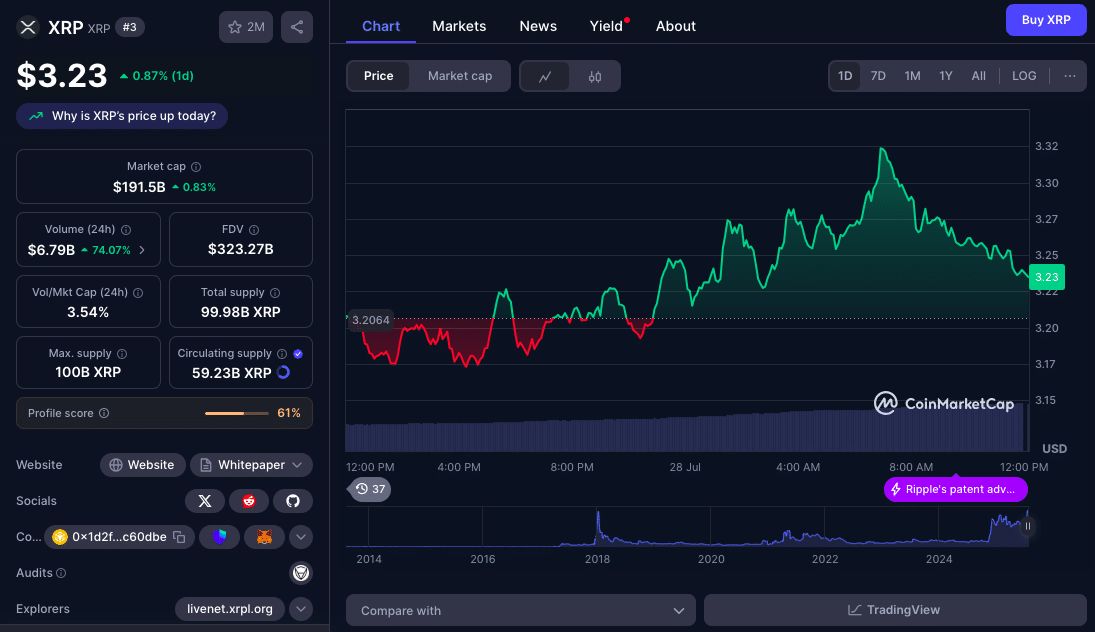

Market reports have divulged that XRP closed at $3.22 on Sunday, going up 1.3% after rebounding from $3.15 in the afternoon with volumes of 80 million, almost double average. These volume spikes indicate institutional accumulation as XRP retested and held the $3.16 support level multiple times. This setup shows a sign of technical strength in a volatile ETF-driven market.

Institutional participation looks strong and contributes to the sentiment that if XRP breaks above current range, the next leg up could be launched higher. As at the time of this writing, XRP trades at $3.23, holding strong due to reduced whale selling, ETF speculation, and bullish derivatives positioning.

Institutional Accumulation and Technical Strength

A deeper pullback to $2.96 occurred just recently, triggering a big bounce, and XRP showed strong recovery dynamics. Technical analysis highlighted higher lows and wider than average volume, which means a build-up of bullish energy and demand absorption by institutions.

Key resistance zones sit at $3.23–$3.30. For XRP price prediction in the short term, if volume confirms, XRP could see a move to $3.45–$3.70, if not, it could see a move back to $3.10 or $3.00.

Bull and Bear XRP Price Prediction Scenarios

| Scenario | Trigger | Target Price | Timeframe |

| Bullish Breakout | Close & hold above $3.23 on high volume | $3.30–$3.45 | 1–2 weeks |

| Neutral Range | Maintain above $3.16 but below resistance | $3.23 | 1 week |

| Bearish Breakdown | Close below $3.16 with fading volume | $3.10–$3.00 | 1–2 weeks |

Bull case relies on strong volume confirming the breakout. Bear case occurs if volume fails and support doesn’t hold. Neutral case sees limited movement around $3.20–$3.25.

Broader Indicators Support Bullish

XRP’s recovery from the 10% drop near $2.96 shows strong buyer interest when oversold, especially from institutions. Sources noted the bounce coincided with volume 30–40% above average.

Market analysis from CoinCentral also observed higher lows and decreasing selling pressure which means measured accumulation.

Meanwhile, technical platforms like Changelly and CoinCodex are also forecasting XRP 2025 ranges of $2.80–$3.60, which is a mildly bullish bias if XRP breaks resistance.

Regulatory Tailwinds and Fundamentals

Experts have noted that Improved regulatory clarity post-SEC litigation has reduced institutional fear for XRP. Ripple’s expanding use cases in cross-border payments, as well as a surge in derivative open interest, strengthen growing adoption.

XRP’s ability to serve as a liquidity token and remittance rail is what props up its utility and value. Analysts are forecasting a move beyond $3.70 if sentiment remains positive and broader expansion occurs.

Conclusion

Based on the latest research, XRP price prediction in the short term rests at a critical juncture. Institutional volume and technicals have established a bullish base but $3.23 remains the critical threshold. If XRP breaks out, it could see $3.30–$3.45 and possibly $3.70, if not it could see $3.10–$3.00.

With XRP’s strong utility story and growing cross-border use cases, the next move above or below $3.23 will set the short-term trend.

Read about XRP future.

Summary

XRP hit $3.23 on strong volume and higher lows from $3.15, institutional accumulation. A breakout above this level on heavy volume could take XRP to $3.30–$3.45, with potential to $3.70. If $3.16 support fails, XRP could drop to $3.10–$3.00. Broader technical and expert views are bullish but confirmation depends on volume above resistance.

FAQs

What is XRP’s current price and daily change?

As at the time of this writing, XRP is at $3.23.

Why is $3.23 important?

It’s a strong resistance zone; a sustained breakout could unleash bullish momentum to $3.30+.

What are the downside risks?

Breaking below $3.16 on weak volume could expose $3.10 or $3.00.

Is institutional activity driving price?

Yes; volume spikes above average during recoveries indicate institutional buying.

What external factors support XRP’s medium-term outlook?

SEC resolution and Ripple’s cross-border growth make XRP more valuable.

Glossary

Ascending Channel – Higher lows and highs forming a bullish trend.

Institutional Accumulation – Institutions buying in large quantities.

Resistance – Price where momentum slows or reverses.

Support – Price floor where buyers step in.

Breakout – A move above a key level that could lead to further direction.