XRP is testing the limits of resistance — and if the charts hold true, a sharp squeeze could send prices surging past $2.60.

While much of the crypto market remains fixated on Bitcoin’s halving aftershocks, Ripple’s XRP is quietly staging a technical comeback. With a renewed bullish structure, surging on-chain metrics, and speculative flows intensifying, analysts say XRP could soon trigger a short squeeze that catapults it toward the $2.60 mark.

Technical Pressure Builds: What’s Driving the XRP Rally?

According to a recent analysis by AMBCrypto, XRP has broken out of a bullish pennant — a technical pattern often associated with continuation rallies. This formation, accompanied by rising trading volumes and positive sentiment, points to a high probability of XRP extending its recent gains.

Market analysts suggest that if XRP closes above $2.10 and holds that support, a clean move toward $2.60 is not just likely — it could come with explosive speed.

“XRP’s structure signals one good push could trigger a squeeze,” an analyst from AMBCrypto noted.

Whale Activity and Derivatives Data Fuel the Fire

On-chain data reveals a subtle yet critical uptick in whale-to-exchange flows, increasing by 0.51% to 2.88K XRP. This shift suggests large players may be preparing for either liquidity exits or major strategic entries.

Meanwhile, options open interest has jumped by over 24%, a sign that leveraged traders are betting on increased price volatility, potentially betting on a breakout.

Price Forecast Hinges on $2.60 Resistance

The area between $2.03 and $2.10 remains a tight band of liquidation zones for short sellers. A move beyond this region could set off a chain reaction of short liquidations, leading to a classic crypto squeeze where sellers buy back at higher prices to cover losses, pushing prices further up.

In a parallel outlook, data from The Crypto Basic highlights even more aggressive targets. If XRP captures just 15% of SWIFT’s daily volume, it could theoretically hit $25.68 — though that’s speculative and assumes massive global adoption.

