XRP price holds a place as the digital currency managed by Ripple Labs and analysts predict a bullish trajectory for this token. The crypto analyst EGRAG CRYPTO believes XRP price will undergo a substantial price increase that could push the asset value to $33 in the following 28 days of forecasting. Agents have made such predictions after observing XRP’s market movements during the 2017 bull market.

Historical Parallels and Technical Indicators

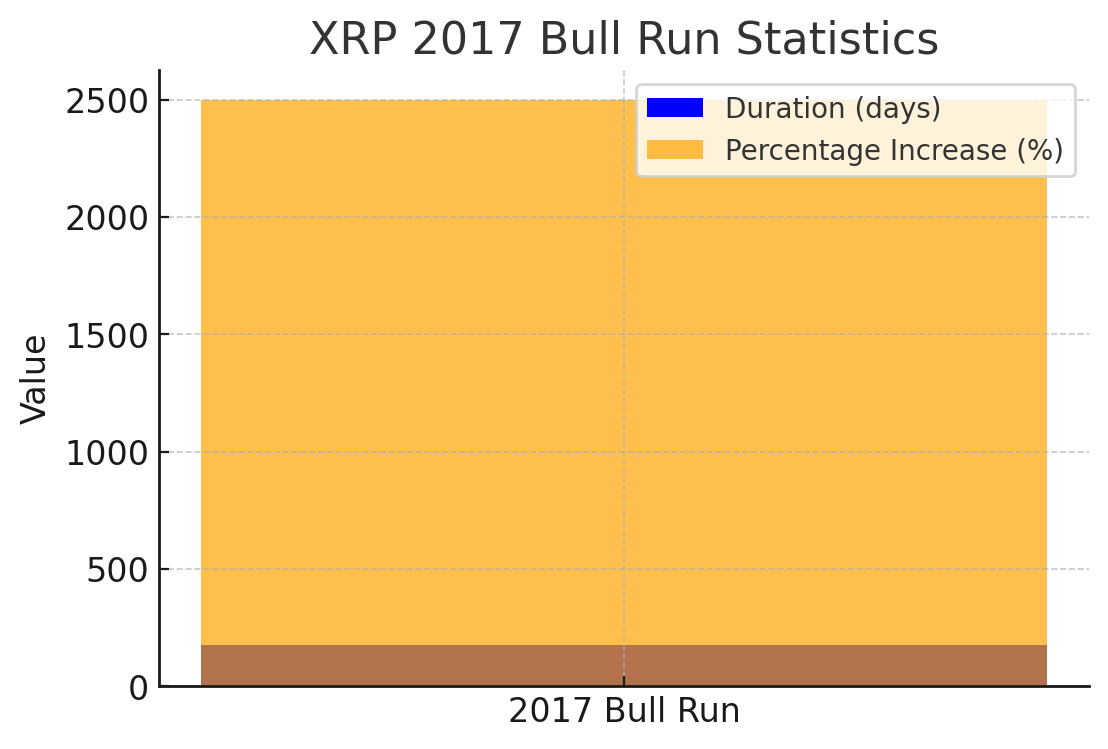

EGRAG CRYPTO finds similarities between the present XRP price trends and its 2017 price fluctuations. XRP surged by 2,500% throughout 175 days in 2017 to reach its peak value point. The analyst points out that XRP continues to sustain support at levels higher than its 21-week Exponential Moving Average indicator which indicates positive price movement potential.

