According to sources, The CME Group’s XRP and Micro XRP futures have reached $542 million in total trading volume since their launch. Analysts see this as an early sign of a possible XRP price surge that might start a new bull run.

Launched on May 19, the CME’s XRP and Micro XRP futures have grabbed attention from big institutions and retail traders. This strong interest in the regulated instruments shows growing confidence in XRP as a serious digital asset.

Institutional Appetite Drives XRP Futures Demand

The XRP futures contracts have attracted a wide range of participants, like ETF issuers, hedge funds, and individual traders.

According to CME’s report, more than 15 institutional firms and four retail platforms were involved in the strong $19.3 million trading volume on the first day. Since then, total volume has reached $542 million, with 45% of that trading activity coming from outside of North America.

Victor Chen, a derivatives analyst at DerivPoint, said the global interest is clear. When almost half of the XRP futures trading comes from outside the U.S., it shows that people around the world want to follow and invest in XRP price movements.

Growing Open Interest Signals Market Maturity

Along with high trading volumes, open interest for XRP futures has reached $70.5 million, which is an important metric that indicates that investors are keeping their positions instead of just trading quickly. Experts see this as a sign that the XRP futures market is becoming more stable and mature.

Marta Griffin, a senior strategist at Hightower Capital, said the increase in open interest shows that traders believe the XRP price will keep moving steadily, not just in quick ups and downs.

CME offers two types of contract sizes, one is the 50,000 units for standard XRP futures, and the second is 2,500 units for Micro XRP futures. Both are settled in cash using the CME CF XRP-Dollar benchmark rate, so there is no need for wallets or blockchain transfers.

This feature makes it easier and convenient for institutions looking for regulated access to XRP without dealing with the technical side.

| Metrics | Value & Details |

| Current Price | $2.18 |

| 24 Hour Trading Volume | $2.86B |

| XRP Futures Launch Date | May 19, 2025 |

| Trading Volume | $542 million |

| Open Interest | $70.5 million |

| Contract Types | XRP, Micro XRP futures |

| Settlement | Cash-settled |

Ripple’s Strategic Moves Bolster XRP Price Outlook

Recent developments in Ripple’s ecosystem have also strengthened the XRP price. Ripple’s $1.25 billion purchase of the prime brokerage firm Hidden Road is likely to make it easier for big investors to access XRP-related products.

Moreover, the launch of RLUSD, a USD-backed stablecoin built on the XRP Ledger, has boosted the liquidity and increased activity on the network.

Alicia Mendoza, a blockchain investment consultant, said These are smart, well-planned moves. Ripple is making the XRP price stronger and also preparing for more big institutions to start using it.

Technical Indicators Hint at Bullish Momentum

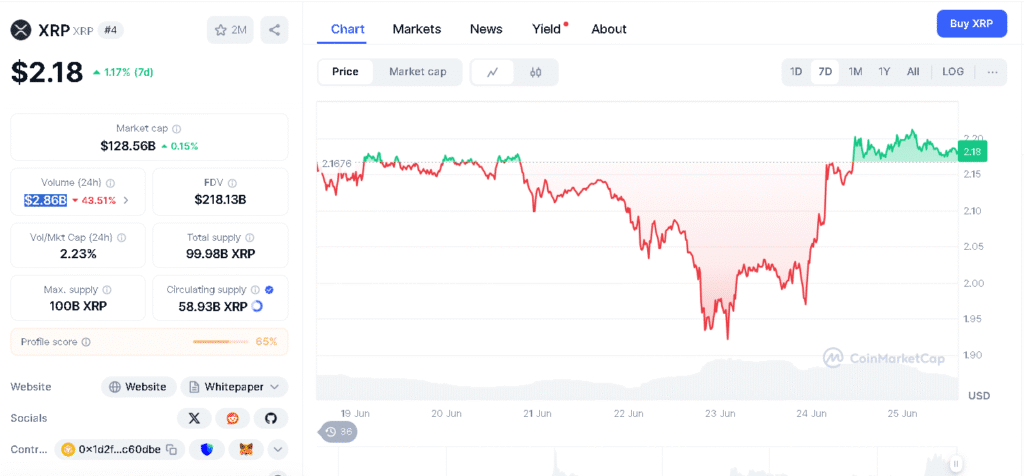

The XRP price is currently trading around $2.18 and is close to the 20-day simple moving average at $2.18. The chart shows the Bollinger Bands getting tighter, which often suggests a possibility of a breakout.

If the XRP price goes above the $2.20 resistance level, it might quickly rise toward $2.30, particularly if XRP futures trading volume and positive sentiment keep growing.

Market indicators also support this idea. The relative strength index is at 49, which shows momentum is balanced but might soon shift. Analyst Jae Min from CryptoRange said we are at a turning point. If buying increases, the XRP price could rise sharply in the coming days.

However, if the XRP price can’t break above the resistance and trading volume drops, it might fall back to the support levels around $2.03. This shows that even with the excitement around XRP futures, investors should still be careful and manage their risks.

Conclusion

The strong launch of XRP futures on CME and growing interest from big investors show that XRP is becoming more trusted in the world of finance.

The XRP price has good momentum with Ripple’s smart moves and new tools like RLUSD, but risks like the technical resistance zone and regulations are still present. Overall, XRP is starting to move beyond just hype and becoming a key part of digital finance.

Summary

XRP futures on CME have reached $542 million in trading volume within a month, showing strong interest from both big investors and retail traders. The open interest reached $70.5 million, proving that traders are holding their positions.

Ripple’s $1.25B Hidden Road deal and the launch of RLUSD have boosted the XRP price outlook. Technical charts suggest a possible breakout, but there are still some risks. Experts believe XRP is moving from hype to real finance.

FAQs

1. When did CME launch XRP futures?

May 19, 2025.

2. How much trading volume have XRP futures on CME recorded till now?

$542 million.

3. How many institutional firms traded XRP futures at launch?

More than 15.

4. What is the current open interest in XRP futures?

$70.5 million.

5. What major acquisition did Ripple make?

Ripple bought Hidden Road for $1.25 billion.

Glossary

XRP Futures – Derivative contracts to speculate on XRP’s price without owning the token.

CME Group – A leading U.S. exchange offering regulated cryptocurrency futures.

Open Interest – The total value of outstanding futures contracts that remain unsettled.

Micro Futures – Smaller-sized contracts designed for lower exposure and precision trading.

Hidden Road – A digital asset brokerage acquired by Ripple to support institutional market access.