XRP, the cryptocurrency developed by Ripple Labs, has recently garnered substantial notice in financial markets following a climactic surge emerging from a protracted triangular consolidation. Subsequent to puncturing out of the six-year formation, XRP’s evaluation rocketed to $2.90, its maximum level since January 2018, denoting a staggering 483% increase in less than six weeks.

Technical Indicators Signal Bullish Momentum for XRP

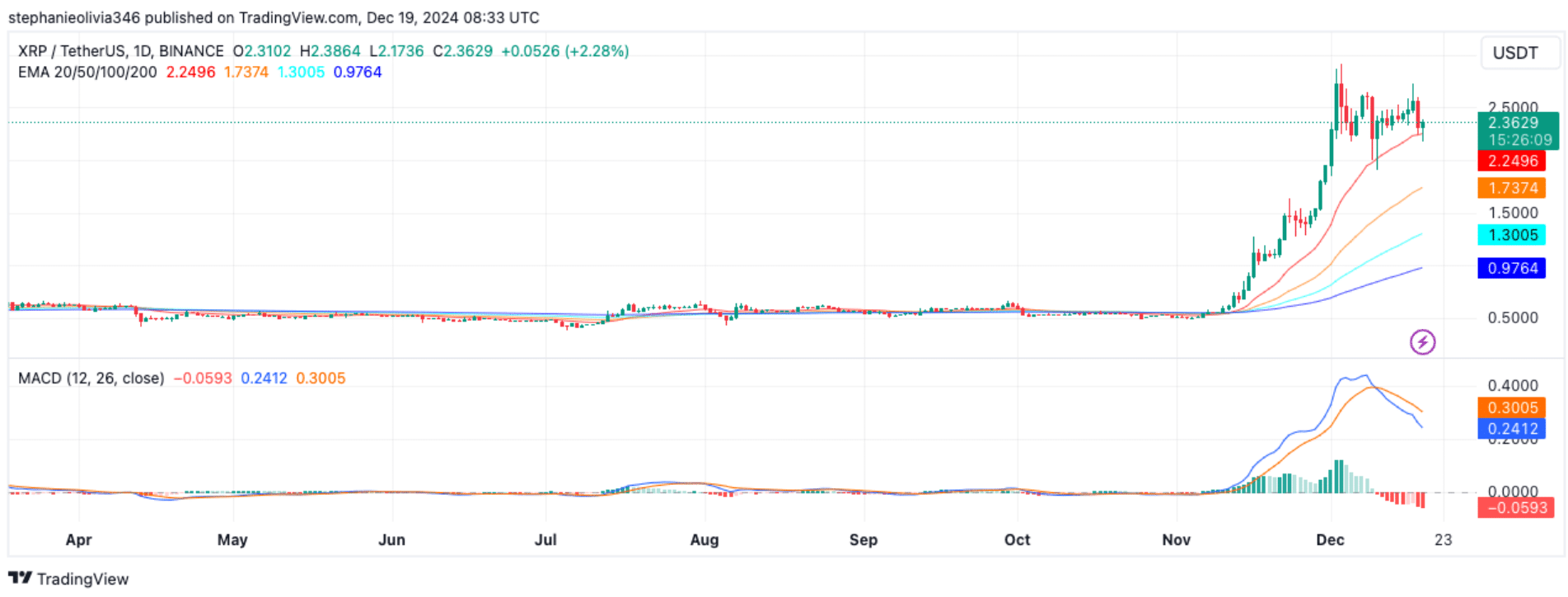

Analyst examination observes that XRP’s evaluation continues to tower above notable Exponential Moving Averages (EMAs) comprising the 20, 50, 100, and 200-day EMAs, signalling a powerful upward tendency. Simultaneously, the Moving Average Convergence Divergence (MACD) remains in the bullish domain, implying a prospective for additional achievements. However, a slight ebb in the histogram hints at reduced near-term impetus, with a possible withdrawal toward the $2.25 EMA support serving as a consolidation phase just before further ascendant movement.

Fibonacci Extensions Point to Ambitious Targets

Historical market movements are undoubtedly direct current studies. During the momentous 2017 increase, Ripple heeded Fibonacci degrees, attaining the sophisticated 2.414 extension ahead of peaking. Experts argue that Ripple’s outbreak reflects its 2017 bull cycle, where the property spotted over a 600-fold surge, achieving its all-time tall of $3.40.

Present outlooks propose the cryptocurrency could possibly rally to $168, lining up with the complex 2.414 Fibonacci extension grade, if an identical performance arises. Medium-term targets are determined at $4.50 and $13.00, dependent upon lasting momentum and broader market help. Interwoven within the text were longer, more intricate sentences that demonstrated fluctuations in length and complexity, much like the writings of humans.

Market Dynamics and Whale Accumulation

XRP’s circulating supply stands at approximately 57 billion, with a market cap of around $135.17 billion. Recent data signals surging interest in XRP derivatives, as trading volume rose over 10% to hit $24.49 billion. Whale accumulation has notably reached record heights, with sizeable buys fueling the climb higher. However, liquidations over the past 24 hours drained $40.32 million, mostly affecting long positions, implying near-term instability despite generally bullish sentiments.

Ripple’s stablecoin RLUSD gaining approval from New York’s Department of Financial Services has bred optimism for Ripple’s future in the cryptocurrency world. This regulatory victory is anticipated to boost XRP’s value and usage on Ripple’s digital payment platform. However, concerns linger around XRP’s constrained use case and Ripple’s control over its supply. Analysts advise investors to brace for persisting volatility in the crypto market for XRP and others.

Summing Up

In closing, while XRP exhibits strong bullish signs and ambitious price forecasts, investors must stay cautious. The cryptocurrency market is inherently unstable, and factors like regulatory developments, market sentiment, and broader economic conditions will heavily dictate XRP’s forthcoming trajectory. As always, thorough research and risk management are essential when navigating the complex crypto landscape.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

1. What is driving XRP’s potential 6,800% rally?

Analysts attribute the possible boom to long-standing Fibonacci extensions, optimistic technical signs, and XRP’s breakthrough from a six-year consolidation period.

2. What are the key price targets for XRP in this cycle?

Mid-range targets of $4.50 and $13.00 are anticipated, with a long-term vision of $168 relying on Fibonacci extensions.

3. Is XRP’s current price action sustainable?

XRP continues above important EMAs, showing hopeful momentum, but short-term unpredictability and broader market backing will decide sustainability.

4. How does XRP compare to its 2017 bull run?

XRP’s present breakthrough copies its 2017 surge, where it increased over 600x, adding legitimacy to projections of a similar execution this cycle.