Bitcoin (BTC) recently crossed the long-anticipated $64,000 level, but bears swiftly intervened, driving the price back down. This current consolidation is seen as part of the post-halving accumulation phase. Typically, after a halving event, it takes around 170 days for a breakout and 480 days for the price to peak. We are now 152 days into the post-halving phase, leading many to believe that the major rally has yet to begin. There’s also speculation that the U.S. elections will trigger an increase in liquidity, which could fuel the expected breakout in Bitcoin‘s price.

Is Bearish Pressure on Bitcoin Still Present?

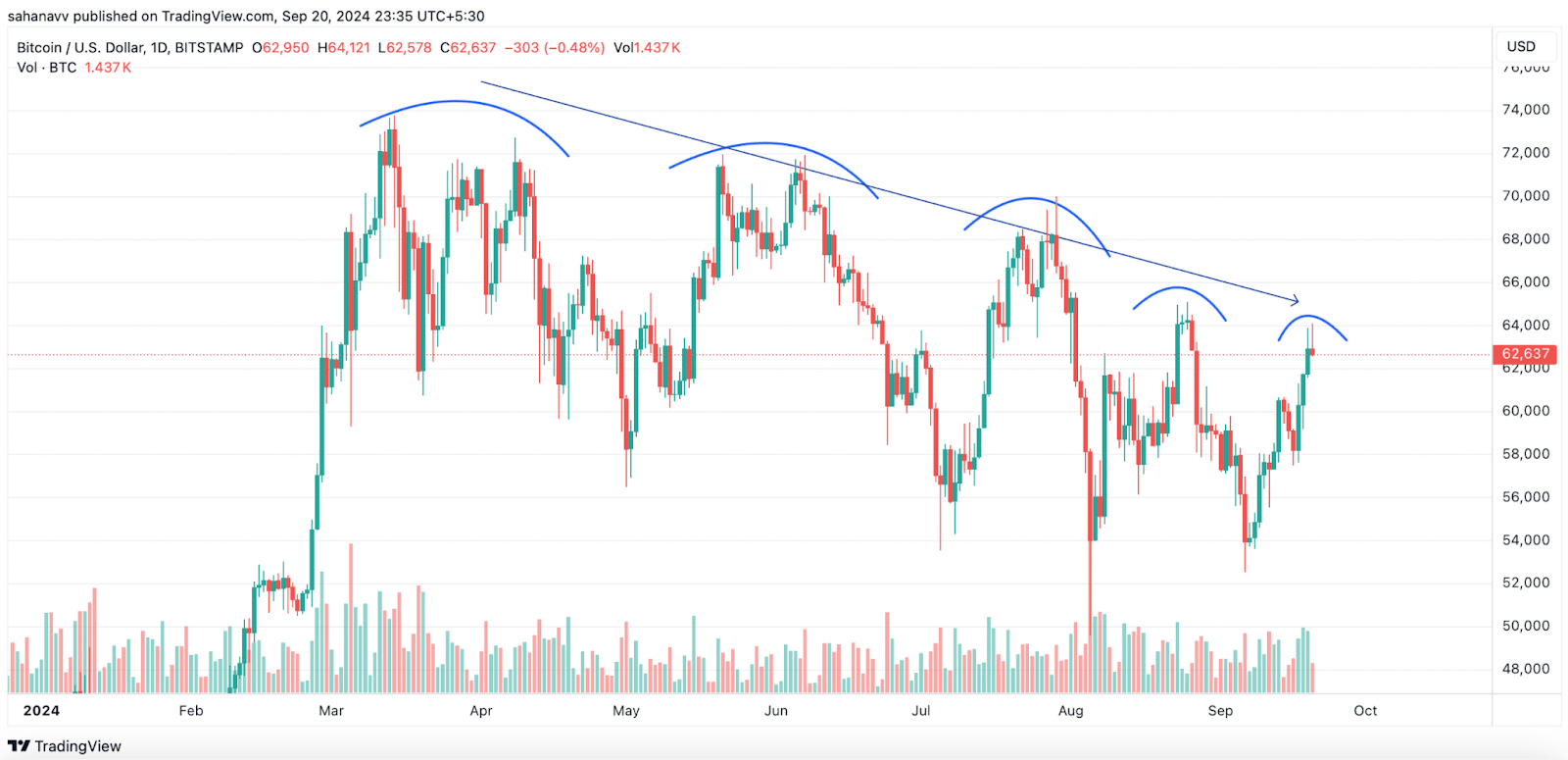

Bitcoin’s price has yet to fully shake off the influence of bears. After crossing $64,000, sellers quickly entered the market, causing significant downward pressure. As of now, the price has dipped below $63,000, raising concerns that it could fall under the $60,000 mark. However, the situation is more complex than it appears.

