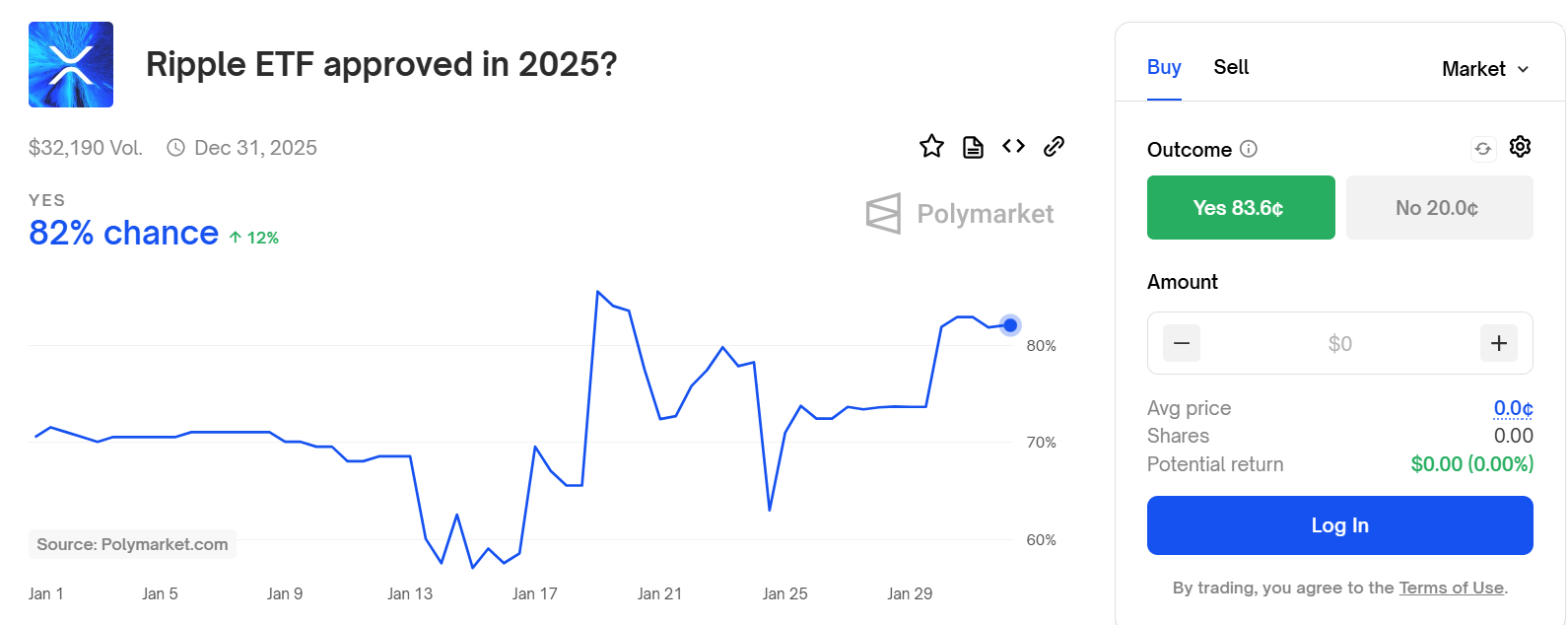

Polymarket, a leading online betting platform, has projected an 82% probability of the U.S. Securities and Exchange Commission (SEC) approving a spot XRP Exchange-Traded Fund (ETF) in 2025. This optimistic outlook is largely attributed to the recent election of President Donald Trump and anticipated shifts within the SEC’s leadership. If approved, XRP would become the third cryptocurrency to secure an ETF in the U.S., following Bitcoin and Ethereum.

A Surge in Market Confidence

Throughout January, Polymarket users have consistently indicated a strong belief in the potential approval of an XRP ETF. The platform’s data reveals that users have maintained a 60% or higher confidence level in the SEC’s approval of a spot XRP ETF within the year. Notably, there’s a 52% perceived likelihood of approval by July 31, 2025. This growing optimism reflects the market’s anticipation of a more crypto-friendly regulatory environment under the new administration.

Major Players Enter the Arena

The actions of prominent asset management firms further evidence the heightened confidence. Companies such as Bitwise, Canary Capital, WisdomTree, and 21Shares have proactively submitted applications for spot XRP ETFs with the SEC. These filings, which previously faced challenges under the prior administration, are now gaining traction. Grayscale Investments has also joined the fray, recently filing to convert its $16 million XRP Trust into an ETF listed on the New York Stock Exchange.

Regulatory Shifts and Market Dynamics

The evolving regulatory landscape plays a pivotal role in these developments. The appointment of Paul Atkins as the new SEC Chair signals a potential departure from the stringent regulatory approaches of the past. Atkins is known for his pro-crypto stance, and his leadership is expected to foster a more accommodating environment for digital assets. This shift has invigorated the crypto industry, leading to a surge in ETF applications across various cryptocurrencies, not just XRP.

