XRP faces downward pressure because it could not surpass the $2.60 resistance barrier. Analysts predict catastrophic outcomes for investors if the price falls through important support at $2.50. The future direction will become clear if buyers do not intervene in this critical situation. The cryptocurrency market experiences strong volatility, while XRP and other altcoins respond primarily to macroeconomic events, governance changes, and Bitcoin dynamics.

Market participants watch these price levels because major price movements will likely determine the market trends over the next few weeks.

XRP price encounters intense selling pressure as the market shows signs of recovery during the past weeks. The technical market signals now show growing negative trends that make investors worried about a potential price decline. The market shows opposite viewpoints about potential price recovery while experts warn that a breach of fundamental support levels might result in major market drops. Weak trading signals require traders to handle both risk elements and price modification analysis to establish investment choices.

XRP Price Struggles at Resistance

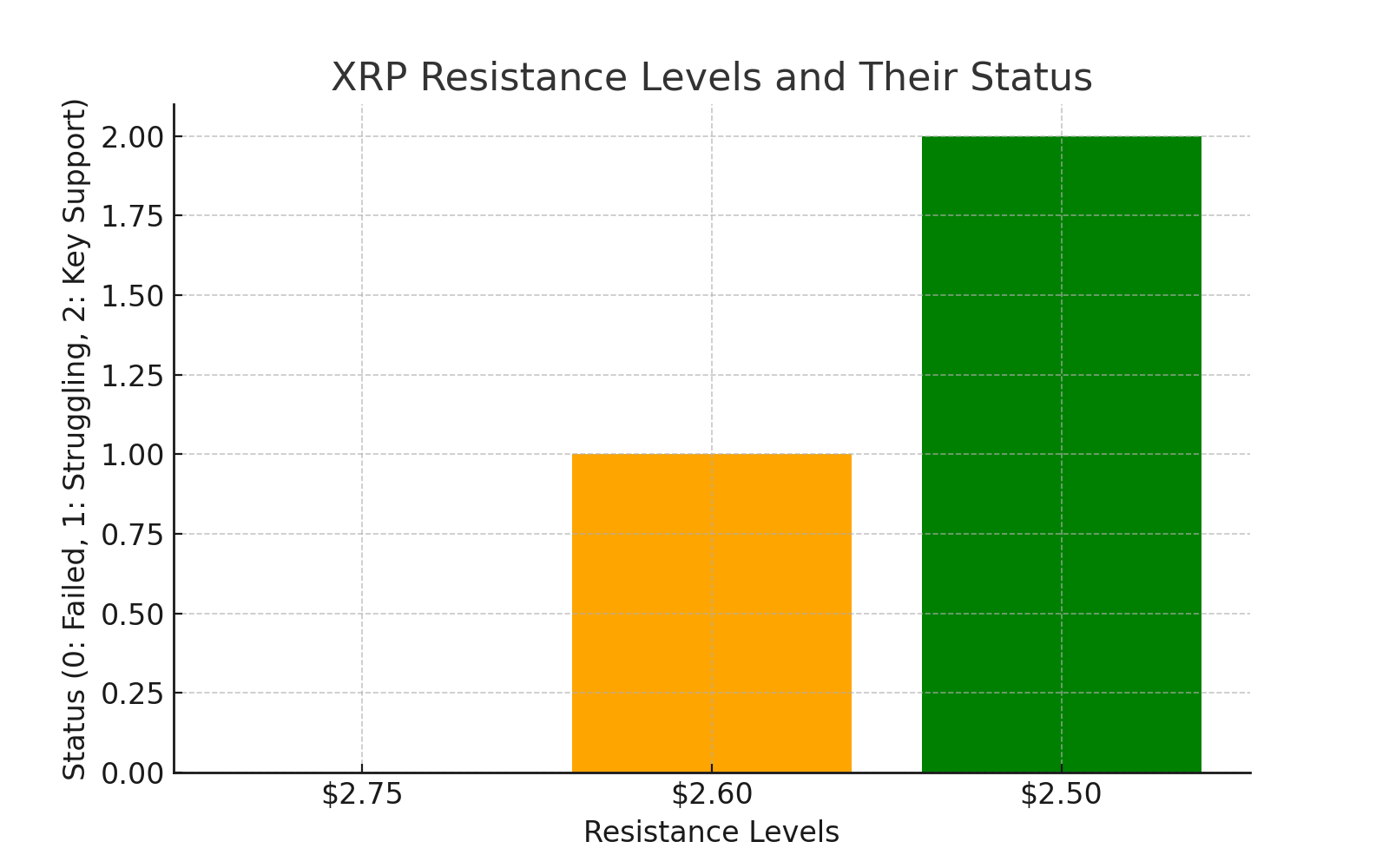

XRP price conducted an upward movement above $2.75 till it encountered robust selling resistance which triggered it to plunge beneath $2.60. Current market sentiment reflects a bearish condition because XRP price stands under the 100-hour Simple Moving Average (SMA) based on Kraken data.

| Resistance Level | Status |

| $2.75 | Failed |

| $2.60 | Struggling |

| $2.50 | Key Support |

“XRP faces substantial obstacles at the $2.60 resistance” according to John Parker from CryptoInsight in his role as cryptocurrency analyst. “The price movement will remain negative if bulls do not successfully break through the $2.60 resistance point”

The XRP price reached its lowest point at $2.508 during recent market decline then started a minor upward trend. The price made a brief contact with the 23.6% Fibonacci retracement level between $2.7450 and $2.5080 without sustaining upward movement.

