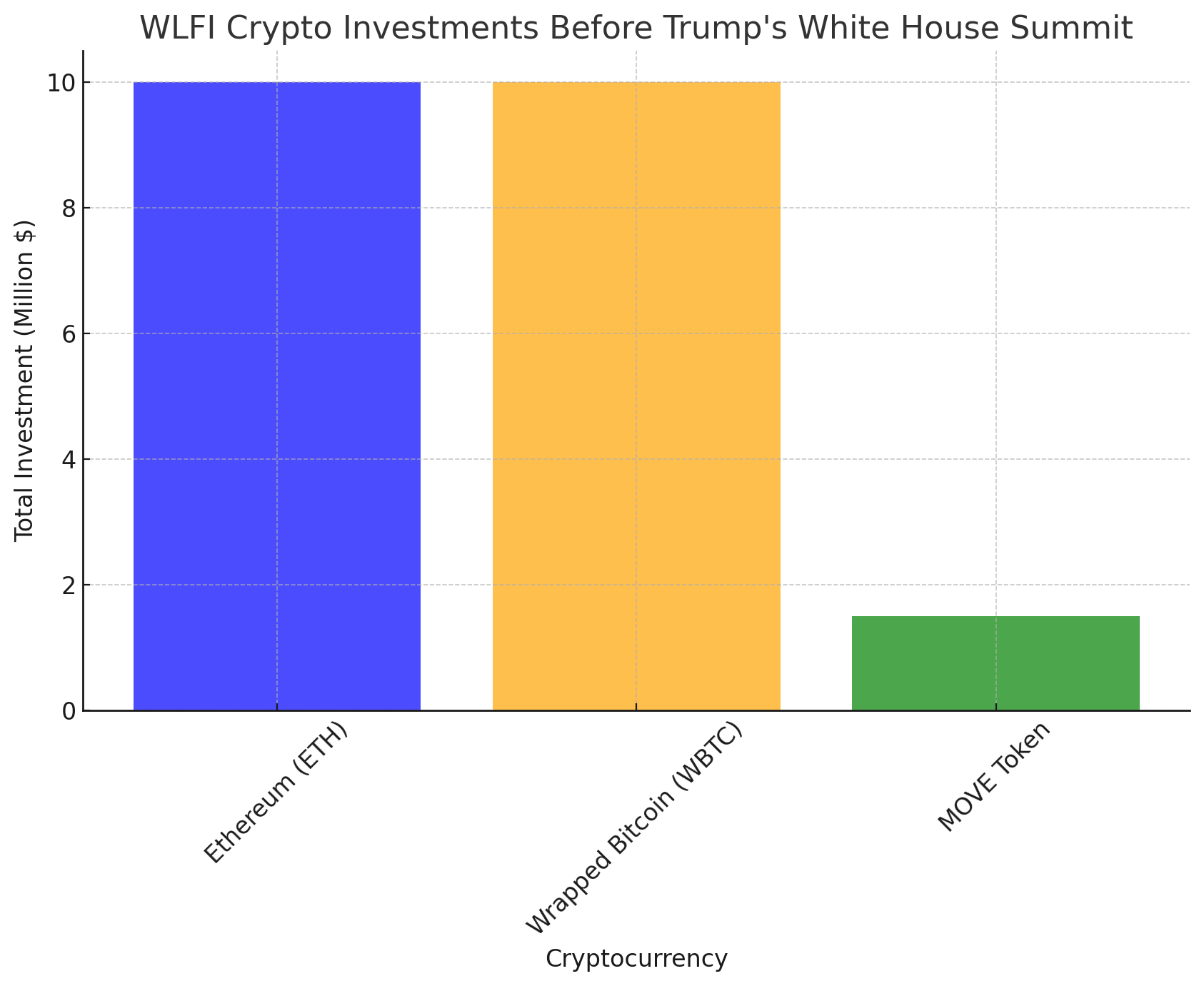

According to reports, World Liberty Financial (WLFI), a Trump-affiliated decentralized finance (DeFi) venture, has made significant cryptocurrency acquisitions just days before the White House Crypto Summit on March 8. On Wednesday, WLFI added $21.5 million worth of crypto to its treasury, reinforcing speculation that the firm is aligning itself with Trump’s broader pro-crypto strategy.

Following on-chain data, the purchases include 4,468 ETH at approximately $2,238 per token ($10 million total), 110.6 WBTC at $90,415 each ($10 million total), and 3.42 million MOVE tokens at $0.438 apiece ($1.5 million total).

With Trump and his sons holding ambassadorial roles at WLFI, this move raises questions about whether the company is positioning itself ahead of regulatory shifts or leveraging insider knowledge from the upcoming crypto summit.

