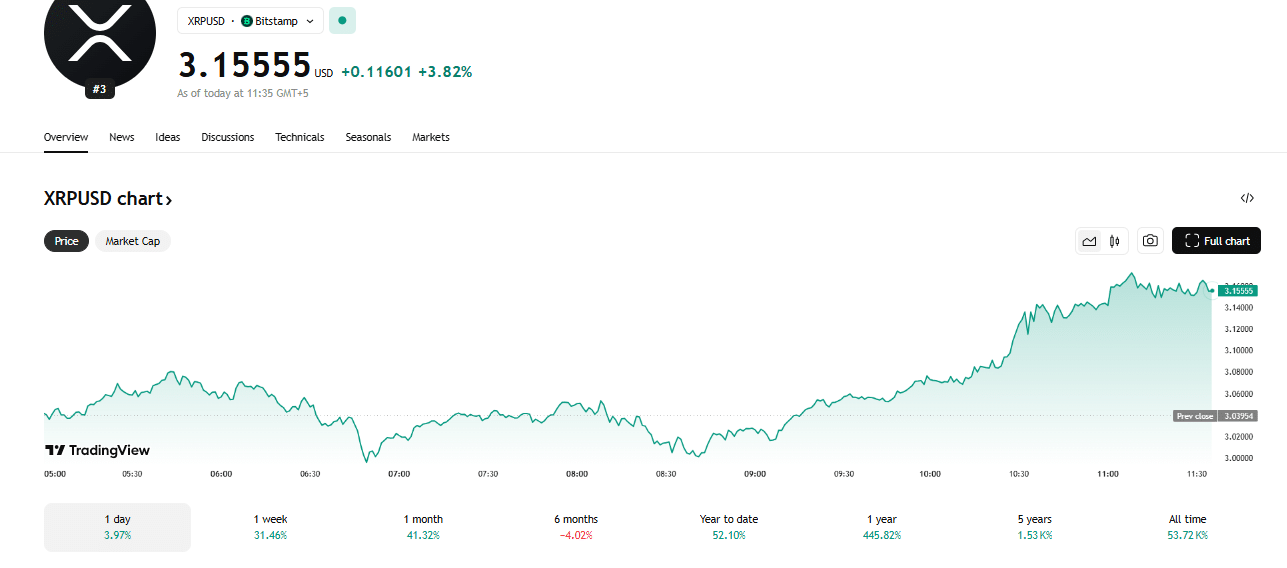

According to the official source, the XRP Futures ETF has generated significant interest since its pre-application days, leading up to its official launch on July 18. XRP climbed to more than $3, a sharp rise supported by high trading volumes, signaling an influx of institutional participation and a shift in global trading dynamics for XRP.

ETF Announcement Pushes XRP Volume to Multi-Month Highs

The XRP Futures ETF, launching under ProShares, will allow investors to gain exposure to XRP through futures contracts on the CME. This regulated pathway opens the door for larger players who previously avoided direct token exposure due to legal or custodial issues.

Recent data from sources shows XRP futures volume exceeded $235 million daily, with total turnover since May hitting $1.6 billion.

This volume increase directly coincides with the growing institutional interest and represents a shift in market sentiment, especially following prolonged periods of price stasis.

On this note, volume spikes of this nature usually precede significant changes in trend. Crypto strategist Priya Das observed,

“We’re seeing the kind of structured accumulation that usually happens before multi-week breakouts. If the ETF launch goes well, XRP could rally well past $3.40.”

Maya Lin, an analyst at Brave New Coin, similarly stated, “If volume stays above $200 million daily, XRP could break through multi-year resistance zones.”

Technical Picture: Key Levels and Market Reaction

XRP has climbed from a low of nearly $2.78 to reach $3.02, testing a key resistance zone. The breakout is driven by anticipation surrounding the XRP Futures ETF. Analysts say that this ETF could help stabilize market access and drive liquidity from institutional desks.

| Indicator | Status | Implication |

|---|---|---|

| Resistance Tested | $3.00 – $3.03 | ETF-driven breakout zone |

| Volume Spike | 176M XRP traded | Confirms strong demand |

| Next Targets | $3.40 → $3.84 | If ETF debut performs well |

| RSI | 79 | Potential short-term exhaustion |

| Support Level | $2.84 | Buy zone if price dips after the launch |

Analysts Weigh In

Market strategist Ben Kessler said:

“The XRP Futures ETF will test how far institutional adoption has come. If early volume sticks, we could see XRP retest its all‑time highs.”

Charts shared on TradingView also support this thesis, showing bullish momentum with higher lows and strong candle closes.

What to Watch After the ETF Launch

While optimism surrounds the XRP Futures ETF, traders are urged to monitor a few factors:

- Whale Activity: Large transfers to exchanges may lead to short-term selling.

- ETF Inflows: Weak inflows following the launch could disappoint traders expecting a price breakout.

- SEC Decisions: A pending decision on a spot XRP ETF, expected around July 25, could shift momentum either way.

Long-Term Impact

The launch of the XRP Futures ETF signals a maturing market structure for XRP. If volume remains strong and volatility stays controlled, the ETF could serve as a key entry point for regulated capital. This has long-term effects on XRP’s market stability, price discovery, and integration into financial products.

Conclusion

Based on the latest research, the XRP Futures ETF is already influencing market behavior ahead of its official launch. The increasing trade volume and bullish price movements demonstrate rising confidence among traders. As institutional capital pours into the market, with XRP maintaining key support, the ETF could open up possibilities for regulated exposure and long-term growth. While there will be short-term dips, this could mark a new chapter in XRP’s role in international financial markets.

Summary

All eyes are now on the impending XRP Futures ETF, with XRP’s price breaking the $3 level and showing substantial trading volume. This will enable institutional participation in holding XRP through regulated futures as of July 18. Market data has also reflected these developing momentum indicators, with the next level seen to be around $3.40. While this proves to be risky in the short term, the new ETF serves as a testament to rising confidence in XRP’s future as a tradable, regulated digital asset.

Stay updated on XRP Futures ETF developments by visiting our homepage for the latest news and analysis.

FAQs

What is the XRP Futures ETF?

It’s an exchange-traded fund that tracks XRP futures contracts, providing traders with exposure without requiring them to hold XRP directly.

When will it launch?

It launches on July 18 under ProShares, the same firm behind Bitcoin and Ethereum futures ETFs.

How does this affect XRP’s price?

Futures ETFs often drive liquidity and speculation. Increased demand may push prices higher if volume stays strong.

Is it regulated?

Yes. The ETF will trade on CME, a U.S.-regulated derivatives exchange, offering institutional trust.

Glossary

ETF: Exchange-traded fund, a product that tracks an asset or group of assets.

Futures Contract: Agreement to buy or sell an asset at a future date for a set price.

Volume: The Total amount of an asset traded in a given time frame.

RSI (Relative Strength Index): A momentum indicator used to spot overbought or oversold levels.

CME (Chicago Mercantile Exchange): Major U.S.-based futures and options exchange.