Bitcoin has long been touted as “digital gold”, a hedge against inflation, government overreach, and financial collapse. But what if the collapse goes beyond economics? What if we’re staring at nuclear war?

A recent report by AMBcrypto explores the unsettling question: Could Bitcoin survive a nuclear doomsday? Using insights from AI models like ChatGPT and additional expert analysis, the scenario paints a complex picture, one that challenges the core narrative of Bitcoin as an indestructible asset.

The Bitcoin Network vs. Global Catastrophe

At the heart of Bitcoin’s resilience is its distributed node network. As of mid-2025, over 22,000 reachable Bitcoin nodes are operational globally. These nodes verify transactions, secure consensus, and maintain the blockchain’s integrity.

In a nuclear scenario, however, that decentralization becomes vulnerable.

AI simulations suggest that a nuclear strike impacting 60–80% of the global internet could reduce Bitcoin nodes to just 1,000 active participants. Such a sharp drop could stall transaction verification, paralyze mining operations, and endanger the entire protocol’s trust layer.

A localized strike, such as a regional war zone blackout, might only affect a portion of nodes. In that case, Bitcoin’s infrastructure could recover within weeks via node redistribution and cloud reboots. But a continent-wide nuclear exchange, especially one involving electromagnetic pulses (EMPs), could destroy communication cables and power grids, leaving no short-term path to recovery.

Price Projections in a Nuclear-Triggered Collapse

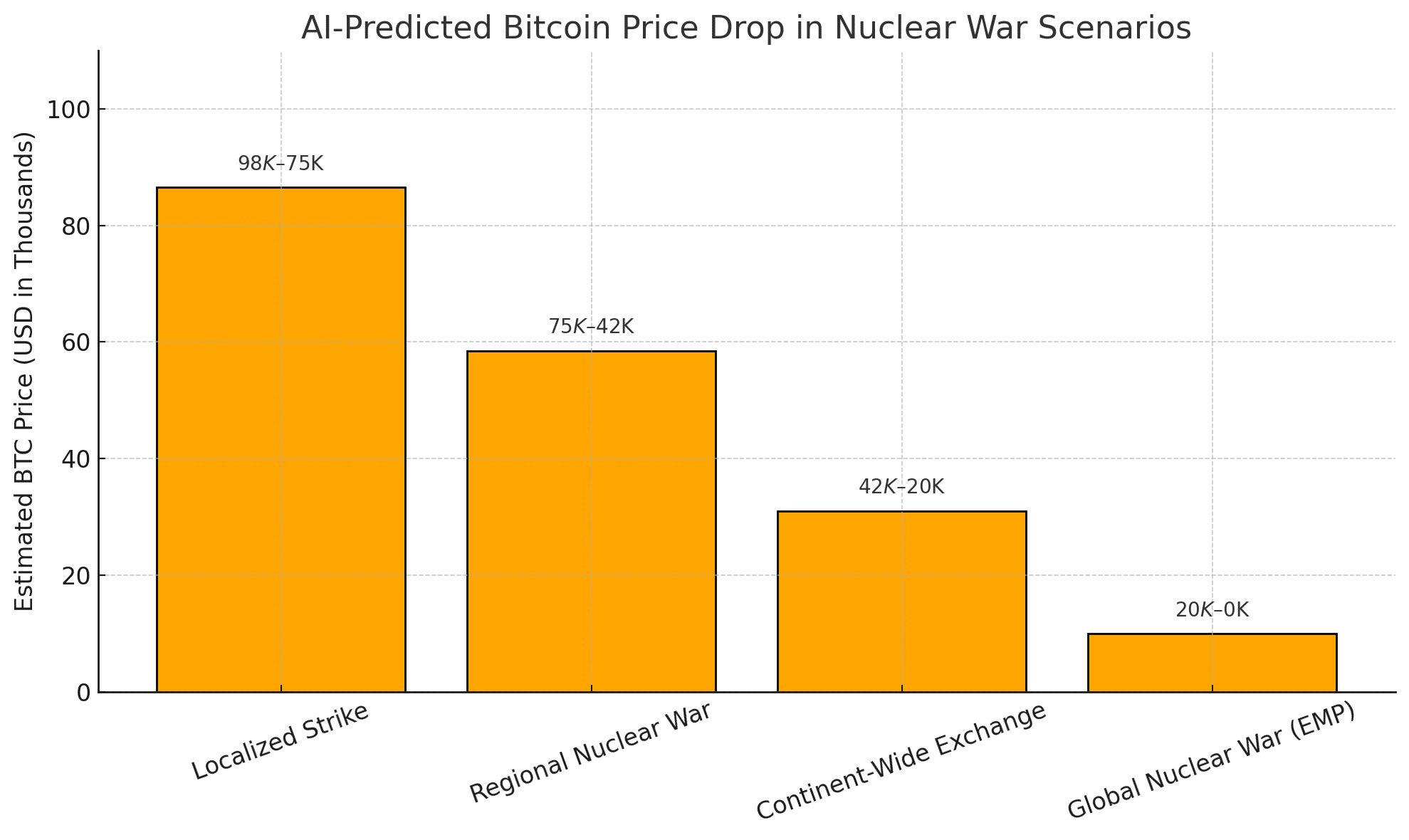

The AI-generated forecasts are sobering:

