Brazil has taken a historic step in cryptocurrency investment, becoming the first country to approve an XRP Spot ETF. The Brazilian Securities and Exchange Commission (CVM) has officially given the green light to Hashdex’s XRP ETF. This first-of-its-kind financial product allows investors to gain direct exposure to Ripple’s native cryptocurrency, XRP, on the B3 stock exchange.

This landmark approval could significantly affect XRP’s adoption, price movement, and the broader crypto investment landscape. Let’s dive into what this means for investors and the potential impact on the XRP market.

XRP Spot ETF: A Game-Changer for Crypto Investment

The XRP Spot ETF, officially named “Hashdex NASDAQ XRP Index Fund”, is designed to offer investors a regulated and secure way to gain exposure to XRP without holding the asset directly.

- Managed by: Hashdex

- Administered by: Genial Investimentos

- Trading on: Brazil’s B3 stock exchange

- Launch Date: Yet to be announced

The approval marks a major milestone in the evolution of crypto-backed financial products, especially when institutional investors actively seek regulated exposure to digital assets.

Why Is Brazil Leading the Way?

Brazil has emerged as a key player in crypto adoption and regulation. The country has progressive policies that support digital asset investments, making it an attractive market for crypto ETFs.

Previously, Brazil has approved:

Bitcoin and Ethereum ETFs

Crypto index funds

Other blockchain-related investment products

Now, with the approval of an XRP Spot ETF, Brazil is reinforcing its position as a crypto-friendly nation, setting a precedent for other global regulators to follow.

How Will the XRP ETF Impact Investors?

The introduction of an XRP Spot ETF has multiple benefits for both retail and institutional investors:

Easier Access to XRP

Investors can now gain exposure to XRP through a traditional brokerage account without needing a crypto wallet or exchange.

Increased Liquidity for XRP

A regulated ETF brings more institutional money into XRP, potentially increasing liquidity and reducing price volatility.

Regulated and Secure Investment

The ETF provides a safer, government-approved alternative to holding XRP directly for investors concerned about security and regulatory risks.

Potential for Higher Adoption

A Spot ETF could drive mainstream adoption, encouraging other countries to consider similar XRP-based investment products.

