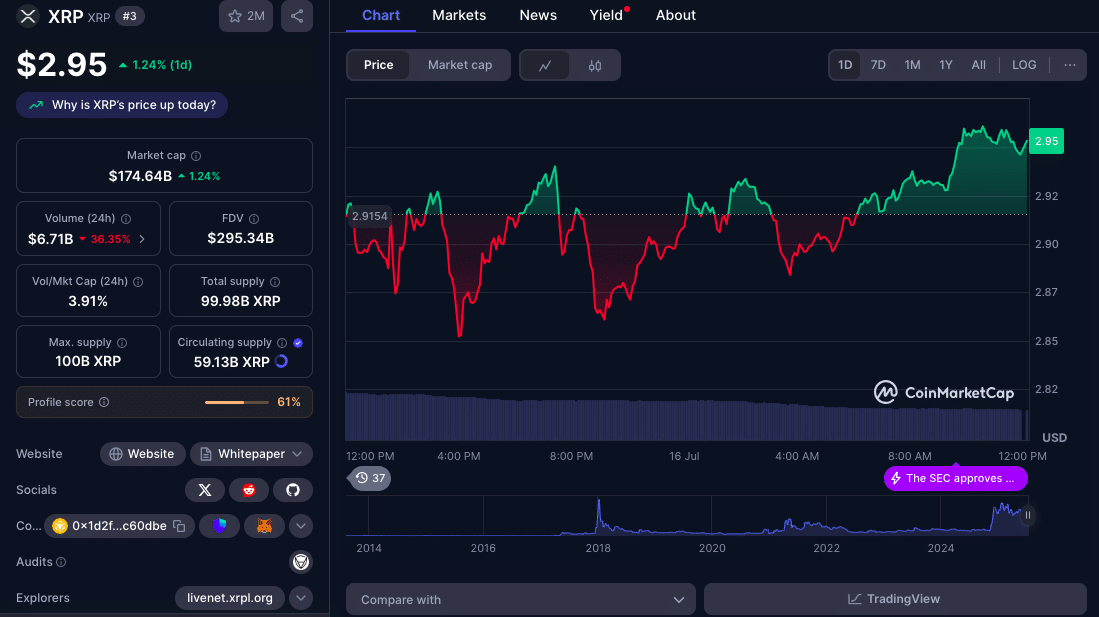

XRP is consolidating below the $3.00 level with resistance at $2.95, capping intraday gains. As institutional volume surges and ProShares is about to launch its XRP Futures ETF on July 18, the market is showing a deliberate accumulation pattern. Looking at this XRP price analysis, despite multiple attempts to clear the barrier, support at $2.85 is holding strong, positioning for a volatility event.

Treasury desks reload at $2.85 as volume spikes

The key to this price action is sustained institutional activity. Market makers and treasury desks are reloading at $2.85, absorbing sell pressure with volume way above the 78.9 million token daily average. Between 14:00 and 19:00 UTC, XRP had accumulation windows, even with ETF uncertainty.

In the final hour between 02:33 and 03:32 UTC, XRP went from $2.88 to $2.90, supported by over 2 million tokens in 6 minutes at 02:36. This is an institutional footprint and shows big holders are cautious but steady.

The technical Structure is Bullish, pending a Breakout

XRP’s setup is higher lows and rejections at the upper boundary of the range. According to FXStreet technical analysts, the resistance has been tested and rejected 4 times in 24 hours. That kind of congestion usually precedes a move.

Momentum needs a confirmed breakout above $2.95 with daily volume above 100 million tokens. Until that happens, XRP is coiled. Experts explain that XRP is seeing range-bound behavior with disciplined treasury positioning.

The $2.85 support is not just technical as traders think crossing $3.00 will trigger allocation upgrades from structured corporate treasuries and a broader altcoin trend.

| Scenario | Trigger | Target Range | Commentary |

| Bullish Breakout | Close above $2.95 on heavy volume | $3.00 – $3.10 | ETF may drive allocation inflow |

| Sideways Accumulation | Range-bound activity (2.85–2.90) | Same range | Prep mode until ETF confirmation |

| Bearish Breakdown | Dip below $2.88 | $2.85 – $2.82 – $2.75 mini-drop | Weak momentum may persist |

What’s at stake with the XRP ETF?

The upcoming ProShares XRP Futures ETF on July 18 is adding fuel to the accumulation narrative. Although US regulatory uncertainty is a headwind, institutional-grade exposure via a regulated ETF is seen as a big deal for XRP.

ETF expert Eric Balchunas of Bloomberg said earlier that XRP’s futures product will be one of a kind in its class if approved, and that alone justifies the buildup.

However, analysts say regulatory uncertainty is limiting full allocation among top desks.

Expert forecasts: Will XRP break $3.00?

CoinCodex says XRP will go up if ETF flows are big. Their short-term model is $3.25 by July 20 if XRP goes above $2.95. CoinPedia is more conservative, predicting $3.10 unless altcoin sentiment shifts. WalletInvestor is neutral, with $2.75-$2.95 until ETF sparks a breakout. TradingView sentiment is 57% long for the next 3 days.

Conclusion

Based on the latest research, XRP price analysis shows a market on edge; coiling below a key resistance zone with institutions reloading at $2.85. Price is cautious but all eyes are on July 18’s ETF launch. Above $2.95 could be the catalyst for corporate reallocation and a retest of $3.00 or higher.

Below $2.88 could unwind short-term structures and bring $2.82 back into focus. For now, XRP is range-bound but not without purpose.

Stay up to date with expert analysis and price predictions by visiting our crypto news platform.

Summary

XRP is coiling below $3.00 as institutions accumulate at $2.85 ahead of the ETF. Price has rejected 4 breakouts in 24 hours and support has held with 2M+ token volume. Technicals show higher lows, pressure is building. Analysts say a clean break above $2.95 with volume could be the catalyst for $3.00+.

FAQs

What’s the current XRP resistance?

XRP is resisting at $2.95, a zone that has rejected 4 breakouts.

What level are institutions defending?

$2.85 is the accumulation point for institutions.

When is the XRP ETF launching?

ProShares XRP Futures ETF is launching on July 18, 2025.

What will trigger a breakout?

A sustained move above $2.93 with 100M+ token volume will confirm the trend.

Will XRP hit $3.00 soon?

Analysts say a break above $2.93 could take XRP to $3.00+ if ETF flows are strong.

Glossary

XRP: native token of the Ripple network, for fast cross-border transactions.

ETF (Exchange-Traded Fund): marketable security that tracks an index, commodity or asset and trades like a stock.

Volume Spike: sudden increase in tokens traded in a short period, indicating interest.

MACD: technical indicator to measure momentum and potential reversals.

RSI (Relative Strength Index): momentum oscillator to measure speed and change of price movements.