| Conflict Severity | Node Impact | Estimated BTC Price Drop |

|---|---|---|

| Localized Strike | Minimal | –10% to –30% ($98K–$75K) |

| Regional Exchange | Moderate | –30% to –60% ($75K–$42K) |

| Global War (EMP Impact) | Catastrophic | –60% to –99% ($42K–$0) |

Bitcoin, like any other risk asset, is susceptible to fear-based sell-offs, especially in times of geopolitical chaos. Even if the blockchain technically survives, sentiment collapse could lead to a massive dump of holdings across exchanges and OTC desks.

EMPs: The Silent Network Killers

A hidden risk in nuclear events is the electromagnetic pulse (EMP). As highlighted in a related TradingView report, EMPs could disable entire digital infrastructures, not just servers, but power grids, communication satellites, and wireless networks.

Without power, there is no internet. Without the internet, there is no Bitcoin.

Unless contingency systems like satellite-based nodes, mesh networks, or cold storage settlements are operational, Bitcoin could become temporarily or even permanently unusable in some regions.

Market Sentiment Will Lead the Collapse—Not Technology

While Bitcoin’s technology might be resilient under limited strain, its price and liquidity depend on people. Traders, institutions, and whales drive BTC’s real-world valuation.

In a nuclear panic, panic selling could come well before any node goes offline. Markets are emotional, and a headline-driven price collapse could outpace actual infrastructure damage. In other words, fear itself could crash Bitcoin before a bomb does.

Bitcoin’s Possible Path to Survival

Despite these risks, all is not lost.

Satellite nodes: Projects like Blockstream already provide satellite-based Bitcoin nodes that function without the traditional internet.

Cold storage: Offline transactions can still be validated and broadcast when communication returns.

Global distribution: No single country holds Bitcoin’s future. Its node base is geographically diverse, offering some buffer against isolated disasters.

If humanity survives a nuclear incident, Bitcoin may not only survive but could also serve as a lifeline for post-conflict financial rebuilding.

Conclusion: A Resilient Network in a Fragile Reality

The idea that Bitcoin can survive anything has long been part of its mythology. But even the most decentralized asset in the world has physical limits.

Bitcoin’s survivability during a nuclear war isn’t just about the blockchain; it’s about internet infrastructure, power grids, human psychology, and the market’s belief in it. Under regional conflict, BTC might recover. Under global collapse, it could be reset entirely.

For now, Bitcoin thrives on decentralization and confidence. But in a true doomsday scenario, even that may not be enough.

Quick Summary: Bitcoin in a Nuclear Doomsday

An AI analysis suggests Bitcoin may partially survive a nuclear war, but its fate hinges on internet infrastructure. Localized strikes could cause 10, 30% price drops, while global EMPs might cripple the network entirely.

With nodes offline and market panic high, Bitcoin’s value could plunge or vanish. While satellite nodes and cold storage offer hope, full recovery would depend on restoring global connectivity. Bitcoin’s survival in a doomsday scenario hinges on both tech resilience and human belief.

FAQs

Can Bitcoin survive a nuclear war?

It depends on the scale. While localized events may be manageable, a global nuclear conflict could permanently disrupt Bitcoin without satellite support.

Will Bitcoin’s price crash in a doomsday scenario?

Yes. AI predicts drops from 10% up to 99%, depending on the severity of infrastructure destruction and market fear.

What can protect Bitcoin in such a situation?

Satellite nodes, mesh networks, and offline cold storage are critical for preserving the Bitcoin network in global emergencies.

Glossary of Key Terms

Node: A computer that validates transactions and maintains a copy of the Bitcoin blockchain.

EMP (Electromagnetic Pulse): A burst of electromagnetic radiation that can disable electrical and digital infrastructure, often triggered by nuclear detonations.

Cold Storage: Offline wallets are used to store cryptocurrency securely, safe from internet-based attacks.

Sentiment Collapse: A market reaction where fear drives mass selling, independent of technical fundamentals.

Decentralization: The distribution of network functions across many independent nodes, reducing the risk of single-point failure.