The crypto market has recently experienced significant fluctuations, with notable declines in major digital assets. This article highlights into the factors influencing these market movements, examines the performance of various altcoins, and provides insights into potential future trends.

Recent Developments in the Crypto Market

Bitcoin’s Price Decline

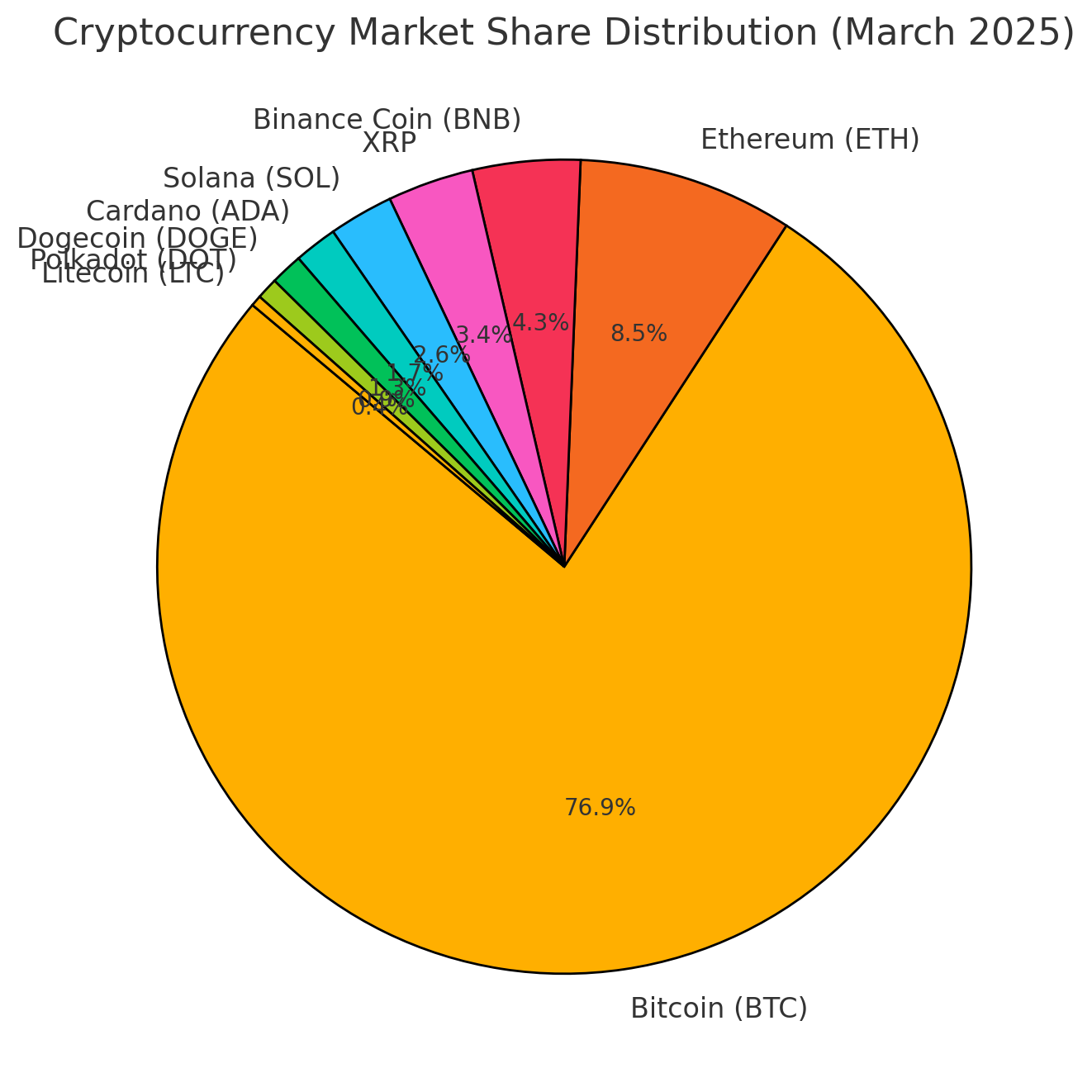

Bitcoin (BTC), the leading cryptocurrency by market capitalization, has faced a downturn, dropping to a four-month low of approximately $76,867 before rebounding to just above $80,000. This decline has been attributed to several factors, including investor disappointment over President Donald Trump’s announcement of a Bitcoin reserve that lacked plans for active government purchasing. The broader market sentiment has also shifted away from risky assets due to concerns over tariffs and economic slowdown, exacerbating the selloff in digital assets.

