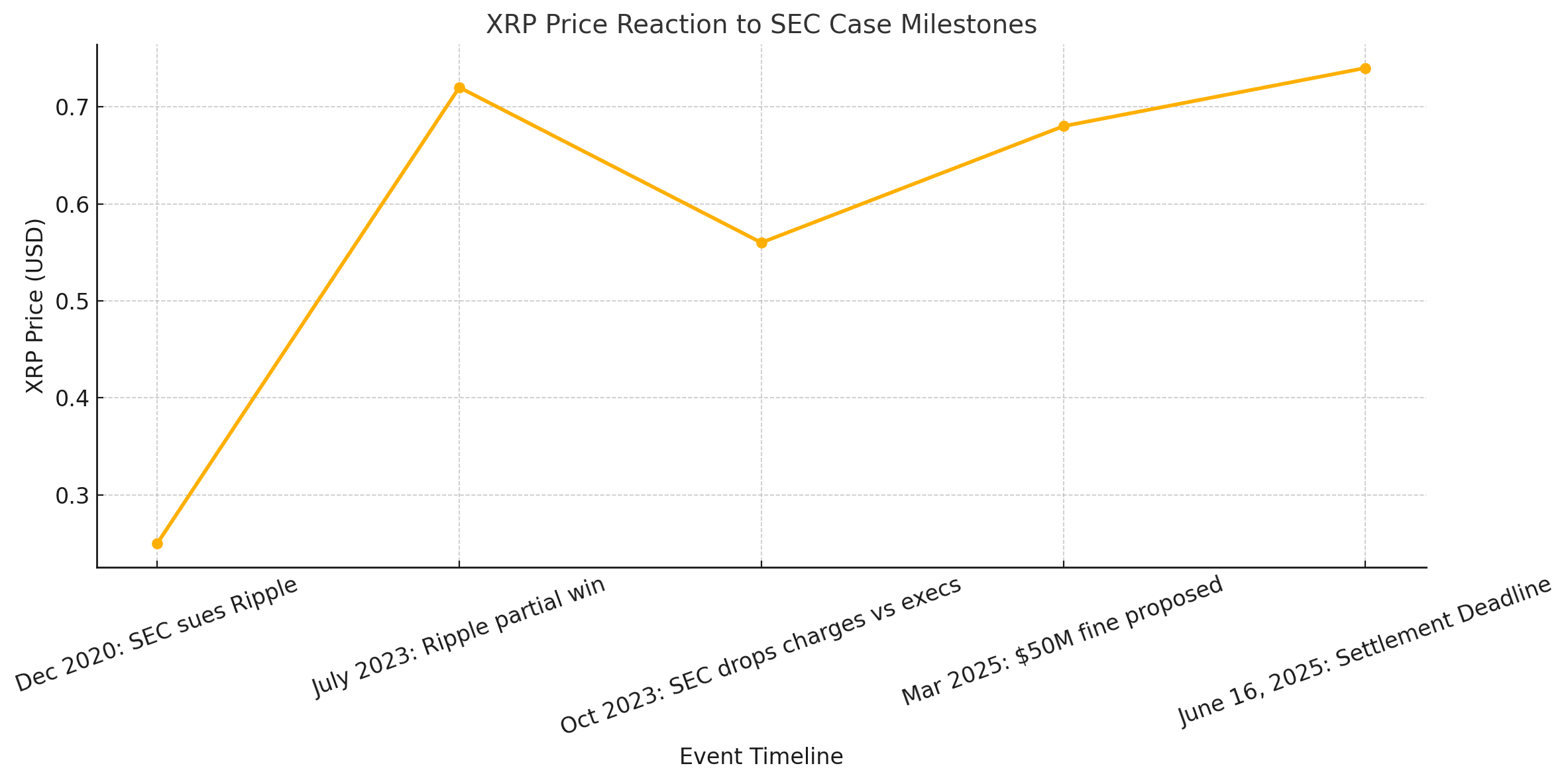

XRP’s legal cliffhanger enters final stretch as the June 16 deadline approaches in the ongoing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC), XRP holders and industry observers brace for what could be a pivotal moment in crypto history. The stakes are immense: a settlement could redefine XRP’s legal status and unleash institutional momentum, while a failure to act may reopen a lengthy and uncertain appeals process.