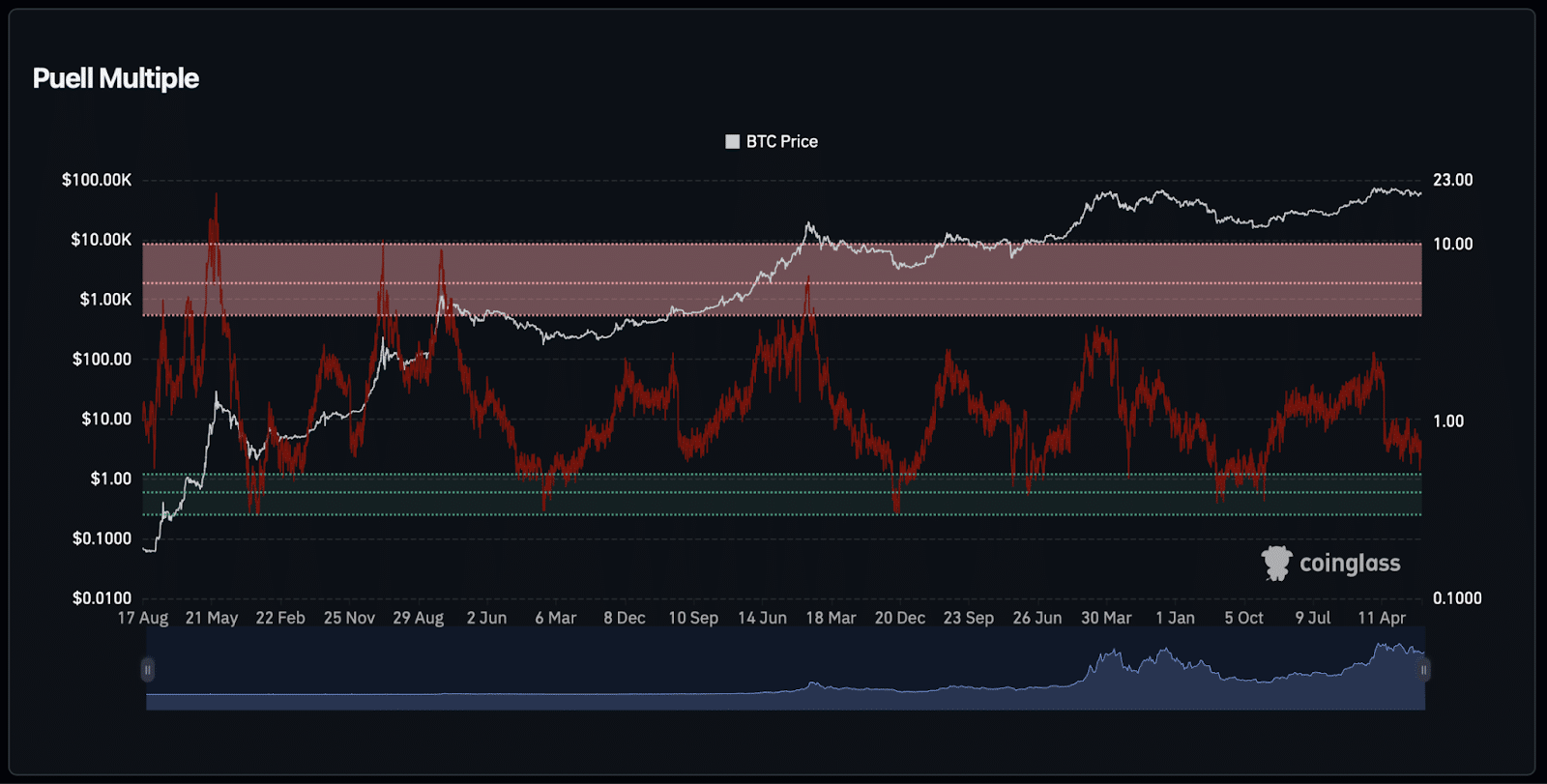

According to Coinglass, the Puell Multiple indicator is showing positive signs. The indicator’s movement towards the green zone suggests that Bitcoin is currently undervalued and could soon recover. This metric analyzes miners’ revenues. If it were to enter the red zone, miners could shut down their operations, reducing the hash rate. However, the current entry into the green zone indicates a buying opportunity for investors.

Is Bitcoin Forming a New Bearish Pattern?

The daily chart for Bitcoin reveals that the price is tightening within a descending trend. Although the latest move pushed the price above a local resistance level, bulls are showing weakness as they approach the descending trendline. This raises the possibility that Bitcoin may form a lower high.

With the daily candle turning bearish, bears are regaining control. Despite this bearish trend, Bitcoin is still trading within a broader bullish flag pattern. A breakout from this pattern could potentially drive the price beyond $100,000.

Bull Flag Formation and Potential Breakout

BTC continues to trade within a bullish flag formation, a pattern that typically signals a major upward move. Should the price break above this pattern, a rally towards $100,000 or more could be triggered.

Is Bitcoin Eyeing $92,000? Which Coins Will Rise Alongside BTC?

Despite the short-term bearish pressure, many investors are watching closely as Bitcoin stands on the brink of a major move. In summary, Bitcoin could be poised for a significant breakout, but whether or not it happens will become clearer in the coming days.