Impact of the U.S. Strategic Bitcoin Reserve Announcement

President Trump’s recent announcement of a strategic Bitcoin reserve has had a mixed impact on the market. Initially, the news led to a surge in cryptocurrency prices, with Bitcoin rising about 10% to a peak of $94,821. However, the lack of a clear acquisition strategy and the realization that no actual budget has been allocated for Bitcoin purchases in the near term led to a subsequent decline in prices.

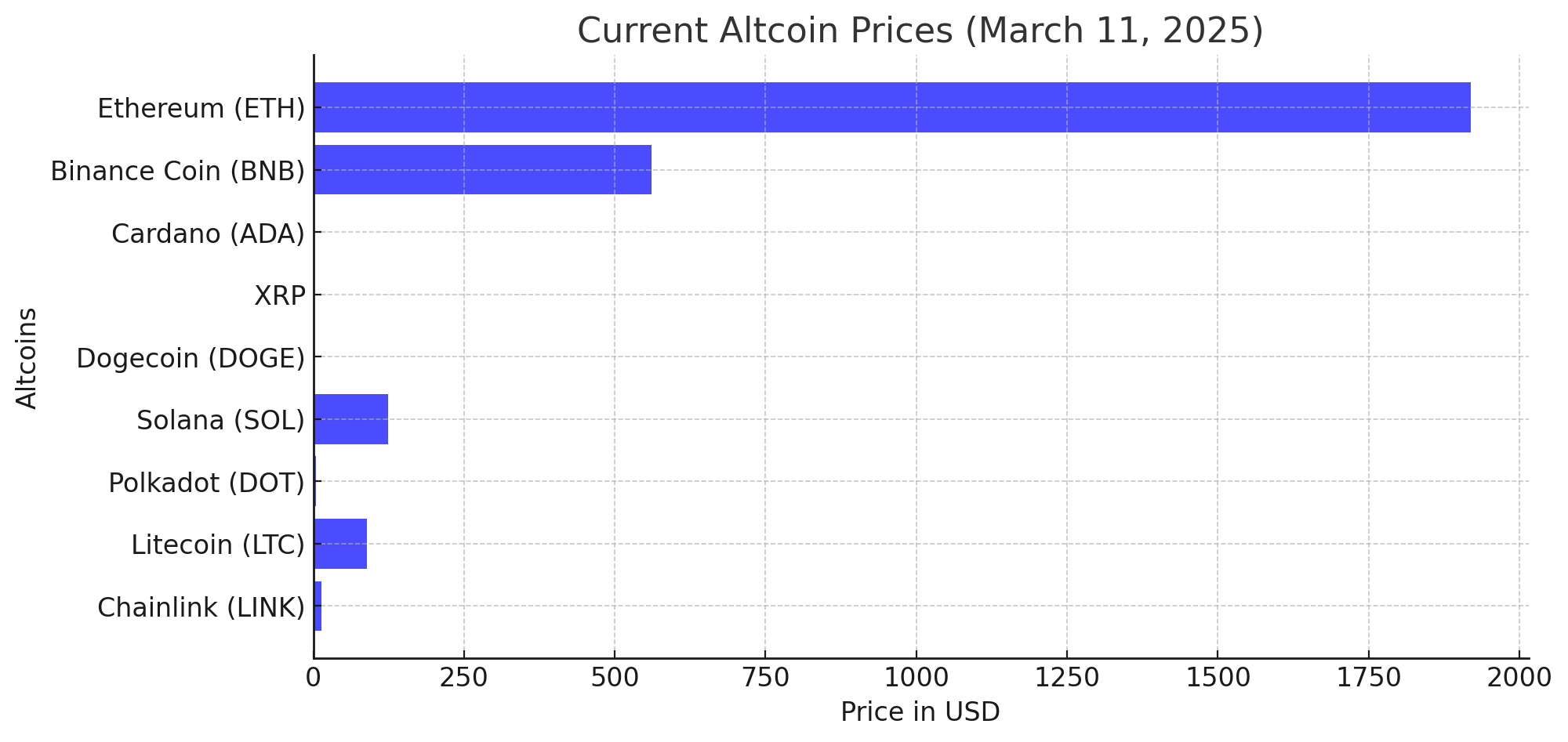

Performance of Major Altcoins

Altcoins, or alternative cryptocurrencies to Bitcoin, have also experienced significant price movements in recent times. Below is a table summarizing the current prices and recent performance of select altcoins:

| Altcoin | Ticker | Current Price (USD) | 24h Change (%) | Intraday High (USD) | Intraday Low (USD) |

|---|---|---|---|---|---|

| Ethereum | ETH | 1,919.08 | -8.79 | 2,142.85 | 1,792.95 |

| Binance Coin | BNB | 560.84 | -0.13 | 570.90 | 511.53 |

| Cardano | ADA | 0.7325 | -2.59 | 0.7604 | 0.6530 |

| XRP | XRP | 2.13 | -3.18 | 2.23 | 1.92 |

| Dogecoin | DOGE | 0.1607 | -8.23 | 0.1788 | 0.1456 |

| Solana | SOL | 123.97 | -3.62 | 130.11 | 113.47 |

| Polkadot | DOT | 3.97 | -5.48 | 4.24 | 3.69 |

| Litecoin | LTC | 89.04 | -7.65 | 98.41 | 83.92 |

| Chainlink | LINK | 12.99 | -8.26 | 14.32 | 11.99 |

Note: Data as of March 11, 2025.

Factors Influencing Altcoin Performance

Several factors have contributed to the recent performance of altcoins:

Market Sentiment: The overall bearish sentiment in the cryptocurrency market has led to decreased investor confidence, affecting altcoin prices.

Regulatory Developments: Announcements such as the U.S. strategic Bitcoin reserve have created uncertainty, influencing altcoin valuations.

Technological Advancements: Altcoins with ongoing development and strong use cases, such as Ethereum’s transition to a proof-of-stake consensus mechanism, have shown resilience despite market downturns.

Expert Insights

