The cryptocurrency market appears to have lost some of its recent bullish momentum, yet a few strong contenders are still holding their ground. According to crypto analyst Nikola Lazic, XRP and ADA are among the altcoins maintaining their bullish trajectory. Lazic highlights that the RSI (Relative Strength Index) indicates moderate bullish momentum for both assets, signaling potential upward movement.

XRP Price Prediction: Aiming for $3.92

XRP’s 4-hour chart displays a robust impulsive structure following a corrective ABC phase. The breakout from a descending triangle around $3.07 (0.236 Fibonacci retracement) triggered a consolidation phase, leading to a bullish Wave (v) attempt. Currently, XRP faces immediate resistance at $3.36 (0.5 retracement) and $3.49 (0.618 retracement), challenging key Fibonacci levels.

The RSI confirms strong bullish momentum while staying below overbought levels, providing room for further growth. Wave (iii) demonstrated impressive strength, reaching $3.68 (0.786 Fibonacci extension). The ongoing Wave (v) is targeting higher levels, with $3.92 (1.0 Fibonacci extension) as the primary bullish target. This level aligns with historical resistance, making it a critical zone for price action.

However, if momentum weakens, XRP could revisit support at $3.07, serving as an immediate pivot. A deeper pullback may test the $2.80 level, corresponding to previous wave supports. Failure to hold these levels would invalidate the bullish outlook, signaling potential downside risks. On the other hand, maintaining higher lows and breaking above the $3.36-$3.49 resistance range would solidify XRP’s bullish trajectory. Continued upward momentum could confirm Wave (v), pushing prices toward or beyond $3.92, with RSI providing additional validation.

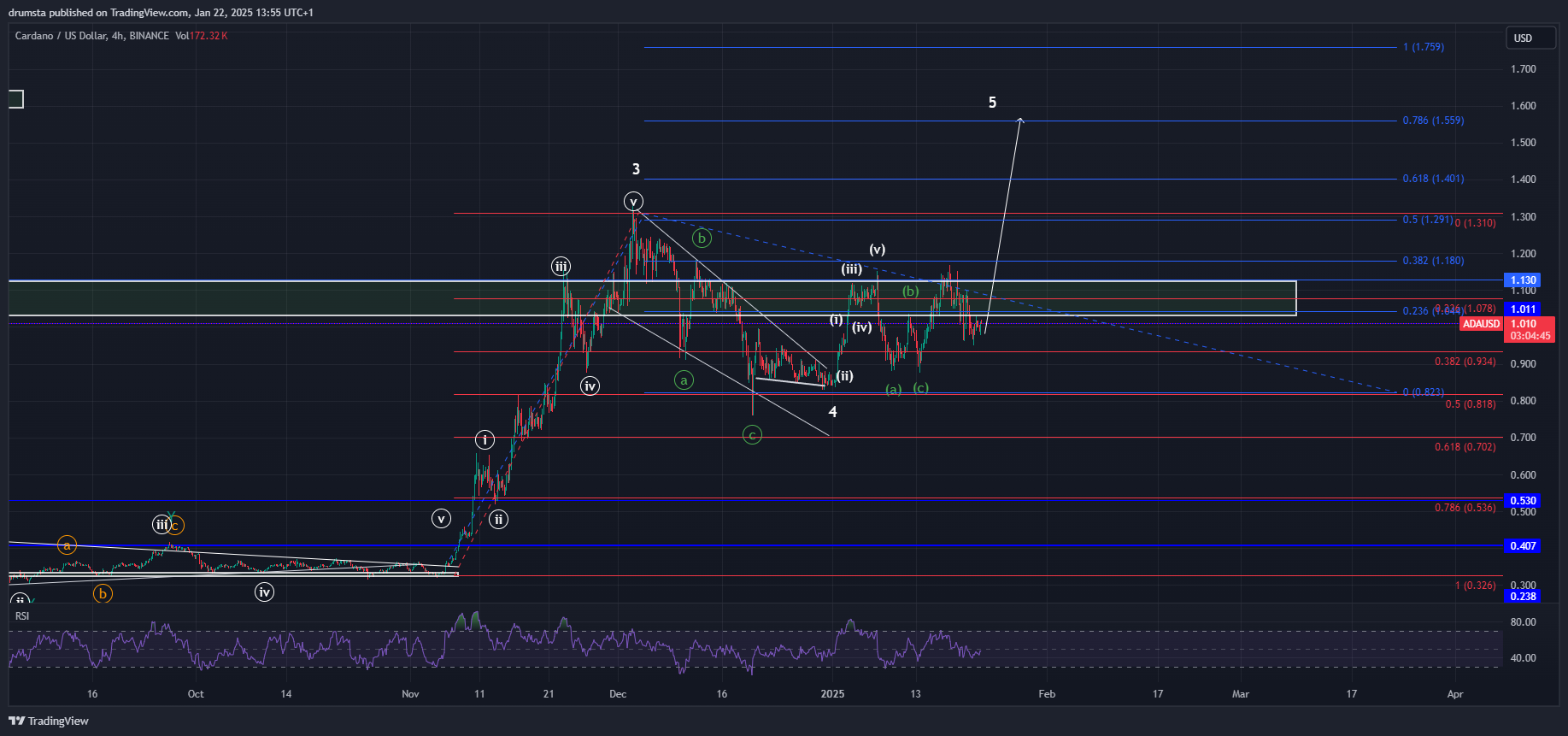

ADA Price Prediction: $1.40 and $1.75 in Sight

ADA’s 4-hour chart suggests the completion of a corrective Wave 4, transitioning into an impulsive Wave 5 structure. After forming a descending channel, ADA broke out in early January, signaling bullish momentum. Currently, ADA is battling strong resistance between $1.08 and $1.13, where previous Fibonacci retracements and horizontal resistance converge. This zone is pivotal for determining ADA’s next move.

Earlier attempts to surpass this range include a rally to $1.15 on January 7, followed by a 23% pullback to $0.88 on January 10, and a retest on January 13. The latest attempt on January 17 reached $1.16 but again faced resistance. ADA now sits at a higher low of $0.99, a key level for maintaining its bullish outlook.

Wave (i) surpassed $1.01, challenging the upper resistance range, while Wave (ii) saw a slight pullback to $1.01 (0.236 Fibonacci retracement), indicating accumulation. If ADA sustains its momentum, Wave (iii) could target $1.40 (1.618 Fibonacci extension), aligning with Elliott Wave principles suggesting a five-wave completion. This scenario could drive ADA to $1.75.

The RSI supports this bullish narrative, recovering from oversold conditions. However, failure to break above $1.13 could shift the short-term trend downward, with significant support levels at $0.93 and $0.82 (0.382 and 0.5 Fibonacci retracements). These levels may serve as potential re-entry zones for buyers. To confirm sustained bullish momentum, ADA must reclaim $1.13 and validate an extended Wave 5. Otherwise, further consolidation could delay upward progress.

Key Takeaways for Traders

Both XRP and ADA show promising bullish momentum, but critical resistance levels must be surpassed to sustain upward trajectories. Traders should monitor RSI trends and Fibonacci levels closely to identify entry and exit opportunities.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!