XRP is looking strong after clearing $2.28 resistance owing to renewed confidence in Ripple’s regulatory progress. The company’s application for a US national trust bank charter has intensified bullish interest in XRP breakout. This has translated directly into the charts with breakout volume confirming the setup and momentum shifting in favour of the bulls.

Ripple’s Charter Application Brings Institutional Confidence

Just recently, Ripple officially filed an application with the Office of the Comptroller of the Currency (OCC) for a national bank charter and a U.S. Federal Reserve master account.

Analysts interpret this as a positive development. Echoing statements from Binance and TokenPost; believing this regulatory achievement could serve as a foundation for XRP’s broader financial use cases.

Ripple’s decision to apply for a banking charter is an important change for the asset. This application could allow Ripple to offer custodial and trust services and get into traditional finance in a more formal way. As market observers note, institutions will allocate capital to assets with compliance visibility and XRP might have just bagged a big advantage over competitors.

Price Action: XRP Targets $2.38 With Volume

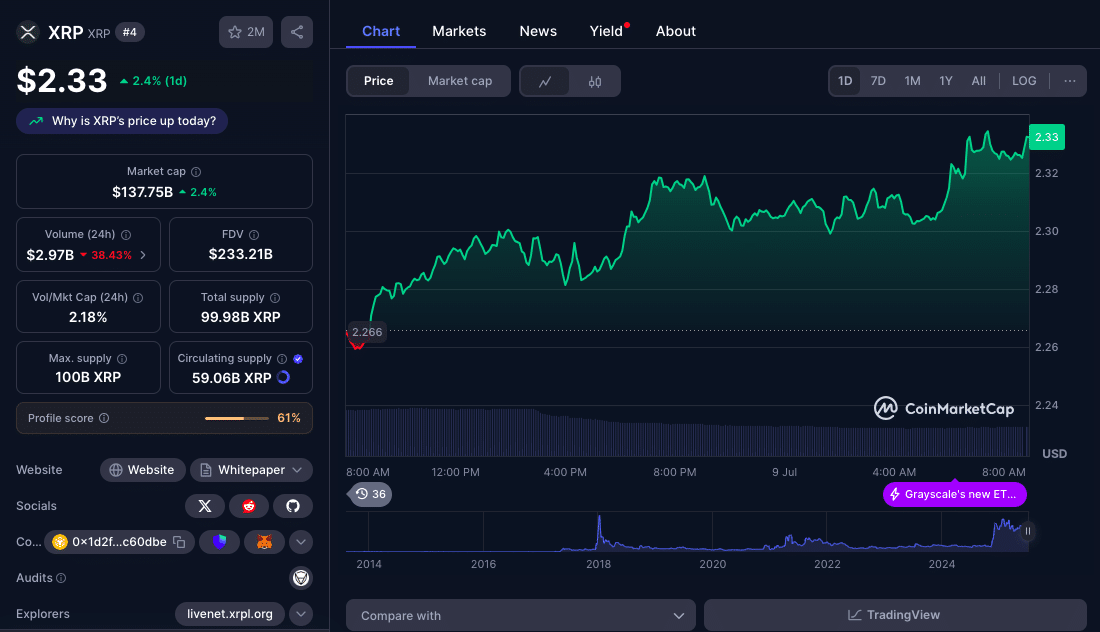

XRP rose 2.36% in 24 hours between July 6 and July 7 from $2.21 to $2.26. The real breakout happened during peak trading hours at 10:00 UTC when volume spiked above 67 million and XRP broke above $2.28. Although it hit a session high of $2.29, profit taking led to some consolidation around the $2.25 support zone.

As at the time of this publication, however, XRP trades at $2.33, up by 2.4%. Traders are now looking for a move above $2.30 with $2.38 as the next resistance. If momentum continues, targets up to $2.60 to $3.40 are possible; but that will depend on broader market conditions and macro stability.

XRP Technicals

On the hourly chart; $2.28-$2.29 is the near term resistance and $2.24-$2.25 is the support. Key volume spikes at 08:00, 10:00 and 13:00 UTC confirmed buying behind each move. RSI is still above 50 so there’s room for exit before it is overbought.

In the final hour of the session (01:05-02:04 UTC) XRP rose from $2.26 to $2.27 with new inflows; another sign bulls are defending higher lows.

XRP Price Table: Key Levels and Metrics

| Level | Price (USD) | Significance |

| Resistance | $2.28 – $2.29 | Breakout zone confirmed by surging volume |

| Next Target | $2.38 | Analyst key trigger for bigger breakout |

| Extended Target | $2.60 – $3.40 | Broader upside outlook on sustained momentum |

| Support | $2.24 – $2.25 | Defended multiple times during dip sessions |

| Secondary Support | $2.21 – $2.22 | Demand zone that precedes resistance and breakout |

Institutional Tailwinds Add Weight to Bullish Thesis

Ripple’s OCC application is a deeper alignment with the US financial system and analysts think this will trigger large scale capital inflows. In previous times, regulatory progress has been a push for sustained rallies in compliant assets and XRP is benefiting from the same.

Market participants are watching Ripple closely as the company expands its remittance and tokenization business globally.

Conclusion: XRP Breakout Reinforced by Regulatory Progress

A close above $2.30 with volume support could validate the move to $2.38. Beyond that, if sentiment improves and Ripple’s banking application goes smoothly without regulatory hiccups, XRP could go to $2.60 in the short to medium term. Failure to hold $2.24-$2.25 would invalidate the XRP breakout and could lead to a retest of $2.21.

This XRP breakout isn’t just about price because it is supported by one of the strongest regulatory narratives in crypto today. Ripple is actively integrating into the traditional financial system and XRP has cleared critical technical resistance. Traders and long term investors are watching closely as $2.38 comes into focus and the stage is set for more upside.

Summary

XRP has broken $2.28 after Ripple’s banking application. Volume confirmed the breakout and analysts are targeting $2.38. Ripple’s trust bank charter will integrate XRP into traditional finance and make it more attractive to institutions. Support is strong at $2.24-$2.25. If bulls hold XRP could go to $2.60 or higher.

FAQs

Why did XRP go above $2.28?

It was due to Ripple’s banking charter application which boosted investor confidence. The surge in volume and price was driven by technical strength and XRP’s regulatory clarity.

What’s the next resistance for XRP?

Next major resistance is at $2.38. If bulls hold and volume remains high, XRP breakout to $2.60-$3.40 in the medium term is possible

What does Ripple’s OCC banking license mean for XRP?

If approved, it would allow Ripple to be a national trust bank in the US. This makes XRP a regulated and institutionally viable asset.

Can XRP fall if $2.25 breaks?

Yes. If $2.24-$2.25 fails to hold, it could see a retest of $2.21.

Glossary

OCC (Office of the Comptroller of the Currency): US regulator that oversees national banks.

Breakout: a price move above a key resistance level; often with increased volume and momentum.

Support/Resistance: price zones where buying or selling interest accumulates; which affects the asset’s direction.

Institutional Adoption: large financial firms entering crypto markets driven by regulation; custody and compliance.

Volume Confirmation: a technical analysis concept where a price move is considered valid if accompanied by high volume.