Despite the recent downturn, some analysts remain optimistic about a market recovery. Macro strategist Raoul Pal describes the current downturn as a typical bull market correction and anticipates a rebound by mid-March, with significant bullish activity expected in the second quarter of 2025.

Additionally, data indicates that Bitcoin whales—investors holding significant amounts of BTC—have resumed accumulation, adding nearly 5,000 BTC since March 3, 2025. If accumulation continues, this trend suggests a potential market recovery in the latter half of March.

Summing Up

FAQs

What caused the recent decline in cryptocurrency prices?

The recent decline has been attributed to factors such as investor disappointment over President Trump’s announcement of a Bitcoin reserve without active purchasing plans, broader market concerns over tariffs and economic slowdown, and a shift away from risky assets.

How did the announcement of the U.S. strategic Bitcoin reserve impact the market?

Initially, the announcement led to a surge in cryptocurrency prices. However, the lack of a clear acquisition strategy and no allocated budget for immediate Bitcoin purchases resulted in a subsequent decline in prices.

Which altcoins have been most affected by the recent market downturn?

Altcoins such as Ethereum, Cardano, XRP, and Solana have experienced significant declines, reflecting the overall bearish sentiment in the cryptocurrency market.

Is there potential for a market recovery in the near future?

Some analysts anticipate a rebound by mid-March, with significant bullish activity expected in the second quarter of 2025. Additionally, the accumulation of Bitcoin by large investors suggests potential for market recovery.

Glossary of Key Terms

Altcoin: Any cryptocurrency other than Bitcoin.

Bearish Sentiment: A market outlook characterized by declining prices and negative investor sentiment.

Bitcoin Whale: An individual or entity that holds a large amount of Bitcoin.

Market Capitalization: The total value of a cryptocurrency, calculated by multiplying its current price by its total supply.

Proof-of-Stake (PoS): A consensus mechanism where validators are chosen based on the number of tokens they hold.