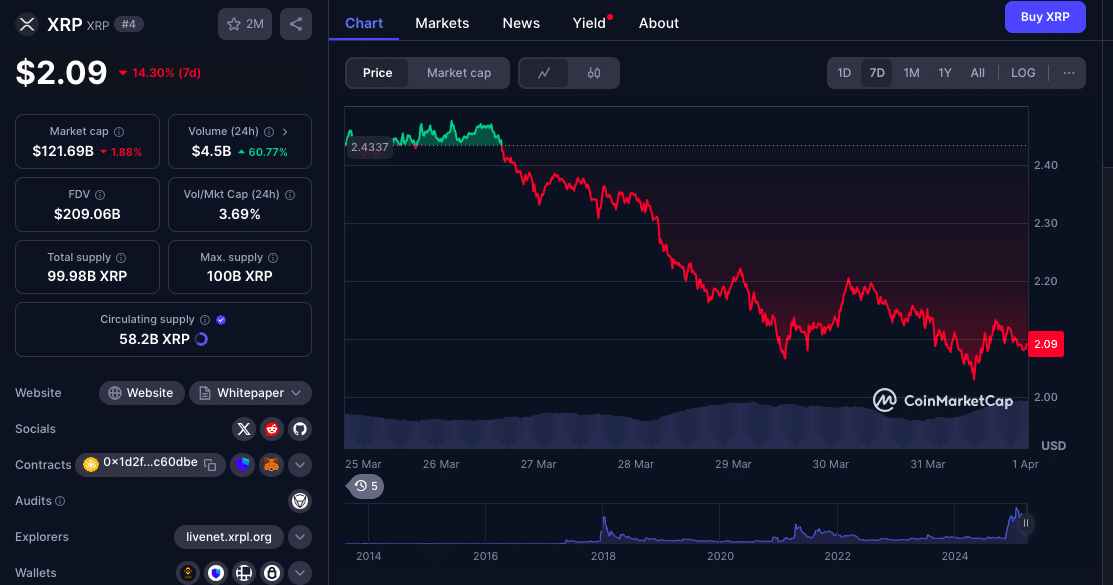

XRP has been all over the place lately, with analysts having different opinions on what’s next. Some think it’s going to break out big time, others think it will only go down. As XRP hovers around $2, investors are watching technicals, market trends and regulatory developments to see if it can get back to all time high or even surpass it.

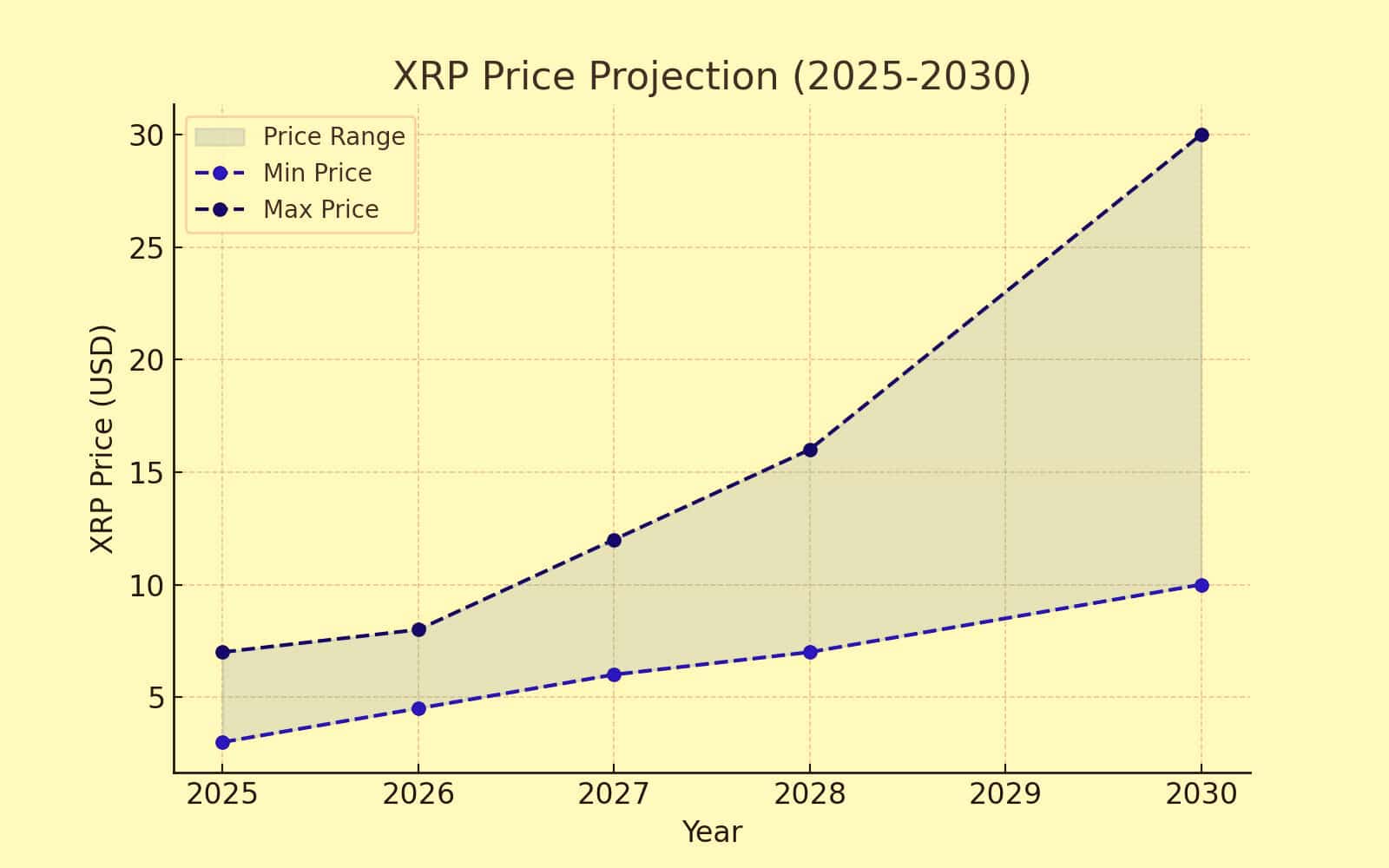

With predictions ranging from $4.60 to $30 in the long term, key factors like institutional adoption, macroeconomic conditions and legal clarity will play a big role in determining the asset’s value.

