Following the recent market reports, XRP jumped 4%, breaking out of a 6-year symmetrical triangle and closing at $3.51. This technical move coincides with US Congressional progress on crypto regulation and the launch of the first XRP ETF by ProShares. Institutional selling in the last hour of trading added caution, but this XRP breakout showed strong market interest with new catalysts.

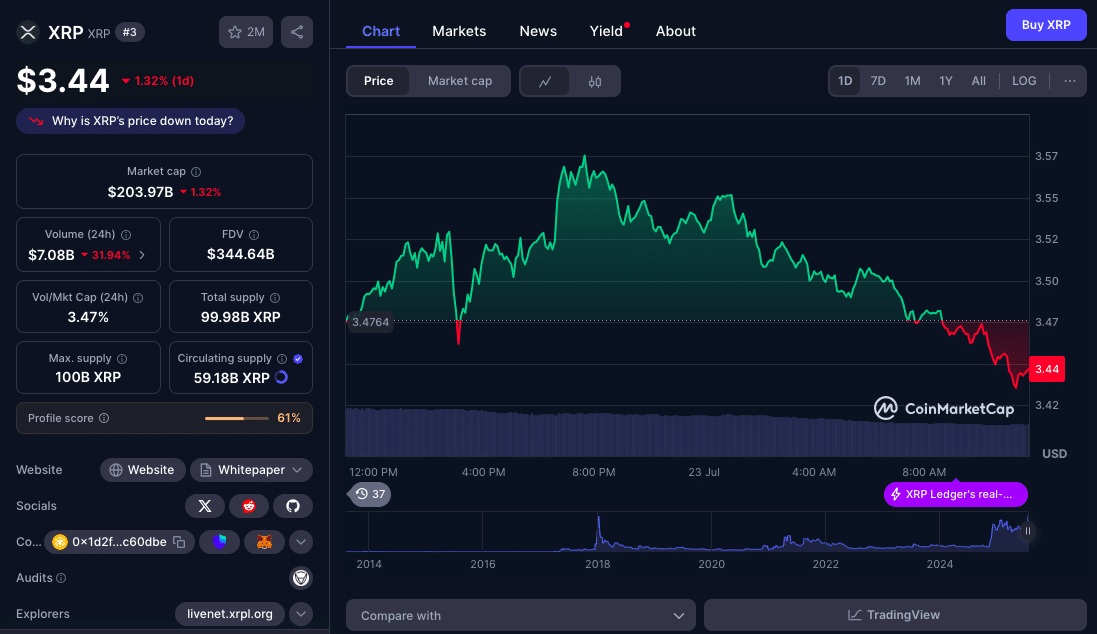

However, based on the latest reports coming in, XRP currently trades at $3.44. Sources say this retracement is because the SEC has just halted Bitwise’s plan to convert its 10 Crypto Index Fund into a spot ETF. The sudden regulatory reversal has created uncertainty about institutional demand timelines, taking a swipe at XRP’s current price.

What Caused the Recent Breakout?

XRP broke above $3.52-$3.57 resistance, a symmetrical triangle that had been in place for 6 years. The volume soared to 106 million, 52% above the daily average, showing conviction. Despite institutions taking profits at $3.57, the market held above $3.50 at that time.

Experts believed this to be driven by two big things. The first is Crypto Regulation. Congress’s move on the GENIUS and CLARITY Acts has removed speculation around XRP’s legal status, giving institutional investors much-needed clarity.

ProShares is also launching the first XRP ETF, opening a regulated way for big investors to get in, and just legitimized XRP as an institutional-grade asset.

Bull vs Bear: An Objective Price Outlook

To assess potential scenarios for XRP, below is a forward-looking analysis table:

| Scenario | Key Drivers | Outlook Target | Risks / Triggers |

| Bull Case | Sustained ETF inflows, regulatory clarity, follow‑through buying | $6.00 (short term), up to $15.00 (long term) | Weak volume, geopolitical shocks, market rotation |

| Base Case | Steady institutional accumulation, price consolidation above $3.50 | $4.50–$5.00 | Profit-taking, lack of sustained momentum |

| Bear Case | Heavy institutional exits, breakdown below triangle support, broader crypto sell-off | $3.00–$3.20 | Crypto‑regulatory rollback, macroeconomic stress |

XRP is in a bullish structure within a range. If XRP goes above $3.50, it could be leg two of the breakout, targeting $6.00 as several analysts have said. Longer-term targets are extended further, referencing symmetrical triangle measured move targets.

Experts and Institutional Sentiment

ProShares analysts are watching for ETF inflows in the coming weeks. One senior strategist noted that If wallet activity and volume align with regulatory shifts, XRP could test the $6 range by year end.

A decentralized finance consultant noted that since Congress is removing regulatory hurdles for XRP, it is is what turned a technical breakout into a fundamental one.

These views align with the breakout, but experts also caution that momentum must continue beyond the initial move to confirm follow-through.

Support must hold above $3.50; else, the next support is at $3.42-$3.45. Immediate resistance is at $3.57-$3.60. If the XRP breakout goes above $4.00, the triangle measured move could reach $6.00

A follow-through volume above average (100M tokens/day) over the coming days will be really essential

Conclusion

Based on the latest research, this XRP breakout is based on fundamentals, institutional interest and clearer regulation. This XRP breakout analysis indicates that while the entry into this zone is good, the journey to $6.00 and beyond will require sustained volume and momentum.

Traders and investors are advised to watch closely to see if XRP can hold above $3.50 and get ETF-driven flows. If it does, the next leg up could happen this year.

Explore long-term XRP Price Prediction.

Summary

XRP breakout analysis shows that technical, regulatory and institutional factors have aligned to propel XRP into a new leg of consolidation and upside. While the 4% rally and ETF debut are good news, the market needs to see levels above $3.50 to shift the narrative from short-term breakout to long-term recovery.

FAQs

What triggered the XRP breakout?

XRP broke out of a multi-year triangle on high volume with Congressional updates (GENIUS & CLARITY Acts) and the XRP ETF.

How high can XRP go?

Short-term targets around $6.00. Longer-term targets to $15.00 from technical measured-move targets off the triangle breakout.

What is key resistance/support?

Support at $3.50-$3.42; resistance at $3.57-$4.00. Above $4.00 is bullish.

What could derail this rally?

Institutional profit-taking, broader crypto sell-off, weak follow-through volume or macroeconomic shocks.

Glossary

Symmetrical Triangle: A chart pattern where trend lines converge signaling a breakout when broken.

Measured Move: A technical target by projecting the height of a chart pattern from the breakout point.

Breakout Volume: Volume above average indicating real interest behind price moves.

Institutional Profit-Taking: Big players selling to book profits, often seen after the initial move.