XRP is getting close to a big test, moving up from the $2.20 zone to challenge the $2.285 level. The move comes after a steady build-up of bullish momentum and a potential XRP breakout if the overhead levels give way. With Bitcoin and Ethereum also up, XRP seems to be building up for a big move above consolidation.

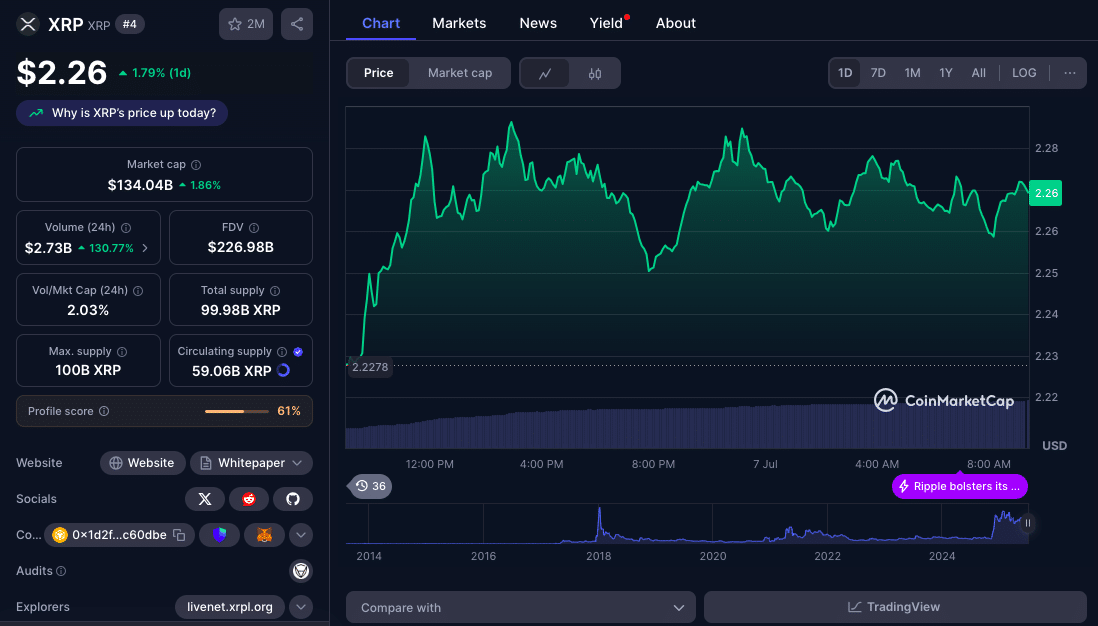

At the moment, XRP trades at $2.26, above the 100-hour Simple Moving Average and tightening into a bullish continuation pattern.

Bulls Take Charge as XRP Bounces From $2.20

After dipping to $2.197 last week, XRP started to regain strength, breaking above $2.220 and $2.2320. The move coincided with a break above the 61.8% Fibonacci retracement of the recent $2.3111 high, a sign that bulls are in control.

Technical indicators are looking good. The MACD on the hourly chart is positive and the RSI is above 50; showing sustained buying pressure.

XRP has also formed a short-term contracting triangle on the hourly chart; and is now pressing against the upper boundary near $2.280-$2.285. A clean break above this zone could lead to a quick move to $2.320 and potentially $2.350-$2.40 if the volume follows.

Resistance Levels: What Needs to Give for XRP Breakout?

The $2.285 level is no small hurdle. It’s also the 76.4% Fib retracement of the drop from the $2.3111 high, a zone that traders are watching closely. A break here would likely trigger more buying and $2.32 as the next near term target.

Beyond that, $2.35 and $2.40 become realistic targets if the bulls can maintain the momentum. Data from TradingView shows that XRP’s historical breakouts from similar patterns often result in 8-12% moves within 24-48 hours. But volume needs to follow for a big XRP breakout.

XRP Price Levels

| Category | Price Level / Status | Significance |

| Immediate Support | $2.260 | First fallback zone if XRP gets rejected at resistance |

| Pivot Support | $2.2320 | Crucial support; flipping this would signal deeper retracement |

| Primary Resistance | $2.280–$2.285 | Triangle resistance and 76.4% Fib retracement level; breakout confirmation point |

| Secondary Resistance | $2.320 | Next upside target if $2.285 breaks |

| Extended Resistance | $2.350 – $2.400 | Bullish extension targets post-breakout |

| Bearish Breakdown Zone | Below $2.2320 | Could trigger drop back to $2.20 or $2.150 support zones |

Buyers seem to be in control presently but XRP breakout can still flop if it doesn’t break $2.285. First support is at $2.260, then $2.2320 (previous resistance). Below $2.2320 it could retest $2.20 and if steeper, $2.150.

Analysts Are Cautiously Optimistic

No breakout is guaranteed but market watchers are optimistic. Analysts point to the confluence of moving averages and Fibonacci zones which often precede upside if broken.

Cointelegraph recently reported institutional inflows into XRP products with over $10.6 million in weekly inflows and $219 million YTD. This growing participation from funds and asset managers has been supporting XRP’s long term structure.

A daily close above $2.30 according to multiple analyst models would be the technical confirmation of an XRP breakout and could see a test of $3.00 in the coming weeks (if macro and crypto markets are stable).

Conclusion: XRP Walking the Tightrope

The XRP chart is at a decision point. If bulls can push above $2.285, there may be a move to $2.32 and $2.35 with the broader market momentum helping. If not, it could slip back into the $2.20-$2.26 range. Either way, this is a high risk zone for short term traders and long term holders.

Institutional inflows into XRP ETPs are increasing and market structure is improving, hence traders are advised to watch this move for trend confirmation.

Follow us on Twitter and LinkedIn, and join our Telegram channel.

Summary

XRP is at the resistance zone of $2.285 after rebounding from $2.20. Price has reclaimed the 100 hour SMA and is in a short term triangle. Hourly MACD is bullish and RSI is above 50 so we are more likely to see an XRP breakout. If $2.285 is cleared, XRP could go to $2.32, $2.35 or $2.40. Failure at resistance could see a pullback to $2.232 or lower.

FAQs

What’s the key resistance XRP needs to break through?

$2.285 which is both a triangle resistance line and 76.4% Fibonacci retracement of the previous swing.

What are the targets after XRP breaks out?

Short term targets are $2.32 and $2.35. A bigger move could take us to $2.40 or $2.50.

What technicals support the bull case?

XRP is above 100-hour SMA, MACD is bullish and RSI is above 50, so momentum is on the buyers side.

What if XRP gets rejected at resistance?

If XRP fails at $2.285, support is at $2.260 and $2.2320. A break of these levels could take it back to $2.20 or $2.15.

Are institutions buying XRP?

Cointelegraph reports XRP ETPs saw $10.6 million in weekly inflows and $219 million year-to-date

Glossary

XRP breakout – When XRP’s price breaks through a major resistance with volume and often leads to a big move.

Fibonacci retracement – A technical tool using ratios to find potential reversal levels.

MACD – A trend following indicator showing the difference between two moving averages.

RSI (Relative Strength Index) – Momentum oscillator measuring speed and change of price; above 50 means strength.

ETP (Exchange-Traded Product) – A tradable asset like a stock that tracks a cryptocurrency or other underlying asset.

Sources