The SEC and Ripple agreed in April to a 60-day pause in proceedings, giving both sides room to discuss potential settlement terms following years of courtroom drama. With that window closing, all eyes are now on what will be filed, or not filed, by June 16.

A Deadline That Could Redefine XRP’s Future

The June 16 filing is not just another procedural event. If Ripple and the SEC report progress or a finalized settlement, it could end one of the most high-profile crypto enforcement actions in U.S. history. If no filing is made, or if an extension isn’t requested, the case could revert back to the Second Circuit Court of Appeals, risking renewed litigation and fresh uncertainty for XRP’s regulatory future.

Legal analysts say a finalized settlement could potentially reduce Ripple’s financial penalty from the previously floated $125 million to closer to $50 million. More importantly, it could resolve the question of whether XRP is considered a security when sold to institutional investors. This critical distinction has long cast a shadow over the asset’s legitimacy.

The Market’s Response: Cautious Optimism

In recent weeks, XRP has shown signs of cautious bullishness. Speculation surrounding both the SEC deadline and possible ETF filings has fueled short-term rallies, with XRP gaining as much as 8% in a single day in early June. According to FXEmpire and CoinCentral, traders are pricing in the possibility of a favorable outcome, though volatility remains high.

Adding to the intrigue, ETF-related chatter continues to swirl. Several asset managers, including Franklin Templeton and VanEck, have reportedly eyed XRP-spot ETF proposals, with some timelines converging around the same mid-June window. A clear regulatory resolution would be a prerequisite for any SEC approval of such products.

Strategic Silence or Tactical Chess?

Neither Ripple nor the SEC has made public statements in the past week, a silence that some analysts interpret as strategic. According to former SEC enforcement attorney John Reed Stark,

“When both sides go quiet this close to a deadline, it often signals that serious terms are being finalized.”

That theory tracks with Ripple’s recent moves, including behind-the-scenes outreach to financial institutions and global partners. Meanwhile, the SEC’s lack of public opposition could suggest an internal willingness to close the chapter—especially as political pressure mounts for regulatory clarity in the digital asset space.

A Pivotal Moment for U.S. Crypto Regulation

Beyond XRP, the outcome of this case could send ripple effects, no pun intended, across the entire crypto sector. A favorable settlement would signal the SEC’s evolving stance on digital assets, possibly opening the door for other tokens long held in legal limbo to pursue listings, partnerships, and ETF applications.

For XRP, it would be a long-awaited return to institutional legitimacy. For the SEC, it would mark a strategic retreat in what has been a widely criticized war against innovation.

What Happens If There’s No Settlement?

Should Ripple and the SEC fail to reach an agreement or request an extension, the case could revert to the appeals process. That would likely delay regulatory clarity by months, if not years, and extend XRP’s exclusion from major U.S. trading platforms and institutional portfolios.

In that scenario, XRP’s price could suffer immediate pullbacks, even as long-term bulls hold steady based on Ripple’s international utility and growing adoption outside U.S. borders.

Final Word

The June 16 deadline could prove to be one of the most consequential moments in XRP’s decade-long journey. Whether Ripple and the SEC deliver a long-awaited settlement or resume their legal battle, the implications will extend far beyond one token.

For now, investors wait, and the entire crypto industry holds its breath.

Frequently Asked Questions (FAQs)

What is the June 16 deadline about?

Ripple and the SEC must update the court on their settlement status or the case may return to appeals.

Will a settlement help XRP ETF approval?

Yes, legal clarity could allow the SEC to approve XRP spot ETFs.

How does legal news affect XRP price?

Positive news boosts XRP; delays or uncertainty often cause drops.

Glossary of Key Terms

Settlement – A legal agreement ending a dispute without trial.

Appeal – A request to a higher court to review a case decision.

Security – A regulated financial asset under U.S. law.

ETF – Exchange-Traded Fund; a way to invest in assets like XRP.

Ripple Labs – The company behind XRP’s blockchain network.

SEC – U.S. Securities and Exchange Commission, a financial regulator.

![Reviewing the 5 Best New Meme Coins to Join This Week [As Recommended by Savvy Investors] 41 Reviewing the 5 Best New Meme Coins to Join This Week [As Recommended by Savvy Investors]](https://thebitjournal.b-cdn.net/wp-content/uploads/2024/12/best-meme-coins-420x280.png)