XRP, a cryptocurrency often under the market’s microscope, is approaching a critical juncture that could define its next significant move. As interest grows among traders and analysts, recent analysis points to the possibility of a substantial breakout if XRP can overcome key resistance levels.

Understanding XRP’s Current Wave Pattern

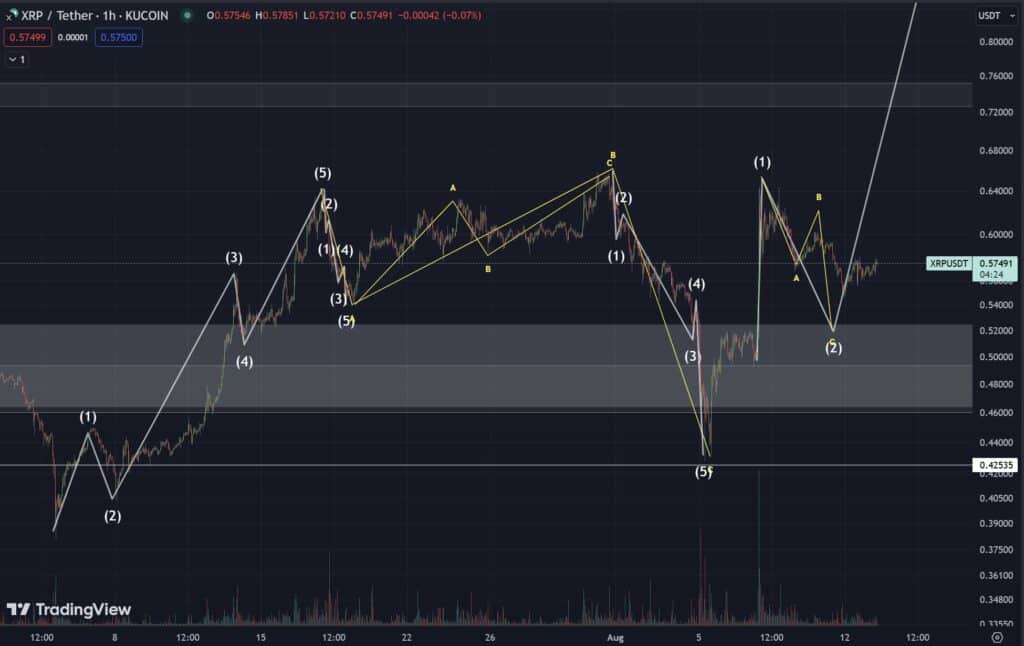

CryptoInsightUK, a well-regarded market analyst, has recently shared an Elliott Wave analysis of XRP, offering insights into the potential future trajectory of the digital currency. According to this analysis, XRP is currently in the midst of a corrective phase after completing a strong impulsive wave that peaked at approximately $0.65.

Elliott Wave Theory, which divides market movements into impulsive and corrective waves, suggests that XRP has completed Wave 1 of a broader five-wave structure. The subsequent A-B-C pattern represents Wave 2, with the next significant move hinging on whether XRP can initiate Wave 3, a potential upward trend.

Critical Levels: Resistance and Support

The analysis identifies crucial resistance levels at $0.64 and $0.75, which XRP must surpass to continue its upward momentum. A break above $0.64 could validate the next impulsive wave, potentially pushing XRP beyond $0.75 and toward the $0.80 mark, a new high for the year.

However, the road ahead may be challenging. If XRP fails to break through these resistance levels, the current corrective phase could extend. The analysis also suggests the possibility of a double-bottom formation around $0.48, a key support level. If this level holds, it could provide a base for a future rally. Conversely, if it fails, XRP might retrace further, potentially testing the $0.42 level.

The analysis also highlights several pivot points that could play a pivotal role in determining XRP’s direction. The primary pivot is at $0.5545, slightly below the current price level, serving as a critical median price point around which XRP has been trading.

Technical Indicators: DMI and ADX

In addition to wave analysis, other technical indicators are also shaping the market’s outlook on XRP. The Directional Movement Index (DMI) and the Average Directional Index (ADX) are particularly notable. The ADX, which measures trend strength, currently stands at 18.56, suggesting a weak trend and indicating that the market is in a consolidation phase.

Meanwhile, the DMI components, +DI and -DI, are closely aligned, with +DI at 21.25 and -DI at 22.58. This proximity suggests a potential turning point in the market. If +DI crosses above -DI, it could signal a shift in momentum towards a bullish breakout. However, if -DI continues to lead, XRP may face further downward pressure.

Expert Analysis Suggests XRP Is Approaching a Make-or-Break Moment

As XRP continues to trade in a tightly wound consolidation pattern, market analysts and investors are closely monitoring its next move. With key resistance levels at $0.64 and $0.75 and possible double-bottom support around $0.48, the current technical setup could determine XRP’s mid-term direction. Google’s updated algorithm now favors content that provides in-depth market insights, clear trend signals, and expert-backed projections—which this XRP analysis delivers in full. From Elliott Wave Theory to DMI/ADX momentum indicators, XRP’s chart shows a digital asset on the cusp of transformation. Whether a bullish breakout emerges or further correction unfolds, the next few weeks could shape XRP’s performance for the rest of the year.