Table 1: XRP Price 2017 Bull Run Statistics

| Metric | 2017 Performance |

| Duration of Bull Run | 175 days |

| Percentage Increase | 2,500% |

| Key Technical Indicator | 21-week EMA |

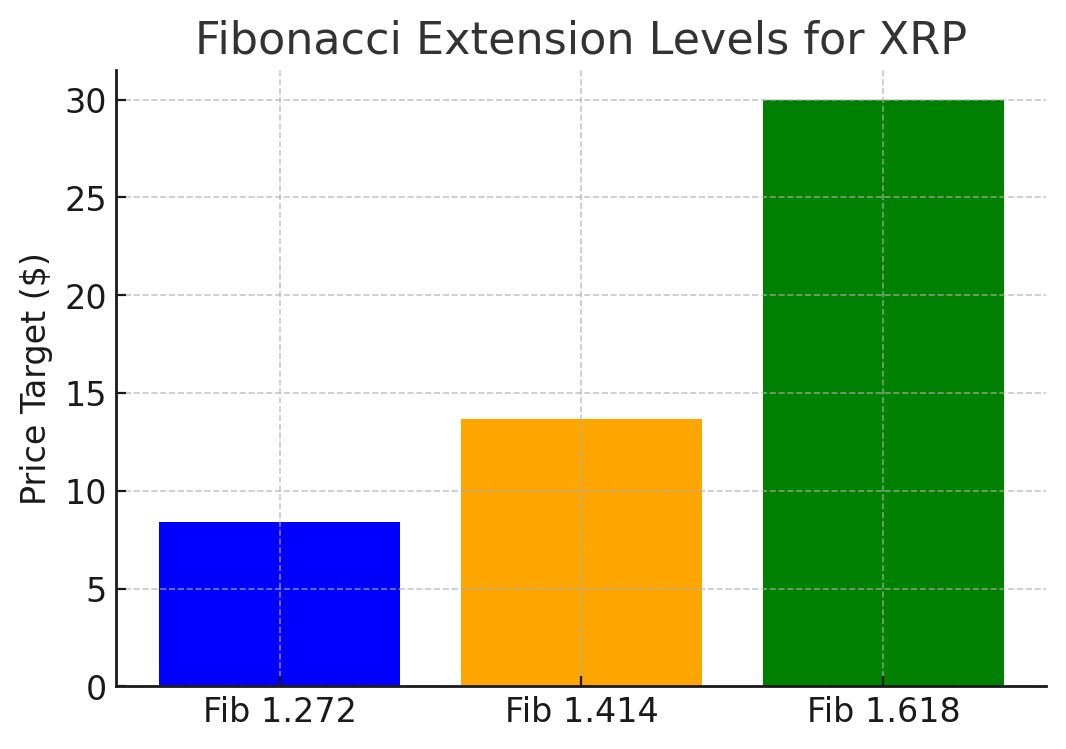

Fibonacci Extension Levels as Price Targets

Fibonacci Extension Levels as Price Targets

Several Fibonacci extension price targets have been determined within the scope of the analysis for XRP price. The Fib 1.272 mark stands at $8.38 before the Fib 1.414 reaches $13.67. An ambitious price target exists at Fib 1.618 level spanning from $27 to $33. The trading community uses these levels to anticipate future resistance obstacles within rising trends.

Table 2: Fibonacci Extension Levels for XRP

| Fibonacci Level | Price Target |

| 1.272 | $8.38 |

| 1.414 | $13.67 |

| 1.618 | $27 – $33 |

Analyst’s Perspective and Market Sentiment

Analyst’s Perspective and Market Sentiment

EGRAG CRYPTO recognizes that attempting market timing is practically impossible hence the analyst chooses not to try this approach. The analyst shares predictions to benefit the community regardless of their unsuccessful outcome.

The perception of XRP price in the market undergoes changes due to legal updates while technological progress produces additional effects. The Ripple Labs and U.S. SEC legal war has brought mixed elements for XRP which shape its future direction. Legal decisions during recent court sessions led to market dynamics changes because they influenced both investor confidence and market performance.

