The cryptocurrency market has been volatile this week, especially with Bitcoin dropping below $70,000. This movement sent shockwaves throughout the market, leaving investors anxious. With the US elections approaching and uncertainty looming, many are questioning the future of Binance Coin (BNB). Despite widespread downturns among altcoins, BNB may be in a unique position, thanks in part to Binance’s latest quarterly burn. But will this move boost BNB’s price?

Binance’s 29th Quarterly Burn and BNB’s Outlook

Binance recently completed its 29th quarterly burn, removing approximately 1,772,712.363 BNB, valued around $1.07 billion, from circulation. By reducing its supply, Binance aims to drive up BNB’s value, following a strategy that has worked well for BNB historically. With this significant amount of BNB tokens gone, the burning process could theoretically lead to price increases, especially if demand remains steady or rises. However, investors wonder if this burn will translate into a tangible price surge for BNB.

A Transparent Process Reassures Investors

Unlike some previous concerns around token burns, Binance’s burns take place on the Binance Smart Chain in a fully transparent manner. Tokens are irretrievably sent to a “blackhole” address, removing them from circulation forever. This clear-cut process provides some comfort for investors, particularly those from Turkey, as it reinforces the token supply reduction and its potential effect on BNB’s price. Still, the question remains: Will this burn be enough to elevate BNB’s value?

Could BNB Reach $970?

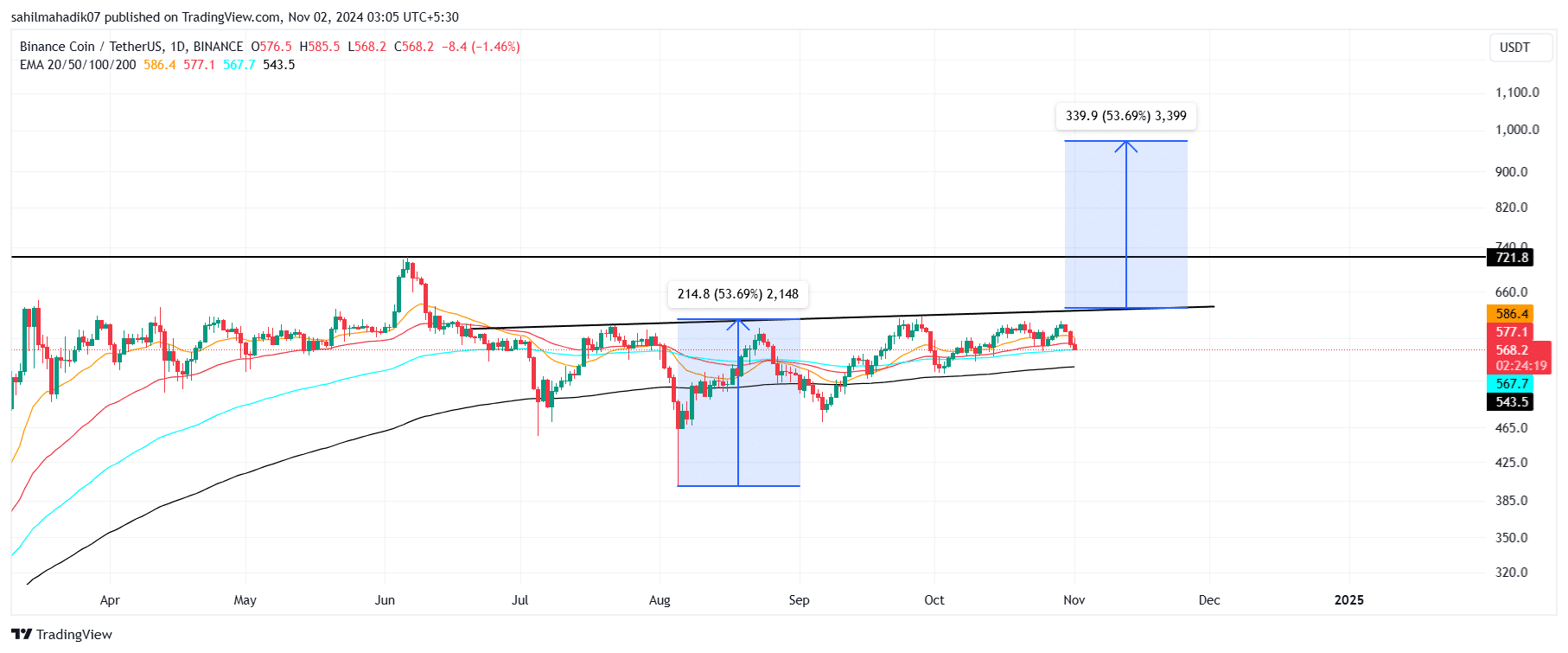

BNB’s price has fluctuated between $530 and $620 over the last six weeks, reflecting the market’s current indecision. Yet, a promising technical pattern has emerged: an inverse head and shoulders formation. Typically seen as a bullish signal, this formation’s structure—where the “head” represents the lowest price and the “shoulders” represent higher lows—suggests potential for an upward movement.

If this pattern plays out as expected, BNB could rebound from its $530 support level and surpass the critical $633 resistance. If BNB breaks through this level, the next target could reach as high as $970, representing a significant 54% upside. However, this outcome, while possible, is by no means guaranteed.

Technical Indicators Point to Mixed Signals

Looking at BNB’s broader trend, the price remains above both the 100- and 200-day moving averages, indicating a continued bullish trend over the long term. Nevertheless, there is risk if selling pressure reemerges around the $180 level. For now, investors should keep both scenarios in mind as they navigate these uncertain weeks.

As always, market volatility could yield both challenges and opportunities. While some might view BNB’s recent burn as a bullish signal, others may await further market developments before making a move. For investors, the upcoming weeks are crucial in gauging whether BNB’s potential price action will align with their expectations.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!