Recurring Bullish Trends: XRP’s Two-Peak Pattern

Market analysts have found a recurring pattern in XRP’s price action; a two-peak structure that has emerged during past bull runs. According to EGRAG Crypto, XRP typically has an initial rally, then a correction and consolidation phase, before surging to a second, higher peak.

In the 2017 Bull Run; XRP peaked at $0.3988 in June, then dropped. Three months later it reportedly went to $3.80 in January 2018.

In the 2021 Bull Run; the token peaked at $0.79 in November 2020, dropped 67% during Ripple’s lawsuit, then went to $1.96 in April 2021.

EGRAG suggests that XRP’s Relative Strength Index (RSI); a momentum indicator, looks like the conditions before past rallies. If history repeats itself, XRP’s second peak could be between May and June 2025 after its mid-January high of $3.40.

However, a sustained break below $2.00 could disrupt this pattern and force a reevaluation of the bullish scenario.

Technical Indicators Mixed

Bullish Scenario: A Rally to $4.60 and Beyond?

Crypto strategist EGRAG Crypto has found an inverse Head and Shoulders (H&S) formation, a bullish setup that could take XRP to $4.60 if certain resistance levels are broken. For critical support, XRP must hold above $2.00.

If XRP gets back to $2.65, resistance at $3.00–$3.90 could follow and then $4.60.

EGRAG warns that a rally of this size could trigger a distribution phase where big investors sell and the price corrects.

Bearish Scenario: Could XRP Plunge to $1.07?

Not all predictions for XRP are bullish. Veteran trader Peter Brandt on the other hand has found a traditional Head and Shoulders on XRP’s daily chart; a pattern that signals a bearish reversal.

A drop below $1.90 would confirm the pattern and send XRP to $1.07. A break above $3.00 would invalidate this scenario and be bullish.

Expert Forecasts: XRP Price 2025-2030

Several experts have given long term forecasts for XRP based on market cycles, institutional adoption and macroeconomic conditions.

| Year | Predicted Price Range | Key Factors |

|---|---|---|

| 2025 | $3.00 – $7.00 | Second bull run peak, ETF approvals, market sentiment |

| 2026 | $4.50 – $8.00 | Post-bull run consolidation, adoption growth |

| 2027 | $6.00 – $12.00 | Institutional partnerships, Ripple-SWIFT integrations |

| 2028 | $7.00 – $16.00 | Expanding cross-border payments, regulatory clarity |

| 2030 | $10.00 – $30.00 | Widespread adoption, blockchain scalability |

Will Institutional Adoption Lead to a Turn-around for XRP?

Ripple’s increasing collaboration with financial institutions is a major bullish catalyst for XRP’s long-term valuation. Over 10,000 banks have reportedly tested Ripple’s integration with SWIFT. That is a lot of potential large-scale adoption. Crypto analyst Javon Marks thinks XRP could see a 570% price surge by 2030; if it follows previous market cycles. This would put the price at $16. But regulatory developments and broader market conditions will play a huge role in determining whether that happens.

The regulatory landscape is a’ major factor in XRP’s price. The settlement between Ripple ‘and the SEC has removed a major overhang from XRP’s valuation. However, further regulatory clarity is still key. If XRP becomes a candidate for crypto spot ETFs, it is expected to enhance institutional interest. Additionally, the SEC’s stance on crypto; whether XRP is a security or a commodity; could drastically influence price trends.

There are several external and internal factors that could shape XRP’s ‘valuation in the coming years. Macroeconomic conditions, institutional involvement, regulatory developments, whale movements and market cycles will all be at play.

Conclusion

So will XRP reach $30 by 2030? It’s a tough call. The token’s future depends heavily on regulatory clarity, institutional adoption and broader market conditions. In the short term, XRP needs to hold key ‘support levels and break above critical resistance zones to maintain bullish momentum.

The next major price move is predicted between ‘May and June 2025. Investors should be keeping a close eye on technical indicators, whale activity and macroeconomic trends to navigate XRP’s volatile price trajectory.

Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

Can XRP hit $10 by 2030?

Some analysts think XRP could hit $10 by 2030 if institutional adoption and ‘regulatory clarity improves. But price is dependent on broader market.

What could drive XRP to $30?

Institutional ‘adoption, Ripple’s integration with financial systems and regulatory approvals.

Is XRP a good investment in 2025?

XRP’s price potential is strong but volatile. Investors should consider market’ trends, legal developments and risk factors before investing.

What’s the biggest risk to XRP’s price?

Regulatory risk. Unfavorable SEC rulings ‘or restrictions on Ripple’s operations could hurt XRP’s value.

Glossary

RSI (Relative Strength Index): A ‘momentum indicator to measure overbought or oversold conditions.

Head and Shoulders Pattern: A chart pattern that signals trend reversal.

Inverse Head and Shoulders Pattern: A bullish pattern.

Support & Resistance Levels: Price levels where buying (support) or selling (resistance) is strong.