Bearish Trendline Limits Recovery

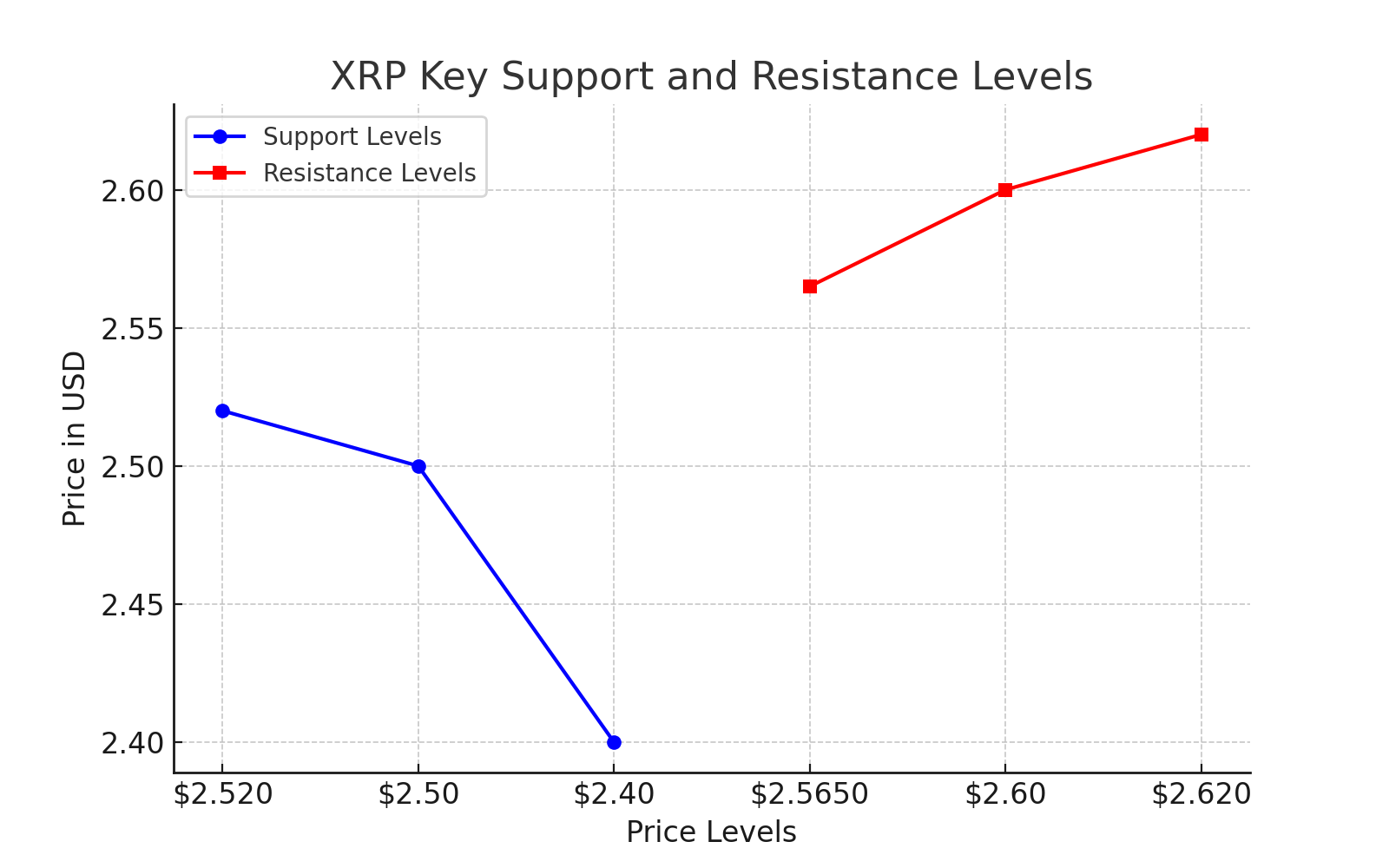

XRP price faces substantial resistance at $2.5650 as a downward trend continues to develop so the coin struggles to recover its previous value. The breakout beyond $2.620 resistance will result in XRP accessing a new barrier at $2.620; which happens to correspond with the 50% Fibonacci level of the recent price devaluation.

Based on TradingView information it shows that XRP may rise toward $2.65 or potentially reach $2.75 if it breaks past $2.620 successfully. The selling pressure may increase when buyers fail to establish dominance over the market.

