XRP may be preparing for its next explosive move. Despite recent sideways price action, four powerful signals are aligning to suggest a breakout could be imminent, potentially pushing the asset toward $2.60. These indicators include a textbook ascending triangle pattern, surging open interest, large-scale whale accumulation, and the rapid expansion of Ripple’s native stablecoin, RLUSD.

XRP Price Holds Steady, But Signals Turn Bullish

At the time of writing, XRP is trading at $2.26, posting a marginal 0.1% gain in the last 24 hours. While the price appears stable on the surface, trading volume tells a different story—XRP has recorded a massive $4.73 billion in daily trading activity, signalling renewed market interest.

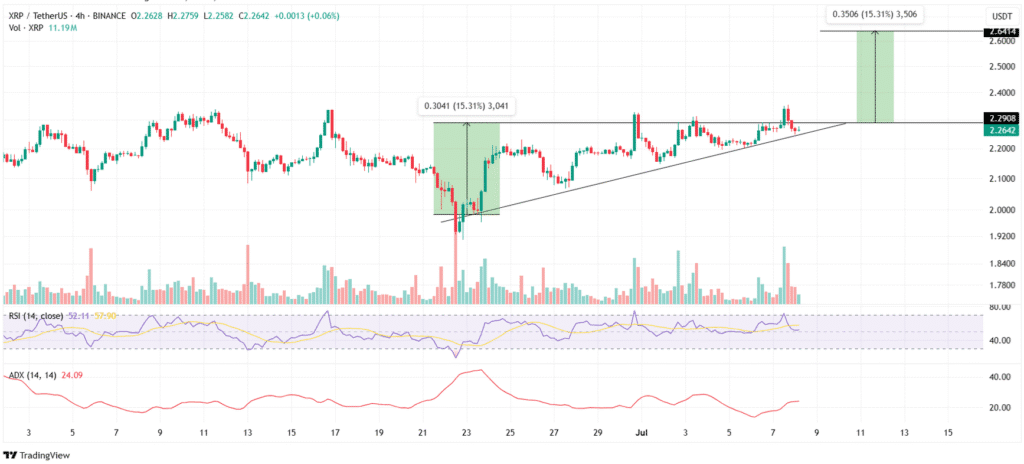

From a technical perspective, XRP is forming a bullish ascending triangle. This classic chart pattern involves higher lows pressing against a stable resistance level, currently around $2.29. If that resistance breaks, analysts project a sharp rally, with price targets ranging from $2.60 to $2.64, representing a potential gain of over 15%. Supporting indicators like the Relative Strength Index (RSI) and Average Directional Index (ADX) also suggest bullish momentum is building.

Open Interest Surge Confirms Market Confidence

Beyond the charts, market data supports the bullish case. According to Coinglass data from July 8, 2025, XRP’s open interest has surged from $3.54 billion to $4.9 billion in just two weeks. This rapid rise reflects growing investor conviction in a positive price trajectory.

Adding to this optimism is Ripple CEO Brad Garlinghouse’s upcoming address to the U.S. Senate—a highly anticipated event that could significantly influence market sentiment and regulatory clarity.

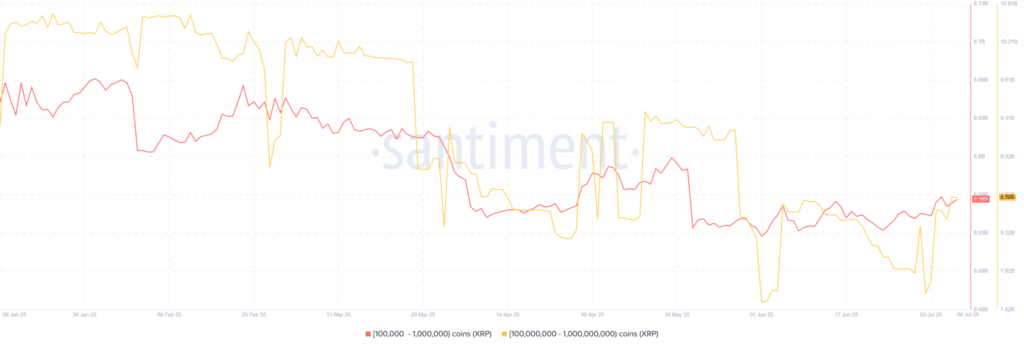

Whales Are Buying—and Holding

Institutional and large-scale investors, often dubbed “whales,” have been quietly accumulating XRP at an aggressive pace. Wallets holding between 100 million and 1 billion XRP have increased their holdings from 7.6 billion to 8.59 billion XRP in recent weeks. Historically, such accumulation precedes major price moves.

RLUSD Stablecoin Strengthens the Ecosystem

Ripple’s RLUSD stablecoin is also seeing remarkable growth. Its market cap has ballooned by over 800% year-over-year, approaching the $1 billion mark. This surge not only reinforces trust in Ripple’s ecosystem but also adds deep liquidity that could amplify XRP’s upward potential.

The convergence of technical patterns, market positioning, institutional interest, and ecosystem expansion places XRP in a strong position for a significant rally. Traders and long-term holders alike are now watching the $2.29 resistance level closely, as a decisive breakout could trigger the next major leg up.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!

Sources:

- Coinglass (July 8, 2025): coinglass.com

- CoinMarketCap: coinmarketcap.com