XRP’s Market Performance

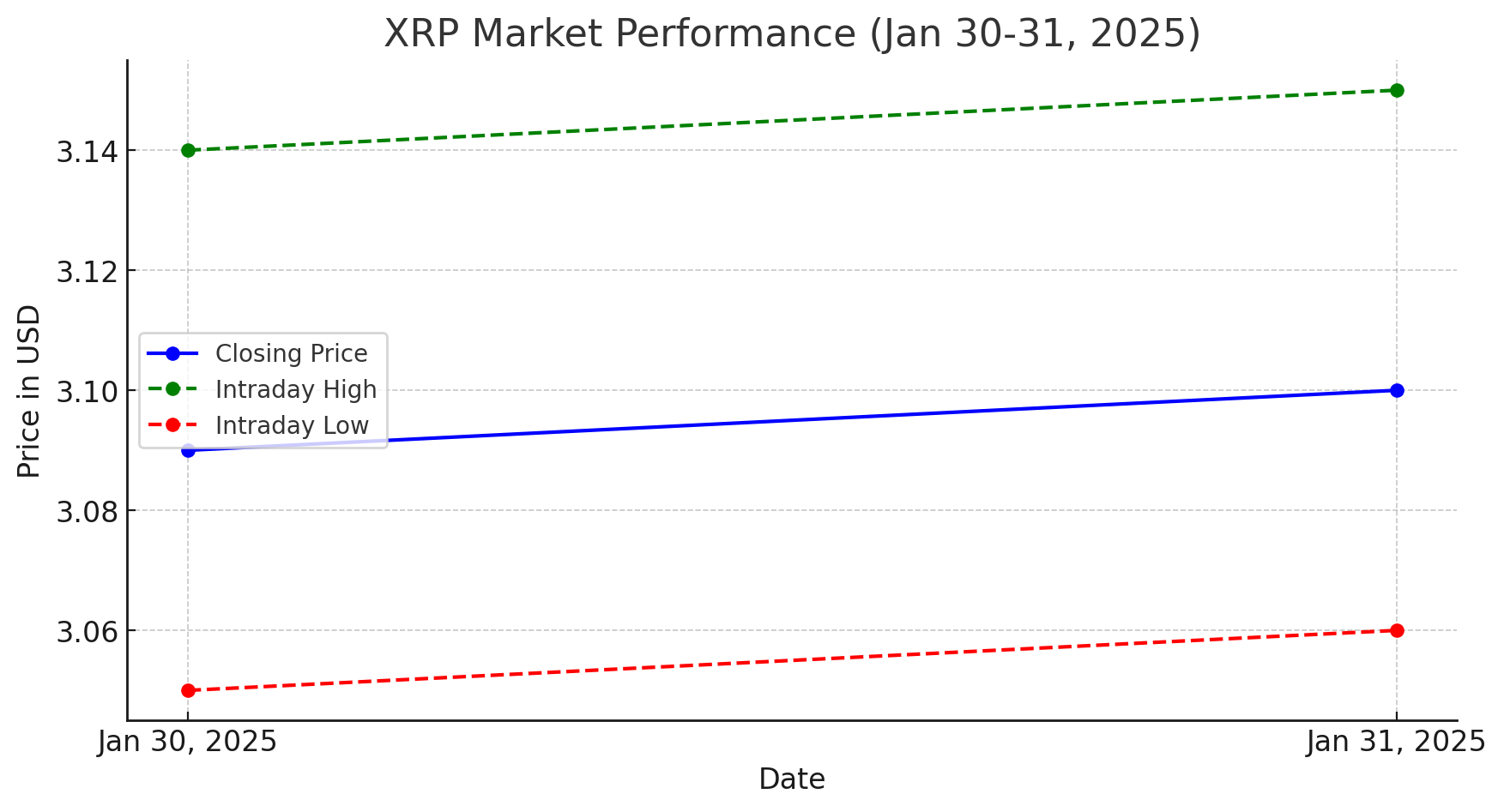

Amid these regulatory and institutional advancements, XRP has demonstrated notable market activity. As of January 31, 2025, XRP is trading at $3.10, with an intraday high of $3.15 and a low of $3.06. The cryptocurrency has experienced a 0.00324% increase from the previous close. Approval of an XRP ETF is anticipated to further bolster market sentiment and potentially drive the asset’s value higher.

The Ripple-SEC Legal Battle: A Lingering Shadow

Despite the positive momentum, the ongoing legal dispute between Ripple Labs and the SEC remains a significant factor. The SEC’s lawsuit, initiated in December 2020, alleges that Ripple’s sales of XRP constituted unregistered securities offerings. While a U.S. court has ruled that sales to institutional investors violated securities laws, it also determined that secondary market sales did not. The SEC is currently appealing parts of this decision, with a review set for January 2025. The outcome of this legal battle could have profound implications for the future of XRP ETFs.

Conclusion

The convergence of favorable regulatory shifts, proactive institutional involvement, and XRP’s market resilience paint a promising picture for the potential approval of an XRP ETF in 2025. While challenges persist, particularly concerning ongoing legal proceedings, the crypto community’s prevailing sentiment is cautious optimism. As the year unfolds, stakeholders will keenly monitor these developments, hopeful for a landmark decision that could significantly influence the trajectory of XRP and the broader cryptocurrency market.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

What is an XRP ETF?

An XRP Exchange-Traded Fund (ETF) is a financial product that tracks the value of XRP, allowing investors to gain exposure to the cryptocurrency without directly owning it.

Why is the approval of an XRP ETF significant?

Approval of an XRP ETF would provide a regulated and accessible avenue for institutional and retail investors to invest in XRP, potentially increasing its adoption and market value.

What factors are influencing the potential approval of an XRP ETF?

Key factors include the recent election of President Donald Trump, anticipated changes in SEC leadership, proactive applications by major asset management firms, and ongoing legal developments concerning Ripple Labs.

How might the ongoing legal battle between Ripple and the SEC affect the ETF approval?

The legal dispute centers on whether XRP is considered a security. The outcome of this case could significantly impact the SEC’s decision on approving an XRP ETF, as a ruling against Ripple may hinder approval prospects.