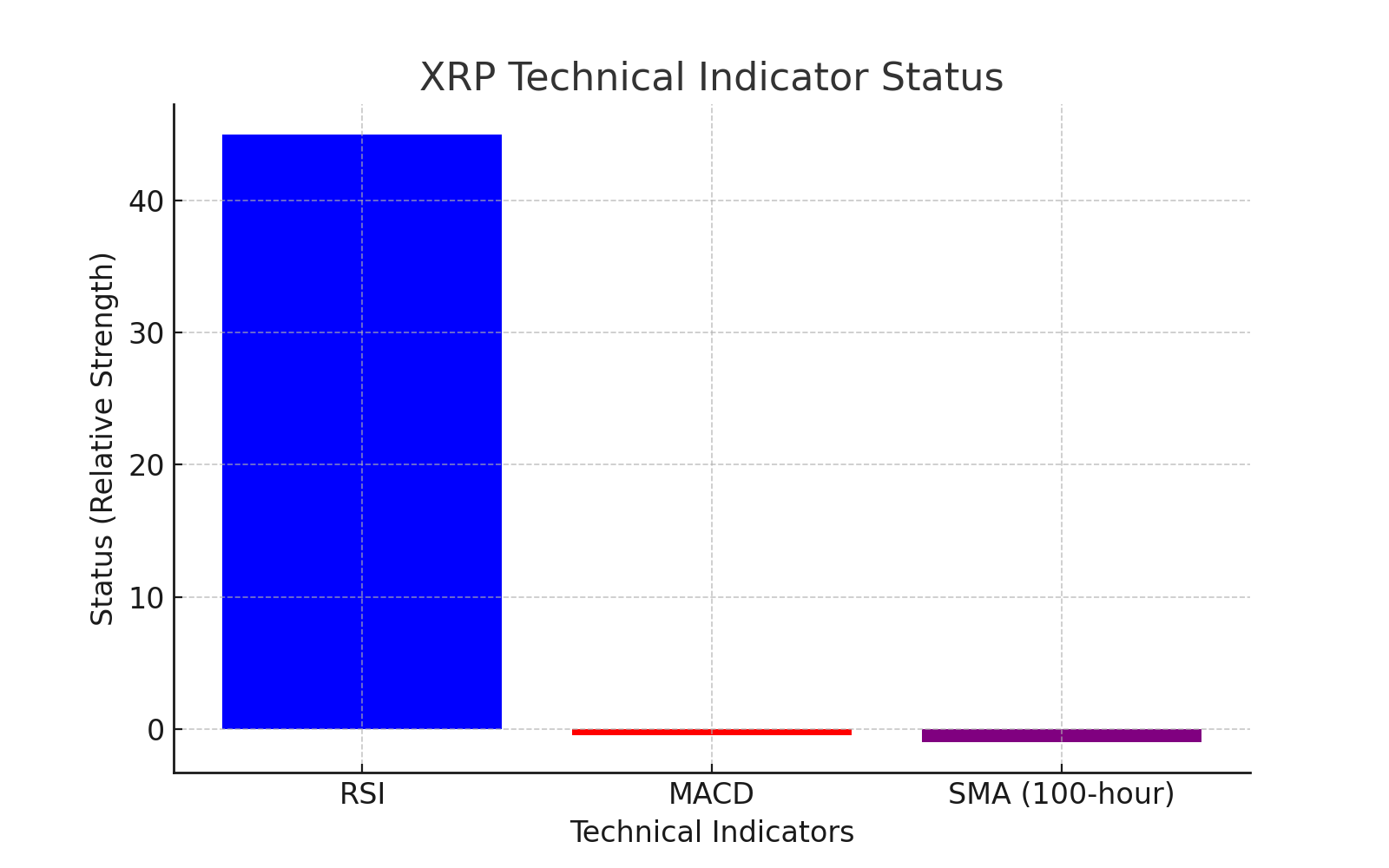

| Indicator | Current Status |

| RSI | Below 50 (Bearish) |

| MACD | Gaining pace in the bearish zone |

| SMA (100-hour) | Below price action |

Can XRP Bulls Prevent a Breakdown?

Can XRP Bulls Prevent a Breakdown?

The XRP token depends heavily on the $2.50 support threshold. A drop below the $2.50 support mark would send XRP prices falling toward both $2.40 then extending to $2.32.

“If XRP loses the $2.50 support, we could see a cascading effect, with sellers pushing the price even lower,” said crypto strategist Mark Lewis from CoinData. “Investors should be cautious and closely monitor this level.”

The price movement of XRP price depends on both its specific market and the movement within the broader cryptocurrency market. Any fresh Bitcoin and Ethereum selling pressure will likely trigger increased XRP downfall.

Key Levels to Watch

Traders should keep an eye on these key price levels:

| Support Levels | Resistance Levels |

| $2.520 | $2.5650 |

| $2.50 | $2.60 |

| $2.40 | $2.620 |

The short-term price action will strengthen if XRP successfully moves past $2.60 but the cryptocurrency may suffer additional losses if it fails to maintain above $2.50.

Conclusion

The price of XRP price continues to face strong resistance at its essential support zone which it struggles to surpass the $2.50 level. A bearish trend would strengthen as the price fails to return to $2.60 which could result in additional market decreases. Traders must track essential support and resistance levels because these price/activity points can shape the following significant market ascent or descent according to market analysts.

The price direction of XRP needs close monitoring alongside Bitcoin and Ethereum trends because both cryptocurrencies affect its market value. XRP currently exists in two possible directions since its price could either rebound or decrease further. Keep following The Bit Journal and keep an eye on XRP price.

