Xapo Bank has made a groundbreaking move by launching its banking services in the UK, introducing a unique Bitcoin yield of 1%. This makes it the first licensed bank in the UK to offer interest-bearing accounts in both fiat and Bitcoin. The introduction of this attractive Bitcoin yield aims to appeal to customers looking to grow their digital assets alongside their traditional currency holdings. Xapo Bank’s expansion into the UK marks a pivotal moment in the financial sector, highlighting the UK’s growing influence as a hub for cryptocurrency and blockchain technology.

With the UK emerging as a significant player in the blockchain industry, Xapo Bank’s entrance is likely to inspire other financial institutions to explore similar ventures. By offering a 1% Bitcoin yield, Xapo is setting a new standard for how digital assets can be managed and grown within the banking sector.

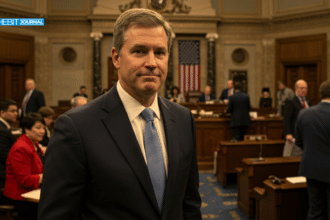

Xapo Bank’s journey to securing its UK banking license is noteworthy. Through the “passporting” scheme, endorsed by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA), Xapo has met stringent regulatory standards. Seamus Rocca, CEO of Xapo Bank, stated, “We have successfully passported our banking license into the UK. This means we are allowed to offer our banking services directly to the UK market. Achieving this is no easy feat and shows we meet the UK’s high regulatory standards.”

The introduction of a 1% Bitcoin yield by Xapo represents a major advancement. This offer allows customers to earn interest on their Bitcoin without having to stake or lock their assets, a flexibility that is rare in the crypto banking sector.

Consumer Benefits of Bitcoin Yield

Xapo’s new service model in the UK enables customers to transfer up to £1 million (about $1.275 million) to their UK wallets and bank accounts, enhancing the fluidity with which they can manage their funds. This Bitcoin yield serves as an incentive for both crypto enthusiasts and traditional investors seeking to diversify their portfolios.

Additionally, Xapo Bank offers widely accepted debit cards that account holders can use to spend their digital assets, invest in S&P 500 stocks, and purchase select cryptocurrencies. The integration of stablecoin payment options into USD bank accounts further showcases Xapo’s commitment to meeting the evolving needs of global finance.

Despite the challenges fintech companies face in securing UK banking licenses, the success of Xapo and similar firms like Revolut underscores the UK’s commitment to fostering a dynamic financial ecosystem conducive to cryptocurrency innovations. Joey Garcia, Director and Head of Regulatory and Public Affairs at Xapo Bank, remarked, “The UK is swiftly emerging as a global hub for cryptocurrency innovation, boasting a promising regulatory framework, a dynamic financial ecosystem, and a talent-rich environment.”

Bitcoin Yield Leading the Way in Banking Innovation

Xapo Bank is pioneering a new era in banking innovation with its offer of a 1% Bitcoin yield, complemented by a comprehensive suite of financial services. This initiative is part of the broader trend within the UK, which is rapidly establishing itself as a frontrunner in the cryptocurrency and blockchain industries. This progressive move by Xapo Bank not only provides tangible benefits to cryptocurrency holders but also showcases a significant shift in the integration and evolution of traditional and digital finance systems.

As these developments unfold, The BIT Journal remains a key source for the latest trends and updates in the dynamic cryptocurrency sector. The station consistently broadcasts in-depth coverage on the evolving landscape of blockchain and digital currencies, keeping listeners informed about groundbreaking changes and the potential impacts on both the financial industry and tech enthusiasts globally.