The cryptocurrency market continues to experience high volatility, and XRP has been on the rise, driven by significant developments such as Grayscale’s XRP Trust launch and Robinhood relisting XRP. Additionally, Ripple’s partnership with the MiCA Crypto Alliance has grabbed the attention of investors. But what should XRP holders do next?

Grayscale and MiCA Collaboration Boost XRP

XRP has experienced a sharp recovery, bouncing from $0.50 to $0.58 during last week’s market correction—an impressive 15.6% increase. One of the key drivers behind this surge was Grayscale announcing its Ripple Trust, capturing significant investor interest. Moreover, Robinhood’s decision to relist XRP on its platform has further boosted enthusiasm for the altcoin.

Ripple’s growing presence in the MiCA Crypto Alliance, aimed at promoting blockchain compliance and sustainability, has also contributed to XRP’s price boost. This move positions Ripple as a regulatory-compliant platform, making it more attractive to institutional investors. According to analysts, developments like these could fuel further price increases for XRP.

XRP Price Nears Major Breakout

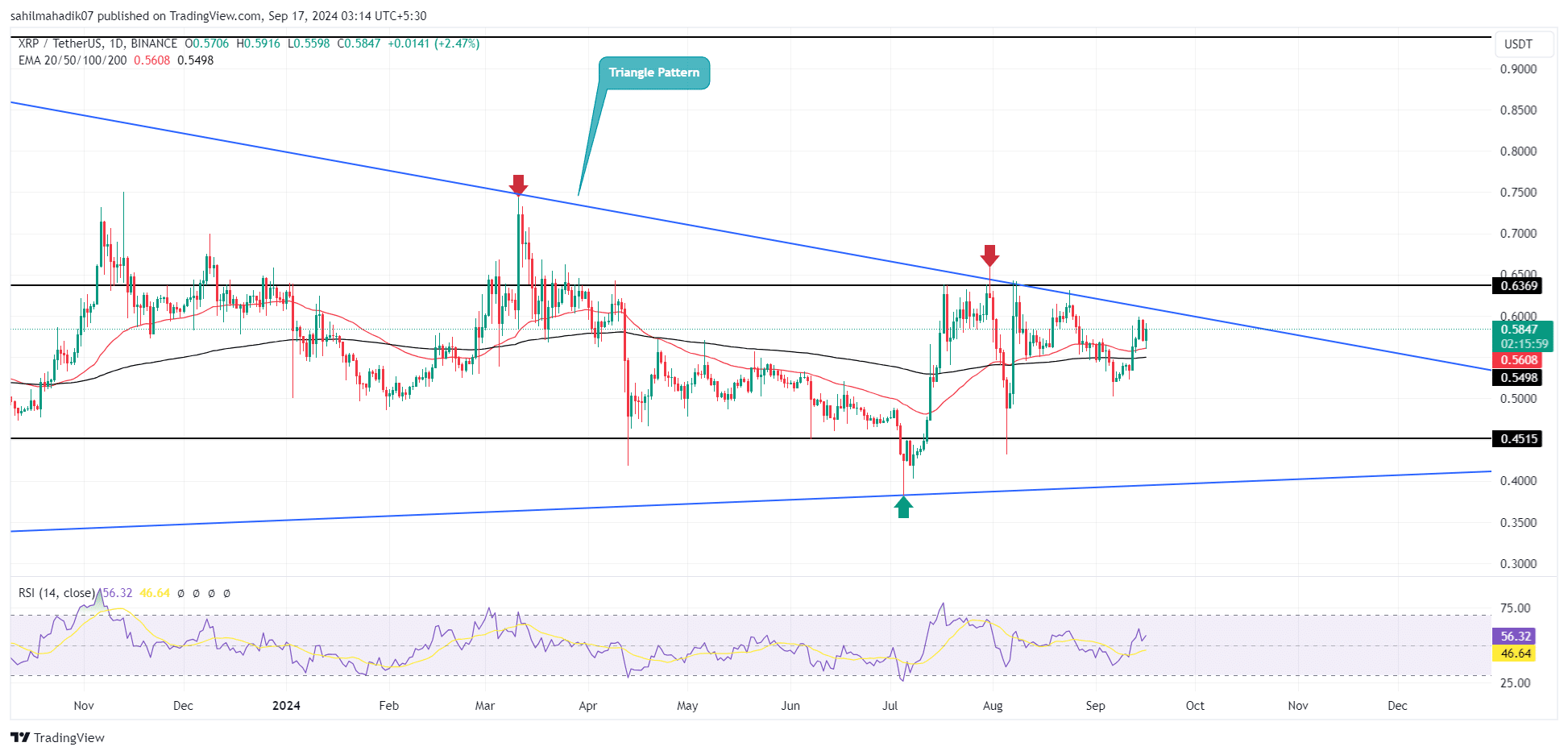

At the moment, XRP is trading around $0.591, with a market cap of approximately $32.6 billion. The recent market recovery has allowed XRP buyers to regain the 50- and 200-day moving averages—an essential step toward starting a new bullish rally. These metrics suggest a potential uptrend that could push XRP prices even higher. If buyers can maintain this momentum, XRP could soon challenge the upper boundary of a triangular formation that has been in play since September. A breakout from this pattern could send the price to $0.93 or even $1.40. However, if selling pressure increases, there is a risk of a pullback to $0.40.

Is It the Right Time to Buy XRP?

The critical question for investors is whether now is the right time to buy XRP. Experts believe that the current price offers a potential buying opportunity for those looking to capitalize on a possible upward trend. However, it is crucial to monitor market conditions closely and wait for resistance levels to be surpassed. This strategy can help minimize risk. Should XRP break through key trend lines, buyers could see even greater returns.

Ripple’s Upcoming Exchange Partnership: What Could This Mean for XRP?

In conclusion, the outlook for XRP remains positive for both institutional and retail investors. However, as The Bit Journal consistently emphasizes, adopting a cautious and strategic approach is essential for navigating this highly volatile market.