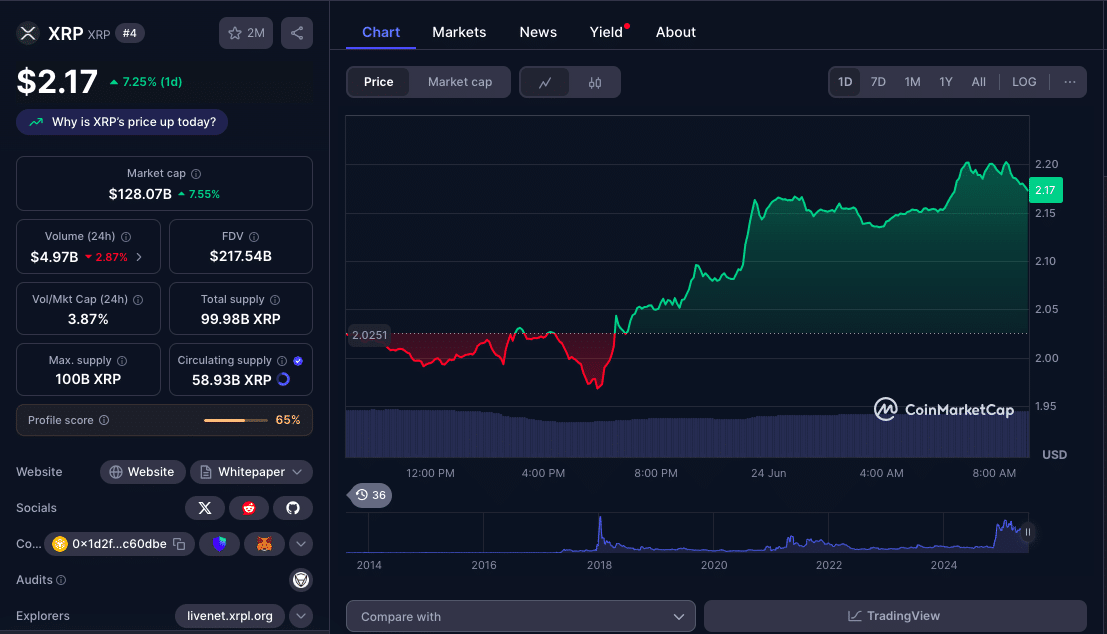

XRP price broke $2.15 in the last 24 hours, driven by a mix of geopolitical de-escalation and institutional interest. This latest price break followed an unexpected announcement from US President Donald Trump who declared a “complete and total ceasefire” between Iran and Israel after nearly two weeks of escalating conflict.

Trump’s statement on Truth Social said the ceasefire would start 6 hours after the announcement, with Iran starting the process and Israel joining 12 hours later. This is happening just days after US airstrikes hit Iranian nuclear sites, sending global markets and crypto valuations into a tailspin.

Ripple Gets More Than Just a Political Breeze

While the ceasefire may have given short term risk-on sentiment a boost, XRP’s move isn’t just about global headlines. Recent market developments have added a lot of fuel. Based on available reports, last week, Canada approved 3 XRP spot ETFs, a big deal that some see as a precursor to US approvals. The SEC has several XRP ETF proposals under review and institutional demand is growing regardless of regulatory lag.

In the last week alone, 3 major global investment firms have reportedly announced large scale backing for XRP based projects. Singapore’s Trident Technologies has committed $500m, China’s Webus International has committed $300m and UK’s VivoPower has committed $121m. These investments are expected to expand the XRP Ledger and fund next gen DeFi initiatives.

Exchange Reserves Declining

One trend that’s reinforcing the bullish momentum is the big decline in XRP exchange reserves. According to CryptoQuant, data reserves have dropped 21% from $3b to $2.3b in a short period. This is a sign of decreasing sell pressure and many holders are moving tokens into cold storage or DeFi protocols rather than selling.

However, some analysts warn that lower exchange liquidity can cut both ways. While a smaller supply can support price appreciation, it can also increase volatility if there’s rapid selling or liquidations.

Broader Market Implications

XRP is up as the broader crypto market stabilizes. Bitcoin is also back around $106,000 and Ethereum and Solana are up too after the ceasefire reports. Analysts say this is a sign of how much crypto sentiment is tied to global headlines, especially for riskier assets like altcoins.

But XRP’s price is standing out. Unlike many tokens that saw a brief relief rally, XRP is up 9% week over week and building on fundamentals not just speculation. With possible US ETF approvals on the horizon, institutional capital expanding and geopolitical tensions subsiding, traders are re-rating XRP’s short term outlook.

Conclusion

The XRP price jump after President Trump’s ceasefire announcement shows rising investor confidence, structural support from ETF demand and institutional capital inflows. While declining exchange reserves add to the optimism on reduced sell pressure, they also bring caution on potential liquidity squeezes. As Ripple gains traction in traditional finance and DeFi, XRP looks set to remain one of the most watched altcoins in H2 2025.

Follow us on Twitter and LinkedIn, and join our Telegram channel.

Summary

XRP went up 7% in 24 hours, above $2.15, after President Trump announced a ceasefire between Iran and Israel. Geopolitical easing boosted crypto markets overall, but deeper structural drivers also drove XRP’s gains. Recent reports of three XRP spot ETFs approved in Canada, SEC reviews ongoing, and $1 billion in fresh institutional capital have boosted sentiment. XRP exchange reserves are down 21% meaning less sell pressure. Despite liquidity concerns, analysts see XRP price movement as fundamentally driven.

FAQ

Why did XRP price go up?

XRP price rallied after Trump’s ceasefire announcement between Israel and Iran, which eased market tensions and triggered altcoins to move up.

What institutional backing does XRP have?

Webus International, Trident Technologies, and VivoPower have reportedly invested $921 million in XRP-focused funds.

How do ETFs impact XRP?

Canada’s spot XRP ETFs are live, US approval pending. ETFs open up access for institutional and retail investors leading to more demand.

Does lower exchange reserve mean supply issue?

Yes, 21% drop in XRP reserves means fewer tokens available to sell, it supports price but may constrict liquidity.

Should traders be cautious?

Yes. XRP could drop if geopolitical tensions rise or if ETFs are delayed, traders are advised to monitor exchange flows and global news.

Glossary

Liquidity – Ease with which XRP can be bought or sold without significant price changes.

DeFi – Decentralized finance applications built on public blockchains.

Spot ETF – A fund that holds the asset and trades its shares.

Exchange reserves – XRP on exchanges; used to measure supply.

DeFi – Decentralized finance apps on public chains.