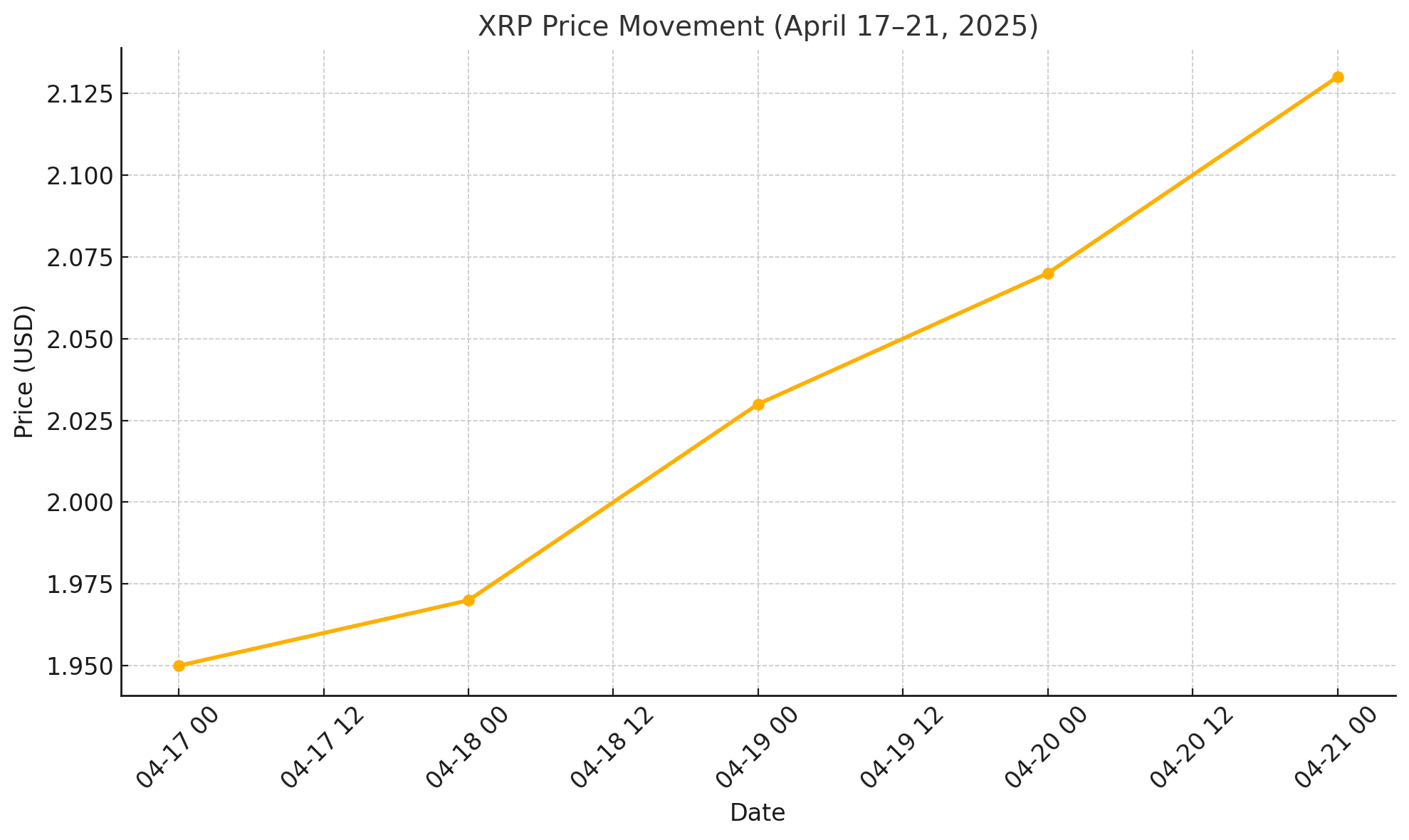

Current XRP Price and Market Performance

As of April 21, 2025, XRP is trading at $2.13, up 2.78% in the last 24 hours.

XRP Price Table (Last 5 Days)

| Date | Price (USD) | 24h Change |

|---|---|---|

| April 21 | $2.13 | +2.78% |

| April 20 | $2.07 | +1.96% |

| April 19 | $2.03 | +3.20% |

| April 18 | $1.97 | +0.85% |

| April 17 | $1.95 | -1.02% |

Source: CoinMarketCap, Binance

Can XRP Maintain Momentum or Is a Pullback Inevitable?

Despite the optimism, not everyone is convinced of an immediate breakout. Some analysts point to the spiking NVT ratio, which suggests XRP’s market cap is growing faster than its transaction activity — a potential warning signal.

Furthermore, XRP’s rising wedge pattern has historically preceded retracements, especially if broader market liquidity thins out or Bitcoin dominance regains strength.

Still, the fundamentals remain strong. XRP’s deep integration in cross-border payment systems and increasing institutional attention could provide enough momentum to break historical ceilings — with $2.60 now acting as the magnet for market momentum.

Conclusion

XRP’s chart setup, combined with bullish sentiment and whale activity, places it in prime position for a breakout. Should it clear $2.10 decisively, $2.60 could come faster than most anticipate. However, macro resistance levels and market caution shouldn’t be ignored — traders are advised to keep a close watch on volume and liquidity trends.

FAQs

What is the current price of XRP?

As of April 21, 2025, XRP is trading at $2.13.

Why is $2.60 a critical level for XRP?

$2.60 represents a major resistance level with dense short liquidation clusters. A breakout could trigger a short squeeze.

What do the charts say about XRP?

Technical patterns such as a bullish pennant and golden cross indicate strong upward potential. However, some bearish signals remain.

Could XRP really reach $25 as some predict?

Only under extreme adoption conditions, like replacing a significant part of SWIFT’s volume. Realistically, targets around $2.60–$5.00 are more achievable in the near term.

Glossary

Bullish Pennant: A continuation pattern formed by converging trendlines, signaling a potential breakout.

Short Squeeze: A rapid price increase that forces short sellers to cover positions, driving prices higher.

NVT Ratio: Compares a coin’s market cap to transaction volume; a spike may suggest overvaluation.

Golden Cross: When the 50-day MA crosses above the 200-day MA — a bullish signal.

Sources

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency markets are volatile and investors should conduct their own research before making any investment decisions.