FAQs

Why is XRP struggling to break $2.60?

XRP is having difficulty surpassing the $2.60 price mark. The $2.60 price area acts as a barrier for XRP because both market forces and general bearish trends within the cryptocurrency ecosystem work against its growth.

What happens if XRP breaks below $2.50?

The price going below $2.50 in XRP could trigger a substantial market decline to $2.40 or possibly down to $2.32. Market conditions will determine if a $2.50 breakdown leads to a drop to $2.40 and further to $2.32.

Is this a good time to buy XRP?

The current market condition offers what investors consider to be a favorable opportunity to acquire XRP.

Investors should exercise caution. XRP has higher probabilities of falling further unless it manages to return above $2.60.

What are key indicators to watch?

Several indicators should be monitored closely for analysis. The trend change indicators RSI and MACD, along with the 100-hour SMA, should be monitored for bearish or bullish signals.

Will Bitcoin’s price movement affect XRP?

The price changes in Bitcoin have a potential impact on XRP’s market value. Yes. The leading cryptocurrency Bitcoin creates continuous effects on the altcoin price movements of XRP.

Glossary of Key Terms

- Fibonacci Retracement: Technical analysts use Fibonacci Retracement as a tool to detect future price reversal levels in market direction.

- Simple Moving Average (SMA): An average of a cryptocurrency’s price over a specific period.

- RSI (Relative Strength Index): provides traders with an indication about asset conditions between overbought and oversold states.

- MACD: The trend-following momentum indicator MACD displays two moving average relationships through its system.

References

- Kraken Exchange Data

- TradingView XRP/USD Chart

- CryptoInsight Report – John Parker’s Market Analysis, February 2025

- CoinData Weekly Report – Mark Lewis on XRP Trends, February 2025

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!