XRP is flexing fresh strength after bulls forced a 4.5 % intraday breakout to a session high of $2.35, then held the token comfortably above the psychological $2.26 line. The move comes as trading volume cracked 182 million XRP price in less than 24 hours and as Ripple edges closer to a U.S. banking license.

Historical Context: From Legal Clouds to Liquidity Surge

Since late-2024 the token has shaken off the repression of the SEC lawsuit, exploding from $0.50 in November to $3.40 by January 2025—an eye-watering 580 % run that reset long-term resistance zones. Corporate treasuries now control more than $470 million worth of XRP price, while fund giants such as Grayscale have re-listed the asset in diversified products, fuelling the latest up-cycle.

Key Price Levels at a Glance

| Metric | Value |

|---|---|

| Spot price (08 July 2025 UTC) | $2.27 |

| 24-hour range | $2.25 – $2.35 |

| Daily change | +4.5 % |

| Support zones | $2.25 / $2.18 |

| Immediate resistance | $2.38 |

| 24-hour volume | 182 M XRP |

Ripple’s Global Push Adds Fuel to XRP Momentum

Ripple’s recent expansion into Asia and Latin America through partnerships with banks and fintech platforms has amplified XRP’s utility as a cross-border settlement token. With RippleNet adoption growing, especially in corridors like Japan, Philippines, Brazil, and Mexico, demand for XRP as a bridge asset is expected to intensify, bolstering both liquidity and long-term price support.

