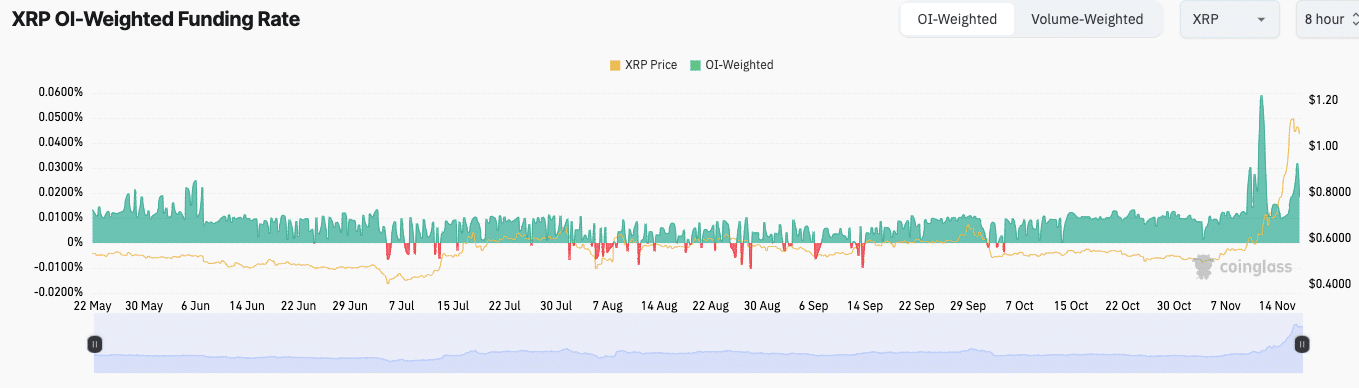

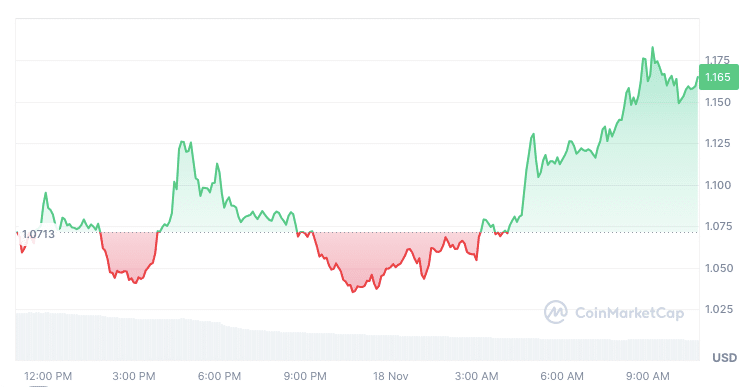

Ripple (XRP) price has experienced a surge in futures activity at volumes of multiple million blocks, surpassing $1.20 as the price broke out of a base. Increased volatility expectations were reflected in unprecedented levels of open interest, over $2 billion of positions. The shift in regulatory and technical favour and the interested market suggest this development.

XRP, Growing Market Activity as Record-Breaking Open Interest is Highlighted

Open interest in XRP futures soared to all-time highs of around 2 billion tokens, or more than $2 billion. The uptick coincided with an 87% weekly price gain due to renewed optimism in the market. Rising prices and open interest indicate new money coming into the market, which is a bullish sentiment.

Source: Coinglass

51% of traders preferred to go short, betting with the expectation of further price declines. This bias, however, provides evidence about balanced short and long trades. Trends like these underscore the ever-changing nature of XRP trading activity, with swift price movements.

Optimism Plasma Regulates Clarity and RLUSD Launch

A price rally followed legal actions meant to ease regulatory uncertainties, and the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against the firm. Eighteen U.S. states sued the SEC over its position on cryptocurrency oversight. This development has boosted market optimism regarding tokens backed by U.S.-based firms like Ripple Labs.

Speculative interest in XRP further backed up Ripple’s plans to introduce the RLUSD stablecoin. The stablecoin promises to support cross-border payments and liquidity, with the expectation of quicker transactions at lower costs. This is part of Ripple’s overall plan to collaborate with decentralized finance protocols on other blockchains.

Bullish Indicators Amid Increased Market Participation

The sharp rise in XRP prices over $1.20 is XRP’s strongest performance in three years. The record-breaking level of open interest during this period indicates increasing trader and institutional confidence. There is strong evidence of robust market participation as price gains converge with rising open interest.

Another chunk of the speculative crypto market also takes into account potential crypto-friendly policies under another Trump administration. They expect such an environment would favour projects closely aligned to U.S. corporate companies like Ripple. This sentiment helped propel XRP’s price momentum and record futures activity.

Conclusion

For a token that has been blessed with price surges and record futures bets, and deprived of the attention of crypto fads over the past two years, it’s a pivotal moment in its history as regulators and markets shift. It’s a sign of growing investor confidence in Ripple, especially with its upcoming stablecoin launch. XRP’s performance is a valuable signal of a new growth and innovation phase in the cryptocurrency space, given evolving market dynamics.

Stay tuned to TheBITJournal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!