WLFI’s Crypto Purchases Breakdown

| Cryptocurrency | Amount Purchased | Total Investment (Million $) |

| Ethereum (ETH) | 4,468 | $10.0M |

| Wrapped Bitcoin (WBTC) | 110.6 | $10.0M |

| MOVE Token | 3.42 million | $1.5M |

This data shows WLFI’s strategic focus on Ethereum and Wrapped Bitcoin, each receiving a $10 million allocation, while the lesser-known MOVE token saw a $1.5 million investment.

With Trump’s White House Crypto Summit approaching, WLFI’s moves suggest strong anticipation of regulatory shifts, positioning itself for potential market changes and new pro-crypto policies.

A Strategic Move or Political Positioning?

The timing of WLFI’s acquisitions has sparked intense speculation within the crypto community. With Trump’s White House Crypto Summit set to bring together top industry leaders, some analysts believe this purchase signals a shift toward a more crypto-friendly U.S. financial landscape.

Others argue that WLFI may be positioning itself to benefit from potential policy changes, particularly if Trump reaffirms his commitment to a national Bitcoin reserve or a broader pro-crypto economic strategy.

Regardless of motive, WLFI’s latest $21.5 million crypto haul places it in a strong position ahead of what could be a game-changing event for digital assets in the U.S.

Expert Insights: What WLFI’s Crypto Purchase Means for the Market

With World Liberty Financial (WLFI) acquiring $21.5 million in crypto just days before Trump’s White House Crypto Summit, analysts are debating whether this is a calculated investment or an inside advantage. Some believe WLFI is positioning itself for a policy shift, while others argue that market speculation is driving the move. Experts weigh in on how this could impact the broader crypto landscape.

Crypto Analyst, Kevin Carter:

“This is a bold move by WLFI, and the timing is no coincidence. Their bet on ETH, WBTC, and MOVE tokens suggests they expect favorable policy outcomes from Trump’s administration.”

DeFi Strategist, Elaine Murphy:

“With Trump’s direct ties to WLFI, this could be a sign of inside confidence in upcoming regulatory shifts. If policies favor DeFi, WLFI’s positioning will pay off significantly.”

Market Economist, Paul Matthews:

“WLFI’s investments ahead of the crypto summit suggest strategic positioning rather than speculation. If the U.S. moves toward a Bitcoin or crypto-based financial reserve, this could be just the beginning.”

Final Verdict: A Calculated Bet or an Insider Advantage?

WLFI’s $21.5 million crypto investment ahead of the White House Summit raises serious questions about whether this is a strategic play in anticipation of market shifts or a case of leveraging insider connections to get ahead of upcoming regulatory announcements.

If Trump solidifies his pro-crypto stance, this could be a bullish catalyst for the entire market, particularly for Bitcoin, Ethereum, and DeFi protocols. However, if the summit fails to deliver clear regulatory direction, WLFI’s bet may not yield the expected returns in the short term.

For now, the market remains on high alert, watching closely for Trump’s next move and how WLFI’s strategic positioning plays out. The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. Why did WLFI buy $21.5 million in crypto before the White House summit?

The timing suggests strategic positioning ahead of Trump’s pro-crypto summit. WLFI, which has direct ties to Trump’s family, may be anticipating favorable policies that could boost the market.

2. What cryptocurrencies did WLFI purchase, and why?

WLFI acquired 4,468 ETH ($10M), 110.6 WBTC ($10M), and 3.42M MOVE tokens ($1.5M). The ETH and WBTC buys align with mainstream institutional strategies, while MOVE’s inclusion remains a mystery.

3. Does Trump’s involvement with WLFI suggest insider influence?

Trump and his sons hold ambassadorial roles at WLFI, raising speculation about whether WLFI has insights into upcoming policy changes that could benefit their crypto holdings.

4. What impact could this have on the broader crypto market?

If Trump announces major pro-crypto policies or a Bitcoin reserve, WLFI’s investment could appreciate significantly, potentially driving broader institutional adoption.

Glossary

World Liberty Financial (WLFI): A decentralized finance (DeFi) venture with ties to Donald Trump and his family, focusing on crypto investments and blockchain infrastructure.

WBTC (Wrapped Bitcoin): A tokenized version of Bitcoin that operates on the Ethereum blockchain, allowing BTC to be used within DeFi ecosystems.

MOVE Token: A lesser-known digital asset included in WLFI’s acquisitions, sparking speculation about its potential role in upcoming crypto initiatives.

Crypto Reserve Policy: A rumored initiative where the U.S. government may hold Bitcoin or other crypto assets as part of its national reserves.