Triangle Tightens

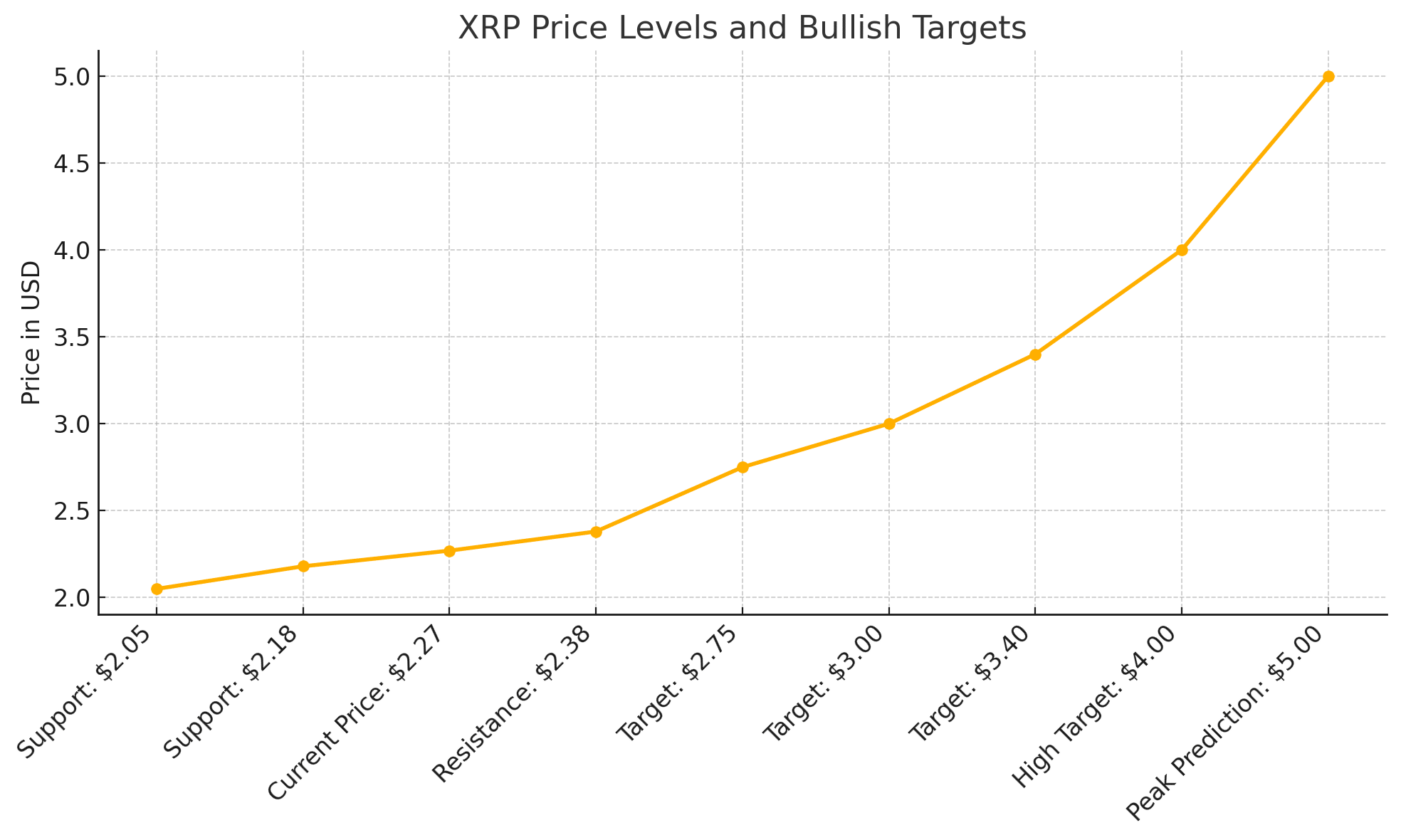

XRP price continues to coil inside a daily symmetrical triangle that has corralled price action since March. Funding rates flipped positive as derivatives volume spiked 165 %, hinting at pent-up directional energy. A sustained close above $2.40 would confirm a pattern breakout targeting $2.75–$3.00, while loss of $2.18 exposes $1.95.

Catalysts and Expert Views

ETF Pipeline: Ten XRP spot ETF filings now await U.S. regulator feedback, a theme analysts call the “bitcoin-effect replay” for settlement tokens.

Bank Charter Bid: Ripple’s application for an OCC national banking license would place the firm under dual state-federal oversight, a milestone expected to de-risk institutional adoption.

Policy Stage: CEO Brad Garlinghouse will testify before the Senate Banking Committee this week, amplifying visibility for market-structure legislation that could finally draw a line under the SEC dispute.

Ryan Lee of Bitget Research argues that “continued corporate allocations plus an ETF catalyst can stretch price toward $5 within months,” provided legal clarity coalesces.

Price Prediction: Next Leg Higher

Base-case modelling expects XRP price a break above $2.38 to ignite momentum toward $3.40, mirroring January’s volume-led rally. A bullish extension could revisit the $4.00 level ahead of Q4 ETF verdicts, while a bear-case retest of $2.05 would likely attract dip-buyers stacking for the charter decision.

Conclusion and Overview

Strength above $2.26 confirms buyers are absorbing profit-taking and preparing for the triangle’s apex. With liquidity, regulatory milestones, and ETF narratives converging, XRP price appears poised for a decisive move that could redefine medium-term valuations. Traders now sit on edge, awaiting confirmation.

Frequently Asked Questions

What triggered today’s rally?

A surge in spot volume, new institutional flows, and optimism over Ripple’s banking license combined to lift price beyond key support.

Is XRP price still influenced by the SEC lawsuit?

Yes. Although a settlement framework is largely priced in, final clarity remains a swing factor for ETF approval and bank charter progress.

Where are the next technical targets?

A daily close above $2.38 opens room toward $2.75–$3.00; failure to hold $2.18 could see $1.95.

Glossary of Key Terms

XRP price: the current market valuation of XRP in U.S. dollars

Symmetrical triangle: a converging trend-line pattern signaling a volatility squeeze

Funding rate: periodic payment between futures traders that indicates market bias

OCC: U.S. Office of the Comptroller of the Currency, bank charter authority

ETF: exchange-traded fund holding an underlying asset such as XRP

Support zone: price area where buying interest historically arrests decline

Resistance: price level where selling pressure typically caps advances

Volume profile: chart displaying traded volume at each price level

Liquidity: ease with which an asset can be bought or sold without slippage

Institutional allocation: purchase of crypto by corporations, hedge funds, or ETFs