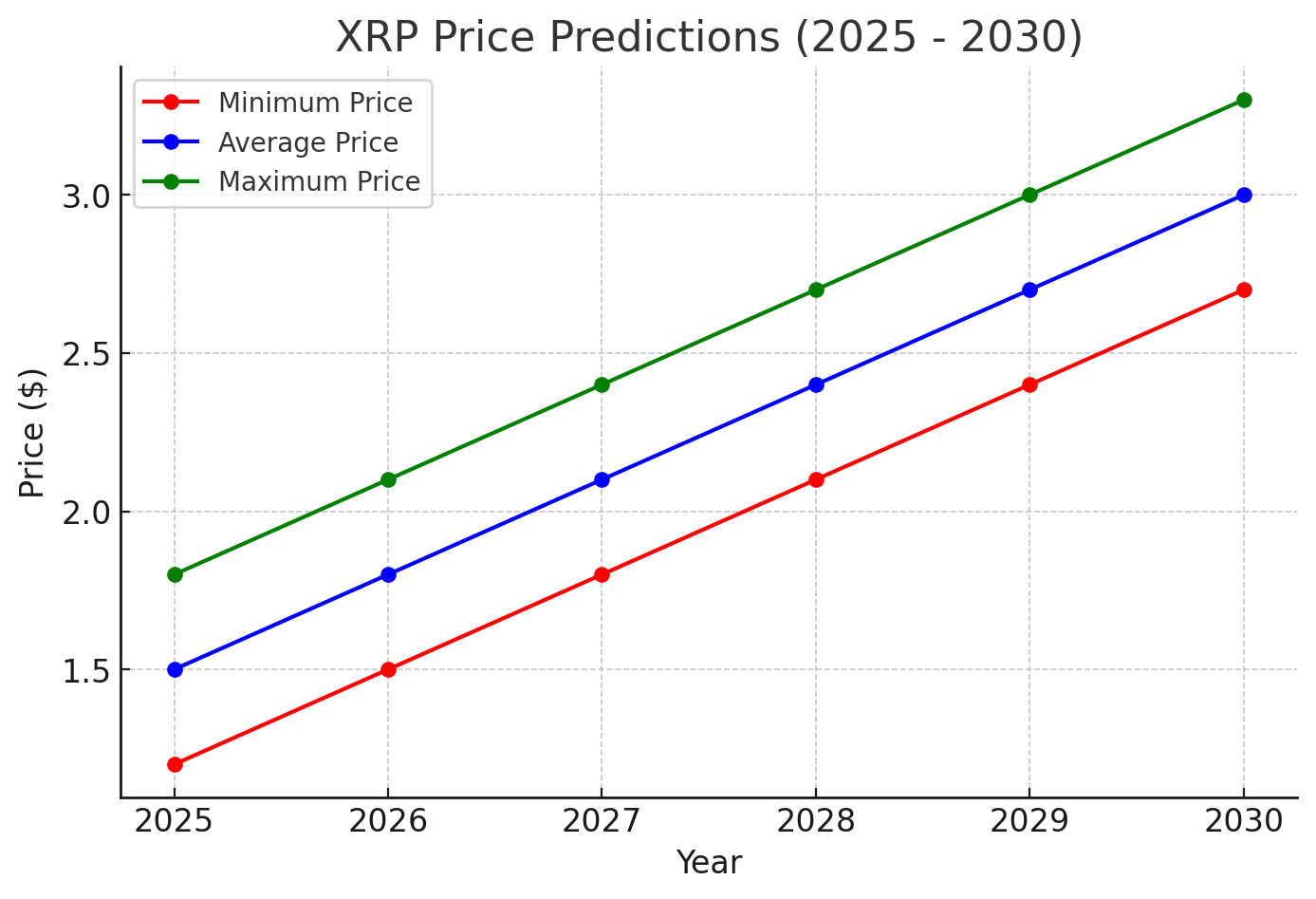

XRP Price Predictions for 2025 to 2030

Analysis experts present different viewpoints about XRP price predictions that stretch from tomorrow up to 2030. Changelly has published XRP price predictions showing its expected values for the period from 2025 to 2030.

Table 3: XRP Price Predictions (2025 – 2030)

| Year | Minimum Price | Average Price | Maximum Price |

| 2025 | $1.20 | $1.50 | $1.80 |

| 2026 | $1.50 | $1.80 | $2.10 |

| 2027 | $1.80 | $2.10 | $2.40 |

| 2028 | $2.10 | $2.40 | $2.70 |

| 2029 | $2.40 | $2.70 | $3.00 |

| 2030 | $2.70 | $3.00 | $3.30 |

Conclusion

Conclusion

Investors should exercise caution toward the projection that XRP will reach a value of $33 during its next 28-day period. The value of cryptocurrency experiences major price instability because several elements, including official decrees and market feelings, make the market fluctuate. Due diligence requires investors to research extensively, together with consulting various sources, which leads to sound investment choices. Keep following The Bit Journal and keep an eye on XRP Price.

FAQs

Q: What is XRP?

XRP exists as a digital currency which Ripple Labs produced for enabling inexpensive yet speedy international financial transactions.

Q: What is the significance of the 21-week EMA in technical analysis?

Technical analysts rely on the 21-week EMA as a vital tool which demonstrates its importance within their analysis framework. The 21-week Exponential Moving Average serves technical analysts by helping them identify market trends. Market price movement above this level indicates positive market sentiment.

Q: What are Fibonacci extension levels?

These technical analysis tools draw their values from the Fibonacci sequence. Fundamental analysts utilize Fibonacci extension levels as analytical instruments to outline potential buy and sell level positions through Fibonacci sequence ratios.

Glossary

- XRP: functions as a main currency designed to support international payment transactions.

- EMA: The Exponential Moving Average tool functions as a moving average system which applies increased value to fresh prices to show trends.

- Fibonacci Extension levels: Technical analysts employ Fibonacci Extension Levels as predictive price targets based on numerical sequences from the Fibonacci sequence.

References

- XRP 2025 Predictions: Can Ripple’s Crypto Double in Value Next Year?

- Crypto XRP reaches all-time high above $3. It now has the $4-plus range in its sights

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!