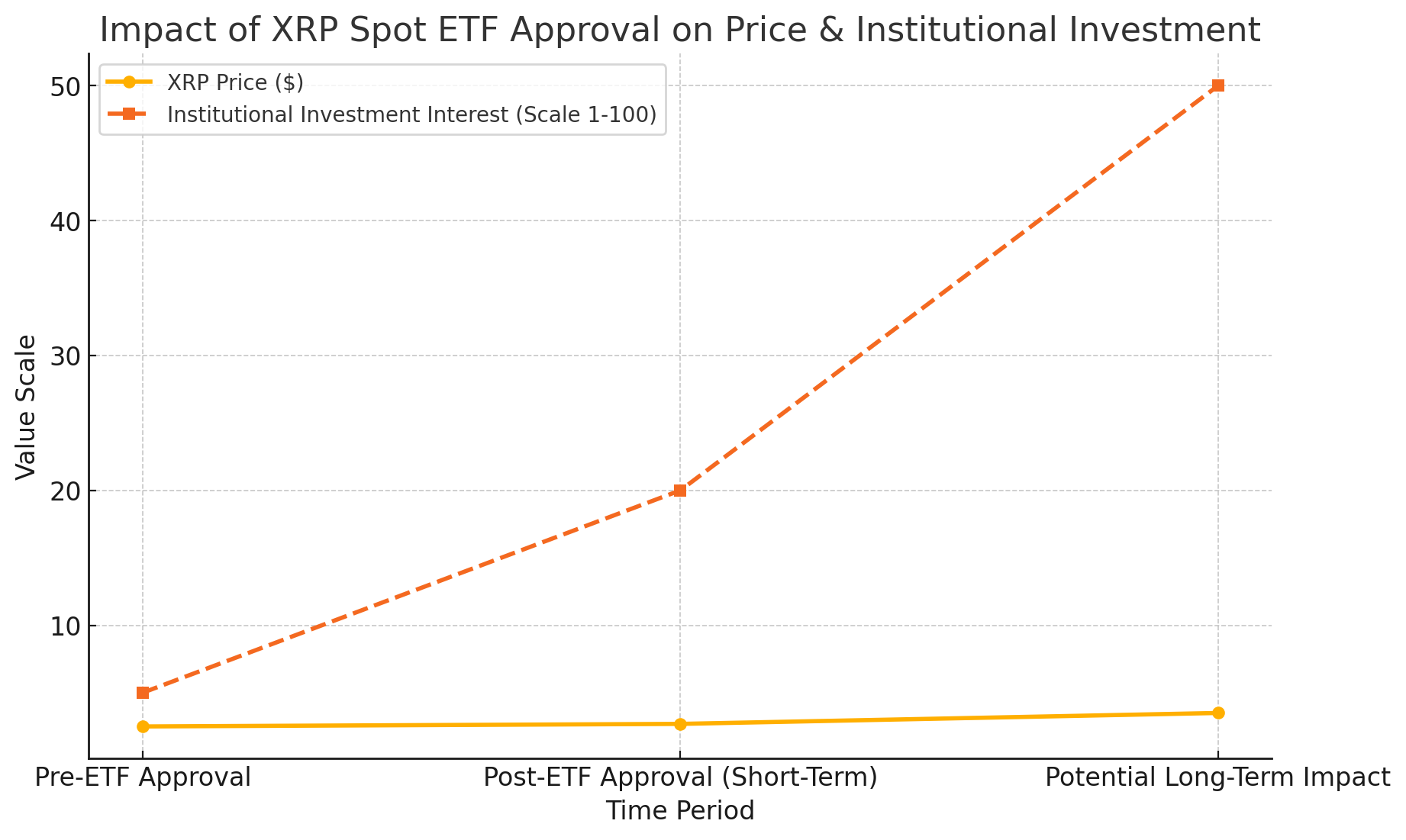

XRP Price Outlook – Will the ETF Approval Trigger a Rally?

The crypto community is closely watching how this ETF approval might impact XRP’s price. Historically, the launch of crypto ETFs has led to short-term price surges, followed by long-term adoption growth.

Key Price Levels to Watch:

Current XRP Price: $2.69

Resistance Level: $3.00 (psychological barrier)

Support Level: $2.50

If the ETF attracts strong institutional interest, we could see XRP push towards new highs in the coming months. However, broader market trends and regulatory developments in the U.S. will also play a key role in XRP’s price trajectory.

Final Thoughts: What’s Next for XRP ETFs?

Brazil’s approval of the world’s first XRP Spot ETF is a major step forward in crypto adoption and institutional investment. If successful, it could pave the way for similar ETFs in the U.S., Europe, and Asia.

For investors, this development presents a unique opportunity to gain exposure to XRP in a regulated environment. With Ripple’s growing ecosystem and rising institutional demand, XRP is positioned as a key player in the future of blockchain finance.

Will other countries follow Brazil’s lead? Only time will tell, but one thing is certain—XRP is making history!

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What is the XRP Spot ETF approved in Brazil?

The XRP Spot ETF, managed by Hashdex, is a regulated investment product that allows investors to gain direct exposure to XRP without holding the asset. It will trade on Brazil’s B3 stock exchange.

Why is Brazil the first country to approve an XRP ETF?

Brazil has a progressive approach to crypto regulation, making it a hub for digital asset ETFs. The country has already approved Bitcoin and Ethereum ETFs, paving the way for XRP’s approval.

How will the XRP ETF impact XRP’s price?

A regulated ETF can increase institutional demand, improve liquidity, and boost mainstream adoption, potentially driving XRP’s price higher over time.

Can U.S. or European investors buy the XRP ETF?

Currently, the XRP ETF is available only in Brazil. However, similar XRP ETFs could emerge in other regions if regulatory conditions improve.

Is an XRP ETF safer than buying XRP directly?

Yes, an ETF provides a regulated, secure, and tax-efficient way to invest in XRP without handling private keys or using crypto exchanges.

Glossary of Key Terms

XRP Spot ETF – An exchange-traded fund that holds XRP directly, allowing investors to gain exposure without owning the asset.

Brazilian Securities and Exchange Commission (CVM) – Brazil’s financial regulator, responsible for approving ETFs and other investment products.

Hashdex – A leading crypto asset management firm behind the first XRP ETF in Brazil.

B3 Stock Exchange – The main stock exchange in Brazil, where the XRP Spot ETF will be traded.

Institutional Investors – Large financial entities like hedge funds, banks, and asset managers that invest in cryptocurrencies through regulated products like ETFs.

Liquidity – The ease with which an asset can be bought or sold in the market without causing major price changes.

Regulated Investment – A financial product that operates under government-approved guidelines, providing investors with legal protections.

Crypto Adoption – The process of cryptocurrencies becoming widely used by individuals, businesses, and institutions.

Price Resistance and Support – Key price levels where an asset struggles to move above (resistance) or finds buying interest (support).