 Outlook: Bullish Momentum or Bubble Warning?

As Bitcoin inches past the $100,000 mark, analysts are increasingly drawing parallels between the current cycle and the 2016–2017 run-up. Experts like Check and BitQuant suggest that a rally to $150,000 is possible—but short-lived. According to Check, that range between $120K–$150K may represent a “topping cloud”, where speculative fever could cause unsustainable gains followed by a sharp correction.

Conclusion

While Bitcoin is still on the rise, traders and analysts are waiting for the cryptocurrency to repeat the patterns of its previous cycles. Some are hopeful that the market will keep on growing, while others are waiting for a pullback to happen soon. Regardless of the path that BTC takes to reach its next peak, the crypto community will be on tenterhooks.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

Frequently Asked Questions (FAQs)

Q1: Could Bitcoin realistically reach $150,000?

Yes. Analyst Check believes BTC could touch $150K in 2025, but expects that zone to act as a top, followed by a pullback.

Q2: What kind of profits are expected for Bitcoin holders at $150K?

Short-term holders may earn ~66% profit, while long-term holders who bought around $24,000 could see over 500% returns.

Q3: How does the current market cycle compare to 2016–2017?

Experts say BTC’s current sideways movement and gradual rise mirrors the pattern from 2016–2017, with a major rally expected mid-to-late 2025.

Q4: When will Bitcoin reach its next all-time high?

Analyst Mags estimates a new peak may occur between July and October 2025, based on BTC’s historical patterns.

Q5: Should investors be cautious?

Yes. While indicators are bullish, any price above $150K could be short-lived. Traders should prepare for volatility and avoid excessive leverage.

Glossary of Key Terms

Bitcoin (BTC): The first and most well-known cryptocurrency, often considered a digital store of value.

Topping Cloud: A speculative price zone where an asset nears its short-term peak, often followed by a correction.

FOMO (Fear of Missing Out): A psychological trigger that causes investors to buy assets quickly due to hype or rising prices.

Long-Term Holders (LTHs): Investors who typically hold an asset for more than 155 days, often considered more resilient during price swings.

Short-Term Holders (STHs): Investors who hold assets for shorter periods are often sensitive to volatility.

TD Sequential Indicator: A technical analysis tool used to predict trend reversals by identifying momentum exhaustion points.

Bitbo: A data analytics platform that tracks on-chain metrics like average BTC purchase prices for various investor segments.

All-Time High (ATH): The highest price point an asset has reached in its history.

Speculative Fever: A rapid and unsustainable increase in market activity driven more by hype than fundamentals.